ETX Capital considers itself one of the world’s top online FX and CFD providers. It apparently has some of the best trading conditions (spreads and leverage) and it boasts outstanding account security. It also supports scores of deposit and withdrawal methods.

According to the official ETX Capital website, the operator maintains a healthy respect for competitors but at the same time, it pretty much believes it has them bested in most regards.

The brokerage was first launched in 2002 – a fact that makes it one of the veterans of the online trading scene. The reason we’re saying “first launched” is that it has since been re-launched under a different (its current) name, in 2007. The original name of the brokerage was apparently TradIndex.

As we’ve already established, the broker really holds its services in high regard. What about its traders though? Their opinion is what truly sets the issue straight in this regard. Unfortunately, the client feedback available through various forums and message boards is not favorable to the operator – to say the least.

While such forums are usually populated with complaints (complainers are always more motivated to air their stories than those content with something), in ETX Capital’s case, the negative feedback goes above and beyond the usual.

Some traders feel that their stop-losses have been manipulated. others have had less than ideal experiences with the support staff, while still others bemoan the multitude of hoops, they had to jump through to even attempt a withdrawal.

What is the broker’s corporate background though? The company that’s currently pushing the ET Capital brand is Monecor London Ltd – a presumably serious and trustworthy outfit, given that it is listed at the London Stock Exchange.

The operator is licensed too: its FCA registration number is 124721.

What exactly does FCA regulation mean though, in regard to how it affects ETX Capital’s offer and ability to peddle its deals abroad. According to the official site of the broker, the license is only valid within the UK. That said, it is clear that the broker advertises its services in other countries too. While we do not know the exact extent of its reach, we do know that it has thus far steered well clear of a handful of countries, such as the US, Canada, Belgium and Singapore.

In terms of trader benefits and guarantees, regulation means that the monies deposited by traders are kept in segregated accounts with top UK banking institutions. What this means is that if the broker goes bankrupt, it won’t be able to touch the funds of its traders to sort out its own financial problems.

The broker is also a member of the Financial Services Compensation Scheme, which allows it to offer some rather attractive guarantees to its traders.

Why would one want to open an account and trade with ETX Capital though?

In addition to keeping the funds of its clients safe, the broker offers some very attractive trading conditions too. In addition to that, its support is said to be top-notch and its trading platforms are on the cutting edge as well.

Long story short: other than the negative trader feedback, we haven’t really found anything out of place with this broker. Of course, this does not in any way mean that the red flags raised by the said feedback should be ignored.

Account Types

ETX Capital have kept their account type selection extremely simple: they offer a Demo account, and there is just one account option available to all those who deposit real money. The minimum required deposit on this real money account is $100.

Deposits and Withdrawals

ETX Capital accept a surprisingly large and varied range of deposit and withdrawal options. Their preferred methods seem to be bank wire, online bank transfer and credit/debit cards.

For wire transfers and online bank transfers, a massive range of currencies are supported. A standard wire transfer is processed within a day, and it takes some 2-3 business days for a withdrawal to be cleared through this method.

The same goes for online bank transfers. In the case of credit/debit cards, the withdrawal procedure may turn out to be lengthier, at 3-5 business days.

The alternative payment method selection is spearheaded by Neteller and Skrill. Through these methods, deposits are processed almost instantaneously, while withdrawals take some 3-5 business days to land in the wallets of the traders.

China UnionPay falls into this category as well. For the above eWallet-based methods, the clearing time of withdrawals sits at 3-5 business days.

European traders (those making their deposits in EUR only) can use Sofort and Giropay as well.

ETX Capital Trading Platforms

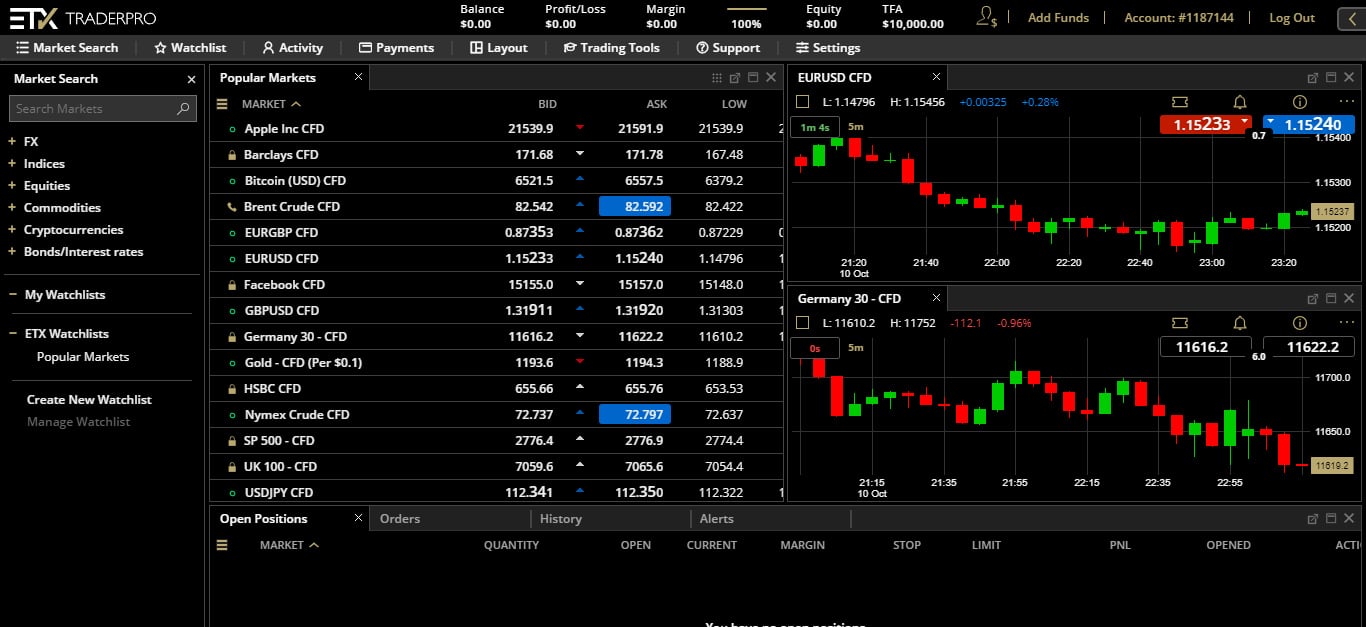

The broker offers two platform options (three if one counts the mobile version of MT4 that’s provided, as a separate option).

Despite MT4’s qualities, the flagship platform of the broker seems to be its own ETX TraderPro, which offers a superb charting package and an equally impressive selection of trading tools.

In addition to those “standard” features, the platform also offers a pip calculator as well as a handy info tab feature.

MT4 is also part of the ETX Capital trading platform lineup. Being the world’s top trading platform, its availability here is indeed more than welcome.

MT4 is well liked for its drawing tools, charting and its superb trading tools, as well as for the fact that it is nothing short of a fully customizable trading environment. Those who possess the required skills, can use the platform to create their own technical indicators and custom scripts, not to mention EAs.

EAs need a good VPS service to truly work their magic and ETX Capital does not disappoint in this regard either. It has to be pointed out however that the VPS service is not a default one. Those who want it are required to contact ETX support and request it.

MT4 also supports a variety of order types, as well as hedging and micro lots, in ETX Capital’s case. The trading platforms can be downloaded for free, from the ETX Capital website.

Support

Available in several languages, ETX Capital support can be contacted through email as well as phone.

The email address is [email protected], while the phone number is +44 (0) 20 7392 1494. Indeed, the operation is based in the UK. Its exact address is: One Broadgate, EC2M 2QS, London.

Market Coverage

The tradable asset selection of the broker is quite impressive. Its Forex section covers more than 50 currency pairs. Needless to say, the major pairs feature some of the best trading conditions the broker has to offer.

Interestingly, the spreads are not bad on the other asset categories either. Indices, commodities and CFDs are covered too. The commodities section covers gold, silver, oil as well as wheat and corn.

Conclusion

Everything accounted for, ETX Capital looks like a decent trading destination. We will not disregard the negative trader feedback though. This is a major red flag and it remains part of the picture.

Other than that, it is clear that the broker offers an accessible real money account, good market coverage, excellent trading platforms and rather attractive trading conditions. The multitude of deposit/withdrawal options accepted are nothing to sneeze at either.

Compare with other forex brokers

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.

79.6% of clients lose money. Capital at risk.

79.6% of clients lose money. Capital at risk.

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk