| eXcentral Pros | eXcentral Cons |

|---|---|

| Well regulated | Limited forex pairs |

| Competitive spreads | High minimum deposit ($250) |

| Well-equipped educational centre | Offers only MT4 and cTrader |

Traders’ Viewpoint

- eXcentral is a CFD broker, operated by OM Bridge (PTY) Ltd, and is regulated by the Financial Sector Conduct Authority (FSCA) of South Africa. The broker is also operated by Mount Nico Corp Ltd, a Cyprus investment firm, that is regulated by the Cyprus Securities and Exchange Commission with CIF license number 226/14.

- Both eXcentral EU and eXcentral International offer a number of account types ranging from Classic, to Silver, Gold and VIP. Each account type is packed with its own unique features, such as educational webinars, VIP webinars, a dedicated account manager and more.

- eXcentral offers its own web-based trading platform as well as the popular and prestigious Meta Trader 4 (MT4) platform. If you wish to trade at eXcentral, you can use the aforementioned platforms and access a range of tools and features to help you with your trading experience.

The broker offers several trading instruments — ranging from 50 currency pairs, three crypto pairs and 125 CFDs. Large capitalised US companies can also be traded at eXcentral.

There are four ways to deposit funds at eXcentral. You can use VISA/Mastercard, Skrill. Neteller and Wire Transfer. The minimum deposit is USD250 and you can choose one of the following account currencies — euro (EUR), US dollar (USD) and British pound (GBP). Copies of credit cards and screenshots of Skrill/Neteller accounts are requested.

eXcentral offers a research & education section on its site. The charts and trading videos are provided by MTE Media. The research section consists of four categories: market news, economic calendar, chart analysis and trading calculators. The education section has an ebook tab, trading videos and trading webinars. You can seek support via live chat, email, phone and call-back request.

eXcentral EU is headquartered in Limassol, Cyprus and eXcentral Int is based in Gauteng, South Africa. The broker began its business in 2019 and after a short period of time, has managed to build a good reputation.

eXcentral Review Introduction

Founded in 2019, eXcentral Int is a market maker broker and eXcentral EU is a straight through processing broker. eXcentral is regulated by the Cyprus Securities and Exchange Commission (CySEC) and the Financial Service Conduct Authority of South Africa (FSCA). The broker’s product offering includes forex and CFDs, crypto, and commodities. eXcentral operates under its EU brand in the European Economic Area (EEA) and Switzerland, and under its international brand in South Africa as well as in other non-EU/US/CA territories. The broker is trusted globally, given that it falls under the regulatory mandate of one of the world’s best broker regulators.

Furthermore, eXcentral provides two trading platforms: the renowned MT4 as well as its own web-based trading platform. As you will see in this review, the platforms can be easily customised and come with several unique features to help traders conduct their trading research and execution.

With a rating of 4.2 on Trustpilot, eXcentral appears to be well revered by its users. Most users are happy with their trading conditions, platforms, and customer service. Moreover, the account opening process with this broker is quite straightforward. Users can access the demo account immediately after registration, but a deposit must be made to access the live account. The biggest drawback with eXcentral is its high minimum deposit of $250. Read this review to the end to learn more.

Who Does eXcentral Appeal To?

eXcentral appeals to both beginners and experienced traders. Firstly, this broker provides a wide range of products, especially in CFDs trading. This means that traders have an option to explore different markets. For instance, those looking for exposure to popular foreign stocks such as Coca Cola (KO), Facebook (FB), and Amazon (AMZN), can trade them through CFDs. The same case applies to those interested in cryptocurrencies.

Secondly, eXcentral provides a wide range of trading tools and resources to support all types of traders. As we will see later in this review, this broker offers comprehensive educational materials for beginners, intermediate, and experienced traders. eXcentral Int also offers a 50% welcome bonus to new traders.

The trading platforms offered by this broker support all types of traders. As mentioned in the introduction, eXcentral provides both the MT4 and its own online trading platform. Both platforms can be used by beginner and advanced traders.

**** 4/5

eXcentral Account Types

eXcentral account types include Classic, Silver, Gold and VIP. As is expected, each account type comes with its own set of benefits. All the four types of accounts provide access to all assets on offer at a leverage of up 1:400. Moreover, they trade at a margin call level of 100% and a stop out of 50%.

Additionally, they all provide a minimum volume per trade of 0.01 and a maximum volume per trade of 50. Also available in all the four types of accounts is a negative balance protection feature, free support, and free trading education.

The Classic and the Silver accounts are the most basic and have similar trading conditions — however, the former does not provide access to eXcentral’s educational webinars. Furthermore, the two types of accounts do not offer full account overview, VIP webinars, and dedicated account managers.

This broker’s most popular accounts are its Gold and VIP accounts. These account types provide competitive spreads among other advantages such as VIP webinars and Dedicated Senior Account Managers. All these types of accounts require a minimum deposit of $250, and it is hence advisable to get started with the Gold or VIP accounts. Read the instruments and spreads section to learn more about the spreads offered for each of the account types provided by this broker.

eXcentral provides a free demo account. Traders can access this account without having to make a deposit. The exCentral demo account is the best place to practice, given that it comes with all the features of the live account and simulates real market conditions.

**** 4/5

Market and Territories Covered by eXcentral

As mentioned above, exCentral operates in countries in the European Economic Area (EEA), Switzerland, and South Africa. The broker has its headquarters in Cyprus and is regulated by the Cyprus Securities and Exchange Commission (CySEC) and the Financial Service Conduct Authority of South Africa (FSCA). This CySEC regulator is classified as ‘tier-one’ meaning that it is among the most trusted across the globe.

The eXcentral website, trading platforms, and customer service provisions are available in multiple languages, including English, Polish, Portuguese, Dutch, Spanish, Czech, and Italian. Its website and platforms automatically detect user location to match the user’s language.

eXcentral provides a live chat option as well as a phone number through which users are rerouted to a customer agent that speaks their local language. Users have an option to request a call-back in their local language. Unlike direct calls, call-backs can take up to 12 hours to get a response. It is recommended that users with a basic knowledge of English should call directly and request a customer service agent that speaks their language.

eXcentral is a brand name of OM Bridge (PTY) LTD, a financial service provider registered in Cyprus and South Africa.

**** 3/5

eXcentral Instruments and Spreads

eXcentral provides a wide range of products including 50 forex pairs, three crypto pairs and 125 CFDs. The forex pairs include all the majors and a few minors and exotics.

However, when it comes to CFDs, this broker is among those with the highest number of offerings. With this broker, you can trade CFDs on popular stocks such as Facebook, Microsoft, Netflix, and Amazon and market indices such as the S&P 500. Furthermore, you can trade commodities in energies such as crude oil, metals such as silver and gold, and grains such as wheat and corn.

The spreads vary with the type of trading account. For instance, the typical spread for the EUR/USD pair when trading with the Classic and Silver accounts is 2.5 pips. The average spreads for the same pair when trading with the Gold and VIP accounts is 1.8 pips and 0.9 pips respectively.

Regarding energy commodities, the typical spread for Crude Oil is $0.10 for both the Classic and Silver accounts. The same commodity has an average spread of $0.08 for the Gold account and $0.06 for the standard account.

**** 4/5

eXcentral Fees and Commissions

This broker charges a withdrawal fee of 3.5% for all withdrawals made through debit, credit and prepaid cards. Withdrawals through Neteller are also charged at 3.5% while those made through Skrill attract a fee of 2%.

Furthermore, all withdrawals through wire transfer attract a fee of 30 USD, GBP, or EUR. The withdrawal fees can be up to 80 USD/EUR/GBP for accounts with insignificant or no trading activity. Further charges may also apply if the client fails to provide accurate or adequate identity verification details.

eXcentral also charges an account inactivity fee of $80 for accounts that are inactive for two to three months and $120 for those that remain inactive for up to six months. The inactivity fee may go up to $200 for accounts that remain idle for more than six months.

This broker also charges a monthly maintenance fee of 10 EUR/USD/GBP for all types of accounts, irrespective of whether there are transactions on the account. eXcentral EU is a straight through processing (STP) broker and eXcentral Int a market maker broker. This broker may charge a rollover interest fee — although there is no rollover on Saturdays and Sundays when the markets are closed, banks still calculate interest on any position held over the weekend. To level this time gap, eXcentral applies a three-day rollover strategy on Wednesdays.

**** 4/5

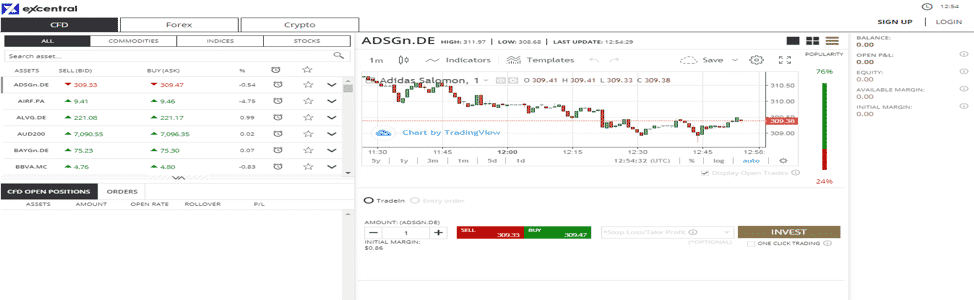

eXcentral Trading Platform Review

eXcentral trading platforms include MT4 and its own online trading platform. The MT4 platform is one the most popular in the industry.

eXcentral’s MT4 platform comes with a myriad of features — among them are interactive charts with nine time frames, 30 built-in technical indicators, and a live news feed. Furthermore, the MT4 platform has a highly user-friendly interface and is easily customisable to fit specific needs.

Even better, the platform allows automated trading through Expert Advisors (EAs). This feature allows traders to set parameters through which the algorithm can identify tradable opportunities and notify the trader or open positions automatically. MT4 also allows social trading where the trader can copy the strategies of expert traders and automatically or manually implement them in their account.

cTrader is highly intuitive and is popular with experienced traders. This platform is best known for superfast entry and execution, asynchronous order execution, level two pricing, and advanced risk management features. Just like the MT4, the cTrader is available in web, desktop, and mobile versions.

The desktop version is compatible with Windows, Linux, and Mac operating systems. Moreover, it’s free and lightweight and hence does not affect the performance of the devices it runs on.

**** 4/5

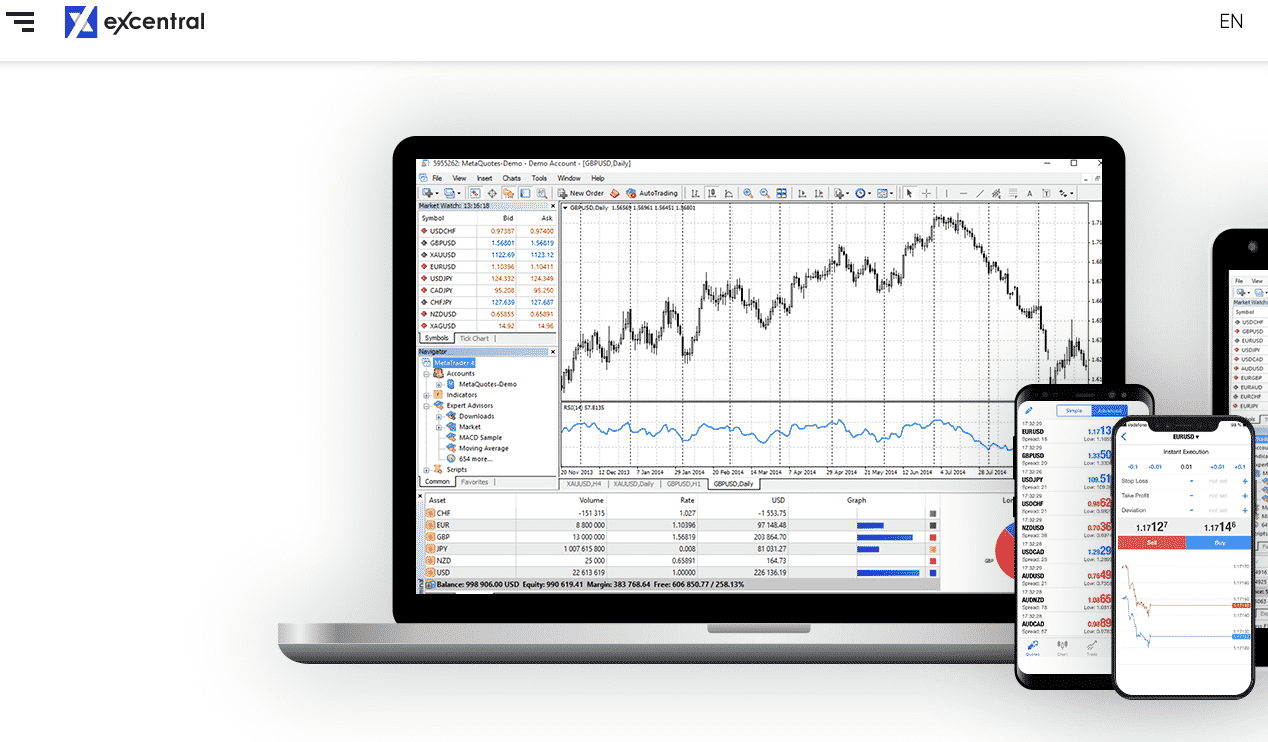

Mobile Trading with eXcentral

eXcentral is accessible through the MT4 and cTrader mobile apps. These apps are available for free on Google Play Store and Apple App Store. Moreover, they are compatible with Android and iOS devices. The mobile trading platforms provide all the features available in the web and desktop versions, including a live news feed and educational resource centre.

Traders can easily access the demo account on their mobile devices by downloading the MT4 or cTrader app and linking it to eXcentral. To do this, the trader can open the MT4 app and click ‘manage accounts’ to add the broker.

Users have to register on the eXcentral website to access the cTrader mobile app. The registration process takes less than three minutes. This review confirms that eXcentral mobile trading platforms are secure and easy to use.

*** 3/5

Social and Copy Trading with eXcentral

As mentioned above, eXcentral provides basic social trading through MT4. This trading approach allows users to copy the trades of expert traders and implement them in their own accounts. Users can copy and execute the trades manually or set the platform to do it automatically.

Traders can also register as signal providers and make an additional income by sharing their trades. eXcentral ranks signal providers based on their trading success, with the best appearing on top.

When compared to competitor brokers, eXcentral is not the best option for social trading. This is because it only provides basic features. Most competitors, on the other hand, partner with third-party social trading tools providers such as Zulu Trade to offer a seamless experience.

*** 3/5

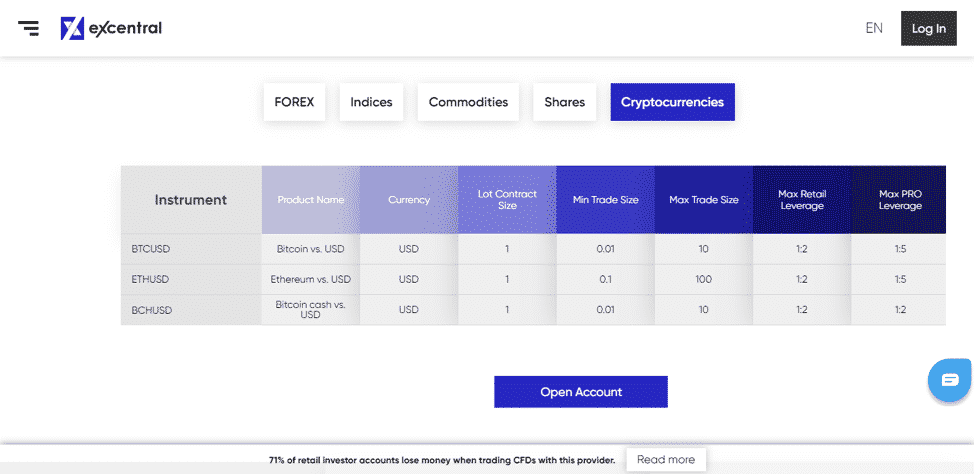

Crypto and eXcentral

eXcentral provides crypto trading through CFDs. With this broker, traders can access CFDs on BTCUSD, ETHUSD, and BCHUSD. BTC, ETH, and BCH are among the most volatile cryptos in the industry. This means that they present a perfect CFD trading opportunity. High volatility magnifies potential earnings but can also lead to huge losses. eXcentral provides comprehensive guides to help users master crypto CFD trading.

*** 3/5

eXcentral Charting and Tools

Both eXcentral’s MT4 and cTrader platforms come with advanced technical analysis tools.MT4 is equipped with 30 built-in indicators, over 2,000 free custom indicators, and 700 paid ones. These tools enable the trader to analyse the market at any level of complexity. Moreover, traders can forecast future price dynamics using over 22 MT4 analytical objects.

cTrader also comes with a variety of charting features, among them the ability to build custom indicators in C#. Traders can also opt to choose from cTrader’s extensive indicator library. As mentioned earlier, cTrader is best suited for experienced traders.

**** 4/5

Learn Trading with eXcentral

This broker provides a wide range of tools and resources for beginner, intermediate, and advanced traders. The educational materials are available in PDF manuals, blog posts, and video tutorials. Most of these materials are only accessible after registration.

Beginner traders get to enjoy well-structured introductory lessons and premium e-books for free. Moreover, they are assigned a dedicated account manager to walk with them through the first crucial steps of trading. Traders can engage these account managers even when on a demo account, provided that they have made the minimum deposit.

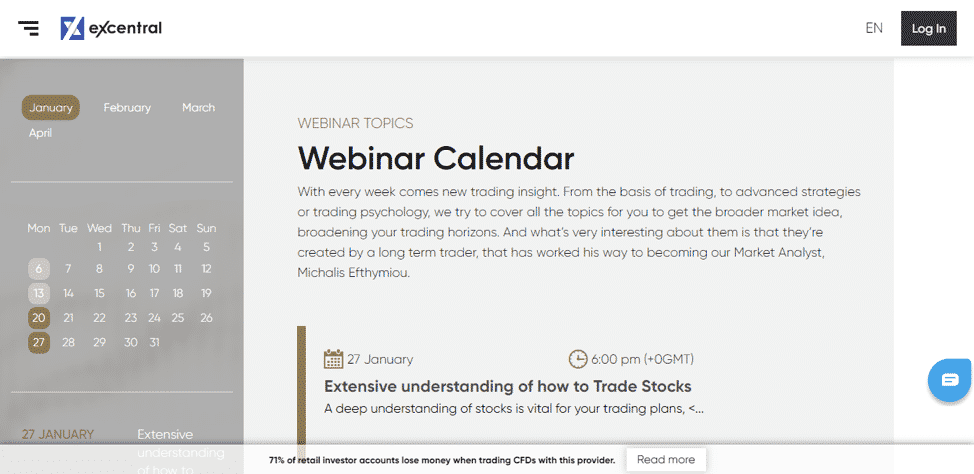

eXcentral offers weekly webinars to help traders stay up to date with the latest market developments. These webinars are categorised into beginner, intermediate, and experienced traders. Furthermore, the webinars are recorded and uploaded on their website so that those who miss the live sessions can watch them later. The accessibility to these webinars depends on the type of account that a trader uses. As mentioned earlier, those registered under a Gold account can access all educational materials and trading research tools.

eXcentral also provides an FAQ page. However, it’s hard to navigate through it, given that it does not have a search bar. Moreover, it does not answer questions on trading platforms. eXcentral provides access to third-party tools for news feeds and blogs.

**** 4/5

Is it Safe to Trade with eXcentral?

The account opening process with eXcentral is straightforward. As mentioned earlier, traders can access the demo account before deposit. However, a minimum deposit of $250 is required to access the live account. Furthermore, users must go through the ID verification process in order to make a deposit.

The ID verification involves uploading both sides of a government-issued ID with a clear photo. Users are also required to verify their current address by uploading a recent utility bill. It is important to note that this step is a requirement with nearly all well-regulated financial institutions.

eXcentral takes less than 12 hours to verify an ID and prove an address. Users can proceed before verification, but they must be verified to be allowed to withdraw. As mentioned earlier, there is a penalty for submitting inaccurate information.

**** 4/5

How to Open an eXcentral Account

The account opening process with eXcentral is straightforward. As mentioned earlier, traders can access the demo account before deposit. However, a minimum deposit of $250 is required to access the live account. Furthermore, users must go through identity verification in order to make a deposit.

The ID verification involves uploading both sides of a government-issued ID with a clear photo. Users are also required to verify their current address by uploading a recent utility bill. It is important to note that this step is a requirement with nearly all well-regulated financial institutions.

eXcentral takes less than 12 hours to verify an ID and prove an address. Users can proceed before verification, but they must be verified to be allowed to withdraw. As mentioned earlier, there is a penalty for submitting inaccurate information.

**** 4/5

eXcentral Customer Support

eXcentral customer service is available for 24 hours a day, Monday through Friday. Traders can contact them through phone, live chat, or email. Traders can also request a call-back through the form provided on eXcentral’s website.

Emails and call-back requests can take up to 12 hours to get a response and hence are not recommended for urgent communication. It takes less than a minute to get connected to an agent through phone and live chat.

eXcentral customer service is available in over five languages, including English, Portuguese, Spanish, Italian, Czech, and Polish.

**** 4/5

eXcentral Review Conclusion

eXcentral is a well- regulated and reputable broker. This broker is regulated by the Cyprus Securities and Exchange Commission (CySEC), a tier-one regulator with a global reputation. The broker is also regulated in South Africa under the Financial Service Conduct Authority (FSCA).

This broker offers competitive spreads of as low as 0.9 pips for the EUR/USD pair and does not charge any commissions on forex pairs. On trading platforms, eXcentral provides the popular MT4 and cTrader. These two platforms are the most popular in the industry and are available in web, desktop, and mobile versions.

Regarding trading education, this broker provides comprehensive beginner, intermediate and advanced trading materials. Beginner traders are assigned a dedicated account manager to guide them through the introduction to trading.

eXcentral FAQs

How can I open a demo account with eXcentral?

Visit the eXcentral website and follow the registration process as instructed. You can also access the demo through the mobile MT4 by linking it to this broker.

Is eXcentral a regulated broker?

Yes, eXcentral is a highly reputable broker regulated by the Cyprus Securities and Exchange Commission (CySEC) and the Financial Service Conduct Authority of South Africa (FSCA).

What are the deposit options for eXcentral?

eXcentral accepts deposits through Visa, Mastercard, and wire transfer. Users can also deposit through Neteller and Skrill. All deposits with this broker are free.

How do I withdraw money from eXcentral?

The withdrawal process with eXcentral includes filling a request form and waiting for up to 24 hours. You can only withdraw through the method that you used to deposit.

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk