Forex Traders’ Viewpoint

Exness offers a wide array of features, low spreads, access to unlimited leverage (in some cases), and free VPS hosting. Aside from this, it also boasts a decent amount of educational tools to help beginner traders get started. This educational content may be very helpful to those looking to learn the basics of Forex and CFD trading.

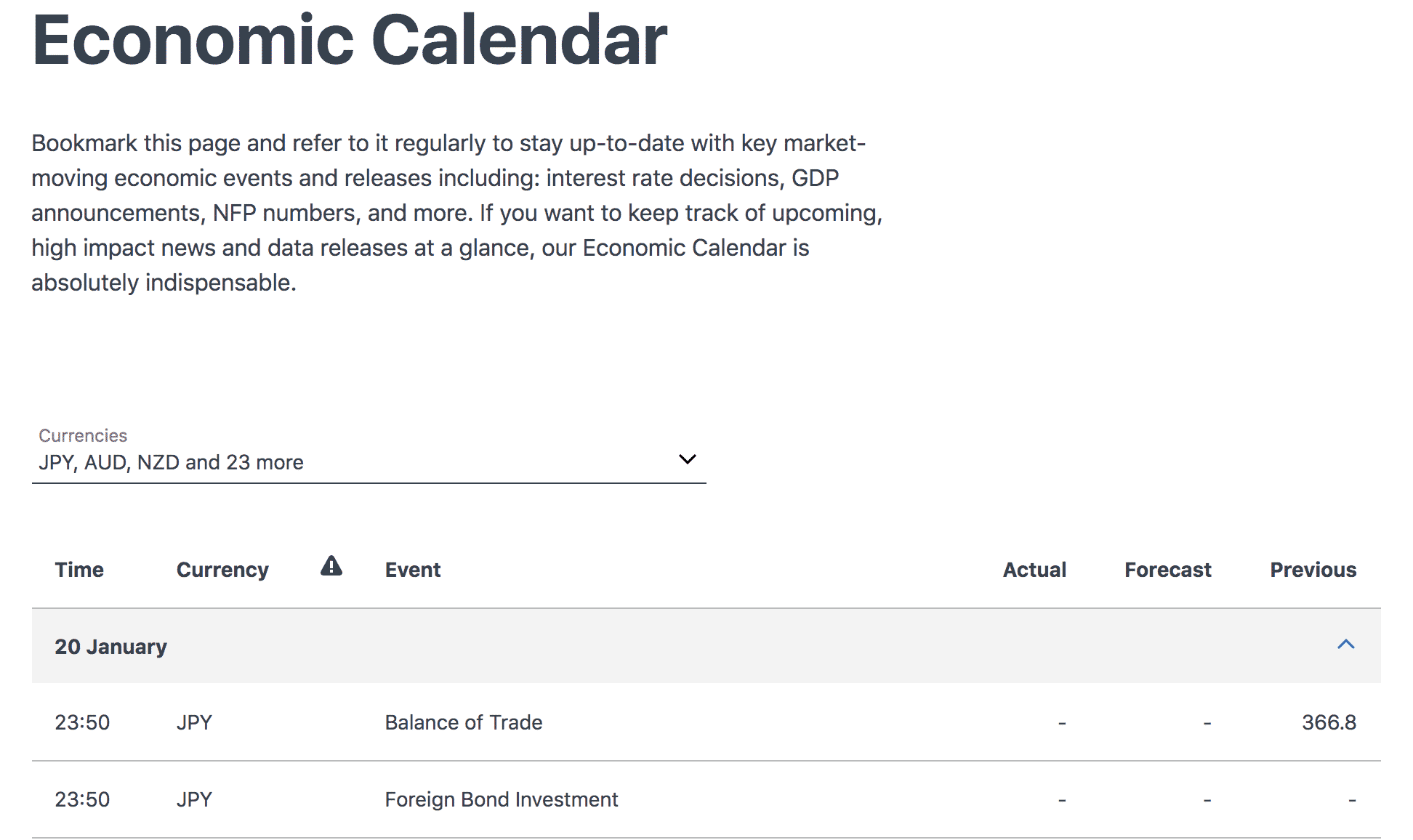

The platform offers the ever-popular MetaTrader 4 and MetaTrader 5 platforms, which are packed full of powerful trading tools. A neat addition is that Exness also provide their own financial news wire service to help clients keep up to date with market events.

Exness support funding options other brokers don’t include the ability to fund an account in either BTC or USDT. There are also several instants, and zero-fee, fiat deposit options. Withdrawals are also free of charge.

The aggressive approach to pricing carries over to trading costs. The Standard account option offers spreads from 0.3 pips, with other accounts offering spreads from as low as 0.0 pips.

The platform has everything needed to get up and running, and great terms and conditions help put you in with a good chance of being successful.

Exness Rating Overview

| FEATURE | Exness |

|---|---|

| Overall | ⭐⭐⭐⭐ |

| Education | ⭐⭐⭐ |

| Market Research | ⭐⭐⭐⭐ |

| Range of Markets | ⭐⭐⭐⭐ |

| Deposits & Withdrawals | ⭐⭐⭐⭐⭐ |

About Exness

Founded in 2008, this global brokerage firm has offices in both Cyprus and the UK and boasts a monthly trading volume of around $673.6. With over 145,400 active traders, it has grown into a very large trading platform known for its outstanding leverage options, tight spreads, high liquidity, and responsive customer support. The broker has even engaged in some humanitarian activities, having donated $1,500,000 to local charities to help them combat the spread of the COVID-19 pandemic.

After its inception in 2008, the company started slow, experiencing some difficulty penetrating the already saturated market. However, by 2010 the platform began to experience a growth in popularity, which would continue for over a decade. Today, Exness has grown to offer a wide array of financial instruments to trade, including stocks, indices, currency pairs, metals, futures, and cryptocurrencies. Exness offers customer service in a total of 13 languages, including English and Mandarin. Furthermore, their website is available in a total of 15 languages.

Who does Exness appeal to?

While Exness is a viable option for both active and long-term investors, most of its users are highly active traders looking to take advantage of the tight spreads and high leverage options. Even though Exness does offer some stocks and indices, the vast majority of its activity is made up of forex trading, for which 107 pairs are offered.

When the above is taken into consideration, Exness is most likely to be enjoyed by high-frequency forex traders who want access to professional-grade trading software but would also like the option to trade in other instruments such as stock, indices, and cryptocurrencies.

While Exness is a viable option for both active and long-term investors, most of its users are highly active traders looking to take advantage of the tight spreads and high leverage options. Even though Exness does offer some stocks and indices, the vast majority of its activity is made up of forex trading, for which 107 pairs are offered.

Exness is best for - advanced forex tradersForex Account types

As of January 2021, Exness offers two different types of accounts, Standard and Professional, and each comes with a MetaTrader 4 or MetaTrader 5 option. Certain account features change depending upon which platform the user chooses.

MetaTrader is a multi-asset software platform used by speculative traders for those who are not familiar. MetaTrader 5(MT5) was the successor MetaTrader 4(MT4) and was initially released in 2010. However, adoption has been slow, and even today, many brokers still use MetaTrader 4. For most traders, the difference between the two will not be of much importance. However, however, Exness offers unlimited leverage to those using MetaTrader 4 and a capped leverage to those using MetaTrader 5.

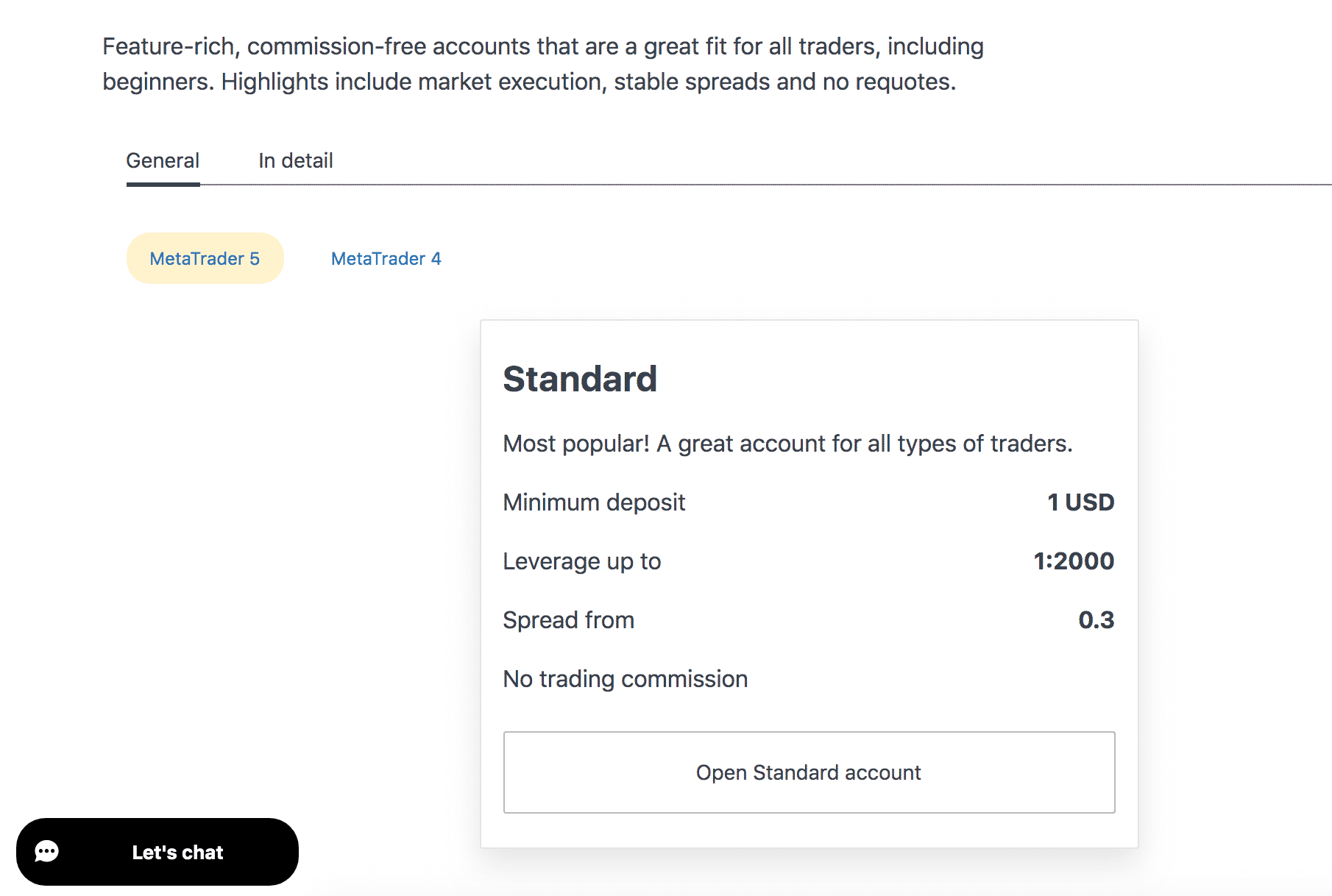

Standard account

The standard account is commission-free and by far the most popular. It is used by experienced and beginner traders. Account highlights include high margin options, super tight spreads, and low minimum deposit amount.

| Minimum deposit amount | $1 |

| Max leverage | 1:2000 for MT5 / 1:Unlimited for MT4 |

| Trading commission | No commission |

| Available trading instruments | Forex pairs, cryptocurrencies, metals, energies, indices |

| Max number of positions | No limit |

| Hedged Margin | 0% |

| Margin Call | 60% |

| Spread From | 0.3 |

Pro account

Unlike the standard account, the pro account has three sub-options — Raw Spread, Zero, and Pro. As we will see, the differences between the three options are small, and these differences are unlikely to be overly meaningful to the average trader. The Pro Account is the preferred type of account for day traders, scalp traders, algo-traders, and even short time frame swing traders.

Like the Standard Account, all Pro Accounts come with a MetaTrader 5 and MetaTrader 4 option. Once again, the only difference between the two is the margin limits.

| Raw Spread | Zero | Pro | |

| Minimum Deposit | $200 | $200 | $200 |

| Max Leverage | 1:2000 for MT4 1:Unlimited for MT5 |

1:2000 for MT5 1:Unlimited for MT4 | 1:2000 for MT5 1:Unlimited for MT4 |

| Trading Commission | Up to $3.50 | From $3.50 | No commission |

| Available Trading Instruments | Forex pairs, cryptocurrencies, metals, energies, indices | Forex pairs, cryptocurrencies, metals, energies, indices | Forex pairs, cryptocurrencies, metals, energies, indices |

| Max Number Of Positions | No limit | No limit | No limit |

| Hedged Margin | 0% | 0% | 0% |

| Margin Call | 30% | 30% | 30% |

| Spread From | 0.0 | 0.0 | 0.1 |

Markets and territories

Exness has grown significantly since its’ founding in 2008 and is now used by traders worldwide. As of January 2021, the broker is licensed by three separate bodies, all of which have high standards when it comes to rules and regulations.

Like most other brokers operating in the market, Exness does not provide its services to certain countries and jurisdictions for regulatory reasons. The most notable of which is the United States.

Financial Service Authority (FSA)

The Seychelles-based regulator, the FSA, has a mandate to license, supervise, and enforce compliance in Seychelles’ non-bank financial services sector. It’s an increasingly popular choice for brokers looking to cater to a global client base.

Nymstar Ltd is a part of the Exness group of companies. Nymstar Limited is licensed and regulated as a Securities Dealer by the Seychelles Financial Services Authority (license number SD 025).

Cyprus Securities and Exchange Commission (CySEC)

The Cypress Securities and Exchange Commission, often referred to as merely CySEC, is Cyprus’s financial regulatory body. Since Cyprus is a member of the UE, CySECs regulations and rules must comply with the EU MiFID financial harmonisation laws.

MiFID provides a legal framework for all securities markets and trading venues. Besides EU nation members, MiFID also extends to Iceland, Norway, and Liechtenstein.

Financial Conduct Authority (FCA)

Exness (UK) Ltd is an investment firm that has been fully authorised by the Financial Conduct Authority with license number 730729. Before Brexit, FCA regulations were the same as MiFID, although this may as the UK removes itself from EU legislation. Nevertheless, we can expect Exness to remain up to date with whatever regulatory changes come its way regarding its UK operations.

Financial Sector Conduct Authority (FSCA)

The broker has also a licence in South Africa form the FSCA.

Instruments and Spreads

Instruments

The MetaTrader platforms provided by Exness offer a standard range of markets and instruments with a heavy weighting towards forex pairs. There are more than 107 currency markets to trade. Spreads on the Major currency pairs are as low as zero, and its possible to trade right through the range of Minor and Exotic pairs.

Other asset groups are also available, including indices, cryptocurrencies, commodities, and shares.

- 107 currency pairs, including all the standard majors, minors, and exotics

- 40 stocks and indices, including Apple, Google, and Amazon

- 12 metals and energies

- 7 Cryptocurrency pairs, including Bitcoin, BitcoinCash, Ethereum, Ripple, and Litecoin

Spreads

One of the most attractive features of Exness is its tight spreads. They have some of the lowest spreads on the market and some even go down to zero pips. Traders who opt for the standard account can expect to receive a 0.3pip spread, while those who use the Raw Spread and Zero account enjoy a spread of 0.0pip. The pro account, which provides users with commission-free trades, has a 0.1pip spread.

One very appealing feature of the Exness package is the accounts that offer super-tight spreads but don’t charge additional commissions. This helps keep costs low, but this degree of transparency also makes it easy to run price comparisons against other brokers.

Fees and Commissions

In the account overview, we looked at commission costs, which are:

- $0 for the standard account

- Up to $3.50 for the Raw Spread Account

- $3.50 and upwards for the Zero account

- $0 for the Pro Account

Deposits: Exness does not charge deposit fees. However, the website does warn that some funding options require a minimum payment, and users may be subject to a third-party deposit fee if these minimum amounts are not met.

Withdrawals: Just like deposits, Exness does not charge any fees when users make a withdrawal. However, some payment processors may charge a transaction fee on their end. Another neat feature is that instant automated withdrawals can be made 24/7. There are no trading inactivity fees at Exness.

Forex Trading Platform Review

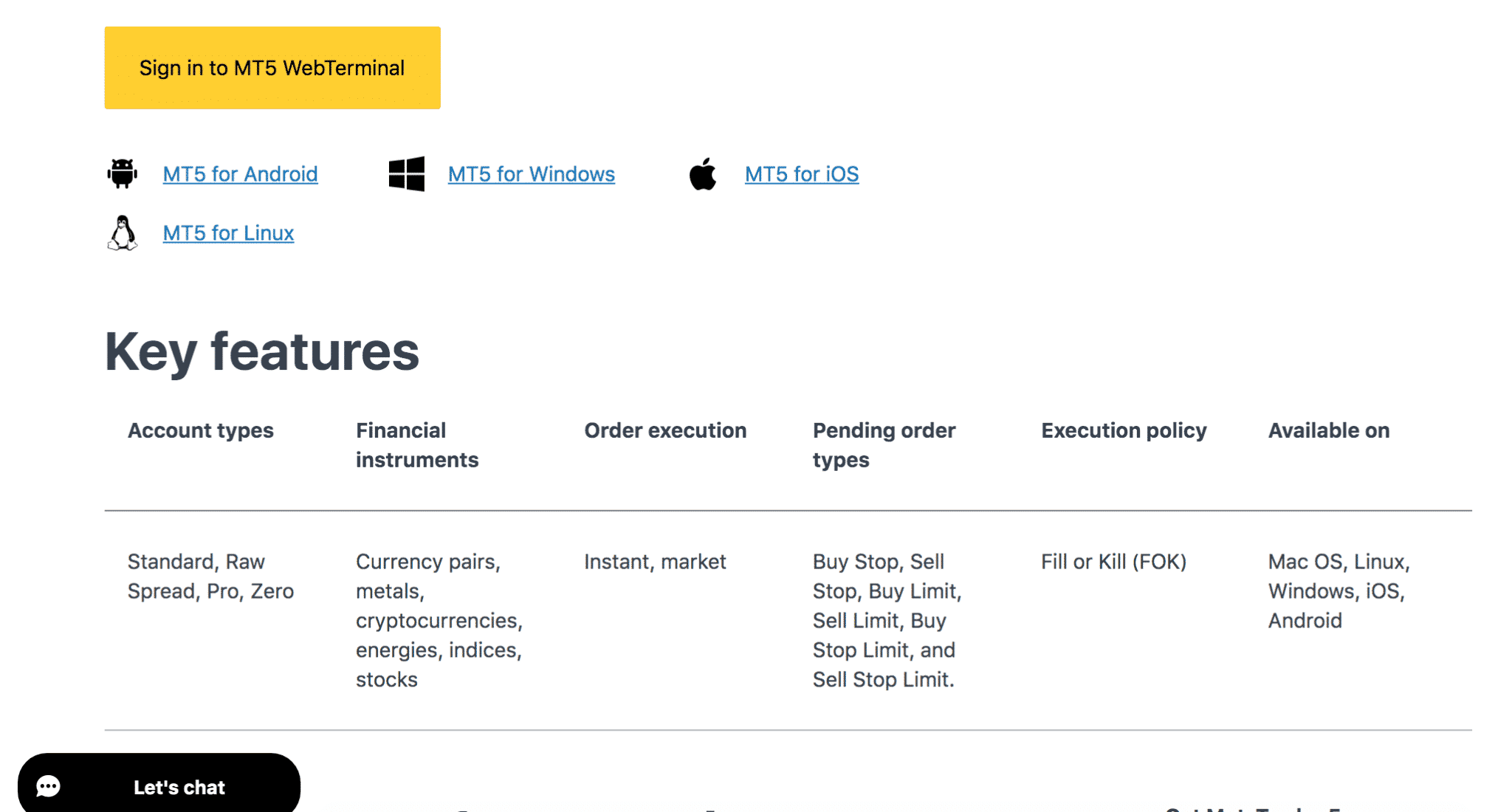

Exness offers its clients the choice of MetaTrader’s MT4, MT5, and WebTerminal trading platforms. These are the industry-recognised core offering for forex trading, with millions of traders across the globe already using them.

The platforms are super-reliable and packed full of powerful software tools. The default settings for MT4 include 23 analytical objects and 30 technical indicators, which can be used to spot trading opportunities.

MetaTrader 5 has 38 technical indicators, 22 analytical tools, and 46 graphical objects.

The MetaTrader community is quite active, and joining the discussion groups throws up finding and using more bespoke indicators, often for free.

The platforms’ razor-sharp graphics make them ideal for technical analysis, and the trade’s highly stable execution interface allows for one-click trading.

One of the great features of the MT platforms offered by Exness is the ability to set up the platform for automated trading. You can build and run your models using the MetaQuotes Language 4 (MQL4) scripting language. Alternatively, the Expert Advisors function makes it easy to incorporate other traders’ systematic models.

Free VPS Hosting

The inclusion of free VPS hosting is a big plus-point for Exness. Orders are executed with minimal lag which cuts down on slippage, which feeds through to the bottom-line in terms of better prices.

Mobile Forex trading

Exness has a mobile trading app supported by both Apple and Android. Once downloaded, users are welcomed by the landing screen, which gives them the option to sign up, log in, or contact customer support via live chat.

For those who already have an account, logging in is as simple as providing the correct credentials, then entering a pre-chosen passcode twice for added security.

Once logged in, traders are provided with three options, real account, demo account, and crypto wallet. If the real account option is chosen, the user is taken to an overview screen, listing current holdings, funding options, and leverage settings. At the bottom of the screen is the trading option, which, when chosen, takes the user to the trading platform.

The trading platform comes in three different versions, Exness Express, MetaTrader5 app, and MetaTrader5. The first option, Exness Express, is a straightforward interface compared to the other two and may not be sufficient for advanced traders. MetaTrader5 and the MetaTrader5 app provide a trading experience similar to what traders will find on their desktop version.

Aside from trading and funding options, the app gives traders access to financial news articles and allows them to create a watchlist for different pairs, stocks, indices, or cryptocurrencies they happen to be following.

Social Trading and Copy Trading

Exness offers social trading through its social trading app. Once downloaded, users can log into the application and look for trading strategies that fit their personal goals and risk appetite.

Users, known as investors, can choose between particular individuals to copy based on their success and trading strategies, based upon their ratings.

When a strategy makes a profit, the strategy provider makes a profit, which can fall anywhere between 0% and 50%.

Crypto

Exness offers traders access to some of the largest market cap cryptocurrencies. As of now, it offers seven cryptocurrency pairs, which are listed below.

- Bitcoin vs. USD (BTCUSD)

- Bitcoin vs. Japanese yen (BTCJPY)

- Bitcoin vs. South Korean won (BTCKRW)

- BitcoinCash vs. USD (BCHUSD)

- Ethereum vs. USD (ETHUSD)

- Litecoin vs. USD (LTCUSD)

- Ripple vs. USD (XPRUSD)

As of now, the only cryptocurrencies that can be withdrawn to an external wallet or centralised address are bitcoin and tether (USDT). Similarly, only bitcoin and tether can be deposited into an Exness account.

Forex Charting and Tools

Both MetaTrader 4 and MetaTrader 5 platforms offer traders access to a wide array of charting tools, instruments, and chart settings. For those looking for a recap:

MetaTrader 4

- 23 analytical tools

- 30 technical indicators

- All charts are displayed on one-minute intervals, with 21 different time frames available

- Financial news display

- Automatic trading, both imported and scripted

MetaTrader 5

- 38 technical indicators

- 22 analytic tools

- 46 graphical objects

- All charts are displayed on one-minute intervals, with 21 different time frames available

- Financial news display

- Automatic trading, both imported and scripted

- Hedging mode system

The analytical tools available on MT4/MT5 include:

- MACD

- Exponential Moving Average

- RSI

- TSI

- Bollinger Bands

- Volume based indicators

- Fibonacci retracement

- Trend following and trend confirmation tools

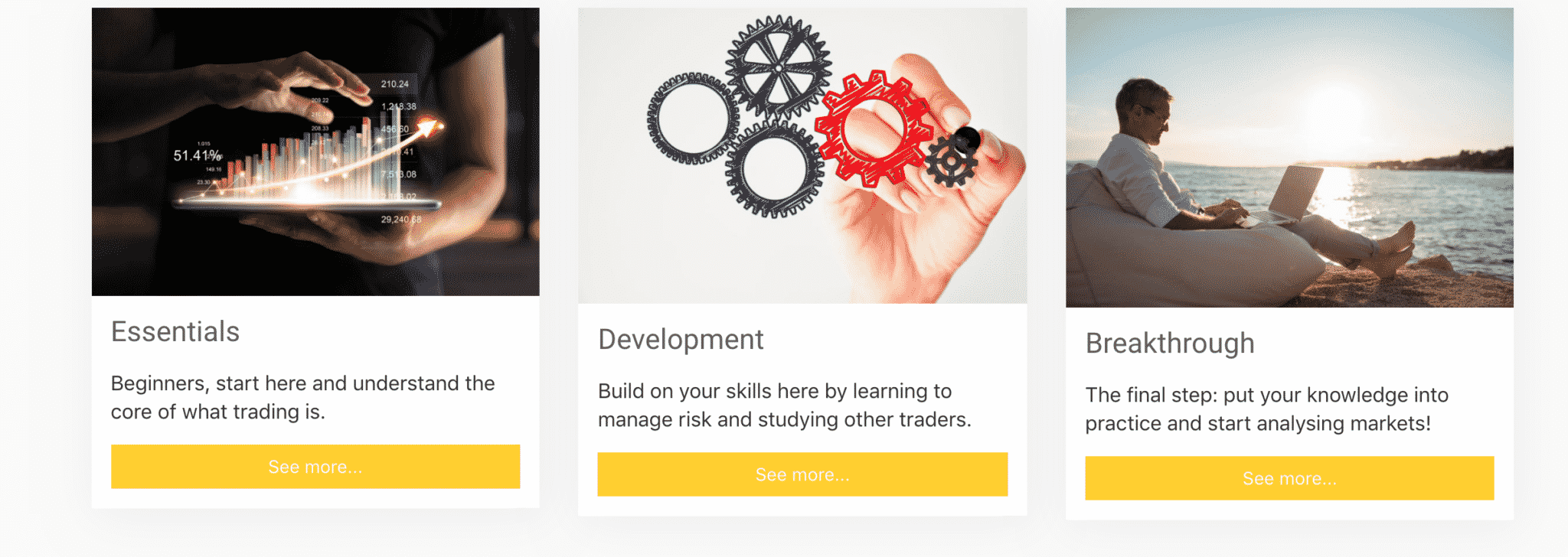

Forex Education

As has become standard with online trading platforms, Exness offers clients its own set of educational tools, which can be broken down into four distinct products:

Exness Academy

This educational program is broken down into three sections: Essentials, Development, and Breakthrough. The first section, Development, starts by explaining to the readers the basics of trading, the terminology, strategy, and basic rules. The second segment, Development, aims to further develop these concepts and build an understanding of risk management by studying other traders. Breakthrough’s last instalment gives insights on how to analyse the market and even pushes traders to try out their skills in bouts of live trading.

Insights and analysis

Unlike Exness academy, the broker’s insights and analysis provisions assume readers already understand markets (stocks, forex, and otherwise) to at least an intermediate level. This section includes articles, sometimes published every other day, looking at different financial instruments, mostly from a technical analysis perspective.

Webinars

Exness also hosts live webinars that users can access. Nowadays, webinars are hosted in several different languages, including English, Arabic, Bahasa Indonesian, Thai, and Vietnamese. Even if a trader has missed a particular webinar, all past events are hosted on the site, where users can access them.

Glossary

The glossary functions just as an alphabetical list of all terms relevant to the act of trading. While most of the glossary is concerned with technical analysis terms, fundamental terms are included.

Aside from these educational tools, Exness also offers users the option to participate in a demo account. This demo account allows individuals to practice their trading skills and strategies without using real money.

Compare Exness with other approved brokers

|  |  |  | |

| Education | market analysis | courses, market analysis | educational content, webinars, market analysis | courses, webinars, market analysis |

| Customer Support | email, phone | email, phone, live chat | email, phone, live chat | email, phone, live chat |

| Minimum Deposit | Starting from $1 on Standard and $200 on Professional accounts | $100 | $50 | $200 |

| Total Markets | 200+ | 1260 | 300+ | 1000+ |

| Total Currency Pairs | 107 | 55 | 45+ | 62 |

| Total Cryptos | 25 | 17 | 16 | 12 |

| Total CFDs | 90+ | 626 | 635+ | 900+ |

| Trading Platforms | MT4, MT5, WebTerminal | MetaTrader4, Sirix, AvaOptions, AvaTrader, Mirror Trader | MT4, MT5, ProTrader, AppTrader, CopyTrader | MetaTrader 4, MetaTrader 5, cTrader |

How to open a Forex Trading Account

Exness has a very fast and streamlined account creation process, which can be completed in four quick steps:

Step 1: Registration: Registering an account is quick and easy and only requires the user to input their country of residence, email address, and an account password.

Step 2: Verification: As per guidelines and regulations, Exness requires all users to verify their account by providing some personal information.

Step 3: Deposit funds: To begin trading, users must first deposit their funds, a topic we will cover in greater depth in the next section.

Step 4: Start trading: Once the account has been verified and successfully funded, it is time to start trading.

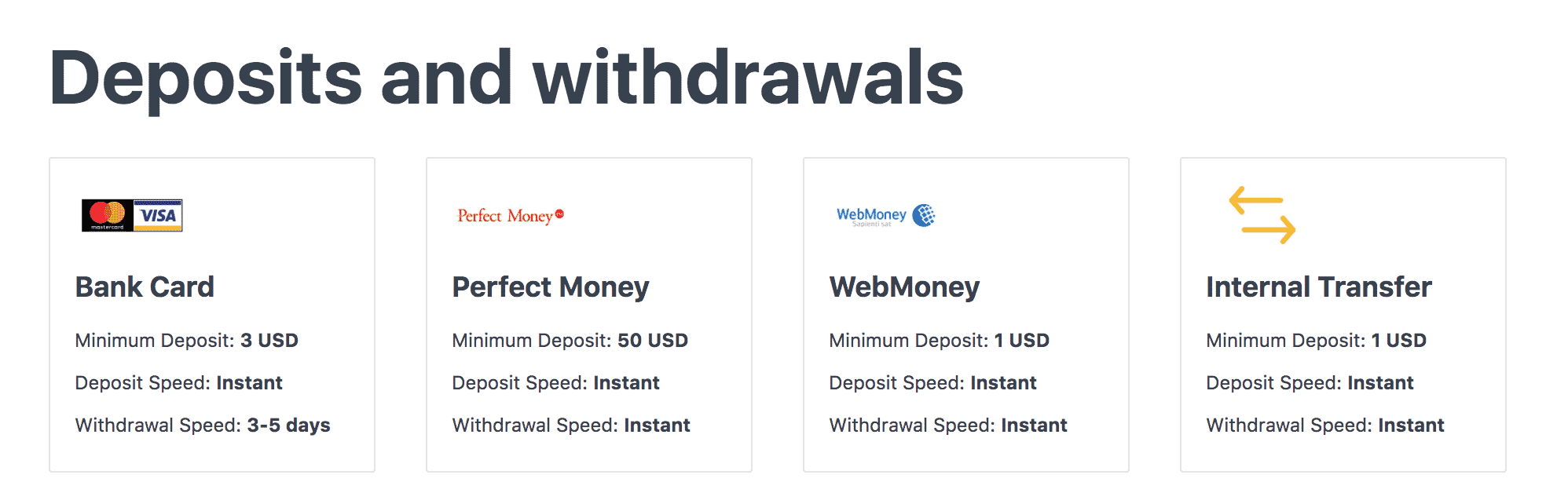

Once the account is set up, Exness offers four convenient funding options, both in fiat and cryptocurrency. Along with the high number of options, Exness does not charge deposit or withdrawal fees, although some third-party processing fees may apply.

| Option | Minimum Balance | Deposit Time | Withdrawal Time |

| Bank Card | $3 | Instant | 3 – 5 Days |

| Perfect Money | $50 | Instant | Instant |

| Web Money | $1 USD | Instant | Instant |

| Internal Transfer | $1 USD | Instant | Instant |

It should be noted that fiat funds can only be withdrawn to the user’s personal account. Furthermore, the term ‘instant’ applies only if no manual verification has to be completed by an Exness staff member.

Customer support

Exness score highly in terms of customer support. The multi-lingual support team are available around the clock.

- The Exness website is accessible in 15 languages

- Live customer support is available 24/5 across 12 languages and provides 24/7 support in English, Thai and Chinese

- The firm provides toll-free numbers depending on the location you are accessing the contacts page – https://www.exness.com/support/

- The Exness team can be contacted by email via the following address – [email protected]

The bottom line

Trading is risky, and you want to ensure that your broker provides the support needed for you to make a success of it. Exness does that and offers traders a quality trading platform and low operating costs.

Access to the markets is via the well-respected MetaTrader platforms, and the high leverage options, tight spreads, 107 currency pairs on offer make the Exness package an attractive option. An additional reason to consider using them is the very low minimum account opening balance of $1.

Trading and administration costs are about as low as you’ll find in the market and the accounts which offer incredibly tight spreads and no additional commissions are market leading.

The site is well laid out and user-friendly. There is also a reassuring transparency concerning T&C’s which reflects the firm’s justified confidence in its position in the market.

There are currently no ongoing bonus promotions at Exness.

FAQs

Q: Does Exness offer an Islamic account?

A: Customers based in Islamic nations can be exempted from swap rules to comply with religious rules and can contact the broker to find out more information about this special account.

Q: What are the deposit options for Exness?

A: Exness currently offers four deposit options. All deposit methods are free of charge, although Exness cannot guarantee that some methods will not come with third party processing fees in some instances.

Q: How can I change leverage with Exness?

A: The amount of leverage a trader can receive depends on their financial situation. Further to this point, the maximum leverage is dependent on their account type. As per Exness’s terms, maximum leverage is 1:2000 for MT5 / 1:unlimited for MT4.

Q: How can I close my Exness account?

A: Unfortunately, Exness does not offer an automated process a user can go through to close their account. Instead, the user must contact customer support should they wish to terminate their trading account.

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk