Finmarket’s standing is a very solid one from the perspective of regulation. Although it is regulated only under the jurisdiction of CySEC, it is fully MiFID-compliant, and its Cyprus-issued license is valid all over the EEA.

Of course, there are some countries, like Belgium, the laws of which do not allow brokers like Finmarket to operate, but for the most part, the operator can indeed peddle its FX/CFD trading all over Europe.

Other countries from which Finmarket does not accept traders are the US, Iran and North Korea.

Launched (and licensed) in 2015, Finmarket is a relatively young brokerage. That said, it has been in business for 4 years now, and it has generated surprisingly little relevant user feedback.

None of the better known FX forums and message boards feature any user chatter linked to the broker, though there are a handful of reviews out there which attempt to tarnish its image. None of these reviews present any proper accusations or proof however, leaving the door open to the possibility that they may in fact be smear-pieces.

The company that owns the Finmarket brand is a certain K-DNA Financial Services Limited. Its offices are located at 56 Griva Digeni Avenue, Anna tower, First floor, 3063, Limassol, Cyprus.

K-DNA is a registered Cyprus investment firm and as such, it is a member of the Investor Compensation Fund.

The CySEC license number of the operation is 273/15.

In compliance with CySEC’s regulatory requirements, the broker has implemented a series of rules meant to ensure the continued safety and security of the funds deposited by users.

Firewalls and cutting edge encryption protect all financial transfers and the monies of the traders are held in segregated bank accounts.

Membership in the Investor Compensation Fund offers protection to the extent of EUR 20,000 on trader deposits.

What exactly does the broker offer above and beyond regulation and security?

While Finmarket’s trading conditions may not be the absolute best the market has to offer, they are quite attractive. Fixed spreads on the EUR/USD pair begin from 1 pip.

The maximum leverage supported by the broker is 1:30, which is indeed fair. Traders do not pay any fees on their deposits and customer support is available 24/5.

No fewer than 3 trading platforms are at traders’ disposal, covering every possible need and device type.

In addition to a fair range of tradable assets, Finmarket also offers a well-stocked selection of trading tools. Its Trading Academy is host to an exhaustive archive of VoDs.

Tutorials about the supported trading platforms, strategy guides and lectures on stocks and CFDs are also available.

Finmarket Account Types

To cater to all those interested in its services, the broker has set up no fewer than 5 real money account types -including the Islamic Account option, which is obviously only available to those of the Islamic faith. In addition to this nifty little selection, there’s a free Demo account available as well.

The cheapest/most basic account option is the Blue one. The minimum required deposit for such an account is $250.

For that money, the trader gains access to some 50 tradable assets, and floating spreads starting from just 0.4 pips.

Like all the other account types, the Blue one is eligible for Reward Point accrual. Blue account users collect 1 reward point per traded lot, the value of which is $5.

The Silver Account represents quite a step up from the Blue one in terms of supported features, rewards as well as minimum deposit.

Those who want to open such an account need to deposit at least $5,000. With this option, the number of tradable assets is 70, and the floating spreads start from just 0.2 pips.

A number of perks, such as personal account managers, trading tools and VoD access, are also offered through this account.

Gold Account holders are required to deposit at least $20,000. For that amount, they get even better floating spreads (from 0.1 pips), as well as access to no fewer than 100 tradable assets. Perks-wise, the Gold account is a full-extra account.

One step further up the account tier ladder is the Elite membership, which costs a minimum of $50,000 to activate. Needless to say, this account type is the VIP option.

The minimum required deposit for the Islamic account is $500. The floating spreads offered by this option start from 0.65 pips. Islamic traders can access some 70 tradable assets.

Finmarket Trading Platforms

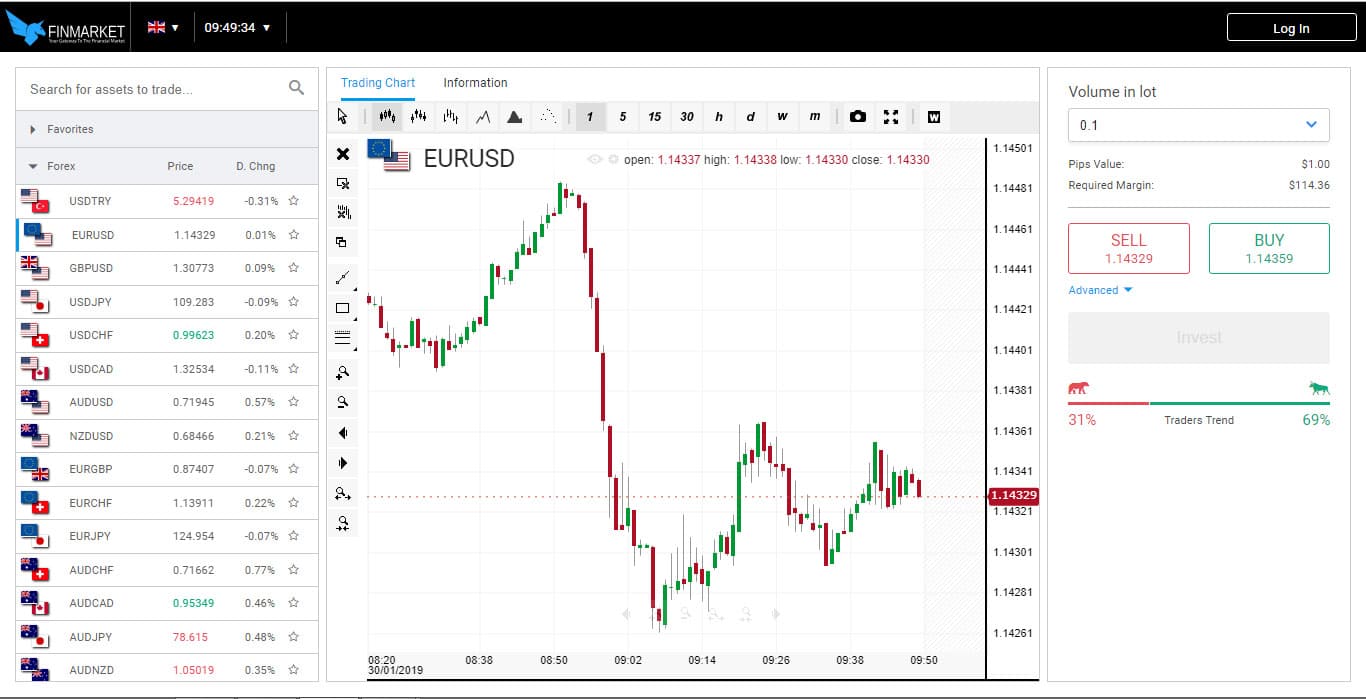

The broker features three trading platforms: MT4, a WebTrader as well as a couple of mobile apps – for Android and iOS – which come with rather similar features and functionality.

MT4 is a well-known Forex/CFD staple. It is arguably the best trading platform available, offering superb charting, scores of time frames and technical indicators, as well as outstanding customization options.

In fact, the platform is often described as a “fully customizable trading environment”.

Not all customization-related features are cosmetic in nature either. For instance, traders can create and add their very own technical indicators to the selection of 50+ which comes preinstalled with the platform.

The same goes for Expert Advisors and custom scripts. EAs can also be imported or created from scratch.

Unfortunately, not everyone is able/willing to download software. Such traders will love the WebTrader, which – despite its browser-based nature – almost equals the full MT4 platform in terms of functionality.

One click trading is supported by the WebTrader too, together with a social trading feature, the actual existence of which is somewhat questionable – the official site says it is there, but that may not be the case.

The charting capabilities of the platform are also quite outstanding.

Last but not least, we have the mobile traders, which cover iOS as well as Android-powered devices, and which put trading squarely into the palms of the users’ hands. The charting capabilities of these mobile apps are nothing short of amazing.

Finmarket Deposit/Withdrawal Methods

A wide range of deposit methods are available for traders at Finmarket. VISA, MasterCard and Maestro are all accepted, as is Bank Wire, Skrill and EFTPay.

Trader withdrawals are said to be processed within 48 hours.

Support

Finmarket support (available around the clock, with the exception of weekends) can be contacted by email ([email protected]), as well by phone (+357-252-54070). The official site of the operator comes with a live chat feature.

The Bottom Line

Finmarket looks like a solid FX/CFD operation. It offers good trading platforms, a diverse range of account types and more than reasonable minimum deposit requirements.

Its market coverage is surprisingly good. Besides all the traditional asset classes, it also supports the trading of cryptocurrencies (such as BTC and ETH).

In this regard, it has to be made clear that the broker does not sell actual cryptos. Rather, these interesting and extremely volatile new assets can be traded through CFDs (Contracts for Difference) – a type of financial derivative which offers exposure to variations of the asset-price, without requiring asset ownership.

That said, some question marks remain regarding the broker’s reputation. It is indeed more than a little strange to see a 4 year old broker without any user feedback extolling its virtues, or more likely: slamming its shortcomings.

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk