| Pros | Cons |

|---|---|

| Great industry reputation | Minimal automated trading support |

| Competitive trading condition | Minimal third party tool support |

Traders Viewpoint

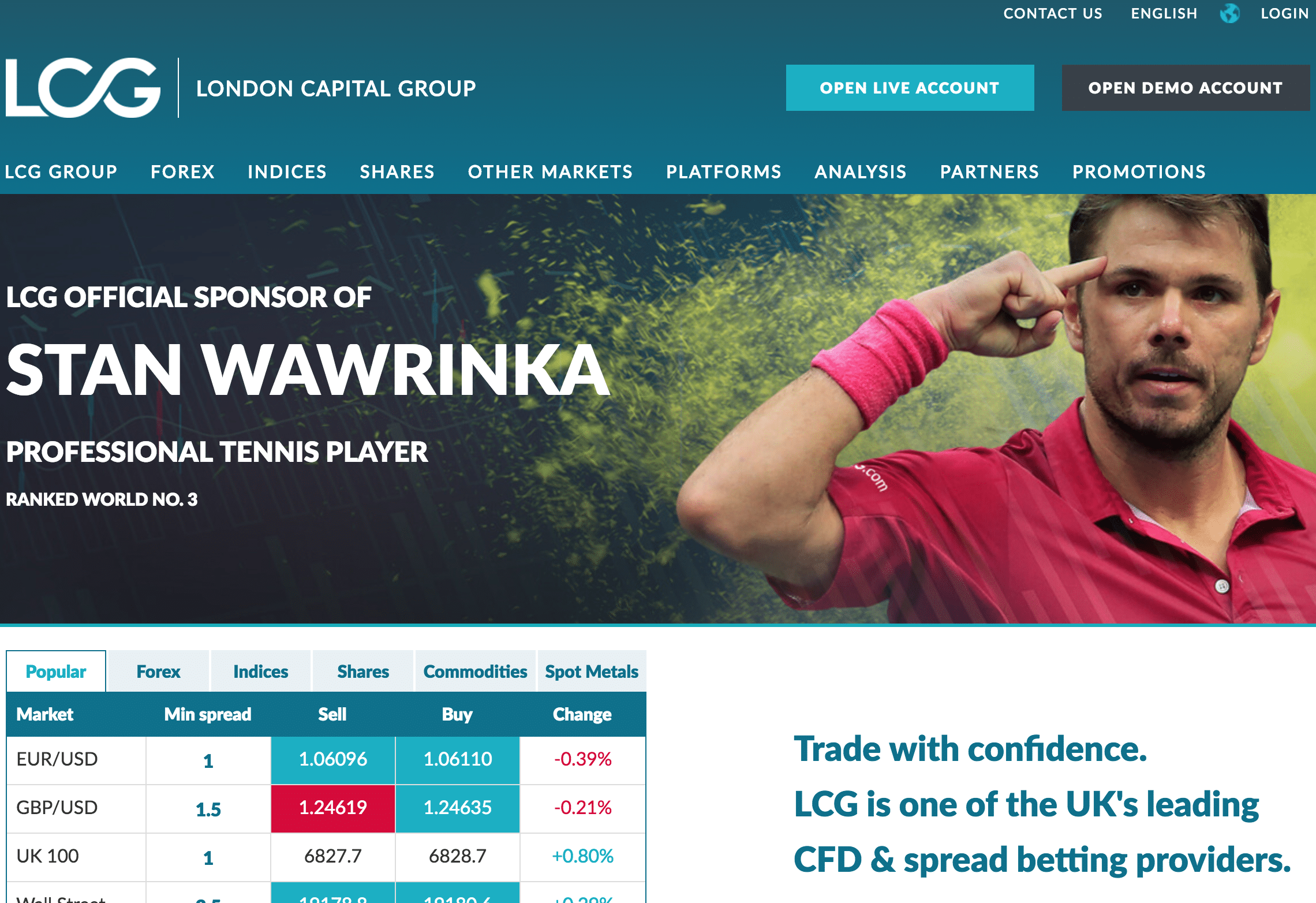

With roots stretching back to 1996, London Capital Group is a non-nonsense broker with an almost unrivalled reputation in the online trading space. With their home office in London, it is currently traded on the London Stock Exchange and provide online brokerage services to clients across the globe.

Although originally focusing on spread betting, it has since gone on to expand into a number of different markets and asset classes. Currently, you can trade thousands of financial instruments across a total of nine asset classes, including forex, indices, shares, commodities, bonds and interest rates, vanilla options, and ETFs.

The spreads on offer across the various markets are generally very competitive when compared with the industry averages. Additionally, it also has access to high levels of liquidity, with their liquidity provides being Tier 1 banks, meaning trades can be executed very efficiently.

Trading is delivered using the MetaTrader 4 platforms which comes with all the stability, ease of use, and advanced features you have come to expect from such a highly respected trading platform. This also includes a mobile version of the MT4, available on both Android and iOS, which allows you to take your trades on the go.

Customer trust and security is something London Capital Group clearly put at the centre of everything it does, and it proudly boasts that in their twenty years of trading it has looked after some $1 billion in deposits and over $20 trillion in executed trading volume. All customer deposits and trading funds are handled with the utmost care and held securely in Tier 1 banks. Additionally, it is also regulated by CySEC, CYMA, and the FCA, meaning it is incredibly well regulated.

Customer support is every bit as responsive and efficient as you would expect from a broker of the London Capital Groups size and prominence, with well-trained customer support agents on hand 24/7 to answer any query you might have.

It can be contacted via phone, email, or live chat. Additionally, it has also made a comprehensive FAQ section available to users of the platform, which should handle most common queries you might run into. For both new and more experienced users, there are a number of basic learning and educational materials that you are given access to, including tutorials, webinars, and eBooks. Additionally, it also provides a daily email service at the start of each day which provides a high-level overview of the markets that day.

If you want to trade with an award-winning online broker who has been delivering industry-leading service for over twenty years, then you need to look no further than London Capital Group. Regardless of whether you are a rookie trader or a seasoned veteran of the markets, London Capital Group has something on offer for you!

Ready To Start Trading With LCG.com?

Simple Sign Up Process, Get Started In Minutes

If you are in the market for a no-nonsense broker that is well established, has home offices in London, and is traded on the London Stock Exchange, then look no further – Londoncapitalgroup.com (LCG) is the broker that will end your search. The firm’s holding company has been in the forefront of financial trading since 1996. In 2003, it formed its financial spread betting broker, “Capitalspreads.com”, and in 2005, it launched its traditional forex trading offering, LCG. Initially, the broker focused on large institutional clients, but today, LCG offers a broad base of retail forex pairs trading, supplemented with futures trading in indices and commodities. The broker is regulated by CySEC, CYMA and also regulated and licensed by the Financial Conduct Authority (FCA). U.S. clients are not accepted.

LCG are able to offer some of the most competitive pricing in the industry. Comparisons may be a little more difficult since their pricing follows the spread-plus-commission pricing model, prevalent for larger institutional clients, but their liquidity providers are Tier-1, as can be expected when you are a public company with more than adequate capitalization. At LCG, you only have one account classification to deal with that comes with a 10% promotional balance up to $5,000. You may trade cash and futures contracts for 39 currency pairs, both major and exotic, and supplement those trades with more than two-dozen indices and commodities asset choices. Leverage varies by asset class.

LCG uses the Metatrader4 set of trading platforms with market execution of orders. There will be no re-quotes, but prices may change due to slippage, as is the normal case when the system automatically matches orders to available liquidity providers. This mode of operating still yields the lowest pricing structures when compared to brokers with a dealing desk model. Automated trading with Expert Advisors is also supported. Support and training materials may appear thin, but LCG relies on its professional Customer Support and Sales Team to get you started. Beginners can always refer to the companion site, Capitalspreads.com, for an abundance of videos, webinars, and user guides for trading, if necessary. Daily emails prepare you for each day’s action.

As of August 1st 2018 LCG has new maximum leverage. It starts from 1:5 for shares and goes up. More information can be found on their website.

Read reviews of other forex brokers.

Trade With One Of The Most Respected Brokers

Get Access to 7000 Instruments Across 9 Asset Classes

Features at London Capital Group

Why trade with Londoncapitalgroup.com? The firm lists these reasons:

- Founded in 1996 and headquartered in London;

- Listed on the London Stock Exchange;

- Regulated and authorized by the Financial Conduct Authority (FCA);

- Holding company is publicly traded on the London Stock Exchange with a market cap of roughly 20 million Pounds Sterling;

- Asset choices range from major and minor currency pairs (39) to indices (12) and commodities (15);

- Commission; LCG low commission charges are included in the FX spreads and there are no hidden fees

- Pip spread on majors; from 0.6 pips

- Leverage varies by asset type.

- Metatrader4 trading platform for desktop and mobile applications;

- ECN/STP processor for swift order execution and low fees;

- One account classification that comes with a free demo account;

- Daily emails with market commentary and analysis get you started for each trading day;

- Customer service reps are available 24X7 while trading markets are open.

Supported Platforms

LCG chose the popular Metatrader4 trading platform products for ECN market execution usage. The MT4 platforms come with a free user guide and access to the MT4 community of traders in case you wish to share information or ask questions of the attending forum. Mobile applications are also supported, and all session activity data, along with personal identity information, are encrypted using the latest 256-bit SSL technology for safety and security purposes.

Deposits and Withdrawals

LCG will accept Visa or Mastercard credit cards or selected debit cards for deposits, but the preferred method is a banking wire transfer. Cash cannot be accepted, due to international AML laws, but in some cases a check will be accepted, as long as it is drawn on a UK bank and the client’s name is on the account. USD, GBP, and EUR deposits are acceptable. No deposit is required to open an account, but the minimum amount required for a trade depends on the asset type chosen and margin allowances dictated by the amount of leverage used. Withdrawals will be processed promptly, as long as personal ID information required by AML laws is on file and in order.

Open Your Live Trading Account

Deposit Here To Get Started

Customer Support

Customer service representatives are professionally trained and have extensive experience trading in financial markets. They are eager to answer your queries and to get you up and trading quickly. Access can be achieved via email or direct phone line during market hours every day, 24X7. If you wish to review basic trading materials in the form of video tutorials, webinars, or ebooks, then all are available on the companion website at Capitalspreads.com. As for planning out each trading day, the broker provides a unique daily email at the start of each day that includes commentary and analysis for the forex, commodity, and indices markets.

London Capital Group(LCG) – Conclusion

For the professional trader that wants low fees, service reliability, excellent support, and the peace of mind that comes with FCA regulation, without any of the distractions that proliferate other broker offerings, then London Capital Group may be your broker of choice. The firm has a long history of serving institutional clients and spread betting customers in the London financial arena. The staff at LCG are eager to earn your trust: “At LCG we’re proud of our key strengths, some of which are listed below. But we won’t stop there because we’re constantly looking at ways we can improve our offering.” If you want a no-nonsense broker focused on you, then LCG may be it.

Claim Your LCG.com Account

As Approved By Forextraders.com

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk