Forex TRADERS’ VIEWPOINT

Moneta Markets is a new entrant into the CFD broker space but has a back story that suggests it will become a significant player.

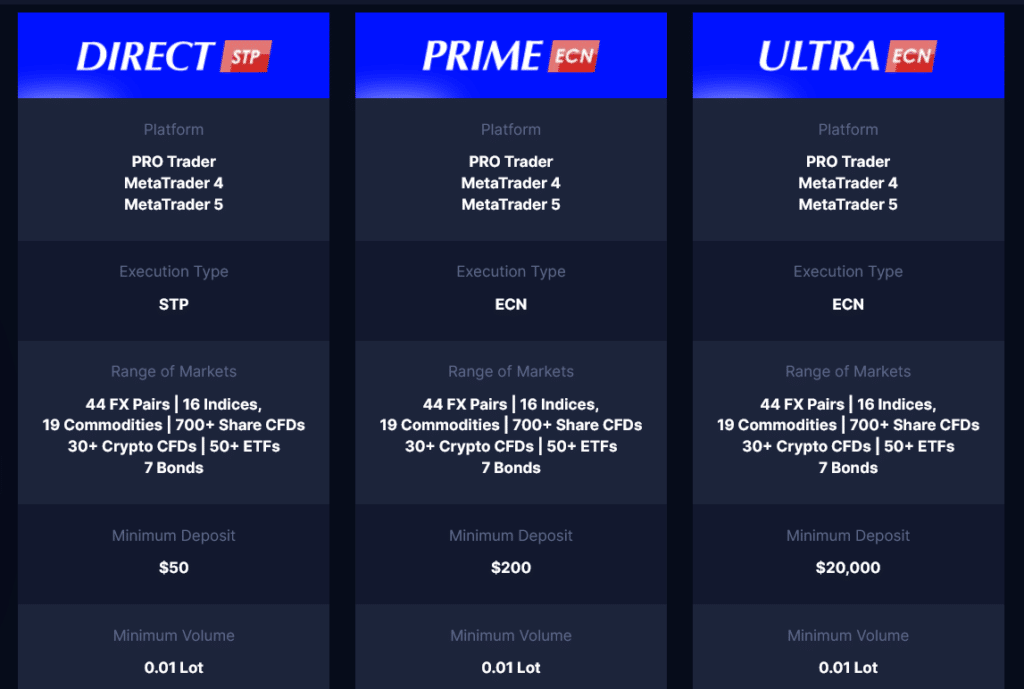

Moneta Markets offers 1000+ of the most liquid Currencies, Indices, Commodities, Share CFDs, ETFs and more. The broker offers two types of accounts. One uses ECN protocols, and the other offers STP (Straight Through Processing), and both frameworks provide clients with high-quality, institution grade trade execution.

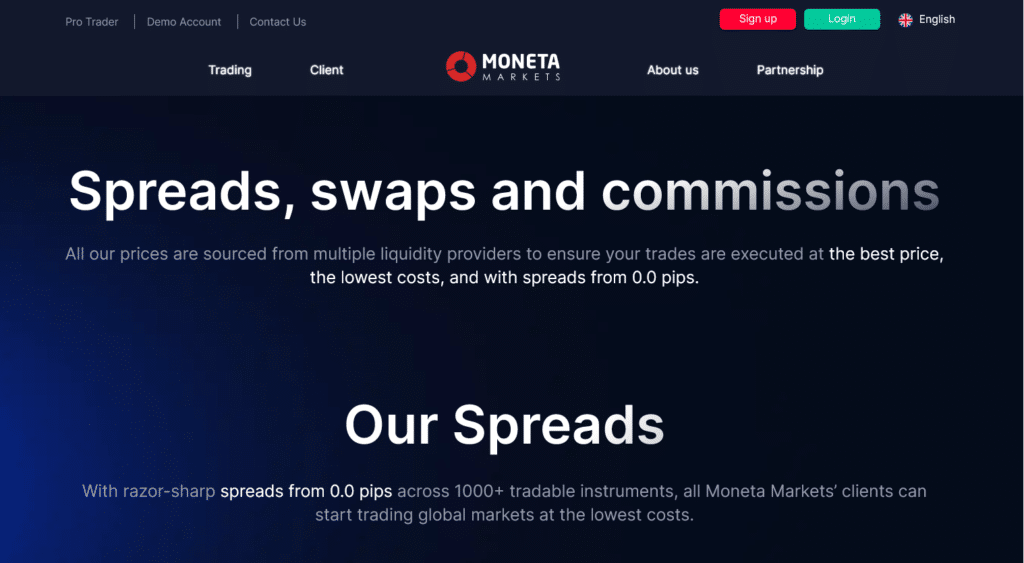

Moneta Markets spreads are floating and start from as low as 0 pips. The commissions are also user-friendly, starting from as low as 0.1%. Rollover fees apply in some markets but aren’t prohibitive, and Moneta Markets does not charge any fees on cash deposits and withdrawals.

As a new entrant to the market, Moneta Markets could decide to adjust its pricing schedule, still they’ve started with the right approach and offer cost-effective, high-quality trade execution.

Fans of MetaTrader’s MT4 and MT5 platforms will be pleased to note both platforms are available. These are complemented by the Protrader platform, an impressive service supported by TradingView. Protrader provides a wide range of technical and fundamental research tools, is highly intuitive and easily customisable, which can help traders meet their goals.

All platforms are available in web-trader and mobile App formats. The web versions are compatible with all major browsers, while mobile versions are available for Android and iOS. You can download the native mobile apps for free on Apple Store or Play Store.

The crossover from the desktop version to the smaller screen is impressive. The mobile Apps include all the features found in the desktop version, making Moneta Markets an ideal choice for traders who want to manage their activity on the move.

A wide range of educational trading resources is provided, catering to both beginners and expert traders, ranging from beginner to expert trading materials. The materials are accessible for free to all registered users.

Moneta Markets Rating Overview

| FEATURE | Moneta Markets |

|---|---|

| Overall | ⭐⭐⭐⭐ |

| Education | ⭐⭐⭐⭐⭐ |

| Market Research | ⭐⭐⭐⭐ |

| Range of Markets | ⭐⭐⭐⭐ |

| Deposits & Withdrawals | ⭐⭐⭐⭐⭐ |

Ready To Trade with Moneta Markets?

Follow The Simple Sign Up Process & Be Trading Instantly!

about MONETA MARKETS

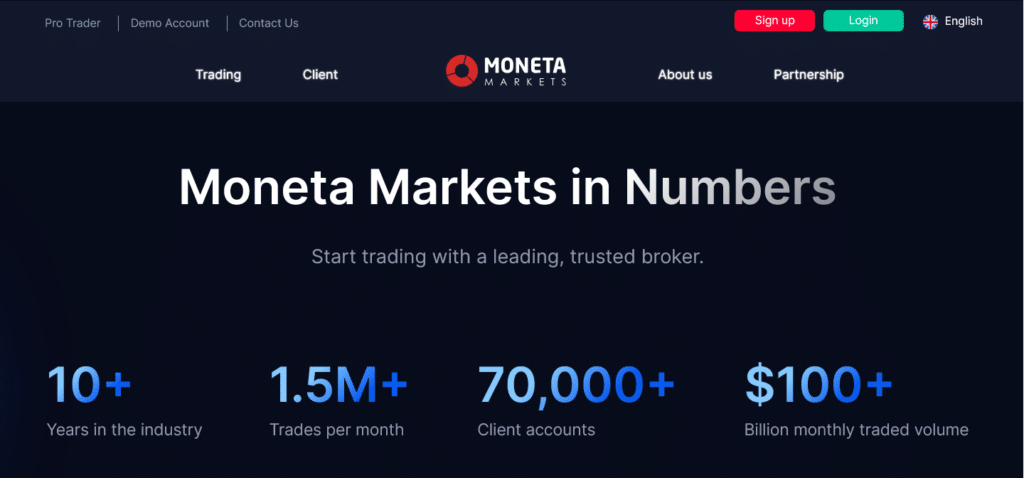

Moneta Markets has had an award winning start to life since it’s inception in 2019, and the 300+ markets available use floating spreads which means trading costs can be super-low, mainly when market trading volumes are high. Leverage terms extend to an impressive 1000:1, and the minimum account opening balance is $50.

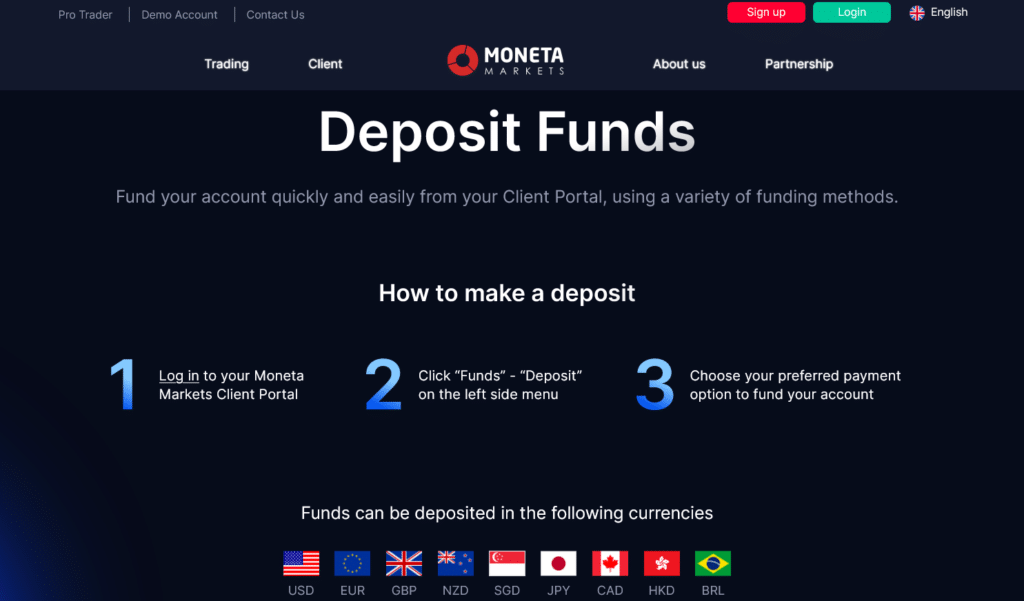

Traders can fund their accounts through debit/credit cards, wire transfers, PayPal, Neteller, Skrill, FasaPay or Bitcoin. Moneta Markets does not charge any deposit or withdrawal fees. However, it is worth checking the T&Cs of third-party providers who might apply their charges.

Moneta Markets is regulated by the Financial Sector Conduct Authority (“FSCA”) of South Africa.

This broker provides 24/5 customer service through email, phone, and live chat. Telephone and live chats are answered immediately, while emails can take up to 24 hours. In CV Magazine’s Corporate Excellence Award, Moneta Markets has won the Best Customer Support 2020 award in the CFD broker category.

WHO DOes MONETA MARKETS APPEAL TO?

Moneta Markets is recommended for both beginner and experienced traders. Its trading platforms are entirely beginner-friendly but behind the neat functionality are an array of powerful software tools. The broker offers adequate educational resources for both beginner and experienced traders.

The number of markets is not extensive, but the range of asset classes is impressive, and crypto trading is also supported. The Direct account is set up in a format ideal for beginners and the Prime account would appeal to scalpers and traders using the Expert Advisors service.

The Protrader platform Moneta Markets offers will be a real draw for some traders. It provides an extensive range of CFD trading research tools and a wide range of educational resources. Moreover, it has a user-friendly interface, and clients can manage all aspects of their accounts in one place.

The minimum deposit required to open a Direct account with Moneta Markets is $50. The service is not available to those based in the US, Canada, Belgium, France, Russia, North Korea, Lebanon, Tunisia or Yemen, and several other countries. Moneta Markets should be available in your country if you can access the signup page.

Moneta Markets is a new entrant into the CFD broker space but has a back story that suggests it will become a significant player. Moneta Markets offers 1000+ of the most liquid Currencies, Indices, Commodities, Share CFDs, ETFs and more. A wide range of educational trading resources is provided, catering to both beginners and expert traders, ranging from beginner to expert trading materials.

Moneta Markets is best for - Beginner to intermediate traders familiar with MetatraderMONETA MARKETS Forex ACCOUNT TYPES

The free to use Demo account is an excellent way for new clients to find out what Moneta Markets has to offer or develop new strategies. The live accounts come in two forms. The Direct account uses STP processing and has a minimum balance requirement of $50, and the Prime account uses ECN protocols and has a minimum balance requirement of $200.

Compared to MT4, the Moneta Markets web-trader seems more intuitive and comprehensive. Both beginner and advanced traders enjoy the same trading features and educational resources. However, only traders with a deposit of at least $500 can enjoy the Moneta Markets master video course. The course includes 100+ advanced video trading tutorials.

The Moneta Markets demo account is a complete simulation of the live account. Consequently, traders can fully prepare without risking real money. The demo runs on real market data and offers an accurate picture of what to expect in live trading.

Moneta Markets assigns all new traders a dedicated account manager to walk with them through the critical first steps of trading. Shariah-compliant Islamic Trading accounts are available on both the Direct and Prime accounts.

Open Your Moneta Markets Account Here

Forextraders.com Exclusive Sign Up Bonus - Up To 50% Bonus

MARKETS AND TERRITORIES

Moneta Markets was founded to cater to retail CFD traders exclusively. The broker offers 1000+ of the most liquid Currencies, Indices, Commodities, Share CFDs, ETFs and more. The broker provides 45+ FX pairs, including all the majors, most minors, and several exotics.

Traders looking for exposure to major global stocks such as Apple Inc, Facebook and Google and market indices such as the S&P 500 and Dax 30 can trade with this broker. Commodity CFDs include gold, silver, US oil, sugar, corn, wheat, etc.

On the other hand, Crypto offerings include all significant coins, including BTC, ETH, BCH and XRP, paired against each other and fiat currencies. As mentioned earlier, Moneta Markets is not available in the US, Canada, Belgium, France, Australia, and several other countries.

Moneta Markets is regulated in multiple jurisdictions by the Financial Sector Conduct Authority (“FSCA”) of South Africa under license number 47490.

INSTRUMENTS AND SPREADS

A dedicated section of the Moneta Markets site gives an impressively transparent breakdown of the spreads in each market. A clear breakdown of T&Cs can help with the cost-benefit analysis of strategies and indicates that a broker is confident about their rates being better than average.

Spreads tend to widen during uncertain times, such as when important news is about to be announced. The spread for the EUR/USD pair 0.02 pip. This is within the industry average. Also, the spread for trading BTC CFDs is $50. This is also within the industry average.

FEES AND COMMISSIONS

The commission mainly applies to share CFD trading and starts as low as 0.1%. Moneta Markets offers over 185 UK, US, Hong Kong and European share CFDs. This broker does charge a swap fee for positions left open overnight.

Moneta Markets claims not to charge any deposit or withdrawal fees. However, a small fee may apply on the side of the banks facilitating the transaction. This is expected with most brokers. All Moneta Markets trading education materials are free.

Get Your Live Trading Account

No Deposit Fees + Free Trading Education!

Forex Trading PLATFORM REVIEW

Moneta Markets offers their own ProTrader, CopyTrader and AppTrader platforms as well as access to MetaTrader’s MT4 and MT5.

The Protrader platform is highly intuitive and available in web and mobile versions. It also comes with over 45 built-in technical indicators, six chart types, trend lines and multiple drawing tools.

MT4 has less than 40 built-in technical indicators and three chart types. Another important feature available in the Protrader platform is an AI-powered Market Buzz. This feature allows traders to filter through the market noise and identify news with the highest impact on the markets.

The Protrader trading platform also offers a trading calculator to help traders determine key price levels and manage their funds efficiently.

Moneta Markets offers both the Take Profit and Stop Loss features regarding risk management. Moneta Markets also provide a Trailing Stop, a part that automatically notches up the Stop Loss as the markets move into profits.

There are video tutorials to guide users through the whole risk management process and how to use these tools efficiently. The Moneta Markets trading platform is intuitive and easily customisable to meet traders’ needs.

Unlike most of its competitors, this broker does not offer a desktop app. However, its web trader is compatible with most browsers. Consequently, users do not need a desktop trader.

MOBILE Forex TRADING

As mentioned above, Moneta Markets offers both web-trader and App- based mobile trading platforms. Moneta Markets’ native mobile Apps work on Android and iOS devices and are available for free on Google Play and Play Store. MetaTrader 4 and 5 are also available in the App Stores.

They are lightweight and do not affect the device’s performance they are installed. Moreover, they come with all the features of the web trader, so users can manage their accounts while on the go.

You can easily signup for live or demo trading on the mobile app. It is, therefore, possible to exclusively trade or practice trading on your smartphone. The Moneta Markets mobile apps are highly intuitive and surprisingly easy to use, even for the complete beginner.

SOCIAL TRADING AND AUTOMATED TRADING

The MetaTrader platforms allow clients to tap into the trading ideas of others using the Expert Advisors tool. There is also a vibrant community of traders willing to share ideas and thoughts on the market.

The DupliTrade copy trading service offers another way of using the trading signals of other traders on your account. Choose the traders you want to follow based on your preferred instruments, trading method, and trading style. Their trades will automatically be duplicated in your Moneta Markets MT4 and Protrader platforms.

CRYPTO TRADING

As mentioned previously, Moneta Markets provides CFDs on six of the largest cryptos by market capitalisation. These include Bitcoin, Ethereum, Ripple, Dash, Bitcoin Cash, and Tether paired against the USD.

The typical leverage for trading Crypto CFDs through this broker is 1:2. Most brokers offer about the same level of leverage. Moneta Markets’ spreads on crypto CFDs are floating, with the average spread for BTCUSD being $50.

Crypto trading is not made available to clients of all countries to comply with regulatory conditions.

Trade The Major Crypto Markets

Ride The Bitcoin Wave!

Forex CHARTING AND TOOLS

Moneta Markets trading tools include over 45 technical indicators, 9-time frames, and six chart types. Also available is a suite of chart drawing tools, including trend lines and Fibonacci levels.

The Moneta Markets charting tools include an Indicator Wizard that enables traders to add any of the supported indicators in a few clicks. Also available is a trading calculator to help traders determine their trading specifics before going live.

With a trading calculator, traders can estimate their trade’s profits and losses, compare results from different opening and closing rates, calculate the required margin for their positions, and identify their pip value.

Forex EDUCATION

Moneta Markets trading resource centre includes trading guides and video tutorials, ranging from beginner to expert level trading education.

The video tutorials come in packages, with the most comprehensive one being Market Masters, which is only available to traders with a deposit of more than $500. Traders who qualify for this package enjoy over 100 video tutorials covering technical analysis, candlestick patterns, sharing CFDs day trading strategies, and more.

Free trading courses are also available to all registered users. They are well structured to cater for beginner, intermediate and experienced traders. All new traders are assigned a dedicated account manager to walk them through the learning and trading process.

There is also a free demo that back tests historical market data. With the demo, traders can practise their skills without risking real money.

Another neat feature designed to support clients make the most out of trading is Moneta TV. The channel provides market updates and daily economic insights into trading ideas based on fundamental and technical analysis.

Open Your Free Demo Account

Learn The Ropes With Full Access To The Trading Platform

Forex TRADER PROTECTIONS BY TERRITORY

Moneta Markets is monitored by the Cayman Islands Monetary Authority (CIMA) under license number 1383491. Tier-one regulators monitor its parent company in three jurisdictions, including the UK FCA.

Consequently, Moneta Markets is globally trusted even though not as stringently regulated as most of its competitors.

Moneta Markets segregates clients’ deposits through the National Bank of Australia. This is a globally recognised financial institution with stringent requirements for financial institutions accepting deposits from the public.

Compare Moneta Markets with other approved brokers

|  |  |  | |

| Education | educational content, webinars, market analysis | webinars, market analysis | courses, webinars, market analysis | courses, market analysis |

| Customer Support | email, phone, live chat | email, phone, live chat | email, phone, live chat | email, phone, live chat |

| Minimum Deposit | $50 | $100 | $200 | $100 |

| Total Markets | 300+ | 725 | 1000+ | 1260 |

| Total Currency Pairs | 45+ | 64 | 62 | 55 |

| Total Cryptos | 16 | 3 | 12 | 17 |

| Total CFDs | 635+ | 725 | 900+ | 626 |

| Trading Platforms | MT4, MT5, ProTrader, AppTrader, CopyTrader | MT4, MT5 | MetaTrader 4, MetaTrader 5, cTrader | MetaTrader4, Sirix, AvaOptions, AvaTrader, Mirror Trader |

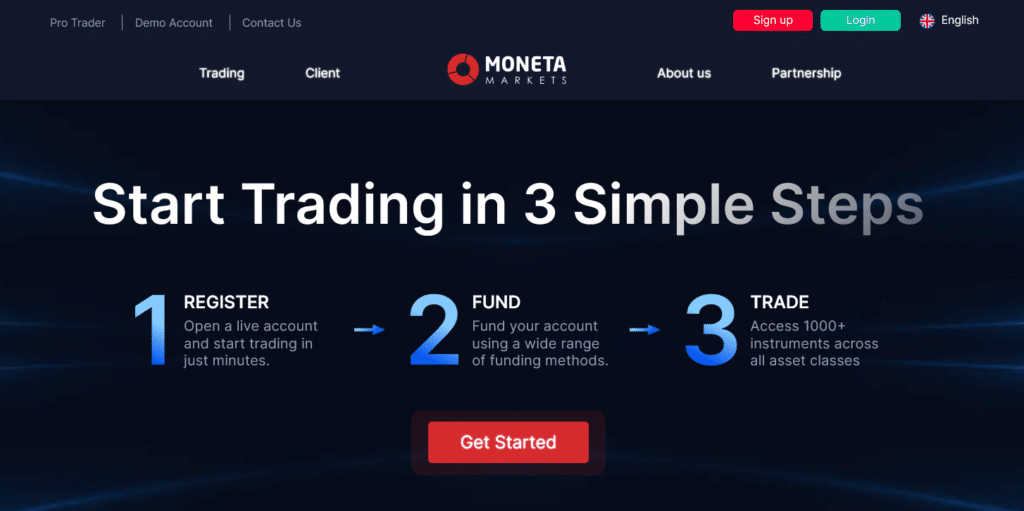

Opening an account

Moneta Markets offer several types of accounts, including those for ‘Professional’ traders. The area of the site used to sign up for a standard trading account is found by clicking on the ‘Sign Up’ button on the top right of the Moneta Markets home page.

The onboarding process starts by inputting basic contact details, or you can choose to sign up using information imported from Google, Facebook, or LinkedIn profiles.

One neat feature of the Moneta Markets registration is that a clear route map guides new users through the onboarding process. It explains how the stages are broken down into five categories:

- Personal Details

- More About You

- Account Configuration

- Confirm Your ID and

- Fund Your Account

As you progress through the registration process, the monitor on the right-hand side of the screen updates the estimated time remaining before the process is completed. The broker claims that opening a new account takes less than five minutes. During our testing, we found that the estimate was accurate thanks to various time-saving features.

The broker requires personal information to ensure that it complies with regulatory KYC (Know Your Client) rules; however, the sharing of identification documents is completed online, making the process seamless. Once set up, you can access your new account immediately and what currency you can use to make deposits is detailed, plus the funding process is explained. If that suits your requirements, then Moneta Markets could be for you.

Whereas some brokers offer accounts denominated in only major currencies such as USD, Moneta Markets offers nine different currency options. That can result in savings as funds don’t need to be converted from one currency to another.

Four of the five funding methods result in your brokerage account cash balance being credited instantly, with only bank wire transfers taking longer, with the broker advising that using that approach could result in funds not hitting your account for up to three days.

There are enough risks associated with trading, so paying administrative fees which could be avoided makes little sense. Moneta Markets again help their clients by not applying any charges on cash deposits, whether you are using debit/credit cards, FasaPay, JCB, STICPAY or bank transfers. Some third parties may levy a fee, which means checking the small print is worthwhile before deciding which method to use.

Placing a trade

Moneta Markets offers its clients access to MetaTrader’s MT4 platform, but the unique Moneta Pro Trader platform is worth getting to know. This in-house developed trading dashboard works in conjunction with the highly regarded TradingView platform. The TradingView connection results in the platform having more than 100 trading indicators as part of the default settings, each designed to identify the optimal time to buy and sell.

The login details for the MetaTrader and Pro Trader accounts are identical, which makes accessing the different dashboards easy. The convenience of the Pro Trader platform is also demonstrated by the fact that it is web-based. There is no need to download the software; instead, it is possible to trade anywhere there is an internet connection. The trading dashboard has an uncluttered feel despite the extensive range of charting tools and indicators, and all of our test trades were executed at the price levels at which we expected them to be filled. Risk management orders such as stop-losses and take profits also kicked in at the expected levels leaving the overall Pro Trader experience being one which is best described as of ‘professional grade’.

The Pro Trader trading platform is an impressive service packed with powerful software tools. One added extra is that it can also be customised to fit your approach to trading, as there are more than 12 chart layouts from which to choose.

Contacting customer support

The award-winning customer support team offers guidance to clients in several languages. The Live Chat service is operated by human staff rather than being set up as an automated assistant. During our testing, the longest we had to wait for someone to respond online was 10 seconds.

Having staff available to answer queries can make a difference to the trading bottom line, so Moneta Markets scores highly with its Live Chat service. Other ways to obtain assistance include by telephone and email. During our testing, we found both forms of communication to be highly effective at resolving issues. The staff contacted by telephone were knowledgeable and professional, and emails detailing more complex queries were answered to our satisfaction within hours of us raising them.

THE BOTTOM LINE

Moneta Markets is a newer broker positioned to offer CFD trading for retail traders, and has set a great standard so far. The firm is picking up pace fast thanks to its low-cost trading approach and superior trading platforms. It offers ECN and STP trading, and spreads start from 0 Pips and commissions from as low as 0.1%.

A few areas of the offering are relatively weak compared to established brokers. The number of markets is satisfactory rather than excellent, but as a new entrant, it can be expected that progress will be made in those areas. That doesn’t mean signing up to Moneta Markets now is not a good idea. The choice of high-quality platforms is as impressive as any in the markets, and trade execution is fast, cost-effective, and reliable.

FAQS

How can I open an account with Moneta Markets?

It takes minutes to open an account with Moneta Markets, and the process is designed to be as user-friendly as possible. From one trading account, it is possible to trade a variety of markets and use whichever of the three platforms you find the best fit for your trading style.

Is Moneta Markets a regulated broker?

Moneta Markets is regulated by the Financial Sector Conduct Authority (“FSCA”) of South Africa under license number 47490.

What fees does Moneta Markets charge?

Moneta Markets doesn’t charge fees on cash deposits and withdrawals. There are some trading commissions to factor in, but these are competitive and in line with the industry standard.

What are the deposit options for Moneta Markets?

The minimum initial deposit requirement for a Moneta Markets Direct account is $50. For the Prime account, the minimum balance requirement is $200.

Moneta Markets PTY LTD soliciting Business from UAE through a Non-Exclusive Introducing Broker Agreement Regulated by SCA , Sterling Financial Services LLC ,Cat 5 ,No 305029.

Moneta Markets is a trading name of Moneta Markets South Africa (Pty) Ltd, an authorised Financial Service Provider (“FSP”) registered and regulated by the Financial Sector Conduct Authority (“FSCA”) of South Africa under license number 47490 and located at 1 Hood Avenue, Rosebank, Johannesburg, Gauteng 2196, South Africa.

Moneta Markets is a trading name of Moneta Markets Ltd, registered under Saint Lucia Registry of International Business Companies with registration number 2023-00068.

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk