Trader’s Viewpoint

OANDA has developed an impressive niche in the broker sector. It offers a high-quality service that provides excellent trading conditions and an array of additional resources to give your trading a cutting edge. The number of instruments available to trade isn’t as extensive as it could be, but all the major asset groups are covered, including crypto. OANDA will likely make it onto your broker shortlist if you’re not looking to trade obscure markets.

There are four trading platforms to choose from; each is well-regarded in the trading community. Selecting the right one for you will come down to personal preference, but having a wide selection is a great place to start.

All the platforms have user-friendly functionality, and navigating between markets and booking trades can be done confidently. Trade execution speeds are ultra-fast, and the broker has a reputation for reliably filling orders.

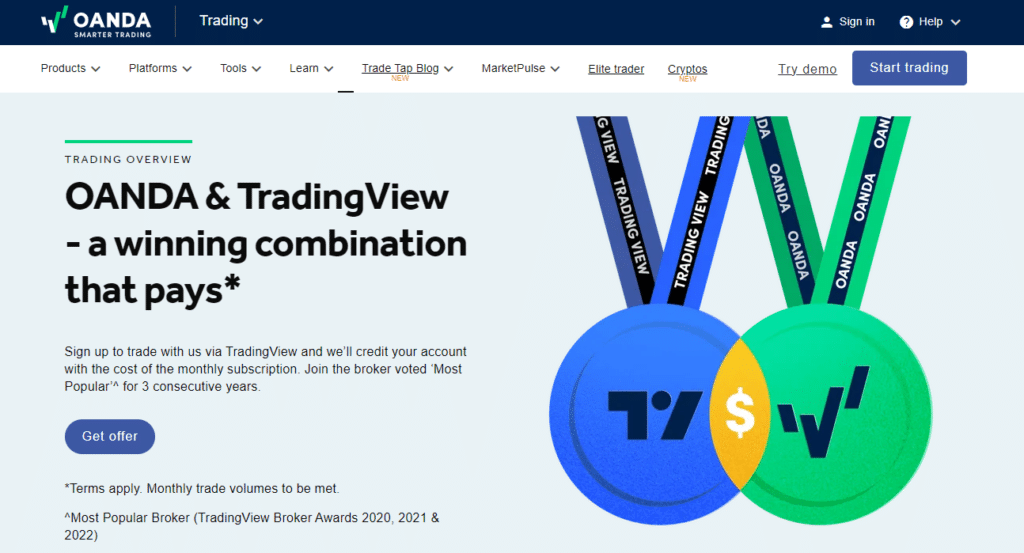

One of the significant advantages of OANDA is the suite of powerful software packages that can be used to support trading activity. The tie-in with TradingView, which forms the TradingView Pro Package at OANDA, is just one example of the broker arranging ways for clients to benefit from the leading platforms on the market.

If TradingView is a good fit for your style of trading, then you can link up to the platform and take advantage of more than 100 technical indicators that allow you to monitor price trends. From there, you can conduct backtesting, develop your own algorithms, and test your ideas using quant model forecasting tools. If you are ‘just’ looking for a reliable trading-focused platform and up-to-date news and research from a trusted broker, then OANDA also ticks that box.

Established in 1996 and with two decades of experience under its belt, OANDA is one of the more established and well-respected online brokerages. Although competing in an increasingly competitive market, OANDA has managed to continue to attract new customers to its platform.

The firm has established a global network of offices and an international client base. Currently, it has offices across Asia, North America, and Europe. It is regulated by six Tier-1 financial authorities, including the US Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA # 0325821). It is also regulated in Canada by the Investment Industry Regulatory Organization of Canada (IIROC).

Who does OANDA appeal to?

If you’re looking for a trusted broker that continues to roll out new innovative tools designed to support clients, then you could do much worse than giving OANDA a try. With favourable trading conditions, a very user-friendly proprietary trading platform, and plenty of experience doing what they do, OANDA is an easy choice. And given that OANDA offers a full-featured demo account which is entirely free to create, OANDA is well worth a try for both new and more experienced traders.

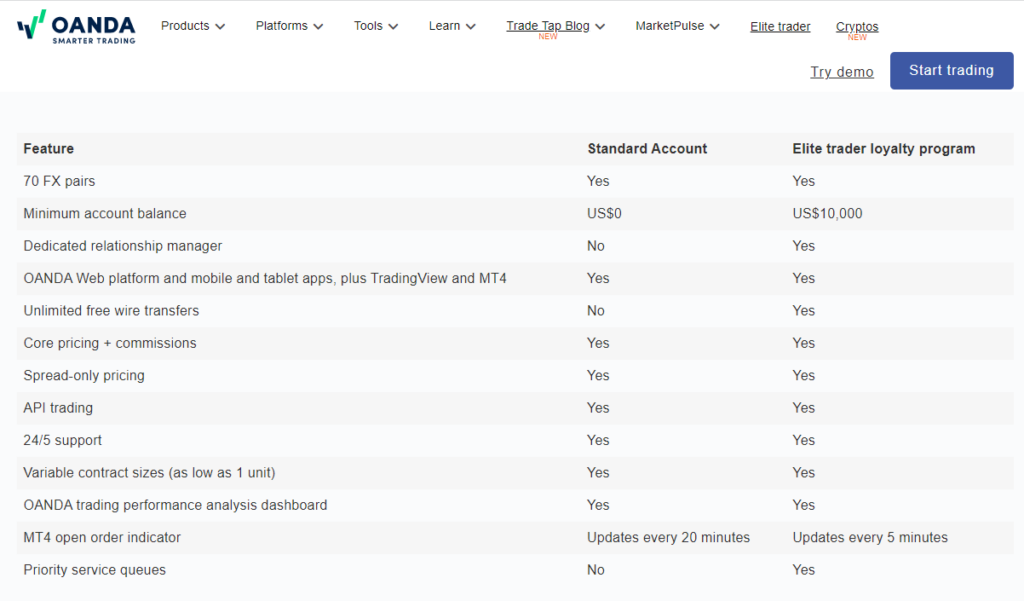

Account Types

Until recently, one of the major criticisms of OANDA was that it only offered a single account. While the terms of the Standard Account were impressive enough, that ‘one-size-fits-all’ approach didn’t work for all traders. It has now been upgraded with the addition of the Elite Trader account.

Those who sign up for the Elite Trader loyalty program can earn cash rebates when they deposit US$10,000 and book trade volumes above US$10m. The rebate is estimated to bring about a net 34% reduction in overall trading costs. Elite Traders also benefit from having a dedicated account manager, unlimited free wire transfers and priority service.

The Standard Account does have some flexibility. Clients can choose to follow one of two pricing structures, Spread-Only or Core Pricing + Commission. Deciding which would be the best fit is helped by a transparent table provided by the broker that breaks down likely costs considering each client’s trading style.

Markets and Territories

OANDA was one of the original pioneers that toiled to make retail forex trading a reality for the general public and quickly leveraged its early successes to become an industry powerhouse. Through its now global consortium of forex-related corporations, it provides retail forex trading and basic rate quote streaming services, money transfer processing, hedge consulting, and a host of other related forex-business services. It serves its ever-expanding global customer base through subsidiaries in the US, the UK, Japan, Singapore, and Australia. It complies with regulatory oversight in each office jurisdiction.

Instruments and Spreads

The trading conditions on offer are generally quite favourable, and the spreads are mostly competitive, with forex spreads as low as 1 pip on certain currency pairs. However, the exact OANDA forex spreads you are offered will change over time and depend on the asset class you hope to trade. For currency pairs, the EUR/USD pair can be as low as 1 pip. Spreads for CFDs vary by asset choice. OANDA also provides an online tab on its website that details the prevailing spreads on all assets offered, each changing in real-time. OANDA leverage terms go up to 1:50 for Major currency pairs and 1:20 for Exotics. Leverage for CFDs may vary widely, depending on the market sector. US traders are not able to trade CFDs.

There are over 68 forex pairs to choose from, so traders can access all the Major, Minor, and Exotic currencies. Ten cryptocurrencies are also available to trade through the OANDA app, including the big names such as Bitcoin and Ethereum and Altcoins including Matic, Solana and Uniswap.

OANDA focuses on providing an ideal marketplace for those looking to trade the major markets. The range of instruments available won’t be the best fit for those looking to invest for the long term, but the specialist approach is part of the appeal for those looking to trade the market more actively.

Fees and Commissions

OANDA has two pricing options: Spread-Only and Core Pricing Plus Commission. Clients can choose to adopt either approach, with selection being determined by which is most cost-effective for a particular trading style.

Traders can run a cost-benefit analysis of both approaches using a neat table the broker provides. It demonstrates the refreshing degree of transparency OANDA applies to its pricing. It sets out to be a quality rather than a budget broker, meaning users are treated to a range of additional extras. Overall, OANDA spreads, fees, and commissions align with the peer group and with large sums of cash potentially at stake,

Platform Review

The flagship of the OANDA enterprise is its proprietary OANDA Trade trading platform. Developed from the fxTrade platform, it takes the honour of being the first online retail forex trading platform to hit the market. It is web-based rather than downloadable, which means it can be accessed from anywhere with internet connectivity and can handle a heavy volume throughput. OANDA Trade provides access to the firm’s market-making trading desk back office and has been scaled up over the years to handle the largest volumes in the industry at peak efficiency.

However, you will not be disappointed if you prefer to use the family of Metatrader4 offerings. OANDA supports MT4, as well, and all of its systems have a mobile app to permit trading from anywhere, as long as your device can access the Internet. All trading activity and personal identity data are encrypted using the latest technology for security purposes.

Mobile Trading

Given the extensive range of desktop platforms on offer, OANDA deserves some credit for combining the high-end functionality of those services into the platform used on handheld devices.

The trading App is free and can be used on iPhone, Android and tablet devices. It can be customised to a granular level, with risk and profitability levels able to be adjusted, chart size changed, and custom notifications put in place to ensure you keep on top of the markets.

One of the significant positive features of the OANDA App is how technical analysis and charting techniques can be used on the smaller screen. It is possible to use dynamic pricing overlays, more than 50 indicators, and nine different chart types. Positions can be opened, closed, and modified, and other aspects of account management can be conducted while on the move.

Social Trading and Copy Trading

Most users of OANDA are likely to have a pretty clear idea of what and how they want to trade. OANDA does not offer copy trading. Those looking for a hands-off way to trade the markets can sign up for the Expert Advisors service that comes with the MetaTrader MT4 platform. That allows users to have trading decisions of others booked automatically to their account, with the additional benefit of allowing traders to develop their own systematic trading models to automate the execution of their strategies.

Crypto Trading

There are ten cryptocurrencies to trade at OANDA through its crypto services partner, Paxos Trust Company. The broker has set up a relationship with a dedicated crypto service Paxos Trust Company to ensure clients get competitive pricing. Adding crypto trading to your standards OANDA account requires following a short verification process where the two accounts are verified and linked – this takes approximately 15 minutes to process but then provides OANDA clients with access to mainstream coins such as Bitcoin, Ethereum and PAX Gold, a coin backed by real gold reserves, Litecoin, Aave, Chainlink, Matic, Uniswap and Solana.

Charting and Tools

OANDA is a natural fit for any trader looking to tap into extensive charting-based resources. All four available platforms have powerful software tools that clients can use to analyse market events and develop strategies. The TradingView Pro Plan link-up with the market-leading TradingView platform is particularly appealing and means using advanced tools and techniques is possible.

Education

There is a lot to like about OANDA’s education and research materials. The wide range of written and video content is presented in a format which aims to get beginner traders up to speed quickly but also has more in-depth features tailored to intermediate and advanced traders. The Education area of the OANDA site is broken down at a high level into Fundamental and Technical analysis, which helps users quickly navigate to their preferred source materials. The Indicators and Oscillators section is helpful for those looking to learn how to spot trade entry and exit points.

A recent addition to the educational package is the Trade Tap Blog. It takes a slightly sideways look at trading and news events and includes idea-sharing by industry experts. It’s informative and insightful and fits well with the rest of the suite of research tools.

Trader Protection by Territory

The firm’s 25+ year track record is reassuring in its own right. But it’s also clear that OANDA has continuously aimed to develop and strengthen client protection protocols since its inception. It is now regulated by six highly rated regulators, including the CFTC and NFA.

OANDA Corporation is a registered Retail Foreign Exchange Dealer (RFED) with the US Commodity Futures Trading Commission (CFTC) and a Forex Dealer Member (FDM) of the National Futures Association (NFA # 0325821).

OANDA (Canada) Corporation ULC is regulated in Canada by the Investment Industry Regulatory Organization of Canada (IIROC).

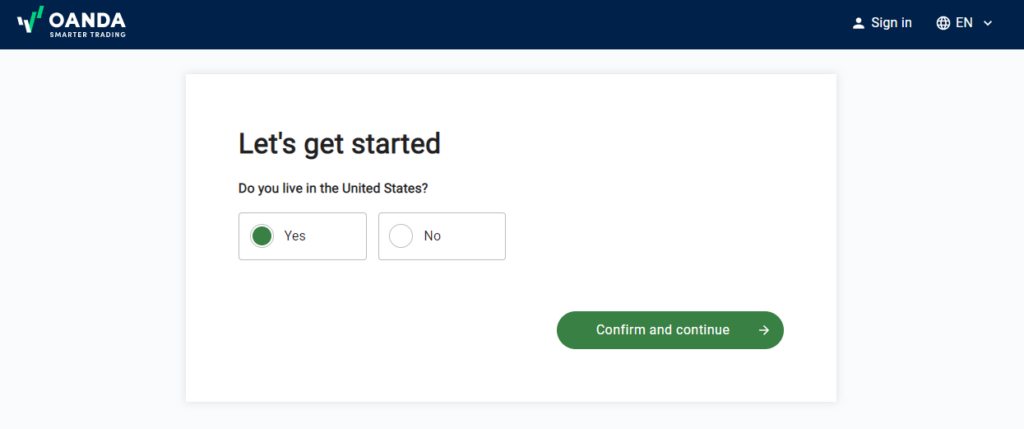

How to Open an Account

Setting up an OANDA account and starting trading follows a simple three-stage process. The first is to complete an account onboarding form. This requires submitting personal information so that the broker can comply with KYC (Know Your Client) protocols and that you, and only you, have access to your account.

Once completed, new users must verify their contact details and fund their account with base currency options, including USD, EUR, HKD, SGD, AUD, JPY, CHF and GBP. And then they can start trading.

Debit cards, ACH deposits, or wire transfers may be used to fund your trading account. Withdrawals can be made via debit card or bank wire transfer. All withdrawal requests will receive quick processing as long as your personal identity information, as international law requires, is current, on file, and in order.

The OANDA minimum deposit requirement is $0.

Customer Support

Multilingual customer support representatives are professionally trained to assist you with any query. Help can be found from English, Spanish, Portuguese, Chinese and Italian speakers, and you can access them via live chat, email, or phone. There are also eight global offices to add an additional layer of convenience to serve you on a regional basis. Support is available every market day across the globe on a “24X5” basis. Training materials are also extensive at OANDA, with premium webinars and commentary that will appeal to all traders scheduled daily to prepare you for each day’s action and to ensure a favourable trading experience.

The Bottom Line

As stated above, OANDA has it all and then some. The firm has been there since the beginning, and it shows. It has won many industry awards for excellence in all facets of the business. It is best known for its early trailblazing efforts in providing conversion rates for the public and then leveraging those experiences to produce the first online, fully automated retail forex trading platform. Over the last two decades, OANDA has amassed nearly a 20% share of the retail forex trading market and continues to grow and prosper. Size has its advantages in this business, as do long-term relationships with major global liquidity providers and regulatory bodies. The management team’s commitment on its website says it all: “We’re dedicated to your success. OANDA is flexible enough to appeal to any trader.” The choice is yours.

FAQs

Is OANDA a regulated broker?

Yes. It is regulated by the NFA and CFTC, which means that, unlike many other brokers, it can support the trading activity of US citizens. However, the CFTC and NFA do not have regulatory oversight over underlying or spot virtual currency products.

What bonus terms does OANDA offer?

The Elite Trader scheme has been introduced specifically to cater to traders looking to leverage off their trading activity in whatever way possible. Those eligible for the account can earn cash rebates from US$5 to US$17 per million, so if you are a high-volume trader, the program gives you more the more you trade.

How do I withdraw money from OANDA?

You can withdraw funds from your OANDA account via debit card and bank wire transfer. Funds can be withdrawn by logging in to your account and using the ‘manage funds’ section of the OANDA Trade account dashboard. One thing to note is that withdrawals are subject to a compliance-based hierarchy rule. Clients who have deposited funds using multiple methods must exhaust the total deposit amounts first by debit card followed by bank wire transfer.

How can I open a demo account with OANDA?

The OANDA demo account allows you to try trading on any of three OANDA platforms using $100,000 of virtual funds. It’s an ideal way to familiarise yourself with the services the broker has to offer or develop new strategies. There is no charge for setting up or using an OANDA demo account, and creating one is easy.

- Fill in the online registration form with your country, full name, age, gender, valid email address, and valid phone number.

- Submit the form and wait for a confirmation email on the email you used to register the account.

- Open the email and click on the verification link to log into your OANDA demo account for the first time.

- Choose whether you want to try trading using the OANDA Trade Platform, OANDA Mobile Platform, or OANDA MT4 from MetaTrader.

- See broker review template for guidance on this.

Your capital is at risk. Losses can exceed investment. Leverage trading is high-risk and not for everyone.

OANDA Corporation is a registered Futures Commission Merchant and Retail Foreign Exchange Dealer with the Commodity Futures Trading Commission and is a member of the National Futures Association. No: 0325821. More Information is available using the NFA Basic resource.

OANDA CORPORATION IS A MEMBER OF NFA AND IS SUBJECT TO NFA’S REGULATORY OVERSIGHT AND EXAMINATIONS. HOWEVER, YOU SHOULD BE AWARE THAT NFA DOES NOT HAVE REGULATORY OVERSIGHT AUTHORITY OVER UNDERLYING OR SPOT VIRTUAL CURRENCY PRODUCTS OR TRANSACTIONS OR VIRTUAL CURRENCY EXCHANGES, CUSTODIANS OR MARKETS.

Trading in digital assets, including cryptocurrencies, is especially risky and is only for individuals with a high risk tolerance and the financial ability to sustain losses. OANDA Corporation is not party to any transactions in digital assets and does not custody digital assets on your behalf. All digital asset transactions occur on the Paxos Trust Company exchange. Any positions in digital assets are custodied solely with Paxos and held in an account in your name outside of OANDA Corporation. Digital assets held with Paxos are not protected by SIPC. Paxos is not an NFA member and is not subject to the NFA’s regulatory oversight and examinations.

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk