| Pros | Cons |

|---|---|

| Competitive Spreads | Limited educational resources |

| Secure trading environment |

Expert’s Viewpoint

OnlineMarketShare is a relatively new broker offering forex and CFDs trading. With this broker, you can trade 35+ currency pairs and 45+ CFDs on a wide range of instruments. The forex pairs include all the majors and a few minors and exotics while CFDs offerings cover major shares, market indices, metals, energies, and futures.

This broker utilises the STP trading model and only charges competitive spreads on all assets on trade. The average spread for trading the EURUSD pair through this broker is 1.5 pips when trading through the Bronze account. This is better than what most competitors offer on a basic trading account.

OnlineMarketShare offers four account types, namely Bronze, Silver, Gold, and Platinum. The Bronze account type requires a minimum trading balance of $250 while the Silver account requires a deposit of $2000. The Gold and Platinum accounts have a minimum balance requirement of $10,000 and $50,000, respectively.

The spreads differ with account types with the typical spread for the Platinum Account for the EURUSD pair being 0.1 pips. OnlineMarketShare doesn’t charge any commissions. While the deposit requirements are pretty high when compared to competitors, this broker ranks among the best in terms of pricing.

OnlineMarketShare offers the MT4 trading platform. This broker is pretty new in the market and hence is still not regulated in most jurisdictions. We find it to be a good bet for both beginner and expert traders.

OnlineMarketShare Broker Review 2020

OnlineMarketShare is an STP forex and CFDs broker founded in The Commonwealth of Dominica. The broker operates internationally apart from in the US and Israel. Moreover, its services and platforms are available in English, Italian, Russian, and German.

OnlineMarketShare offers the MT4 trading platform. At least 90% of brokers offer this platform alongside a proprietary platform and other third-party trading platforms. OnlineMarketShare offers the MT4 only, but this shouldn’t be a challenge since this platform is all that most traders need.

There are four account types with this broker, namely the Bronze, Silver, Gold, and Platinum. As we will see later in this OnlineMarketShare broker review, each account type comes with its advantages and disadvantages. You need a minimum balance of USD 250 to trade with this broker. Deposits are free and can be made through bank transfer, Visa, American Express, Master Card, Maestro, Neteller, Skrill, and WebMoney.

OnlineMarketShare requires all users to verify Identity as part of the global Anti-Money Laundering Policy. User information is safe with this broker since it relies on advanced encryption measures and is compliant with data privacy laws such as the EU General Data Protection Regulation (GDPR). The GDPR is the world’s most reputable data privacy law and firms that are compliant with it are considered to be of high quality.

OnlineMarketShare is relatively new and therefore, still working on getting regulatory approvals in all jurisdictions of operations. It’s a fully registered company in The Common Wealth of Dominica under registration number 2020/IBC00013. Even with the inadequate regulation, this broker has proven to be highly reputable.

Who Does OnlineMarketShare Appeal to?

OnlineMarketShare appeals to both beginner and expert traders. Traders who register with this broker are assigned a dedicated account manager to help them through the first steps of trading. You can engage the account manager while still at the demo.

Consequently, you do not have to stake your capital to learn. As mentioned earlier, OnlineMarketShare is still relatively new in the market and therefore, still building on its educational resources. You won’t find a lot of educational materials on their website, but the dedicated account manager will guide you on the best free third party educational resources.

Expert traders also have a lot to benefit by trading through this broker. These include competitive spreads starting from as low as 0 pips and zero commissions. Expert traders must be familiar with the wide range of free and high-quality educational resources out there, and hence lack of educational materials on this broker’s website shouldn’t be a concern.

OnlineMarketShare broker supports non-aggressive scalping techniques. This means that traders can have long-term trades along with short-lived trades. Users should peruse through this broker’s scalping policies and contact their customer service for clarifications. OnlineMarketShare also supports news trading. This broker doesn’t offer any specialised professional wealth management services.

As stated earlier, OnlineMarketShare is pretty new in the markets and hence doesn’t have a lot of reviews on the internet. It’s therefore not possible to point out the areas that most users find appealing. We will update this review as more data becomes available.

Account types

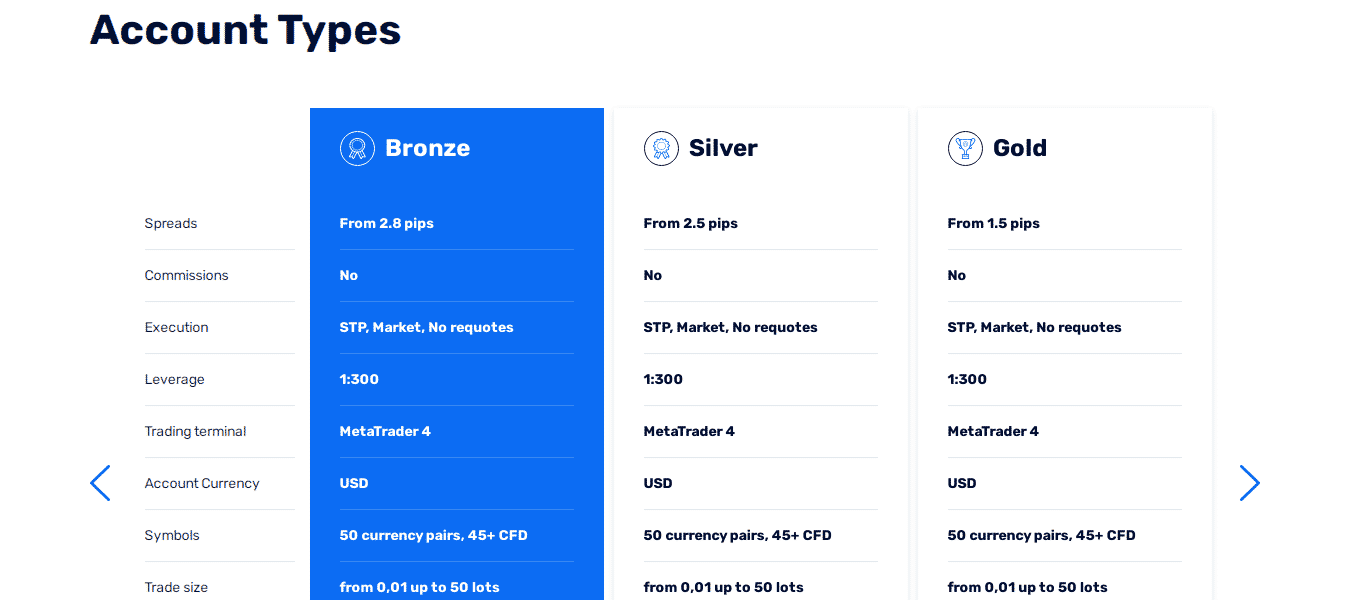

As mentioned earlier, OnlineMarketShare broker offers four types of accounts. These include Bronze, Silver, Gold, and Platinum accounts.

The Bronze account is the most basic and highly recommended for beginner traders. Users must deposit at least USD250 to access this account. The maximum leverage on this account type is 1:300. Moreover, spreads start from as low as 2.8 pips at zero commissions.

While the minimum balance is higher than what most brokers require, the trading conditions are quite favourable compared to what most brokers offer for basic accounts. OnlineMarketShare offers a stop out level of 5%. This is among the lowest you can get in the industry and a big plus for traders with a low margin.

The Silver account, on the other hand, requires a minimum deposit of USD 2000. Its pricing is better than that of the Bronze account with spreads starting from as low as 2.5 pips and zero commissions. Other trading conditions such as leverage and stop out level are similar to that of the Bronze account. The Silver account is suitable for intermediate level traders.

Spreads are surprisingly lower in the Gold account, starting from as low as 1.5 pips at zero commissions. However, traders must have a minimum account balance of $10,000 to access this account type. The maximum leverage remains at 1:300, and the stop out level is 5%. This account type is best suited for expert traders.

OnlineMarketShare Platinum account is the pinnacle with a minimum deposit requirement of $50,000. The spreads start from as low as 0.1 pips and zero commissions. All account types allow scalping and news trading and support unlimited open positions.

OnlineMarketShare also supports Islamic Trading through an Islamic Account.

Markets and territories

OnlineMarketShare is an international broker operating in over 120 countries. However, this broker is not available in the United States and Israel. As stated in the introduction, this broker was founded in the Commonwealth of Dominica in 2019.

It’s headquartered in Church ST, Dominica but has offices in other jurisdictions including London. As we will see later in this review, OnlineMarketShare product offerings include global stocks, market indices and commodities.

Its platforms and services are available in English, Russian, Italian and German. Most of its competitors offer services in over ten languages. However, this broker is still relatively young in the market and is therefore likely to keep expanding its reach.

This broker is also regulated in the Commonwealth of Dominica only but has stated that regulation in other jurisdictions including the UK is still in the pipeline. Even with the inadequate regulation, this broker has managed to build a strong reputation since launch.

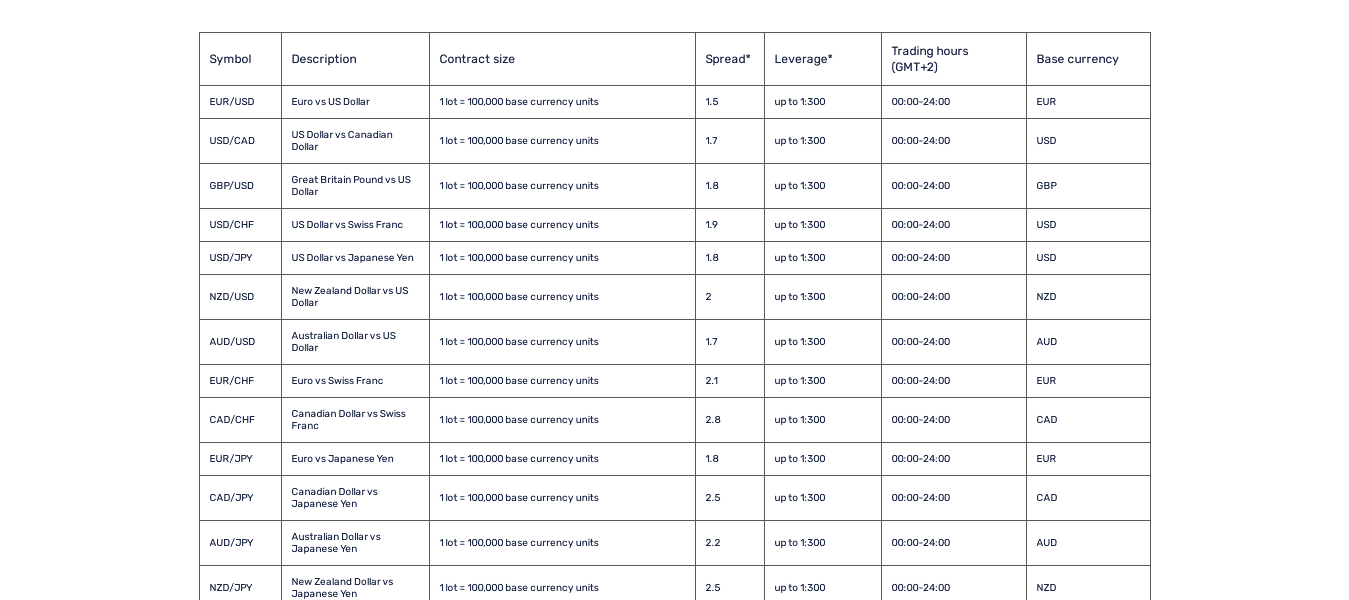

Instruments and spreads

OnlineMarketShare offers 50+ spot forex pairs and 45+ CFDs on shares, indices, metals, energies, and futures. The spot forex pairs include all the majors, and a few minors and exotics. Popular pairs with this broker include EURUSD, GBPUSD, and USDCAD. OnlineMarketShare boasts of institutional-grade liquidity and super fast order execution.

Its liquidity providers include top financial institutions such as HSBC and Commerzbank AG. High liquidity enables easier transaction flow hence making pricing more competitive. The typical spread for the EURUSD pair through this broker is 1.5 pips. This is lower than the industry’s average of 1.7 pips. OnlineMarketShare does not charge any commissions on forex accounts.

CFDs on shares include heavily traded global stocks such as Google, Alibaba, Amazon, Netflix, Facebook, and Apple. The maximum leverage for share CFDs is 1:20. OnlineMarketShare doesn’t disclose the typical spreads for its major CFDs offerings.

Likewise, CFDs on Market indices include major offerings such as DAX 30, UK100, AUS200, VIX, SPX500, and JPN225. The spreads for Indices begin from as low as 1.5 pips, and the maximum leverage is 1:100. CFDs on market indices happen through the OnlineMarketShare real account.

CFDs on energies include Spot UK Brent, Spot US WTI, and Natural Gas. The typical spreads for UKOIL is 5 pips while that of NGAS is 6 pips. Maximum leverage on CFDs on Energies is 1:100, and the base currency is the USD. OnlineMarketShare does not offer any form of crypto trading.

Fees and Commissions

OnlineMarketShare doesn’t charge any trading commissions. Straight through Processing (STP), brokers pass clients orders directly to the liquidity providers.

This means that the prices are executed at the bid/ask rate offered by the liquidity provider. These types of brokers make money by applying a markup to the price feed or a commission per lot or both. OnlineMarketShare only charges a markup on spreads.

Rollover/swap fees also apply on positions left open overnight, during the weekend, or on public holidays. A rollover/swap fee is an interest charge calculated basing on the difference between the two interest rates of traded currencies. OnlineMarketShare doesn’t disclose much about its swap charges. Most of its competitors offer a swap rate chart and a calculator.

This broker doesn’t charge any deposit fees for deposits through Bank Transfer and Debit and Credit cards. Withdrawals through these methods are also free. However, the financial institution facilitating the transaction may impose some charges.

OnlineMarketShare users are encouraged to contact their financial institution for clarification on transaction charges before depositing or withdrawing through this broker.

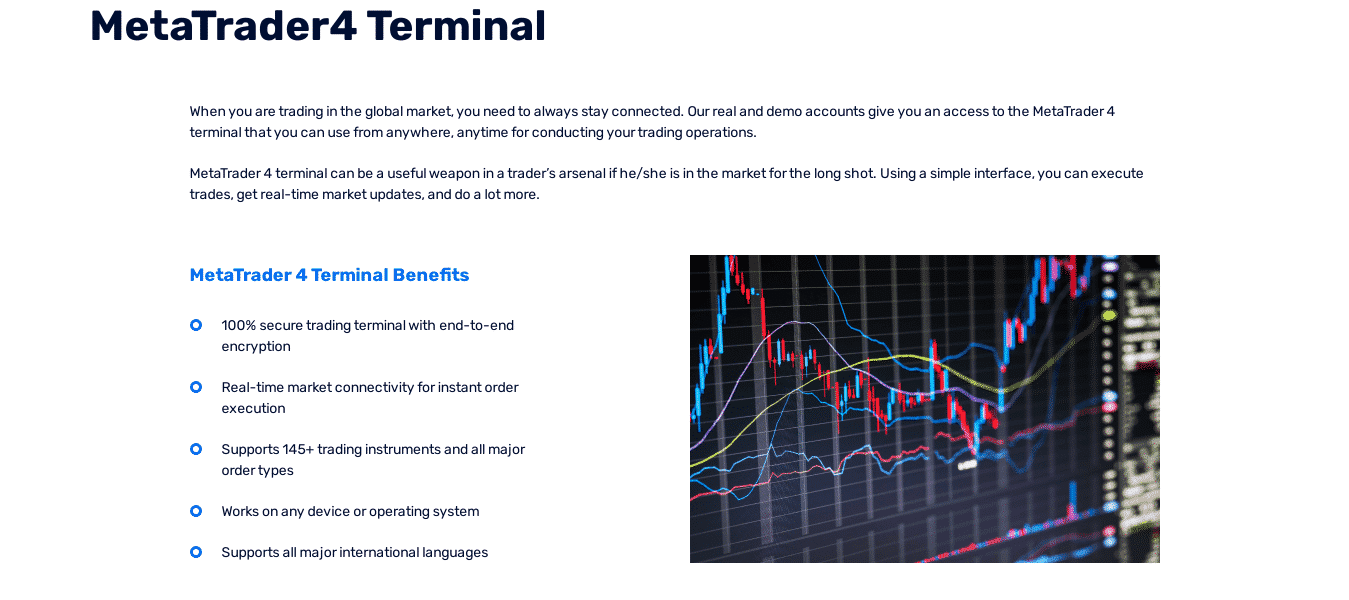

Trading Platforms

OnlineMarketShare offers the MT4 trading platform. As mentioned earlier, this platform is popular with traders. At least 95% of brokers offer this trading platform alongside proprietary applications and third-party tools.

The MT4 is stable, highly intuitive and easily customisable to meet traders’ goals. Moreover, it is available on the web, desktop, and mobile versions. Users can easily trade on the web-version through any browser, including Chrome, Firefox, and Apple’s Safari.

The desktop version, on the other hand, is compatible with Windows, Linux, and MAC operating systems. It’s lightweight and hence doesn’t compromise the performance of the device in which it is installed. You can download the MT4 desktop app for free on the OnlineMarketShare Website.

Top MT4 features include multiple technical indicators, expert advisors, and advanced charting capabilities. The technical analysis tools include Fibonacci and Gann Based Tools, and leading indicators and oscillators such as RSI, MACD, Stochastic Oscillator, moving averages, and many more.

Traders have an option to choose between line, bar, or candlestick charts to match their preferences. Other advantages of the MT4 include real-time market connectivity for instant order execution and support for a variety of trading instruments and all major order types. Moreover, the platform is available in multiple international languages.

OnlineMarketShare offers a demo account through the MT4. Traders are required to register and verify their accounts to access both the demo and live trading platforms. You can register for the demo on their website or through the MT4 trading platform.

Mobile Trading

OnlineMarketShare MT4 mobile app is available in both Android and iOS versions. Traders must register with the broker and then link their accounts with the mobile MT4. The mobile MT4 is available for free download on both the App Store and Google Play. It’s also lightweight and hence works well on most mobile devices.

Moreover, the OnlineMarket hare mobile MT4 comes with nearly all the features found on the web and desktop traders. You can add OnlineMarketShare to the mobile MT4 by clicking the plus sign on the manage accounts tab. Contact OnlineMarketShare if you can’t find them on the mobile MT4s search box.

Social Trading and Copy Trading

The MT4 supports both social and mirror trading. Users can monitor trading activity and profitability of successful traders and copy their trades.

The MT4 trading terminal allows users to identify traders with consistent performance and follow them to automatically replicate their trades. Social trading allows beginner traders to generate profits from the first day of trading by copying profitable signals from experts.

Expert traders can also make extra income by becoming signal providers. The MT4 ranks the signal providers according to their success rate. Expert traders with a higher success rate earn more money. The MT4 offers 3200+ free and commercial signals.

OnlineMarketShare does not provide additional third-party tools to enhance social and copy trading. This makes this broker less competitive to social traders when compared competitors that offer advanced alternatives such as Zulu Trade.

Charting and Tools

As mentioned above, the MT4 comes with a comprehensive and easily customisable charting package. Traders can easily change the chart type and keep track of the price of the instrument on trade at different intervals.

They can also compare charts side by side and open multiple charts in one window. Unlike most brokers, OnlineMarketShare does not offer additional third-party trading tools.

Education

OnlineMarketShare only offers a glossary and FAQs page on its educational resources centre. Most of its competitors offer comprehensive materials, including PDF guides, video tutorials, and regular webinars.

OnlineMarketShare is less than a year old and hence still updating its educational resources. The broker offers a dedicated account manager to help all type of users identify top-quality trading free trading resources and trade on the platform successfully.

There is no reason to shun this broker based on scarce educational materials since there are a lot of free high-quality educational materials on the internet.

Traders Protection by Territory

As mentioned earlier, OnlineMarketShare is still relatively young in the market and hence has not acquired regulation in most jurisdictions.

The broker is only regulated in its country of origin. However, it has managed to build global trust in about a year of existence. Users have reviewed it widely with most reporting a satisfying trading experience.

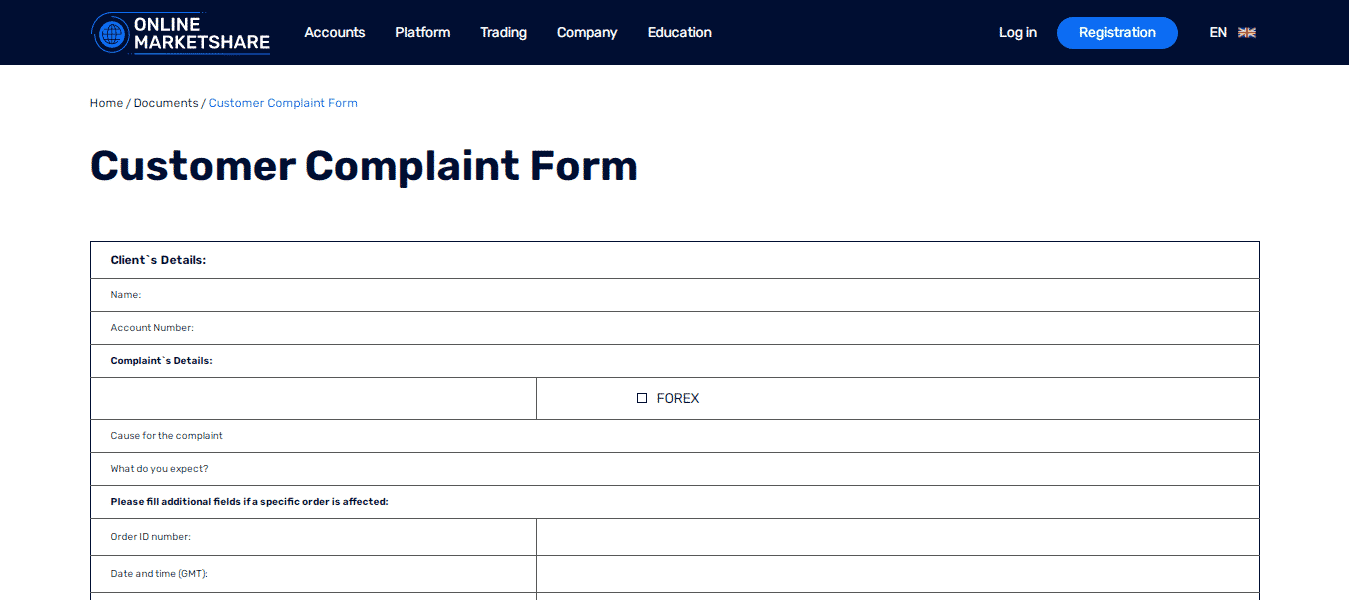

How to open an account

Registering a trading account with OnlineMarketShare is quite a walk in the park. You need to visit the broker’s website and submit the required details through the provided form.

OnlineMarketShare is compliant with the global Anti-Money Laundering Regulations by verifying the identity and address of all users. The verification process is simple and involves uploading a scanned copy of government-issued identification document and the latest utility bill with the current address displayed on top.

Users must also verify their payment methods by uploading a photo of their debit/credit cards with the CVV number hidden. Payment verification is part of the KYC requirements.

Customer Support

OnlineMarketShare customer services are available for 24/5, from Monday to Friday. Traders can reach them through phone or email. They can also request a call back by filling the provided form. This broker does not offer live chat services.

We have tested the phone and email services and confirmed that they are active. It takes a few minutes to connect to the broker through a phone call. Call back requests and emails may take up to 12 hours to get a response.

The Bottom line

OnlineMarketShare is a reputable broker founded in The Commonwealth of Dominica. The broker operates internationally but does not accept clients from the US and Israel. OnlineMarketShare is only regulated in the country of origin. This is because it’s still new in the market and still working towards acquiring regulation in other jurisdictions.

Since launch in 2019, this broker has managed to build a reputation as a low-cost forex and CFDs broker. The broker offers 35+ spot forex pairs in all the majors and a few minors and exotics. It also provides 45+ CFDs in global shares, market indices, and commodities.

OnlineMarketShare adopts the STP model. It charges competitive spreads and zero commissions both on its forex and CFDs offerings. The typical spread for the EURUSD forex pair through this broker is 1.5 pips. This is highly competitive when compared to the industry’s average. OnlineMarketShare offers multiple account types, namely Bronze, Silver, Gold, and Platinum accounts.

Each account type is priced differently with the Platinum account offering the lowest trading costs. The minimum deposit for the Bronze account type is $250 while that of the Platinum is $50,000. OnlineMarketShare offers all trading services through the MT4 platform. This broker offers limited educational resources, but all new users are assigned a dedicated account manager to walk with them through the baby steps of trading.

FAQs

How can I open an Account with OnlineMarketShare?

Visit the OnlineMarketShare website and use the registration form to create an account. You will need to verify identity and provide proof to your current address and payment method for your account to be approved.

Is OnlineMarketShare a regulated broker?

OnlineMarketShare is only regulated in The Common Wealth of Dominica. This broker is pretty new in the market and hence still working around getting regulation in other jurisdictions.

What are the deposit options for OnlineMarketShare?

OnlineMarketShare deposit options include bank transfer and debit/credit cards. The minimum deposit for the Bronze account type is $250. There are no deposit charges with this broker.

How can I withdraw money from OnlineMarketShare?

OnlineMarketShare offers a seamless withdrawal process. You can only withdraw through a verified method. All withdrawals facilitate within the same day on weekdays between 9:00 and 18:00 hours.

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk