| Pros | Cons |

|---|---|

| Regulated by the FCA | Limited trading education resources |

| Initiative trading platforms |

Expert’s Viewpoint

TigerWit is an STP+ECN broker founded in 2015. The broker offers over 60 spot forex currency pairs and CFDs in major stocks, market indices and commodities. TigerWit offers competitive spreads starting from as low as 0 pips.

The typical spread for the EURUSD pair when trading with this broker is 1.2 pips. This is not the best you will get in the industry, but it is competitive nonetheless. TigerWit charges rollover fees on positions left open overnight, during the weekend, or on public holidays. The swap fees depend on the asset on trade and the day of trading. Copy traders pay a commission of 20% on profits generated through this broker’s copy trading platform.

There are no deposit fees with this broker. However, a fee may be applicable on the side of the financial institution facilitating the transaction. TigerWit provides four free withdrawals per month, after which a $1 flat fee applies per withdrawal. We rate this broker as fairly priced when compared with competitors.

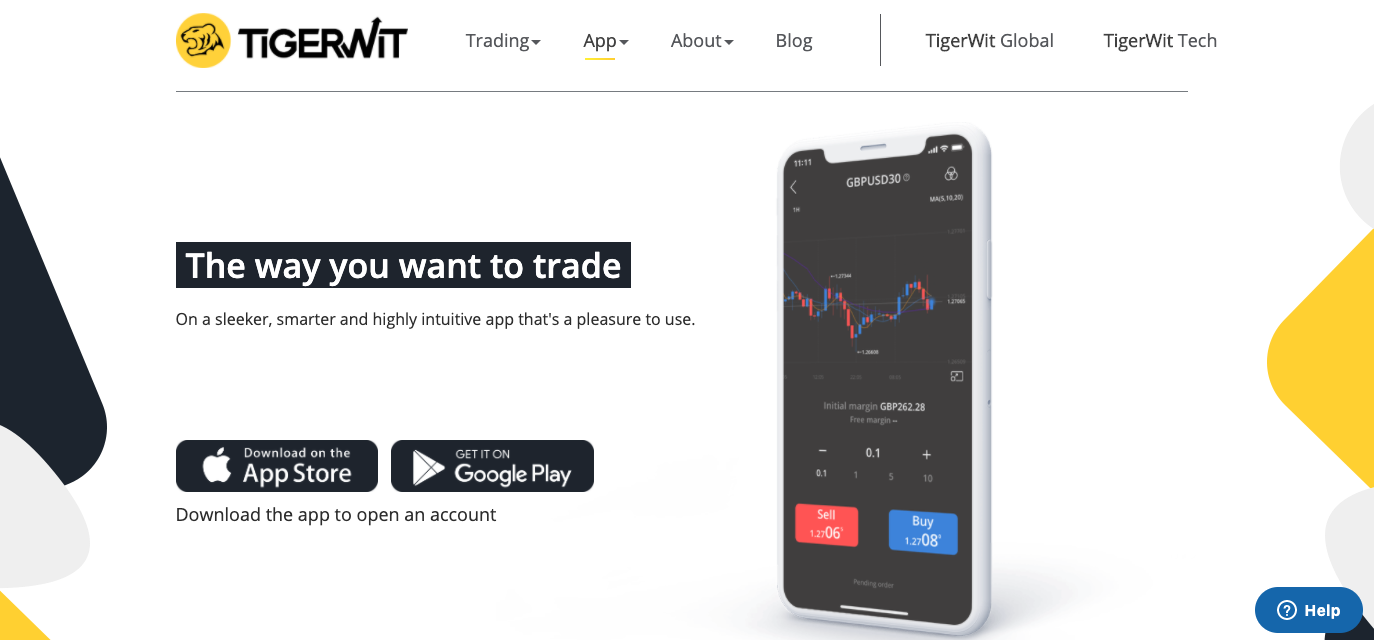

Like most brokers, TigerWit offers the MetaTrader 4 (MT4) trading platform. This platform is the industry’s standard and is what most traders prefer. However, it would be great if the broker provided an alternative platform. TigerWit provides a highly intuitive trading mobile app that is available for free on Google Play and the App Store. The mobile app provides access to all trading functions, including copy trading.

TigerWit provides 24/5 customer care through phone, email and live chat. This broker is regulated by the Financial Conduct Authority (FCA), a tier-one regulatory authority trusted across the globe. TigerWit seems like a good bet for the beginner as well as experienced traders.

Are You Ready To Trade?

Get Started Within Minutes With The Simple Sign Up Process

TigerWit Forex and CFDs Broker Review 2022

TigerWit was founded in 2015 to cater to retail and institutional forex and CFD traders. The broker is registered in England and Wales and is regulated by the FCA under licence number FRN 679941. TigerWit Global is also regulated by the Securities Commission of The Bahamas (SCB) under licence number SIA-F185.

This broker is available in over 60 countries in Europe, Asia, North America and Africa. It is not available in the US, Canada, Japan and any other country where CFD trading is prohibited. TigerWit offers over 60 spot FX pairs and over 100 CFDs in forex, stock, market indices and crypto.

Moreover, the broker adopts the STP+ECN trading model and therefore charges variable spreads and commissions depending on the asset on trade. The spreads are from as low as 0 pips. There are no deposit and withdrawal fees with this broker. However, a small fee may be applicable on the side of the financial institution facilitating the transaction. This broker does charge rollover fees depending on the asset on trade.

TigerWit offers the MT4 trading platform and supports copy trading. MT4 is the industry’s standard and comes in web, desktop and mobile versions. This broker is among the few in the industry that offers a blockchain-based trade settlement system. Blockchain ensures a transparent and safe trading ecosystem.

TigerWit has won various awards, including the ‘Most Transparent Global Forex Broker’ and the ‘Best Asian Forex Trading App 2019’ by the Global Forex Awards. This broker is an official partner of Liverpool Football Club.

Who does TigerWit appeal to?

TigerWit seems fit for both beginner and experienced traders. The broker offers MT4, a trading platform that is popular with both beginners and experts. Beginner traders can get started on a highly intuitive demo account that simulates all the functions of the live trading platform. TigerWit provides trading education through its YouTube channel.

The lessons are comprehensive and cover both beginner and experienced trading education. However, these materials are inadequate when compared to what most competing brokers offer. TigerWit assigns all new users a dedicated account manager to walk with them through the account set-up process and initial steps of trading.

Beginner and experienced traders who prefer copy trading are also at home with this broker. TigerWit offers a proprietary copy trading platform where you can follow a ‘Master’. The platform allows expert traders to make an extra income by allowing other traders to copy their trades.

TigerWit also provides a wide range of IB, affiliate and white label solutions to help support institutional traders.

Account types

This broker provides four types of accounts: demo, live, copy trading and professional. New traders can register for the demo in a few simple steps.

No deposit is required to trade with the demo account. TigerWit provides $10,000 in virtual money to help clients test their trading skills. The demo account simulates on historical market data and therefore creates a real trading experience.

Explore The TigerWit Platform Yourself

Sign Up Here To Gain Instant Access

You need a minimum of £50 to open a live account with this broker. TigerWit UK offers a leverage of up to 30:1 depending on the asset on trade. This is in line with the UK regulatory requirements. Professional traders and traders outside the UK can enjoy leverage of up to 1:200.

Professional account holders must have a portfolio of $500k+, not including property or cash. Moreover, they must have a history of placing huge positions and must provide proof of working in a professional trader position in the past.

TigerWit requires all users to go through ID and proof of address verification to be approved. The process is straightforward and fast.

Markets and territories

TigerWit is a global brand with operations in over 60 countries. Its main target markets are in Europe, Asia, the UAE, North America and Africa. As mentioned earlier, this broker is not available in the US, Canada, Japan and other countries that do not support CFD trading.

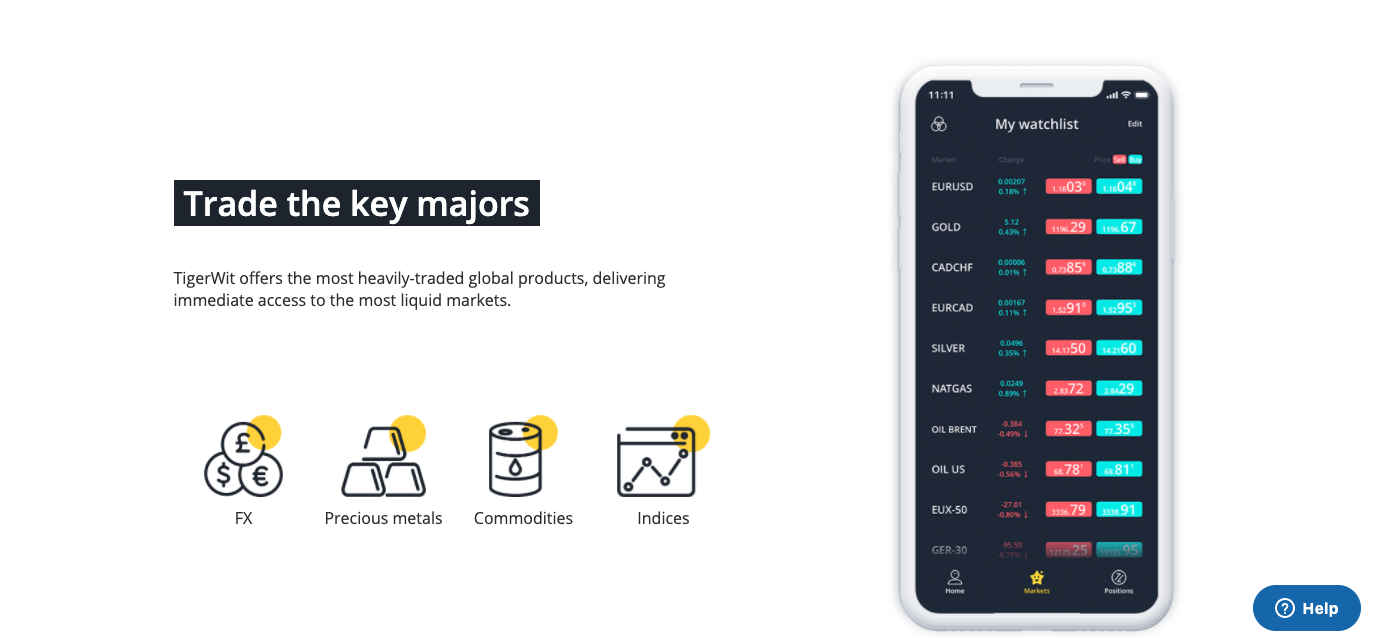

TigerWit provides a wide range of products in major global markets. Its CFD offerings include popular global stocks such as Netflix, Google, Coca-Cola and Facebook. Also on offer are popular market indices such as the S&P 500, DAX 30 and FTSE 100, and energies such as WTI, Brent Crude and Natural Gas.

TigerWit services are available in multiple languages, including English, French, Portuguese, Spanish and Arabic.

Instruments and spreads

TigerWit offers both spot forex and CFDs trading. The broker provides over 60 pairs, including all majors, most minors and a variety of exotics. Popular forex offerings with this broker include EURUSD, USDJPY and GBPUSD. As mentioned above, TigerWit provides a leverage of up to 30:1 for traders in the UK and 200:1 for those in other countries.

Professional traders who choose this broker get to enjoy higher leverage among other favourable trading conditions. This broker provides floating spreads starting from as low as 0.7 pips. The typical spread for the EURUSD pair when trading with TigerWit is 1.2 pips. This is not the best you will get in the industry, but it is competitive nonetheless.

TigerWit CFD offerings include stock, market indices, commodities and crypto. The trading conditions and pricing for CFDs depend on the asset on trade.

Fees and commissions

TigerWit UK charges commissions on CFDs on shares, precious metals and market indices. The commissions vary with the asset in question. For instance, indices CFDs mostly attract a commission of $10 per lot. TigerWit charges a 20% commission on all profits generated through its copy trading platform.

This broker charges rollover fees on positions left open overnight and during the weekend. The rollover fees depend on the type of asset traded and the day of trading. For instance, overnight interest rates for positions left open on Wednesday are three times the normal.

TigerWit does not charge any fees for deposits and withdrawals through debit/credit cards, wire transfer and e-wallets. However, the financial institution facilitating the transaction may charge a small fee. It is important to confirm these fees when choosing a payment or withdrawal method.

Deposit For Free With TigerWit

Fund Your Live Account To Start Trading The Markets

Platform review

TigerWit provides the MT4 trading platform. The MT4 is easily customisable to meet different clients’ needs. Moreover, it comes with a variety of tools for technical and fundamental analysis.

These include multiple chart types, time frames and order types, a market watch window, and 30+ technical indicators. Another great feature of the MT4 is that it offers instant access to live price feeds, therefore allowing 24/7 trading from anywhere across the globe.

The MT4 supports automated trading through Expert Advisors (EAs). Traders with basic coding skills can use the program’s MQL editor to automate their strategies. Those without coding skills can reach out to a pool of programmers to help them at a small fee.

The TigerWit MT4 is available in web, desktop and mobile versions. Traders can access the web version on any browser. The desktop version can be downloaded on the website and is compatible with both Mac and Windows devices. As stated earlier, TigerWit supports copy trading through the MT4 platform.

This broker does not provide any proprietary trading platform. While MT4 is enough for most traders, it is important to provide a variety.

Mobile Trading

TigerWit is accessible through the mobile MT4. You can download the TigerWit MT4 on Google Play or App Store for free and register an account. The mobile app is compatible with both Android and iOS devices. Moreover, it is lightweight and therefore does not affect the performance of devices in which it is installed.

Start With The TigerWit App For iOS

Download For Free

Start With The TigerWit App For Android

Download For Free

The TigerWit mobile app is highly intuitive and completely beginner-friendly. Beginner traders can easily access the demo account through the app. Also, copy traders can easily follow expert traders and copy their trades.

Social and Copy Trading

As mentioned above, TigerWit provides a highly intuitive copy trading platform. The platform allows beginner traders to copy the trades of experienced traders as they continue to learn. This means that they can make profits right from the beginning.

Signal providers are listed according to their win rate, enabling users to identify and follow the best. TigerWit charges a 20% commission rate on all profits earned through copy trading.

Part of this money is passed to the Trading Masters (signal providers) as compensation for allowing their trades to be copied. TigerWit provides a detailed profile for each Trading Master to help users identify and follow the best.

The Trading Master profile includes details such as their win rate, last 30 days return, and their number of followers.

Charting and Tools

As mentioned earlier, the MT4 technical analysis tools include 30 built-in indicators, 2,000 free custom indicators and 700 paid ones. These tools enable the trader to easily and accurately analyse markets of any level of complexity.

The MT4 also enables users to predict future price dynamics through 24 analytical objects, including lines, shapes, arrows and the Gann and Fibonacci tools. The MT4 provides beginner-friendly and customisable charts to enable users to easily detect various trends and set support/resistant levels.

All these tools are accessible through TigerWit’s web, desktop and mobile trading platforms. Consequently, users can conduct research and implement trades from anywhere. Beginner traders can watch TigerWit MT4 tutorials on the broker’s YouTube channel.

The MT4 comes with fundamental analysis tools, including a news portal and an economic calendar. TigerWit does not provide any of these tools on its website.

Education

TigerWit only provides trading education through its YouTube channel. The YouTube channel is updated regularly with beginner and experienced-level trading tutorials and market updates. However, the trading education is not well structured, and therefore it is difficult for a complete beginner to follow through it.

TigerWit has a blog, but it is not regularly updated. The broker also offers free live webinars, but it doesn’t provide a webinars calendar. Users are notified about upcoming webinars through email. All webinars are recorded and uploaded on the broker’s YouTube channel.

Most of TigerWit’s competitors provide comprehensive materials covering beginner and experienced-level education. In an interview with Good Money, TigerWit’s CEO encourages traders to seek trading education materials on platforms such as Udemy and Dabbl.

This broker would do better if it invested in its own trading education resource centre. However, the lack of a comprehensive educational centre is not a sufficient reason to shun it. There are a lot of high-quality trading resources that are available on the web for free.

Start Trading Straight Away

If You Want To Just Get Started, Sign Up Here

Traders’ protection by territory

TigerWit UK is a private limited company registered in the UK under registration number 09479466. It is authorised and regulated in the UK through the FCA under licence number FRN 679941. The FCA is a tier-one regulator with global trust. Brokers that partner with this regulator must observe strict client protection measures.

These include ensuring the protection of clients’ funds by holding them in segregated accounts and using tier-one banks and quality liquidity providers. The brokers must also undertake yearly external audits and submit reports to the regulator. Furthermore, they must comply with the Investor Compensation Fund, which ensures that clients can recover up to €20,000 in the event of bankruptcy.

TigerWit Global is regulated by the SCB under licence number SIA-F185. This is not a tier-one regulator, but it is reputable nonetheless. TigerWit is compliant with the UK General Data Protection Regulation (GDPR). Consequently, users have an assurance of the safety of their data.

How to open an account

The registration process with TigerWit is simple and fast. You only need to submit your name, email and phone number to register for an account. TigerWit will prompt you to confirm your email and phone number.

Live account registration also includes ID and proof-of-address verification. Traders must upload a clear scanned copy of a government-issued identification document to prove their identity. Current address proof involves uploading a scanned copy of a recent utility bill with the current address displayed on top.

The verification process takes less than an hour, and clients can make a deposit and proceed to live trading as they wait. As mentioned earlier, the minimum deposit to trading with TigerWit is $50. Account funding can be done through any major debit/credit cards, wire transfer and e-wallets such as Skrill and BitPay.

Open Your Account

Be Trading Within Mere Minutes

TigerWit does not charge any deposit and withdrawal fees. Moreover, deposits are facilitated almost instantly, while withdrawals can take up to 24 hours. It is worth noting that only verified accounts can withdraw funds.

TigerWit allows up to four free withdrawals per month. After that, clients are required to pay a fee of $1 per withdrawal. The minimum withdrawal amount with this broker is $30. Clients are required to place at least one trade in order to be able to withdraw their capital.

Customer support

TigerWit provides 24/5 customer support through email, live chat and phone. The services are available in English, Spanish, German, Dutch, Chinese, Arabic, French, Afrikaans, Harshen Hausa, Igbo and Yoruba. A test on the platforms reveals that it takes less than a minute to get connected to agents through live chat and phone.

As is expected, enquiries through email may take up to 24 hours to get answered. The agents seem well-equipped and knowledgeable to address all forms of trading questions. TigerWit assigns new clients a dedicated account manager to guide them through the set-up and first steps of trading.

TigerWit provides a FAQs page, but it is not detailed enough. The broker also provides a dispute resolution centre to address clients’ complaints. Those not satisfied with how the broker handles complaints are offered links to raise a complaint with the regulator. TigerWit ensures a transparent trading environment through the distributed ledger technology.

The Bottom Line

TigerWit is a legitimate and high-quality forex and CFD broker. It is regulated by the FCA, a tier-one broker trusted worldwide. TigerWit global is also monitored by the SCB. This broker is among the few in the industry that applies blockchain to ensure a transparent trading ecosystem.

TigerWit provides over 60 spot FX pairs and CFDs on major currencies, global stocks, market indices and commodities. With the broker, you can trade top global stocks such as Facebook, Apple and Google. It adopts the hybrid STP+ECN trading model and therefore charges floating spreads starting from as low as 0 pips.

The typical spread for trading the EURUSD pair through this broker is 1.2 pips, which is lower than the industry’s average at 1.7 pips. TigerWit commissions on CFDs depend on the asset on trade. Moreover, this broker charges swap fees on positions left open overnight, on weekends, and during public holidays.

Regarding trading platforms, this broker offers MT4. This platform is the industry’s standard and is what most traders prefer. TigerWit supports copy trading through its highly customised trading platform. Clients are charged a 20% commission on any profits generated through the copy trading platform.

The broker provides 24/5 customer service through email, live chat and phone. Its services are multilingual, covering over 10 languages. TigerWit does not provide enough trading education resources. You can register with this broker on its website or through its trading applications.

Claim Your TigerWit Account

As Approved By Forextraders.com

FAQs

How can I open a demo account with TigerWit?

You can register for a demo account on the TigerWit website or through its trading apps. Simply click the ‘sign up’ button and follow the self-explanatory process.

Is TigerWit a regulated broker?

Yes, it is monitored by the UK Financial Conduct Authority (FCA) under licence number FRN 679941 and the Securities Commission of The Bahamas (SCB) under licence number SIA-F185.

What are the deposit options for TigerWit?

TigerWit accepts deposits through major debit/credit cards, wire transfer and e-wallets such as Skrill, Neteller and BitPay. Other methods may apply depending on your location. TigerWit does not charge any deposit fees.

How do I withdraw money from TigerWit?

Fill in the withdrawal request form on the TigerWit funds management page and wait for up to 24 hours for your money to be processed.

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.

Your capital is at risk

Your capital is at risk

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk