| Trade 360 Pros | Trade 360 Cons |

|---|---|

| Innovative CrowdTrading function | A limited number of markets |

| Real-time analysis and research designed to support trading decisions | Cryptocurrency trading is not supported |

| Well regulated | Pushy sales team |

Traders’ Viewpoint

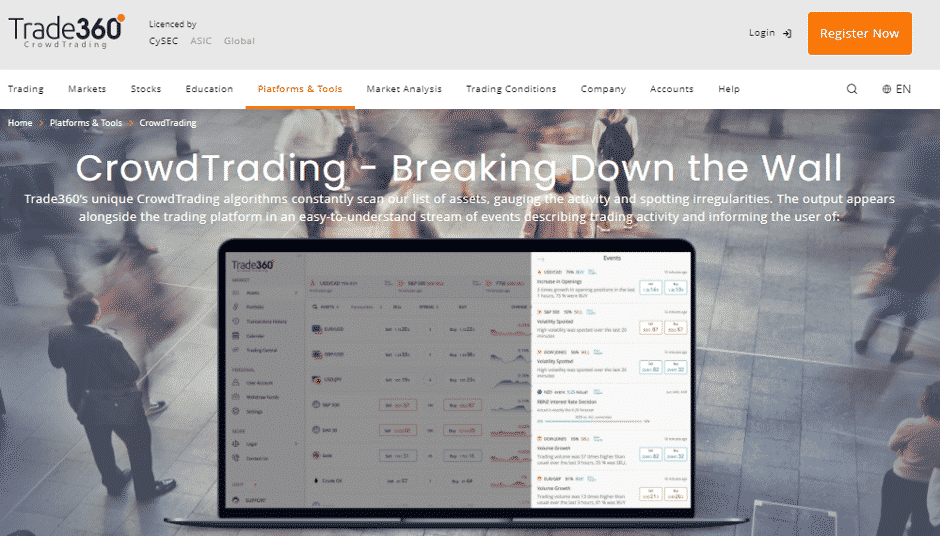

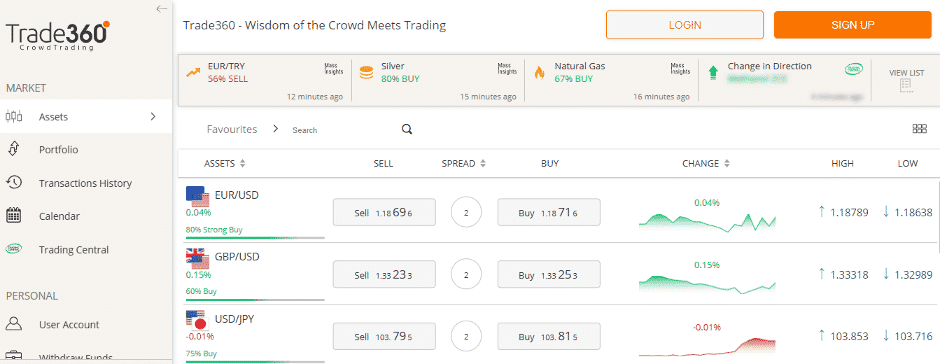

Trade 360 do things differently and in a good way. The CrowdTrading function is a stand out item. It takes market data, particularly buying and selling pressure, and turns it into useful indicators.

With a lot of brokers failing to differentiate themselves from their rivals, it’s refreshing to see a broker offering something new. For some people, the CrowdTrading service will be an ideal trade support tool.

While the firm emphasises the CrowdTrading aspect, it’s far from being the only good thing about the service.

- The firm was established in 2013 but the platform’s aesthetics and functionality look up to date.

- Other trading support tools such as Trading Central also come as part of the package. There’s a lot of benefit from having top-grade third-party software thrown in as well.

- The number of technical indicators and oscillators is market-leading. Having hundreds of powerful software tools on hand is a way to give yourself the best chance possible of making a profit.

- The boring but essential side of things is also covered. Operating under license of CySEC and ASIC means that two tier-1 regulatory authorities cover the firm.

- While Trade 360 doesn’t compete on cost alone, the pricing in some markets is as good as you could hope to find.

- There is a choice of two high-quality platforms – the in-house web trader platform and MetaTrader’s MT5. These might cover hundreds rather than thousands of markets but there are enough markets for most traders.

Trading with Trade 360 is a positive experience. Our test-traders did report that the quality of the trading experience was tarnished by the number of calls made by the Trade 360 team.

The offer of a dedicated account representative is welcome. The Trade 360 team did though, at times, cross the line between committed and being pushy. Some of our testers who politely asked to have the conversation another time found it hard to get off the line.

Trade360 Rating Overview

| FEATURE | Trade360 |

|---|---|

| Overall | ⭐⭐⭐⭐ |

| Education | ⭐⭐⭐⭐ |

| Market Research | ⭐⭐⭐ |

| Range of Markets | ⭐⭐⭐⭐⭐ |

| Deposits & Withdrawals | ⭐⭐⭐⭐ |

About Trade 360

Trade360 is a multi-asset CFD broker, headquartered in Limassol, Cyprus. It has been in operation since 2013.

It is regulated by the Cyprus Securities and Exchange Commission (CySEC). The tier-1 European regulation allows Trade360 to operate in all the countries within the European Economic Area (EEA), the UK and beyond.

Depending on your domicile, you may find your account sits under the regulatory protection provided by another well-regarded authority, the Australian Securities and Investments Commission (ASIC).

Both regulators require the broker to operate within a range of guidelines designed to protect clients. The specific T&Cs vary from regulator to regulator but focus on the safety of client deposits, segregation of funds and negative balance protection.

Trade 360 also delivers on other forms of protection. For example, it has stringent guidelines in place to safeguard client privacy and data security.

What sets Trade 360 apart from most of the other CFD brokers is CrowdTrading. That gives Trade 360 users a broad picture of the positions of the other traders, and from that develops trading signals designed to help with trading decisions.

All of the neat new features have earned Trade 360 a strong reputation in the trading community and an array of industry awards. Atoz Forex.com naming Trade 360 ‘Broker of the Year’ in 2017 and 2020.

Who does Trade 360 appeal to?

Trade 360 gets a lot of the basics right and also offers clients some interesting new features. The user-friendly functionality and the ‘How to…’ style educational tools would be attractive to new traders. Those with more advanced strategies would appreciate the additional extras such as Trading Station.

The fresh approach offered by the flagship CrowdTrading feature could appeal to both novice and experienced traders.

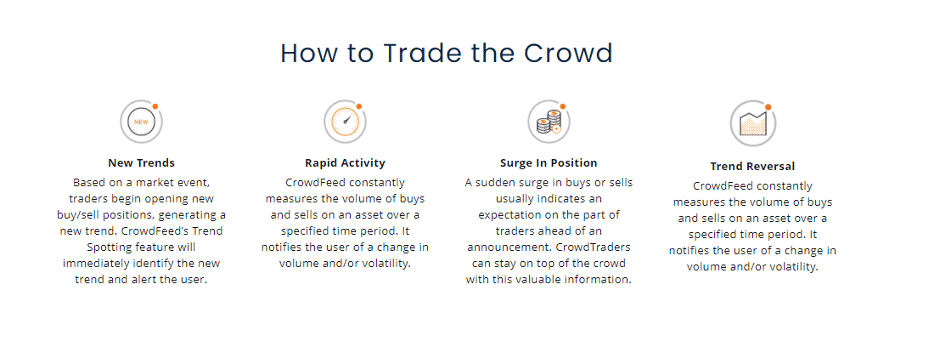

One of the initial challenges faced by beginners is timing trade entry and exit points. Being able to get an idea on market sentiment can undoubtedly help with that.

More experienced traders would find the patented CrowdTrading service offers a new way of doing things. It might be used as a confirmatory indicator to complement strategies they are already operating.

Trade 360 gets a lot of the basics right and also offers clients some interesting new features. The fresh approach offered by the flagship CrowdTrading feature could appeal to both novice and experienced traders.

Trade360 is recommended for traders of all levelsAccount types

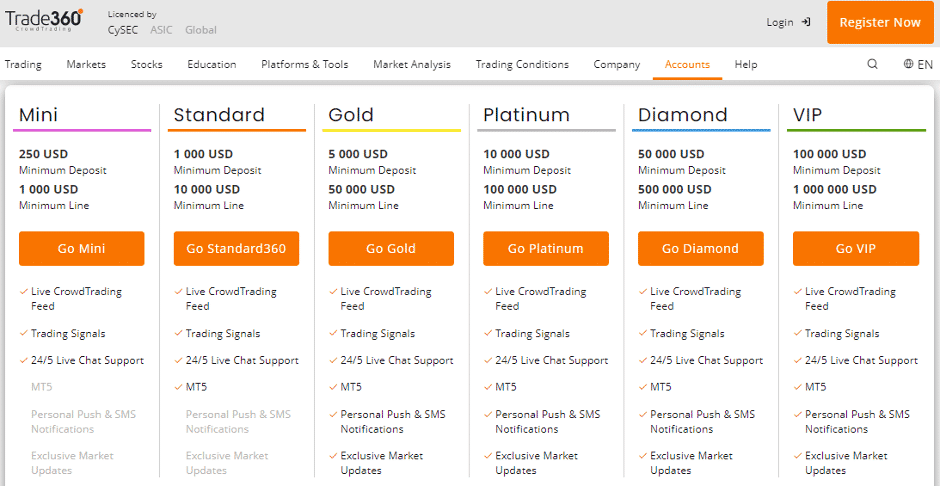

Trade360 clients have the choice of six account types plus the swap-free Islamic account option. The minimum deposits are reasonable and start at $250 for the basic account type, while individuals signing up for the VIP account have to deposit a minimum of $50,000.

The registration process is speedy, and you can start trading with deposits as low as $25. All client funds are in segregated accounts, separate from the CFD broker’s operating capital, and backed by investor protection schemes in certain countries. Irrespective of the account type, Trade360 offers the fixed spread.

Trade 360 is not available to residents of the USA.

Individuals registering with the CFD broker have the choice of only the patented CrowdTrading platform. While the trading terminal comes as a web and mobile application, it does not support automated trading.

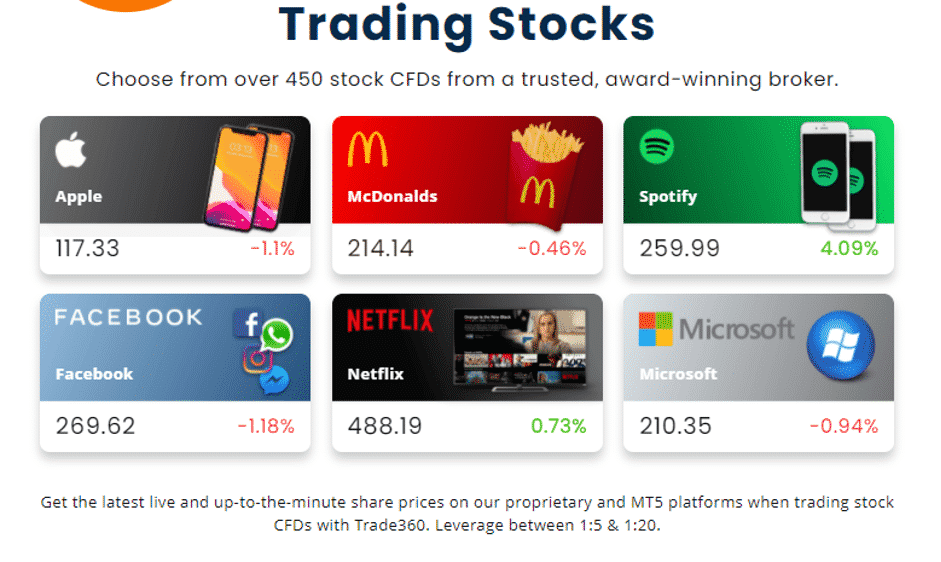

The product range includes forex, commodities, CFDs in shares and stock indices. Besides, traders can also access three futures contracts in commodities and stock indices.

Not all of the additional services are provided to Demo and Mini account holders. Trading Central, for example, can only be accessed if you make a minimum initial deposit of at least $1,000.

Markets and territories

The number of markets offered is satisfactory but by no means ground-breaking. There are in total more than 500 markets. It’s possible to trade, Forex shares, commodities, ETFs & index CFDs.

One notable asset group which is missing is cryptocurrencies. Given the increasing popularity of this asset group, clients of Trade 360 may be hoping that this situation will soon be rectified.

Instruments and spreads

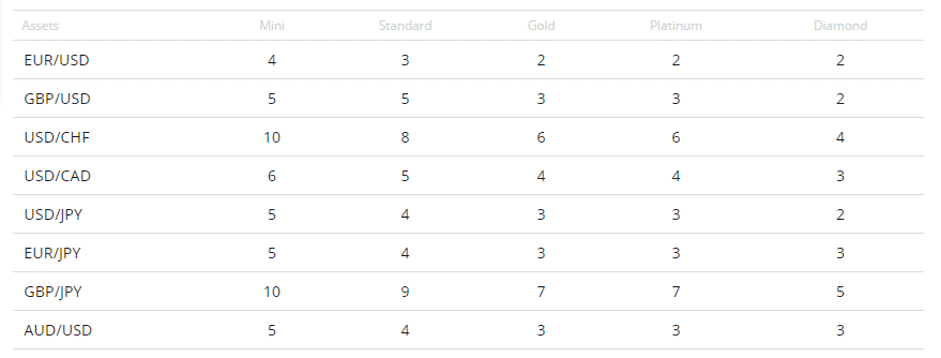

Trade 360 offers spreads in line with its peer group. EURUSD on the Gold, Platinum and Diamond accounts can be as low as 2 pips.

The trading margins vary and are primarily dependent on the client’s location and the monitoring authority in that country. For instance, if you are a European or UK resident, the max permissible leverage is 30:1 in FX.

International clients receive higher leverage that can extend up to 400:1. Besides, clients outside the purview of the CySEC are also eligible for the various bonuses offered by the CFD broker from time to time.

Fees and commissions

Platform review

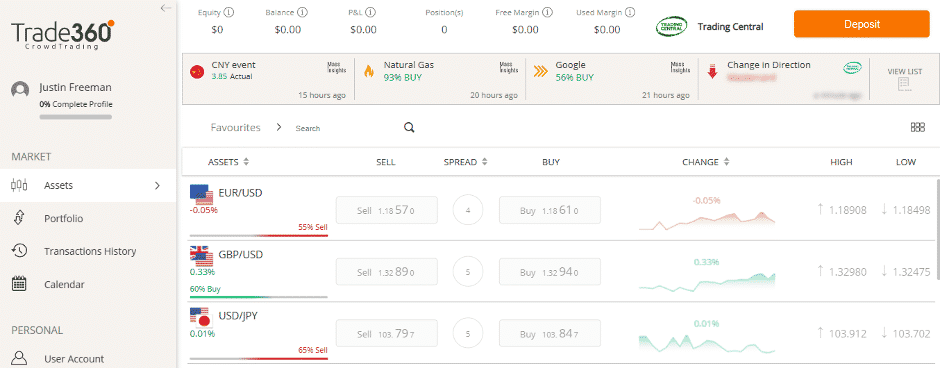

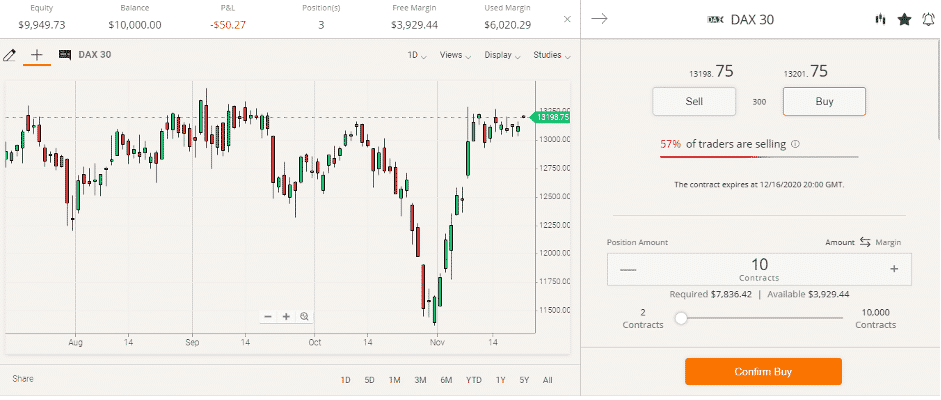

The two main platforms offer an effective route to trading the markets.

Their intuitive web-trading platform is of their own making and is well adapted to the unique functionality of the CrowdTrading tools and displays.

No downloads are necessary, since the system is entirely online, with a mobile application if you prefer to go in that direction. Open positions and assets that are worthy of a second look, depending on crowd shifting sentiment changes, are easily visible and can be modified with a single click.

All data is also encrypted using the latest in 128-bit technology for security purposes.

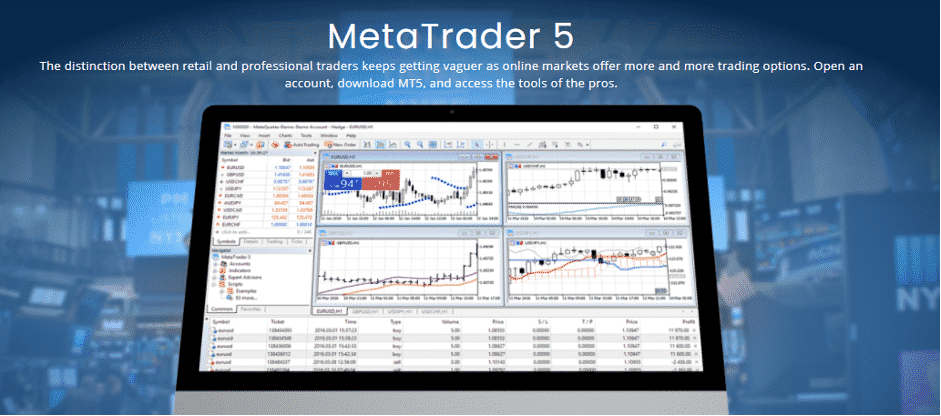

The second platform on offer is MetaTrader’s MT5. It has a different and more clinical feel than the web-trader platform. Notably, the Metatrader MT4 platform which so often accompanies MT5 is not available at Trade 360.

Mobile trading

The Trade 360 mobile apps can be downloaded for free and are available in Android and iOS format. They can also be accessed using web trader service, which means an internet connection is all it takes to keep up to date with market prices.

Hand-held trading is a priority for the firm as reflected by the award of the FBA ‘Best Forex App’ prize in 2020.

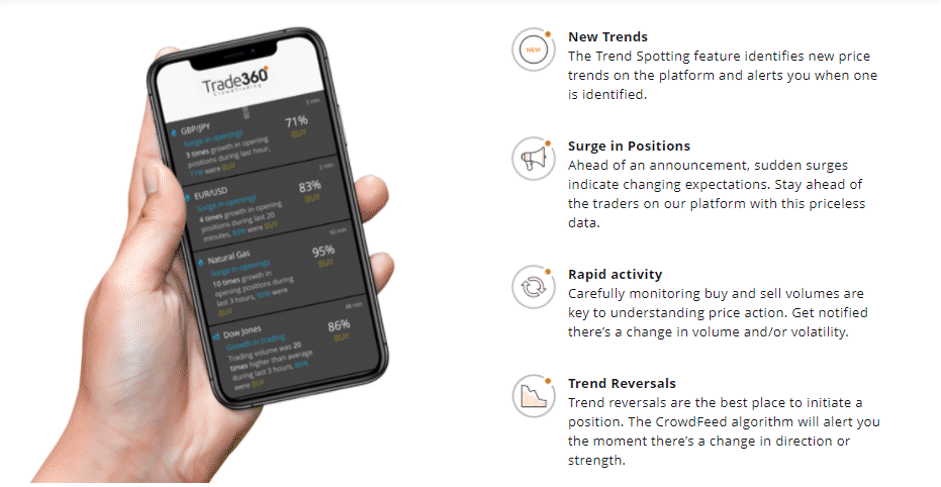

The New Trends, Surge, Rapid Activity and Trend Reversal indicators are all accessible while you are on the go, which means you never lose contact with the markets.

The functionality of the mobile trading platform is very user-friendly. You can flick through the market, view your portfolio and carry out account administration tasks with speed and efficiency.

Trade360’s proprietary technology and hundreds of technical tools are all accessible on the smaller screen. It’s also possible to access the customer support team using the mobile Live Chat function.

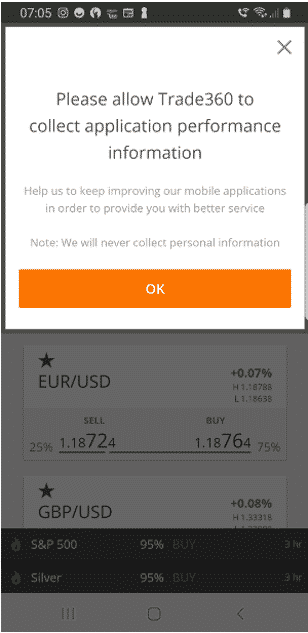

Our testing did reveal two less appealing features of the mobile trading experience.

The first is that every log-in attempt was met by a pop-up window asking if we wanted to share App performance information with the firm. Those who preferred not to share were met with the same message every time they logged on. It was shared that it would be better if this question were asked once only.

The second is that some of the graphs take moments longer to come to life than we would expect. The slight lag is not significant but it is noticeable.

Social trading and copy trading

The CrowdTrading is in itself a form of Social / Copy trading. The neat thing about Trade 360’s approach is that CrowdTrading takes the ‘chatter’ of the markets, processes it and presents it in a clear and easy to trade format.

There isn’t a clearly defined in-house Social trading or Copy Trading section so clients would have to look elsewhere to crowdsource ideas or take the ideas of others.

The MQL5 community page which comes as part of the MT5 package is one possible source of ideas. In general terms, Trade 360 relies on CrowdTrading to provide clients with interaction with other traders in the market.

Crypto

Crypto trading is currently unavailable at Trade 360.

Charting and tools

The emphasis on the CrowdTrading tool means that the web trader platform’s focus is not on charting tools.

The MT5 platform is an out and out charting platform. It comes with 82 technical indicators and charting tools, 21 timeframes, six order- and four execution-types, hedging, netting and table/chart reporting.

Education

There is a very comprehensive range of ‘How to …’ style materials.

The What are Commodities? What are Stocks? What is an ETF? are useful and well laid out.

The learning materials provide a clear breakdown of what traders can expect when trading the different asset groups. There is little ‘stardust’ which comes with them or the ‘Daily Market Update’.

There is limited access to advanced style research. To be eligible for the more advanced materials such as ‘Exclusive Market Updates’ clients are required to trade a Gold standard and above account.

Trader protections by territory

Trade 360 is a trading name of MPF Global Markets Ltd, authorised and regulated by the CySEC. The company is headquartered in Limassol, Cyprus.

- com – Our EU client portal, operated by CrowdTech Ltd. under CySEC Regulation, license number 202/13.

- com.au – Our Australian client portal, operated by Sirius Financial Markets Pty Ltd. under ASIC regulation, license number 439907.

- finance – Our global client portal, operated by ST Services Ltd.

Compare Trade360 with other approved brokers

|  |  |  | |

| Education | educational articles, market analysis | educational content, market analysis | courses, webinars, market analysis | courses, webinars, market analysis |

| Customer Support | email, phone, live chat | email, phone, live chat | email, phone | email, phone, live chat |

| Minimum Deposit | $25 | $0 | 50$ | $200 |

| Total Markets | 1000+ | 180+ | 2000+ | 1000+ |

| Total Currency Pairs | 49 | 70+ | 49 | 62 |

| Total Cryptos | 0 | 0 | 37 | 12 |

| Total CFDs | 400+ | 60+ | 2000+ | 900+ |

| Trading Platforms | CrowdTrading | MT4 | eToro Platform | MetaTrader 4, MetaTrader 5, cTrader |

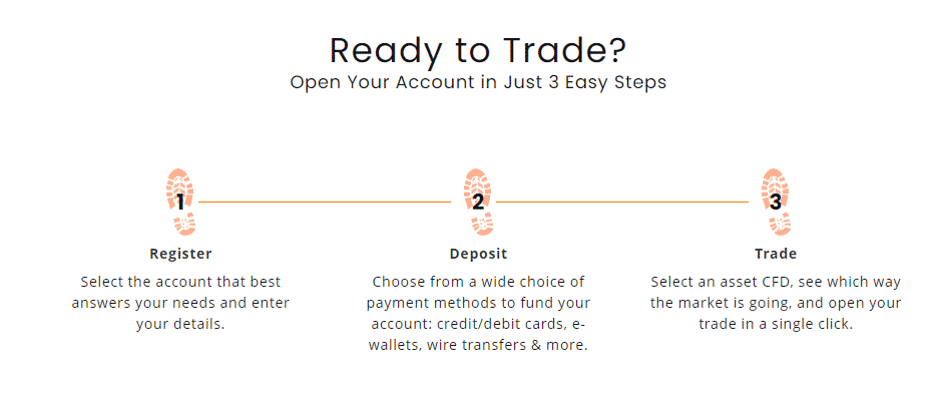

How to open an account

The minimum deposit required is $250, and it can be made using major credit or debit cards, e-wallet services, banking wire transfers, or other popular payment methods.

Withdrawal requests are handled quickly, as long the mandatory AML documentation is on file and current. The length of time may vary depending on your original deposit method since the same service must be used in reverse.

Customer support

When it comes to client support, Trader360 provides a 24/5 bilingual helpdesk, although the website is accessible in 11-languages. You can reach out to the broker via phone, email, live chat or by simply filling out a ‘Contact us’ form.

Technical support personnel are trained to answer your questions quickly and to get you familiar with Trade360’s unique product and service offering. In addition to their direct support, there are training ebooks for beginners, and once up and trading, there is market commentary and analysis, as well as trading ideas generated by the CrowdTrade system.

The firm does not give investment advice or provide account management services. Still, it does attempt to give you the best and most timely information possible for your decision-making process.

The bottom line

Trade360 is an innovative entry in the forex and CFD arena, attempting to use the latest technology advances to benefit its clients.

Regulatory compliance is high-grade, and the firm offers a broad range of asset classes which can be traded in a straightforward manner. As the firm asserts on its website, “By enabling our Traders to examine the movements and behaviour of the collective in real-time, we empower them to better recognise market trends.”

Finding an edge before the crowd does is the goal of every trader. For the first time, Trade360 appears to be a broker that is prepared to give you that edge in real-time with its unique and proprietary service offering.

There is a question as to how successful copying retail traders can be. For some, retail sentiment is a contrarian indicator. Whether you want to follow the crowd or bet against it, the high-spec indicators offered by Trade 360 will still be useful.

The absence of crypto markets, scalping and automated trading, would deter some traders. But those who are not put off by those omissions will find Trade 360 a welcome addition to the short-list of brokers to consider using. Setting up a Demo account can be highly recommended if just to find out what “the power of crowds” is all about.

Yellow = Please out link to Demo account here

FAQs

Is Trade 360 a regulated broker?

Yes. Trade 360 operates under licenses from two tier-1 regulators, CySEC and ASIC. The exact terms of your protection will depend on where you live.

How can I open an account with Trade 360?

The account opening process is completed online and can be found by following this link. As the broker is regulated, you will have to complete some client protection and client verification forms.

GREEN = Please out link to live account here

What are the deposit options for Trade 360?

There is a wide range of payment methods available to you. These include credit/debit cards, e-wallets, wire transfers & more.

How do I withdraw money from Trade 360?

To comply with Anti-money Laundering rules any withdrawn funds have to be returned to the account from which they were initially sent.

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk