cTrader is a premium-grade trading platform known for providing all types of traders with an exceptional trading experience. Its easy-to-use functionality and professional grade trade execution is backed up by powerful software tools designed to tilt the odds in the favour of its users. Trades in forex and other instruments benefit from super-fast trade execution, a Depth of Market monitor which allows traders to look into the heart of the market, and highly regarded research tools such as Autochartist. cTrader has the capacity to support advanced traders, but thanks to its well-thought-out design is also suitable for beginners. Whatever your investment aims, the first step is to establish which brokers offer the service and whether that broker, and the cTrader platform, are the best-fit for you.

The Best cTrader Brokers

One of the few drawbacks of cTrader is that it isn’t widely available. It tends to be offered by premium-grade brokers who see the cTrader platform as a natural fit for their high-quality offering. These are the cTrader brokers to consider when choosing the platform which takes your trading to the next level.

| Broker | Features | Regulator | Platforms | Next Step | |

|---|---|---|---|---|---|

Your capital is at risk

Founded: 2014 Your capital is at risk

Founded: 2014 |

|

FSPR | MT4 | ||

Between 74-89% of CFD traders lose

Founded: 2010 Between 74-89% of CFD traders lose

Founded: 2010Between 74-89 % of retail investor accounts lose money when trading CFDs |

|

ASIC, FCA | MetaTrader 4, MetaTrader 5, cTrader | ||

Your capital is at risk

Founded: 2006 Your capital is at risk

Founded: 2006 |

|

CySEC, DFSA, FCA, FSB, SIA | MetaTrader4, MetaTrader5, cTrader, FxPro Edge (Beta) | ||

The Pros and Cons of cTrader

The cTrader platform first launched in 2010. Since then, the developers and owners Spotware Systems Ltd have had time to fine-tune the operating protocols and enhance the trading experience by introducing a range of new features. The finished product is a platform packed full of tools which are ideal for trading the forex markets, and a trading experience based on reliability and security. There are of course areas where the service could still be improved, with the weighting given to these ‘cons’ being determined by the types of markets and strategies you are looking to trade.

cTrader Pros

cTrader has many positive elements that traders can benefit from, particularly its user-friendly interface and institutional grade tools, such as the Autochartist monitor. Here are some the main benefits of cTrader.

Easy set up

cTrader is available in Webtrader, downloadable desktop, and mobile App format. Not only is it easily accessed, but there is no need to work through third-party certification and additional logins in the way you have to when onboarding to use MetaTrader’s MT4 and MT5 platforms. Once you log into your chosen broker account, the cTrader platform is ready to launch at the click of a button.

Intuitive navigation

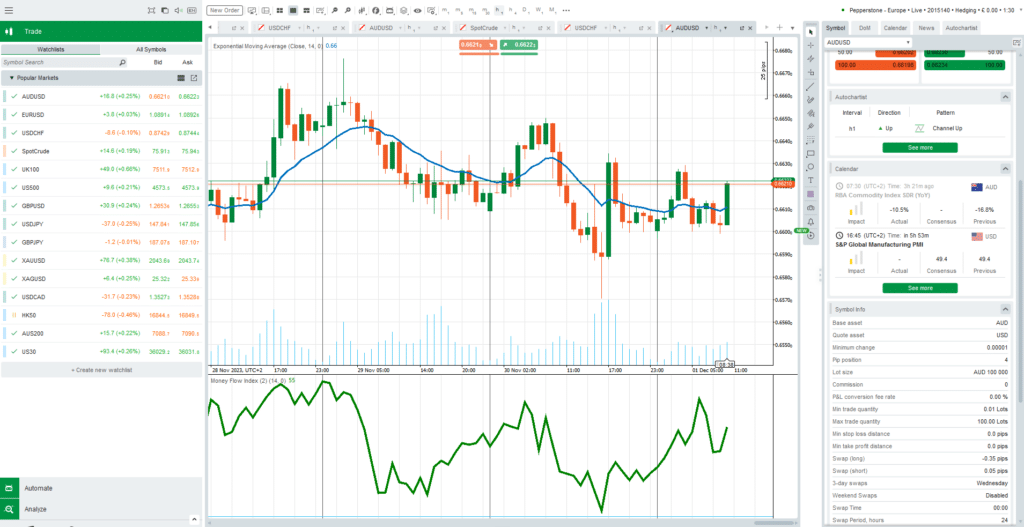

The layout of the cTrader dashboard makes trading easy. That can be important in fast-moving forex markets. The central monitor hosts price charts which can be set out in a multi-chart format, and the left- and right-hand side toolbars contain a range of support tools which can be accessed with ease but don’t get in the way of the trading experience.

Trade execution

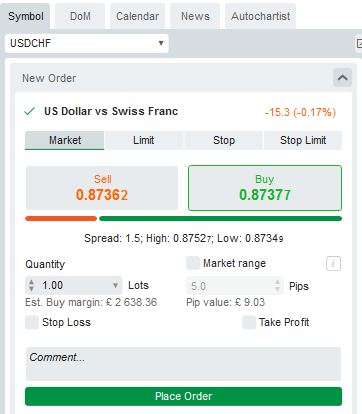

The ‘by traders, for traders’ feel of the cTrader platform is well demonstrated by the trade execution interface. Crucial data fields such as stop-loss, take profit, and trailing stop loss can all be set at time of trade, and booked orders are reported instantly thanks to super-fast connectivity links to the major forex exchanges.

Depth of Market

The Depth of Market monitor offers retail traders the chance to use an institutional grade tool. It shows traders where big buyers and sellers have placed their orders in any particular market. That allows cTrader users to see in advance the price levels at which an influx of cash can be expected to come into the market.

Personalised dashboards

The trading platform can be laid out in whatever way helps you pinpoint the best time to book a trade. Monitors can be set up in multi-screen format, using different timeframes, or detached and enlarged if you want to focus on a particular trading situation. The dashboard also comes in a range of colour options. Whatever style of strategy you are looking to trade, the cTrader dashboard can be set up to meet your personal requirements.

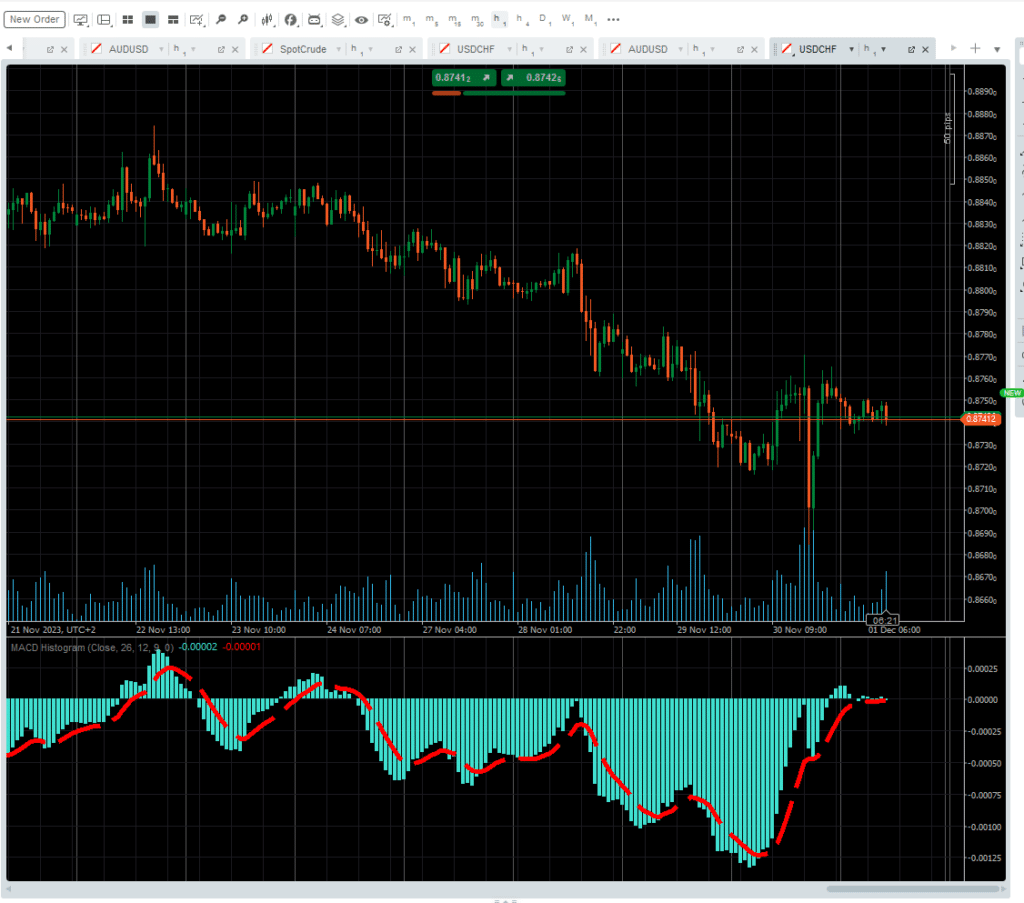

Advanced charting tools

Each price chart can be analysed using pinpoint accurate annotation tools and graphics. In addition, there are +50 pre-installed indicators which can be used to confirm the strength of any trading situation.

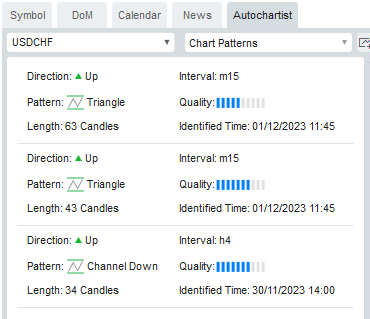

Third-party research and analysis

The Autochartist monitor found in the right-hand toolbar tracks market moves to identify and report real-time trading opportunities across a range of different timeframes. These can be treated as a signal to carry out your own further analysis on the situation, or as a signal to book a trade.

Automated trading

cTrader offers automated as well as manual trading. The cTrader Automate feature is an all-inclusive algorithmic trading solution that allows those who want a more hands-off trading experience to build automated trading robots, custom indicators, and algorithmic models. That way the trades which form part of your strategy can be booked on a 24/7 basis, with no human intervention required.

Performance analysis

One element of trading which is sometimes overlooked is self-analysis. The cTrader Analyze tool allows clients to review and assess their own trading performance, with the detailed analytics providing a way for users to learn from their past trades.

Security

cTrader uses robust security protocols, including secure socket layer (SSL) encryption which ensure that sensitive client information like login details and financial data remains secure.

Copy Trading

The cTrader Copy trading service is a simple and flexible way to benefit from the ideas of other traders. It’s accessed from the main dashboard and as you might expect from cTrader has a few neat additional features, including filters which allow you to analyse performance returns of potential lead traders. Those allow you to learn more about how their strategy works before committing capital to following them.

cTrader Cons

On the other hand, traders who want to explore more niche markets or who are looking to switch from one cTrader broker to another, may find that cTrader brokers limit their opportunities. Below are some drawbacks of cTrader offerings that are worth noting.

Server latency

cTrader is a third-party service provider. That means that executed trades must connect to Spotware’s global network of proxy servers before feeding into the market. The technical infrastructure is state-of-the-art, but whenever an additional stage is introduced to any process it can result in additional complexity and latency issues.

Limited availability

cTrader’s popularity with end-users is not yet matched by demand from brokerage firms. That can potentially limit traders’ choices when selecting a broker to support their trading.

Advanced features

It takes time to learn how to make the best use out of some of the intermediate and advanced features of the cTrader site. It is also the case that not all brokers will supply the exact same package. So, if or when, you are considering switching from one cTrader broker to another, it is worth checking the T&Cs to ensure a like-for-like service is available.

Market coverage

It is possible to use cTrader to trade major, minor, and exotic forex pairs, as well as CFDs, indices, equities, commodities, and cryptocurrencies. But those looking to gain exposure to more niche markets may find the markets offered by cTrader limits their options.

Mobile trading

It is worth noting how many of the additional trading tools which are found on the desktop version of cTrader can also be found on the mobile App version of the platform. It’s possible to use handheld devices to seamlessly access the markets at any time and carry out the research and trading activity needed to help you keep on top of the markets.

Is cTrader Good for Forex Trading?

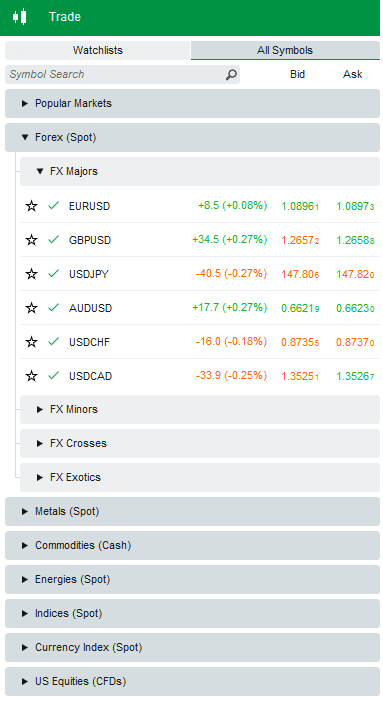

cTrader has developed overtime to support trading in a wide range of markets but the forex markets remain its core offering. It’s set up in a way to ensure its clients have access to the most liquid markets in 60+ currency pairs, ranging from the major to exotic instruments. That ensures trade execution is reliable, and bid-offer spreads and other frictional trading costs are low.

To ensure around the clock coverage, cTrader forex brokers sign up to cTrader’s IT architecture which consists of a high-end connectivity network with direct links to seven of the world’s primary currency exchanges. That means cTrader clients will have their trades booked to the market which is seeing the greatest flow as the 24/7 trade in forex passes through different time zones.

The cTrader platform is a natural fit for traders looking to use charting techniques and technical analysis to trade the forex markets. The dashboard has a crisp aesthetic, and an extensive range of annotation tools and indicators are conveniently broken down into Trend, Oscillator, Volatility, and Volume sub-categories. These +50 trade indicators such as MACD and Bollinger Bands identify anomalies and trade entry points for those following strategies based on time frames ranging from day-trading to long-term investing, with cTrader having a greater number of time frames on offer than many of its competitors, including MT4.

The multi-chart functionality is particularly beneficial. It allows you to simultaneously follow market moves on time frames ranging from seconds and minutes to weeks and months. Tracking where price sits in each timeframe can help you identify the relative strength of short and long-term trends. Then when it comes to booking your trades, cTrader’s pending orders functionality allows you to pick an optimal trading level and introduce additional discipline into your strategy.

Is cTrader Good for Beginners

If you’re new to trading, then talk of building your own algorithmic models or following a Depth of Market monitor may appear daunting. The reality is that whilst the additional features of the cTrader platform are impressive, they have been designed to be provided in a user-friendly manner. Another step taken to accommodate beginners is that the extra tools are stored away from the main trading screen so that the core visuals of the dashboard remain uncluttered.

It’s not only powerful software tools which can be useful to traders. Each market is accompanied by a clearly laid out factsheet which sits on the right hand of the screen and can be used to check the terms of that market. It details all the important information traders need to make an informed decision with lot size, trading costs, swap pricing terms and minimum pip distances among the metrics included. Just below that Symbol Info monitor is the Economic Calendar, another crucial if straightforward tool for those taking a sensible approach to trading the markets. It outlines upcoming news events and grades them by significance so traders can keep ahead of the market.

cTrader is used by professionals and beginners alike. One good reason for beginners to choose cTrader and embrace a relatively steep learning curve is that when the time comes to take your trading up to the next level, cTrader has the capacity to allow you to grow. Some of the more advanced services wouldn’t look out of place on an institutional-grade trading platform, and the added benefit is that there is no need to start out afresh using a new platform and learning a new set of protocols. The caveat to this is that the in-house video tutorials which are designed to outline how the platform works are so plentiful that it’s hard to match the video to your specific question. That can lead to traders taking the choice to instead learn via hands-on testing which is best done using a Demo account until the ‘how to’ and ‘what is’ style questions have been resolved.

Related Articles

- cTrader vs MT4 – What Are the Differences?

- MT4 vs MT5 – What are the Differences?

- How to Count and Calculate Pips in MT4

- MetaTrader 5 Review – MT5 Trading Software Review

Final Thoughts

There are plenty of justifiable reasons for the popularity of the cTrader platform among forex traders. The long list of attractive features means that when considered overall, the platform can be seen to offer an all-round service that is easy enough for beginners to use, but advanced enough for the platform to be a good fit as their trading progresses. If one of the main disadvantages of a platform is that it is only offered by a relatively exclusive number of brokers, then reviewing those firms, and establishing which offers the T&Cs to support your style of trading appears to be the next logical step towards improving your trading returns.

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.