GBPUSD continues to show bullish sentiment. The Forex Trader analysts who picked it as a potential long position on Monday deserve some credit. They noted the bullish price pattern was forming when price was at 1.335, and the pair is now trading 1.341 as the halfway stage of the European session approaches.

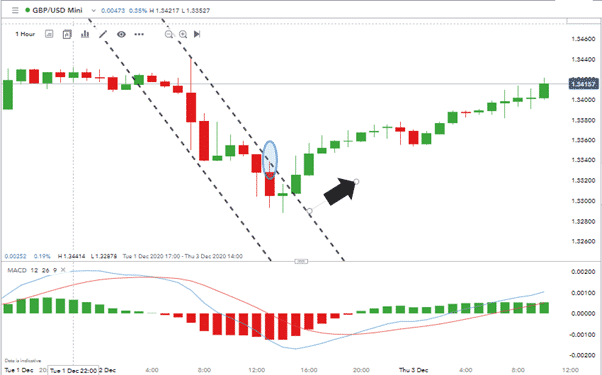

GBPUSDS – 1HR

Source: IG

They didn’t hit a home run though. What has been noticeable about GBPUSD is the up-tick in volatility.

Rather than breaking out convincingly, cable instead started trading in a wider range. Given that news items on Brexit talk developments are feeding into the markets intermittently, it could be expected to be the case for some time yet.

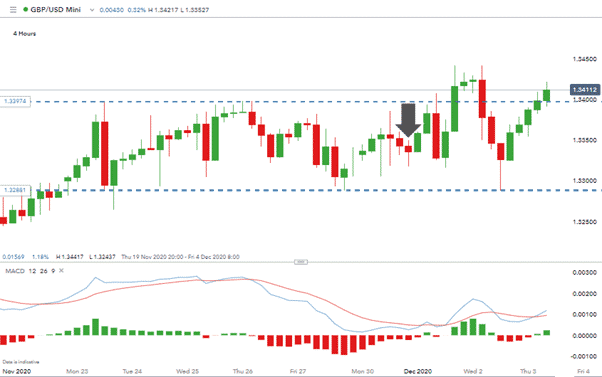

GBPUSD 4HR

Source: IG

The break out to 1.344 in overnight trading on Tuesday-Wednesday hit resistance and fell back to the 1.32881 support level.

That support level could be crucial as it now provides a clear barrier to downward price movements.

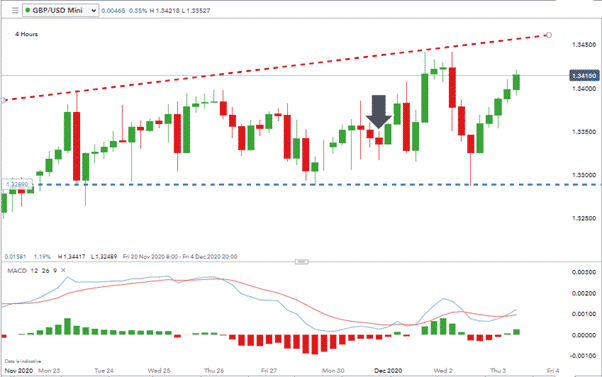

GBPUSD 4HR

Source: IG

Adjusting the angle of the upper trend line to factor in recent price points now offers room for price to reach 1.345 without breaking out of the channel. One question outstanding is if the new channel has an upper limit of 1.3440 or 1.3450.

Possible Scenarios

GBPUSD is offering a timely reminder of how the currency markets can be subject to the whims of politicians. Fishing rights still appear to be a potential stumbling block.

Italian and German industrialists are wondering how fish could be such an important issue that their trade with the UK could be in jeopardy. They, and GBPUSD, are at the mercy of the countries bordering the North Sea.

French President Emmanuel Macron continues to be showing a hard line on fishing. The subject also raises the temperature of politicians in Belgium and the Netherlands.

Thursday’s comments by UK Education Secretary Gavin Williamson and Irish Foreign Minister Simon Coveney that good progress is being made only clouds the waters.

Michel Barnier, the EU’s chief negotiator, is, after all, a representative of the 27 member states and his mandate is to deliver on their instructions. The fact that he is now getting mixed messages from EU member states, including the possibility of a French veto led to him warning that “a deal hangs in the balance.”

Dollar Updates

The stage looks set for GBPUSD trading in a wider range and showing strength until rumours from negotiating talks slap price back down again.

That is reliant on the US dollar continuing to show weakness. One eye must be focussed on news from Brussels and London but the other needs to be ready for the large number of US data releases which are due out on Thursday.

07.30 Eastern Time the market will be updated on the Challenger job cuts report. At 8.30 the following are due:

- Continuing Jobless Claims

- Initial Jobless Claims

- Initial Jobless Claims – 4-week average

Might a bunch of medium-importance economic data reports from the US trigger the end of the USD decline? It is unlikely but this is after all 2020.

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk