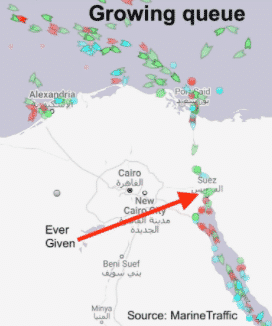

The 400m long Ever Given ‘mega ship’ that has blocked the Suez Canal has left vessels of all types waiting to pass through one of the world’s busiest waterways. Approximately 12% of world trade passes through the canal and the 4% spike in spot oil prices provided an immediate demonstration of the consequences of the grounding.

The 224,000-ton container ship is likely to be soon resuming its journey to Rotterdam. However, the temporary confusion has turned out to be an appropriate analogy for the financial markets’ current state.

Source: 247

Wednesday’s stock markets saw energy and industrials show strength, the former’s rally no doubt due to events in the Middle East. That followed two days of a different rotation, Monday and Tuesday marked by a shift from cyclicals to defensive stocks.

Factor in a slide in consumer durable names and tech stocks and certain parts of the market appear to be chasing their tails. The alternative is that institutional investors are onto something and the realignment marks a change in market mood.

Markets at a Crossroads

Sideways trading has taken over the market for several reasons.

- Calendar – we’re in between the last and next round of earnings announcements

- Monetary – Jerome Powell and his team have indicated they don’t intend to pull any rabbits out of their hat until next year

- Fiscal – Covid recovery plans across the world have worked their way through to the implementation stage and look priced in

- Covid – vaccination rollouts have turned out to be drawn out affairs

The absence of any macro-level catalysts comes at a time when markets are also relatively stable. Reports from analysts at the big banks point to equity indices having 5-10% upside potential and bond yields are squirming within a relatively tight range. The furious rally in assets from March 2020 appears to be reaching maturity leaving many thinking it’s too late to buy and too early to sell.

Are cyclicals the best bet?

Those companies that look best positioned to benefit from the global economy’s opening up are obvious candidates for investment. Personal savings levels have increased over the last twelve months, at least for the ‘winners’ from the change in lifestyle and working practises. With their spending options limited, there is now a lot of spare cash sitting in middle-income bank savings accounts.

Pent up consumer demand looks set to be released; the entertainment sector in particular looks likely to benefit from a renewed interest in certain pastimes, but is that already priced in? In some instances, yes, the rising markets have left some companies wearing fairly aggressive p/e ratios. Still, with the potential for sideways trading to be the new norm, the below names might come into focus.

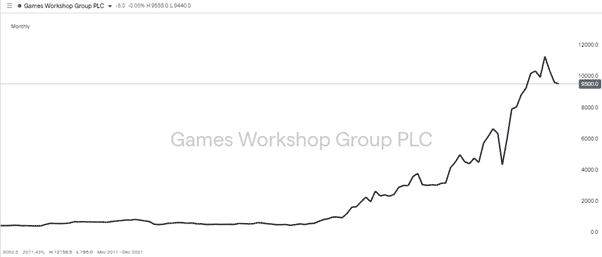

Games Workshop Group – Normalised p/e ratio 43.3

Source: IG

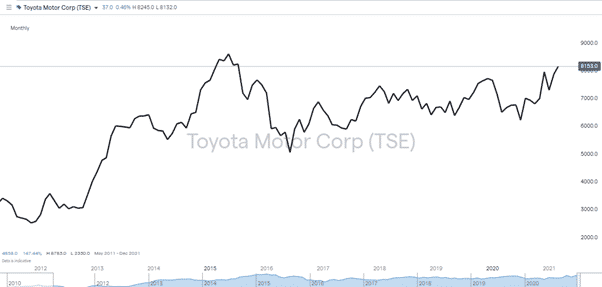

Toyota Motor Corp – Normalised p/e ratio 11.0

Source: IG

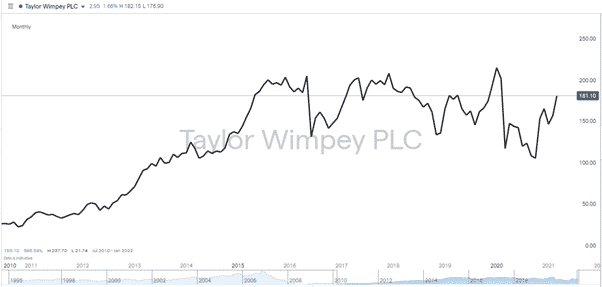

Taylor Wimpey PLC – Normalised p/e ratio 21.2

Source: IG

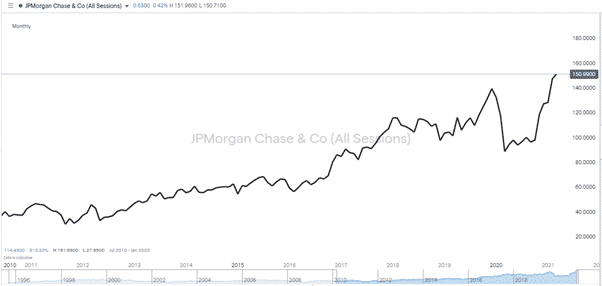

JP Morgan Chase – Normalised p/e ratio 13.5

Source: IG

Berkeley Group Holdings PLC – Normalised p/e ratio 14.0

Source: IG

If you want to know more about this topic, please contact us at [email protected]

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk