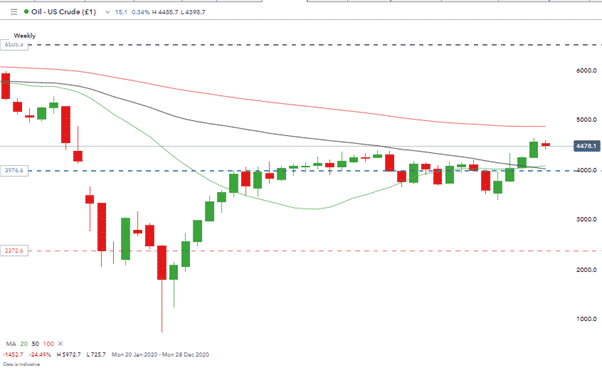

Crude oil markets came back into play on Tuesday. The dramatic price slump of oil in March was followed by a rapid recovery and by June it was again trading above $40 per barrel. A level which it has broadly held despite intermittent alarm about secondary COVID lockdowns.

Source: IG

The pull-back in US WTI crude to $33.82 in the first week of November was a short-lived affair. Oil’s six-month high of $46.29 was posted less than three weeks later but there are signs that further upward price momentum is waning.

Rumours

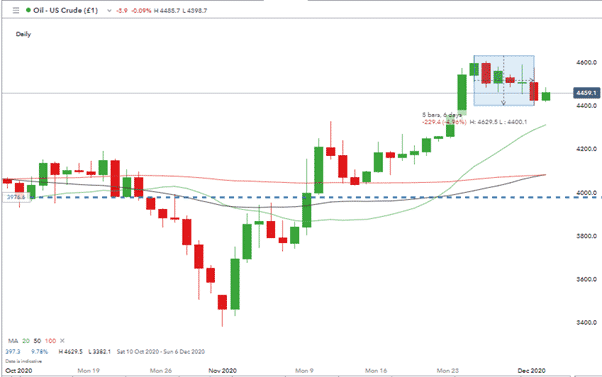

OPEC+ members have been holding virtual meetings this week to hammer out a deal regarding production levels in 2021. Initial signs for oil prices aren’t promising. When the price ventured below $20 earlier in the year, it focused the minds of OPEC+ members who found enough common ground to drive the price northwards.

The recent consensus among members now looks like an outlier rather than the default situation and price fell away 5% in the last four trading sessions.

Source: IG

Facts

The politics of OPEC meetings are hard to gauge but the policies of Norway’s Ministry of Petroleum and Energy are the opposite. The problem for oil bulls is that the Norwegians, who are not members of OPEC+, have announced they’d be turning on the taps in 2021.

In a bid to support prices, Norway in June announced it would cut its crude oil production by 250,000 barrels per day. As prices recovered, it adjusted its position but still held production levels at 134,000- barrels per day lower for the rest of 2020.

It’s likely to be more than coincidence that Norway has chosen this time to announce its intention to restore production levels to normal in 2021. While OPEC+ members have dithered, Norway has laid the first card down on the table.

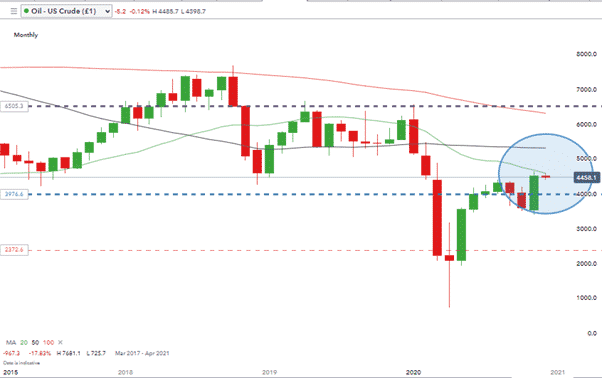

Source: IG

Technicals

Technical analysis offers little relief with price currently failing to break the Monthly 20 SMA.

On the weekly charts, the 100 SMA is currently at $48.66. This could also cap any further price rises; however, the uncertainty of the OPEC+ meeting is making many look towards the downside.

The first target for short-sellers would be the Daily 20 SMA at $43.11. Target 2 is the Daily 50 SMA at $40.81. Target 2 also sitting just above the psychologically important $40 price level.

Oil this week – What else to look out for

The next EIA crude oil inventory report will be released after 10.30 (Eastern Time) on Wednesday. That may act as a catalyst for the next move with analysts forecasting a 2.358m barrel decline in supplies.

All eyes will be on the OPEC+ talks, but there is definitely scope for a surprise increase in inventories to piggyback on fears that the cartel talks might break down.

The demand for oil could also become a topic of interest. The rebound in the number of commercial airline flights has stalled and reversed.

Flightrader reports that the seven-day flight count average dropped to 129,008 on the 1st of December from September’s peak of 155,543. That raises the question of whether the uptick in demand is already priced in.

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk