The positive US jobs data released on the 5th of March took some time to feed into the markets in terms of higher asset prices, but they finally finished last week in bullish mode. Reasons for the delayed reaction aren’t clear, but the below non-USD currencies, indices and precious metals all ended up positive on charts running from the 8th to the 15th of March. Only oil posted a down week, with the possibility of that happening identified in this report by the Forex Traders analysts on the 8th of March.

| Instrument | 8th March | 15th March | Hourly | Daily | % Change | |

| GBP/USD | 1.3828 | 1.3922 | Strong Buy | Neutral | 0.68% | |

| EUR/USD | 1.1889 | 1.1922 | Strong Sell | Strong Sell | 0.27% | |

| FTSE 100 | 6,656 | 6,784 | Strong Buy | Strong Buy | 1.92% | |

| S&P 500 | 3,810 | 3,941 | Strong Buy | Strong Buy | 3.44% | |

| Gold | 1,695 | 1,723 | Neutral | Strong Sell | 1.65% | |

| Silver | 2,536 | 2,586 | Strong Sell | Sell | 1.97% | |

| Crude Oil WTI | 66.57 | 66.26 | Strong Buy | Strong Buy | -0.47% | |

| Bitcoin | 49,657 | 58,203 | Strong Sell | Strong Buy | 17.21% |

Source: Forex Traders Technical Analysis

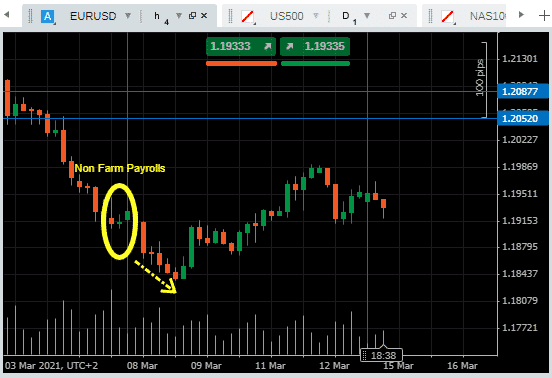

The 4H chart for EURUSD details how following the Non-Farm Payrolls announcement on Friday the 5th of March, risk-appetite faded before rallying overnight on Monday the 8th of the month.

EURUSD – 4H price chart

Source: Pepperstone

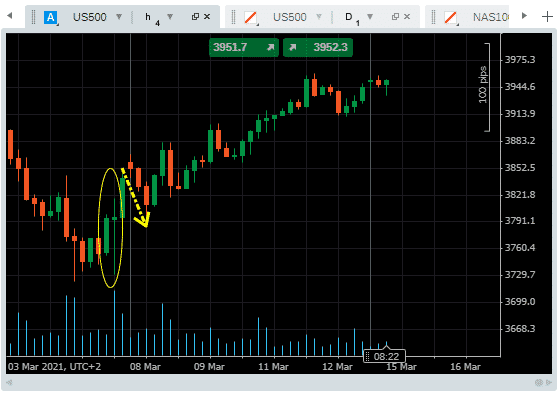

The US500 4H price chart shows a similar pattern in equities.

US 500 – 4H price chart

Source: Pepperstone

The strong run into the end of the week marks Monday’s price weakness as a chance to have bought dips as governments and central banks continue to pour liquidity into the financial markets in an effort to kick-start their economy’s.

More detail on the scale of the financial support is due out this week. Four major central banks are set to provide interest rate announcements and the all-important statements so that analysts across the global markets can spend hours trying to read between the lines.

- Tuesday the 16th of March – Reserve Bank of Australia – interest rate decision

- Wednesday the 17th of March – US Fed – interest rate decision

- Thursday the 18th of March – Bank of England – interest rate decision

- Friday the 19th of March – Bank of Japan – interest rate decision

Other data points relating to the economic recovery (or not) and, in particular, inflationary pressures are prominent items in this week’s calendar.

- Monday the 15th of March – China house price index, industrial production, retail sales

- Tuesday the 16th of March – US: Retail sales, import and export prices, NAHM house price index

- Wednesday the 17th of March – Japan: Trade balance. Canada: Consumer price index

- Thursday the 18th of March – Eurozone: trade balance. Australia: unemployment rate, US: initial jobless claims

- Friday the 19th of March – Japan: February inflation report, UK consumer confidence, Germany producer price inflation report

Inflation, bond yields and fiscal stimulus look set to be the main drivers of market prices this week, with Jerome Powell and the US Fed being the key players. The market appears to have taken Powell at his word and priced in that he will stick with his policies rather than taper any monetary relief.

The policy may be little changed but the comments made will be key. Tech stocks and the Nasdaq index have been particularly sensitive to USD strength over the last three weeks and could suffer a shake-down if Powell forgets any of his lines.

If you want to know more about this topic, please contact us at [email protected]

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk