The Bitcoin miners who unearth new coins and collate the transaction data to keep the blockchain open ledger up to date run on super-tight margins. There’s little room for moving the business model away from using banks of super-powerful computers and trying to squeeze a profit by accessing the cheapest electricity possible. That is partly why 65% – 75% of the world’s mining has historically taken place in China.

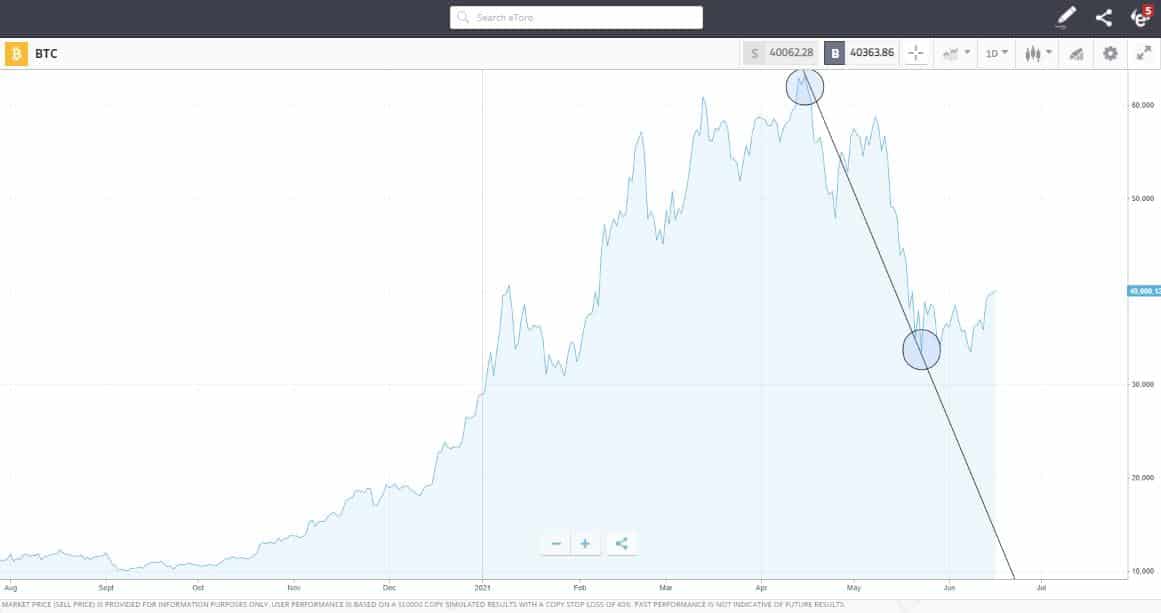

The announcement made on the 18th of May by China that they want miners out of the country within months shook the industry and played a large part in BTC’s eye-watering 47% fall in value in a few weeks.

Source: eToro

Faced with the proposition of ‘change or die’, Bitcoin miners have opted for change. While the frictional and logistical problems associated with carrying that out are huge, the shift could ultimately improve the prospects for Bitcoin and all cryptos. Mining can, after all, be carried out anywhere in the world.

Why does China Want Bitcoin Miners to Leave?

The break-up between the miners and China’s governing bodies has a feel of “it’s not you, it’s me” about it. The two primary reasons for China’s aggressive clampdown are related to the crypto’s success. The first is that Bitcoin mining is holding China back from meeting its carbon reduction targets. Why would Beijing want to allocate a precious carbon quota to miners who ultimately generate few positive side effects for the economy? The second reason is that The People’s Bank of China is developing its own cryptocurrency style product, which will be a direct competitor to Bitcoin. It’s not that crypto’s don’t work; it is just that China wants theirs to dominate the global financial system of the future.

Will Crypto Mining Go Green?

The inland regions of China, which formed the base of so much mining, supplied cheap electricity. In Sichuan and Yunnan, the power source was predominantly hydro based. In Xinjiang and Inner Mongolia, the dominant fuel source was cheap coal. Miners are agnostic to the ultimate power source of the electricity they use; the main determinants of location are price and reliability of supply.

Unsurprisingly the exodus of miners from China has resulted in them targeting new homes which future-proof them against having to pack up and move any time soon. Texas has become a popular destination. The authorities there are crypto-friendly, and 20% of its power comes from wind. However, there are questions about the reliability of the Texas power grid and applications to build new plants take months rather than weeks to process. Fans of crypto point out that a North American hub of crypto miners, forming part of a decentralised global framework reduces the risk of capacity being concentrated in one place. The decentralisation of mining fits in with the ethos of decentralised financial transactions, which are at the core of crypto’s appeal.

According to the Cambridge Centre of Alternative Finance (CCAF), 76% of the “hashers” crucial to the network already use renewable energy. The problem has been that big players have so far stuck with using carbon, meaning only 39% of hashing total energy consumption comes from renewables. That looks set to change, and if Bitcoin can increase its eco-credentials, the price could rise once again, and Beijing’s plan could backfire.

If you want to know more about this topic, please contact us at [email protected]

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk