- Eurodollar and cable sit at 50% Fib retracement levels of the 2021-22 sell-off.

- All-important US Non-Farm Payroll jobs numbers are due to be released Friday.

- This could be a pivot point determining if the price surge from September 2022 will continue.

The Non-Farm Payroll report due to be released in the US on Friday has taken on extra significance thanks to EURUSD and GBPUSD trading at key price points in the run-up to the announcement. The NFP report is a milestone of every month’s economic calendar, and this set of numbers could help traders determine if central banks will pivot from hawkish to dovish policies.

To make matters even more interesting, the release falls on a date when the major exchanges will be closed for the Easter holiday, opening up the possibility of extreme price moves on the back of limited liquidity in the market.

The backdrop to all this is that both EURUSD and GBPUSD are sitting on the crucial 50% Fibonacci retracement levels of the sell-off in each currency in 2021-22. The question is whether the price surge dating from September 2022 is the start of a new bull market in the currency pairs or a retracement rally in an ongoing bearish market. We could be about to find out.

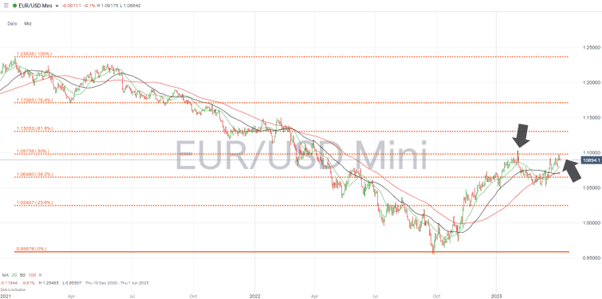

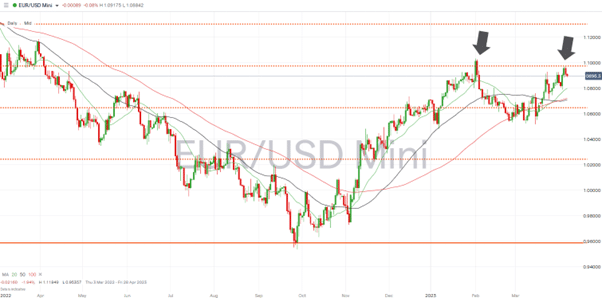

EURUSD –Daily Price 2021-2023 – 50% Fib

Source: IG

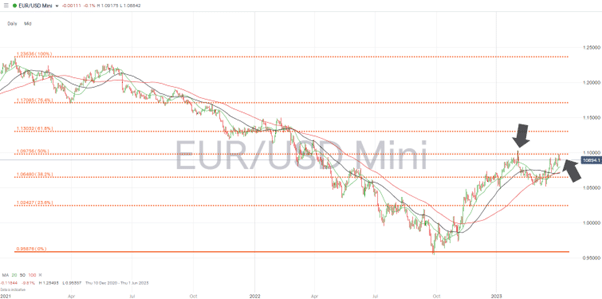

GBPUSD –Daily Price 2021-2023 – 50% Fib

Source: IG

EURUSD and GBPUSD at the 50% Fibonacci Retracement

The multi-month rally in EURUSD and GBPUSD, which started in September 2022, has seen the currency pairs gain in value by 14.49% and 20.74%, respectively. A 20% gain in a market is often considered to confirm that a bull market has formed, but many traders and analysts are holding off on taking that view. Their thinking is that the upward price move is just a short-term reversal during a longer-term downward price pattern.

Those with a bearish view on the fundamental prospects of the euro and pound can point to the fact that price is now at a 50% retracement level of the long-term downward trend that started in January 2021.

It is possible to debate quite how effective the 50% retracement level is in triggering a change in price direction. The statistics vary from market to market, but price action over recent weeks shows that the 50% fib level is playing on people’s minds.

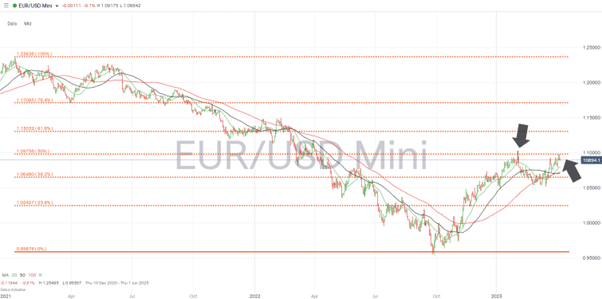

EURUSD –Daily Price 2022-2023 – 50% Fib

Source: IG

GBPUSD –Daily Price 2022-2023 – 50% Fib

Source: IG

Eurodollar’s year-to-date high of 1.10330 on 1st February 2023 tested the 50% Fib in that currency pair which sits at 1.09756. The next day price broke back below the 50% Fib and hasn’t traded higher than 1.09756 since then.

It’s a similar story for Sterling. The GBPUSD currency pair tested the 50% Fib level of 1.24463 on 13th December 2022 and 23rd January. On both occasions, price quickly fell away to trade in the region of 1.185.

The reaction to Friday’s NFP report could provide the extra momentum to settle the debate and determine the medium-term price direction of both markets.

People also Read:

- The Best and Worst Performing Currency Pairs in March 2023

- Forex Market Forecast for April 2023

- How to trade EURUSD bullish momentum triggered by banking ‘reforms’

If you have been the victim of a scam, suspect fraudulent behaviour, or want to know more about this topic, please contact us at [email protected]

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk