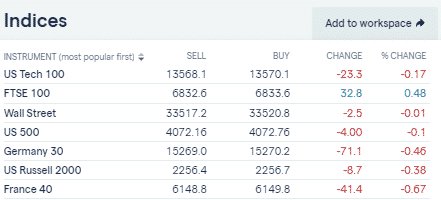

Global markets have had a lot to digest over the extended weekend break. During Tuesday’s session, APAC equity markets sold off as the US-Japan political summit diarised for next week exposed underlying points of friction between Tokyo and Beijing. In early trading in London, stock futures were in positive territory with the FTSE 100 up 0.48% as investors continued to take on board positive US jobs numbers released on Friday.

Eurozone

Early trading in Europe reported the French and German bourses being somewhat off the pace. The pan-European EuroStoxx 600 index posted all-time highs overnight, but the upcoming release of Eurozone job numbers took some froth off the top of the market.

Source: IG

Lyxor Stoxx Europe 600 (DR) – Hourly price chart

Source: IG

The EU employment data was released at 10 am London time and provided few surprises, leaving investors able to concentrate on the probably more important and more positive news from the US on Friday.

Eurozone Jobs Data

- Unchanged from January 2021 at 8.3%. On a year-to-year basis up from 7.3% in February 2020

- In real terms, this represents 1.50m more jobless eurozone citizens compared to February 2020

- An estimated 13.57m people were unemployed in the euro area in February. A rise in the total of 48,000 from January 2021

- The January jobless number was also revised upwards from 8.1% to 8.3%

EURUSD

In fundamental terms, the vaccine rollout is still the key metric to follow. The relative outperformance of the US operation has weighed on the euro as the North American economy looks likely to achieve a return to normality before its European counterpart.

In early trading, before the release of the unemployment figures, EURUSD had recovered some ground and posted an intraday high of $1.18218.

Soon after the eurozone job data was released, the EURUSD fell to a post-stat low of $1.18116 but did find support at that level.

Oil

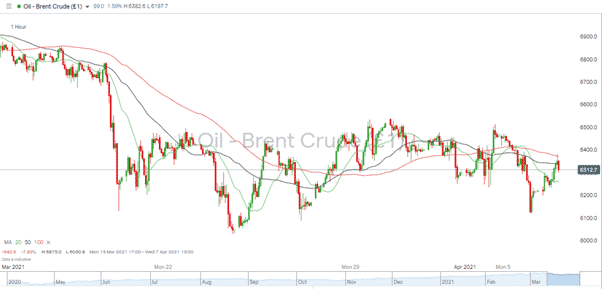

Brent oil prices have been trading in a relatively wide range since Thursday. A 4% price drop on Monday saw Brent prices close at $61.23, the lower end of the $60.42 – $65.43 range. But overnight events have seen prices pick up by 3.49%.

Brent Crude Oil – Hourly price chart

Source: IG

There’s plenty of headroom before Brent reaches its current resistance level in the $65 area but rumours of OPEC+ oversupply look likely to make that ‘big number’ price level a hard one to break. The online OPEC+ summit is due to start on Thursday. Until then, more sideways price action can’t be ruled out.

The potential catalyst for more price strength is that bad news on supply looks to be already priced in. The perennial wildcard, Iran, is reported to be one of the OPEC members pumping out more oil than its quota stipulates. Also, the US-Iran nuclear programme standoff could escalate as officials in Tehran take the opportunity to test the new White House administration’s boundaries.

If you want to know more about this topic, please contact us at [email protected]

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk