Different asset groups are continuing to show varying degrees of price volatility as the aftershocks of two weeks of big news continue to be digested by the markets. Interesting technical moves are demonstrated by EURGBP, US Tech stocks, USD and Gold – Bitcoin.

These markets are just four of many forming patterns which will be very tradeable. There’s no way of knowing for sure which way the next move will be. The use of stop-losses will be essential as will be not ‘falling in love’ with a position, but trading what you see, not what you want to see.

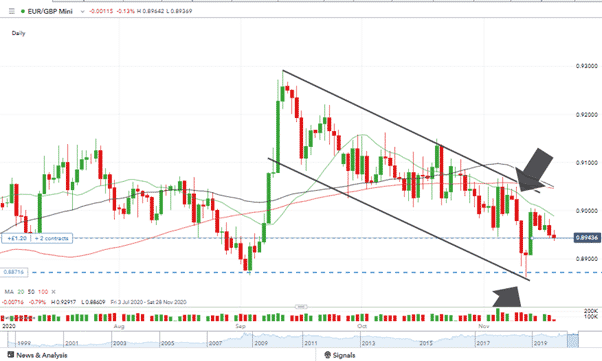

EURGBP

Range-traders will be pleased that EURGBP continues to trade within its downward channel; the long-term pattern is paying little regard to other and more recent events.

The Forex Trader’s analysts identified the opportunities to trade the channel last week. As expected, the first price rise reached resistance and offered a chance to sell short. This kind of trading requires discipline and some will not have caught the trade to the downside as the change came early – approximately two-thirds of the way through the trading range.

Anyone missing that opportunity ought not to be too hard on themselves as range trading requires patience, waiting for price to move the full distance allowing tighter stop-losses to be set.

The risk is picking some winners but then entering into a position too early. That invariably leads to giving up those profits on the trade, which ultimately fails.

Source: IG

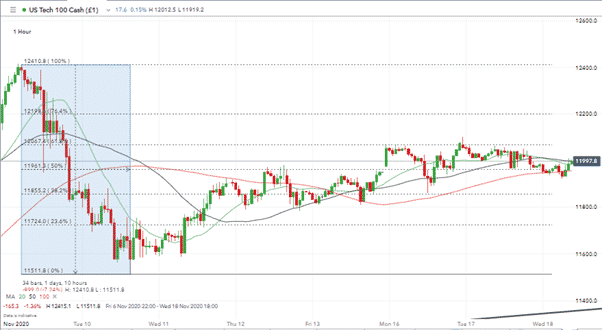

US Tech Stocks

Tech-stocks have rebounded after the Pfizer vaccine sell-off. The Nasdaq, which lost 7.28% of value in 32 hours on the 9th / 10th of November has climbed back to the 61.8% retracement. It is forming a distinctive sideways pattern between the 61.8% resistance at 12,674 and the 50% level support at 11,961.

Anyone not already in a position would do well to remain agnostic and monitor what happens rather than call the market. There is a lot of hard to define ‘sentiment’ being factored into prices.

The case for the upside is that the changes to social activity brought about by COVID are now hard-wired into the economic system. That would mean the 7% dip was enough to bring valuations in line.

More bearish sentiment is supported by the resistance of the 61.8% Fib. Several efforts to break that effort have failed.

Source: IG

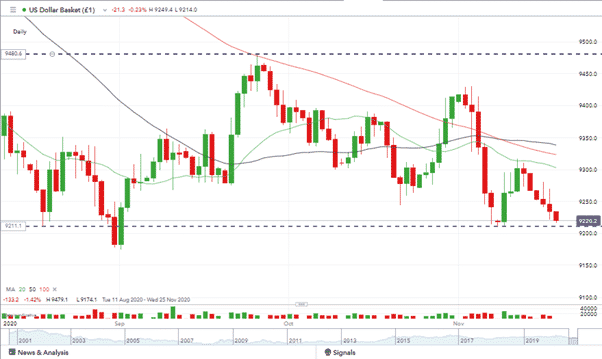

US Dollar

USD is reaching a crucial level. A stick-or-twist situation is forming in the US Dollar Basket at 9,211. The analysis from the Forex Traders analysis team on Monday picked this level as a potential trade entry point. Price has since conveniently dropped to the entry point level.

The US Dollar Basket could go either way. This more than most is a position that proves you don’t have to be in love with a position to make money out of it.

Source: IG

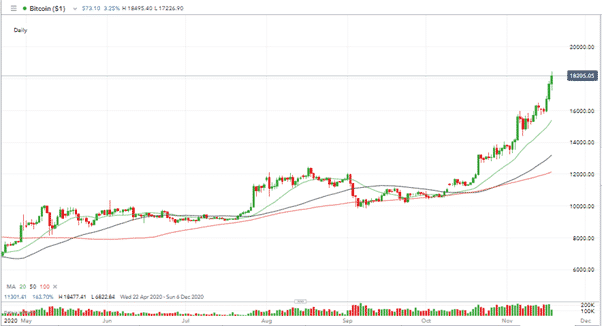

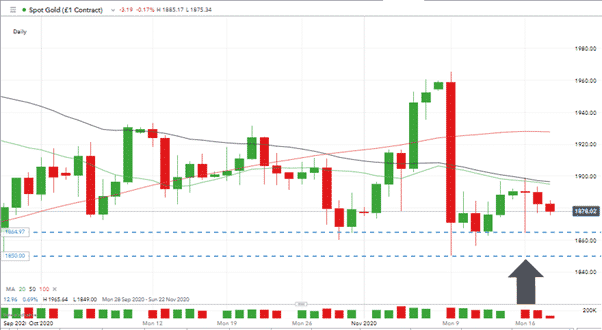

Gold & Bitcoin

Gold and Bitcoin appear to be heading in different directions. It won’t resolve the debate as to whether BTC is the new reserve currency but the crypto looks set to test the $20,000 level which might lead to profit-taking.

Source: IG

The Gold chart patterns from Monday offer a trade entry point for short-sellers. The extended doji candle from Monday is casting a shadow over the weeks trading and a break of that day’s range signify a break-out.

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk