The Pfizer vaccine news is now built into prices. Markets took a considerable step towards risk last week and have held at the new levels.

Equities

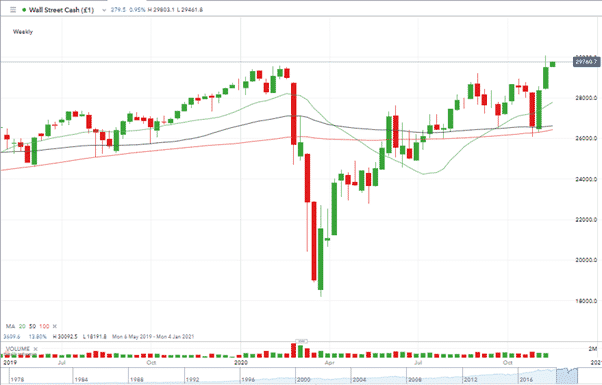

Only two of the last twelve daily candles for the S&P 500 have been red and the Dow Jones (DJIA) outperformed the Nasdaq 100 index last week. The rotation into value stocks did, however, start the week before. The week beginning the 2nd of November posted a higher DJIA return than that of Pfizer-vaccine week.

The small size of the fall back at the end of the week, to a daily close of 29,559 on Friday the 13th suggests that Wall Street still has some way to go. One bullish signal being that the index marked a year to date closing high, topping the 29,456 of the 16th of February.

Source: IG

On Monday 9th the DJIA broke to a yearly high of 30,092

One data point from last week appears to have been crowded out by more positive news. The University of Michigan report on US consumer confidence unexpectedly plunged to a three-month low in November. Even more concerning, the forward-looking “Expectations” component of the survey seemed to drive the bulk of the disappointment.

The US consumer has supported the US and global economies for decades and household consumption still accounts for close to 70% of US GDP growth.

Any more disappointing announcements in the coming weeks may get more airtime now that Pfizer, Trump and Biden have less reason to hog the limelight.

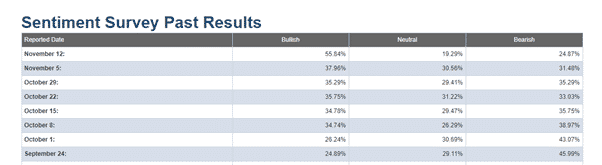

Source: aaii

The Suntrust Sentiment Survey moved firmly into bullish territory last week. Bullish markets can be more susceptible to bad news so short term but intense pullbacks in equities may be on the cards. The question is whether they will be seen as opportunities to buy the dips.

Market Neutral Strategies for trading COVID

The divergence between COVID stocks, such as Amazon and Netflix, and mainstream economy names reflects changing timeframes in terms of infections and injections. There is a chance to build a strategy on how the two sectors will trade in the coming weeks.

A pairs trade, long/short Nasdaq 100 and short/long DJIA would offer some market neutrality. Setting it up would be down to what extent you think the good news about the vaccine has been overdone.

US Dollar

Many will be looking to trade the US Dollar. If the ‘trend is your friend until the bend at the end’, then notable price moves in the US Treasuries market could be pointing to a bounce for the greenback.

Source: IG

US Treasury spreads have widened in comparison to other G7 countries, suggesting the selling of US Treasuries could be overdone. Any inflow of international funds could be sufficient a catalyst to trigger a bounce, particularly as the US Dollar basket is closing in on its year to date low, support level.

EURGBP

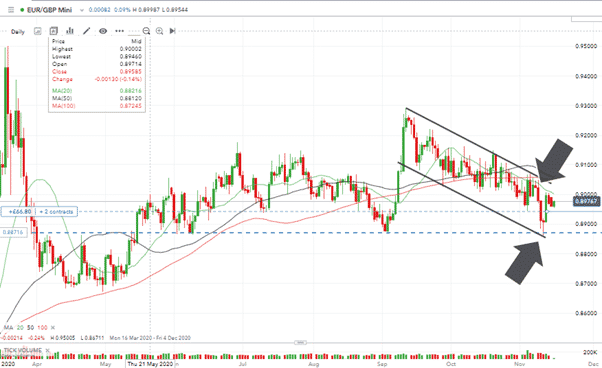

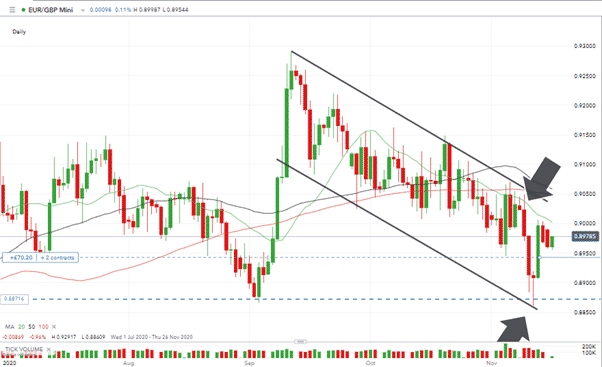

Last week’s strategy idea from the Forex Traders analyst team came good. The long EURGBP with an entry point of 0.89426 is, as expected, trading within the range of the channel. No-one is going to retire off the back of it but with USD and equity markets showing potential for volatility, trading non-USD pairs, away from dollar noise, might be a quieter, but still profitable week.

Source: IG

Source: IG

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk