A more contagious strain of COVID-19 has been found in the UK and the discovery has taken chunks out of risk appetites. Traders and investors spent Monday morning considering the potential rate of infection in comparison to the speed of vaccine roll-outs.

The economic impact of the break-out strain includes travel to and from the UK being stopped by European countries, including France, Switzerland, Germany and Italy. There are global ramifications as well, with Hong Kong joining the list of countries which are at least for now ‘no-go’ zones for UK citizens.

FTSE 100 – Holding up on the back of forex gloom

A committed sell-off in UK asset markets on Monday morning was followed by a mid-morning holding pattern for equities, but GBPUSD had found it has even fewer friends. The sell-off in sterling is possibly something of a saving grace for the equity markets as price moves in the UK flagship index are typically inversely related to moves in GBPUSD.

Source: IG

Early into the European session, the FTSE 100 index was down 1.73% from Friday’s close.

How long this support holds is anyone’s guess. Should a combined major sell-off in UK currency and equities take hold, there could be ramifications for other markets. The one lesson learned from the pandemic is the grim certainty that the problems facing one country tend to be soon followed by others.

COVID-19 infection rates in the UK rose by 35,928 on Sunday – nearly double the number recorded seven days previously.

The UK Health Secretary Matt Hancock warned that the new variant of the virus is “getting out of control”.

Press reports suggest that fresh produce imported from the continent may not be available in UK grocery stores by the middle of next week. It’s certainly not the case that Christmas has come early, but a no-deal Brexit may have.

With talks between Brussels and London stalling, the virus-led blockade of the Channel ports has given sterling a taste of what to expect if EU and UK politicians don’t come to some agreement.

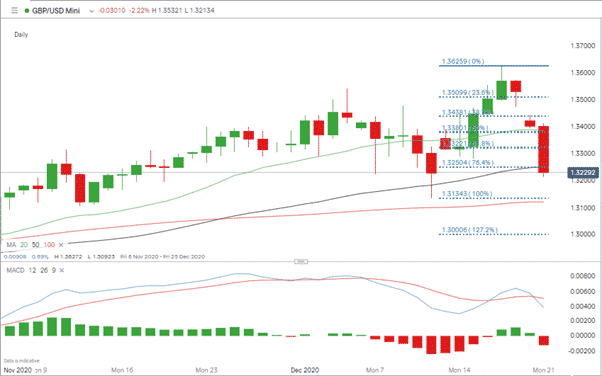

GBPUSD – Cable tumbles through potential support levels

The bellwether for the Brexit negations GBPUSD was down as much as 2% during the London morning. A move of such a scale is relatively rare in the forex markets and possible support levels failed to kick in.

Attempts to rebound at the Daily 50 SMA (1.32513), 50% Fib (1.3380) and 61.8% Fib (1.33221) found little support.

Source: IG

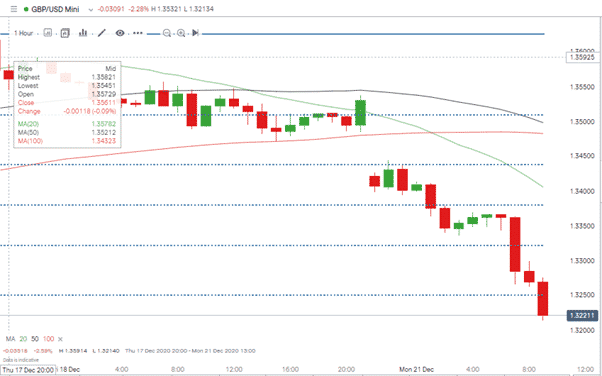

There is some committed selling pressure in cable with the hourly candles marking the start of the week’s trading forming a very bearish pattern.

The 100 Daily SMA might offer support at 1.31210 but with the sell-off building significant momentum the question of when it ends could come down to ‘big number’ psychologically important levels such as 1.32, 1.31 and even 1.30.

Source: IG

The lack of any dead-cat bounce could be related to the political discussions. It’s politically savvy for the UK government to allow an act of nature to be held responsible for a currency crash rather than the Brexit talks breaking down.

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk