Gold has long been regarded as a stable investment and a hedge against economic uncertainty. In 2024, the gold market has witnessed significant developments influenced by various economic factors and market cycles. Analysts have observed a dominant 72-day cycle in the gold market, affecting its pricing and investment strategy. Recent analyses suggest a correction phase in the gold market. Predictions have indicated the potential for gold to surge above $2,100, especially given that precious metals typically rally in presidential election years.

economic factors affecting The gold Price

Several factors are influencing these advancements and predictions in the gold currency market:

- Economic Trends and Employment Data: A notable surge in January employment figures led to a temporary tumble in precious metal prices, demonstrating the sensitivity of gold to economic indicators.

- Monetary Policy and Interest Rates: The Federal Reserve’s stance on interest rates has a profound impact on gold prices. The end of rate hikes has been particularly favorable, suggesting a conducive environment for gold’s value appreciation.

- Market Sentiments and Investment Flows: Investment trends, such as fund flows into ETFs and the stock market’s performance, provide insights into investor sentiment and its effects on gold prices.

Experts believe that the gold market is correcting into an intermediate low, with expectations for a rebound. This correction is viewed in the context of the dollar’s performance and broader market complacency. Looking ahead, gold’s value is expected to be influenced by several key factors, including long-term economic trends, monetary policy expectations, and the dollar’s strength. Notably, gold’s historical role as a store of value suggests its price may rise as stock markets face volatility.

The interplay between the US dollar strength and gold prices remains a critical factor, with a traditionally inverse relationship observed. As the dollar weakens, gold becomes cheaper for holders of other currencies, potentially driving up its price.

Gold Futures Record Highs

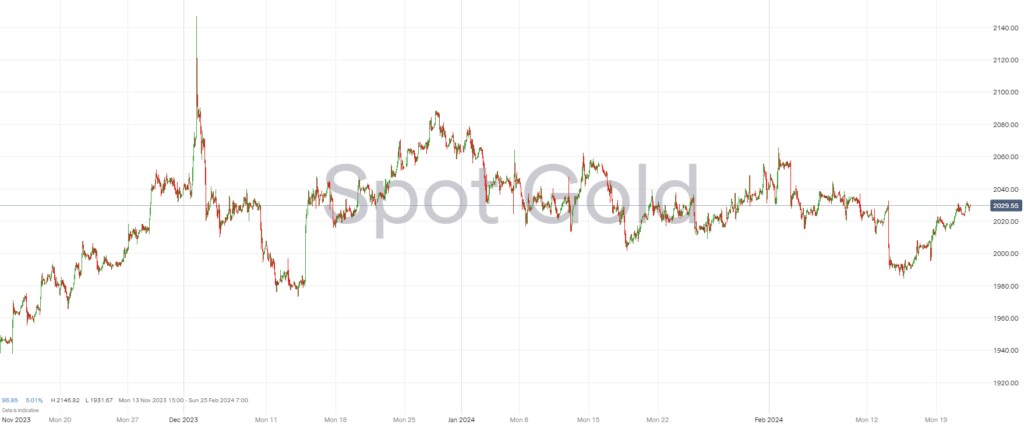

As 2023 drew to a close, the gold market witnessed a remarkable surge. Futures prices reached new heights and set records across various currencies. The precious metal‘s price trajectory was influenced by a complex interplay of factors, including central bank activities, geopolitical tensions, and prevailing economic conditions, underscoring its multifaceted role in the global financial landscape.

Central banks’ buying activities contributed significantly to the metal’s price appreciation. This was particularly evident as geopolitical risks heightened, leading to increased investment in gold as a safe-haven asset. The World Gold Council highlighted this impact on gold’s performance, estimating a 5% contribution to its returns in 2023.

The end of 2023 saw gold prices reaching unprecedented levels. The price for London settlement touched $2062.40 per Troy ounce—a 13.7% increase from the previous year. This rally was not confined to the US Dollar; gold set record highs in almost all major currencies except for the Swiss Franc, reflecting its universal appeal as a store of value amid uncertain times.

Despite the bullish futures market, the physical gold market experienced varied dynamics. Investment demand for physical bullion, as measured by small bar and coin purchases, faced a decline, marking its weakest point since the 2013 price crash. Conversely, gold-backed ETF trust funds saw a contraction for the third consecutive year, impacted by a mix of profit-taking in Europe and subdued private investment demand.

Central bank purchases of gold reached a six-decade high, led predominantly by China. This substantial central bank demand, coupled with robust jewellery sales, particularly in India and the United Arab Emirates, underscored gold’s enduring allure beyond its investment value

Gold Price Forecast for 2024

As we move into 2024, the gold market faces a delicate balance between potential inflationary pressures and recessionary risks. The World Gold Council’s outlook suggests that gold’s performance could be moderated by these competing forces. Its future trajectory will likely be influenced by central bank policies, interest rate movements, and ongoing geopolitical developments.

Experts from J.P. Morgan predict a sustained bullish momentum for gold, with prices expected to ascend to new records. A critical factor underpinning this forecast is the anticipated reduction in Federal Reserve interest rates and a cooling inflation scenario, which historically enhances gold’s allure as a hedge against currency devaluation and economic uncertainty.

Moreover, central bank activities underscore the growing confidence in gold as a safe-haven asset amid financial and geopolitical instability. These include robust purchasing patterns and a renewed interest from Exchange Traded Fund (ETF) investors, notably in the SPDR Gold Shares ETF.

The London Bullion Market Association (LBMA) and the World Gold Council echo these sentiments. The LBMA anticipates gold leading the precious metals space with an expected average price rise exceeding 6%, while the World Gold Council identifies a potential 4% gain in gold value, contingent upon a 40 to 50 basis points drop in longer maturity yields following substantial rate cuts.

However, challenges loom on the horizon. A resurgence in inflation could compel the Federal Reserve to reconsider its easing stance, potentially dampening gold’s upward trajectory. Additionally, the pace at which inflation cools relative to rate cuts may influence economic activity and consumer demand, including for gold jewellery in significant markets like China.

As we advance into 2024, gold remains a focal point for investors navigating the complex interplay of economic factors. Its historical role as a store of value continues to attract diverse market participants seeking financial safety in turbulent times.

Don’t Trade Before you see this!

We consulted our team of experts and put together 10 tips to help improve your trading.

These tips could help make you a better trader – and we’re giving them away for free!

Related Articles

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk