FOCUS ON: Fed Guidance Due Midweek Most Likely Trigger of Breakout of Consolidation Patterns

- Range trading could be a dominant theme during a quiet news week.

- Market prices are forming consolidation patterns after a multi-month burst of increased risk appetite.

- Jerome Powell provides further guidance on Wednesday.

With all eyes still on the Federal Reserve and its interest rate policy, an uptick in price volatility can be expected when Jerome Powell offers traders a further insight into his approach towards inflation. The Fed Chair updates the markets at 2.30 pm BST on Wednesday in what is otherwise a relatively quiet news week.

Forex

GBPUSD

Traders of sterling-based currency pairs did not react as expected to last week’s 50 basis point hike in UK interest rates. By Friday, GBPUSD had posted a week-on-week loss of 0.79% as traders sold the pound on concerns about the underlying health of the UK economy.

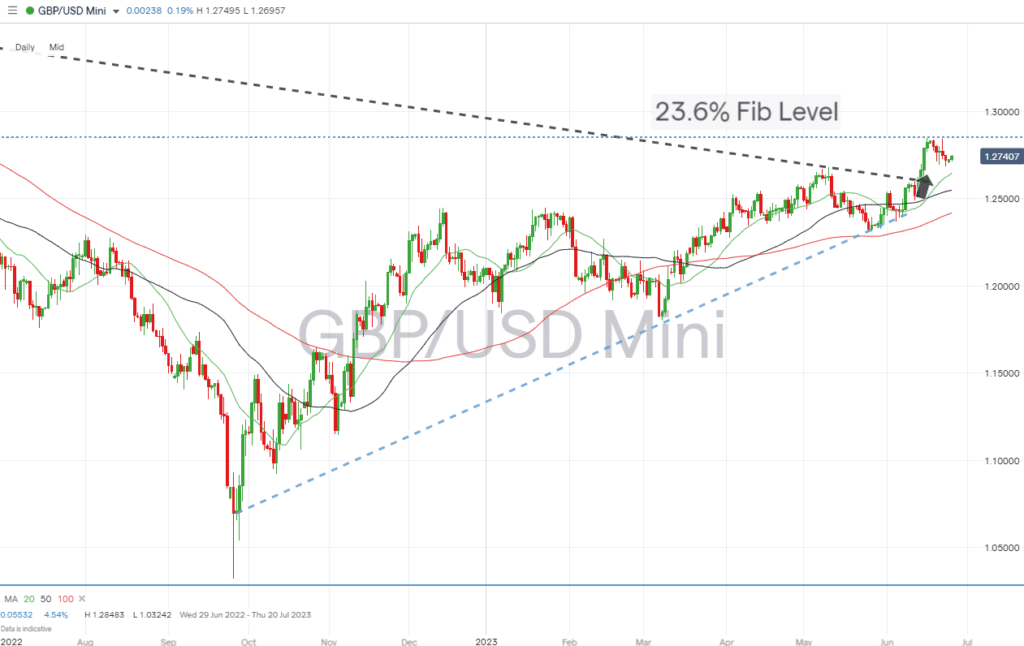

Daily Price Chart – GBPUSD Chart – Daily Price Chart – Fib Level Resistance

Source: IG

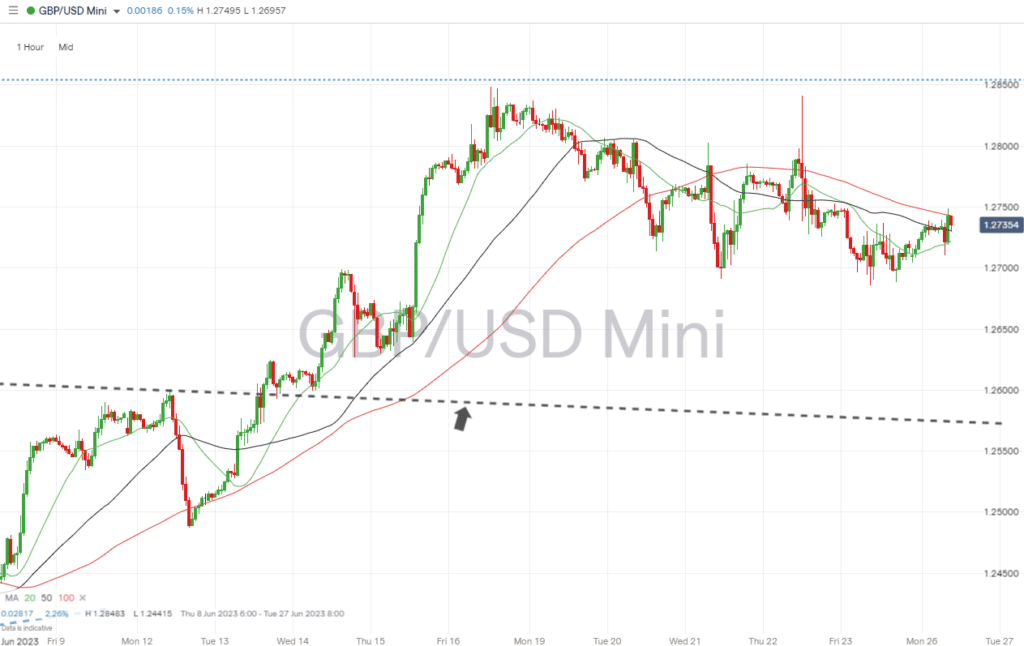

GBPUSD Chart – Hourly Price Chart

Source: IG

Economic data report likely to influence the value of GBP currency pairs:

- Wednesday 28th June – 2.30 pm BST – Federal Reserve Chair, Jerome Powell, updates markets on interest rate policy.

EURUSD

Germany’s dominant position in the Eurozone means that Eurodollar traders will pay attention to a range of data coming out of that country throughout the week. Sentiment, inflation, and unemployment reports will be released on Monday, Thursday, and Friday.

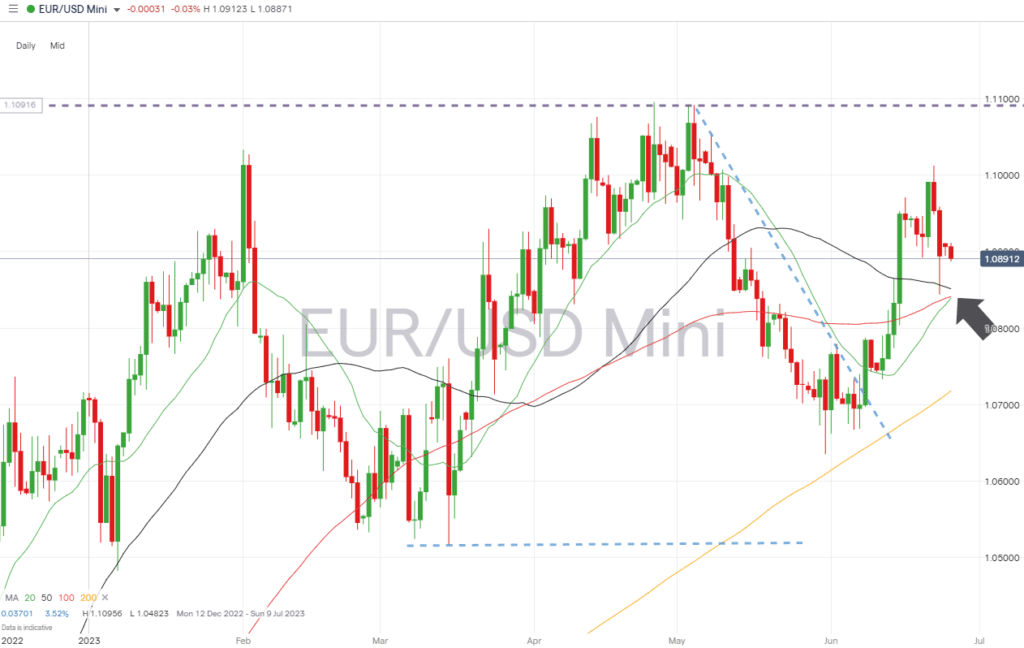

EURUSD Chart – Daily Price Chart

Source: IG

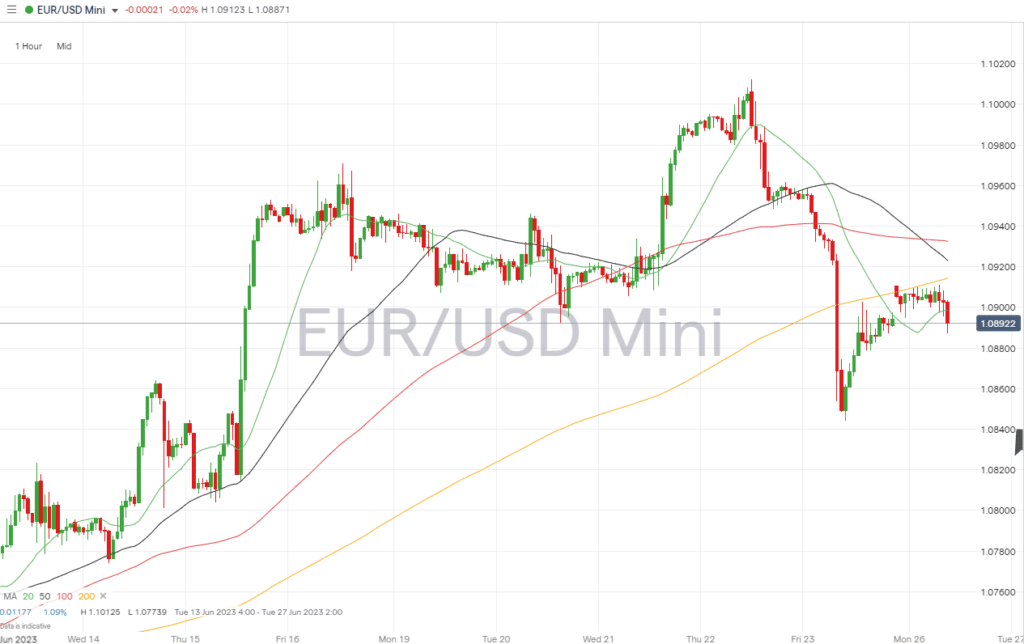

EURUSD Chart – Hourly Price Chart

Source: IG

Economic data report likely to influence the value of EUR currency pairs:

- Monday 26th June – 9 am BST – German IFO index (June). Analysts forecast the index to fall to 91.7.

- Wednesday 28th June – 2.30 pm BST – Federal Reserve Chair, Jerome Powell, updates markets on interest rate policy.

- Thursday 29th June – 1 pm BST – German CPI (June, preliminary). Prices are expected to rise 6.3% year-on-year and fall 0.3% month-on-month.

- Friday 30th June – 8.55 am BST – German unemployment (June). The unemployment rate is expected to be unchanged at 5.6%.

Indices

S&P 500

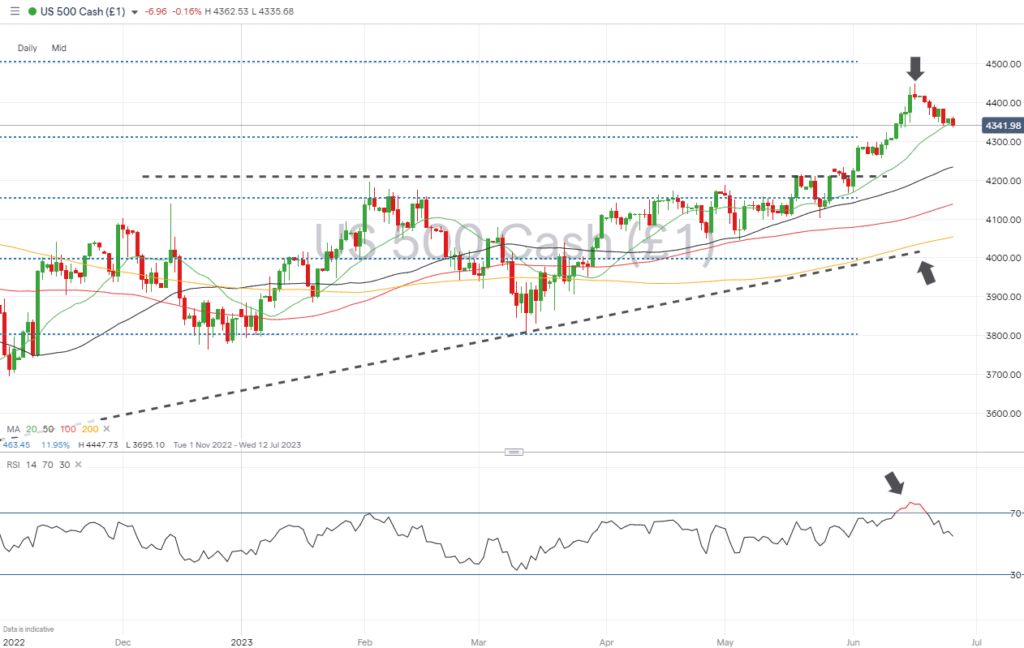

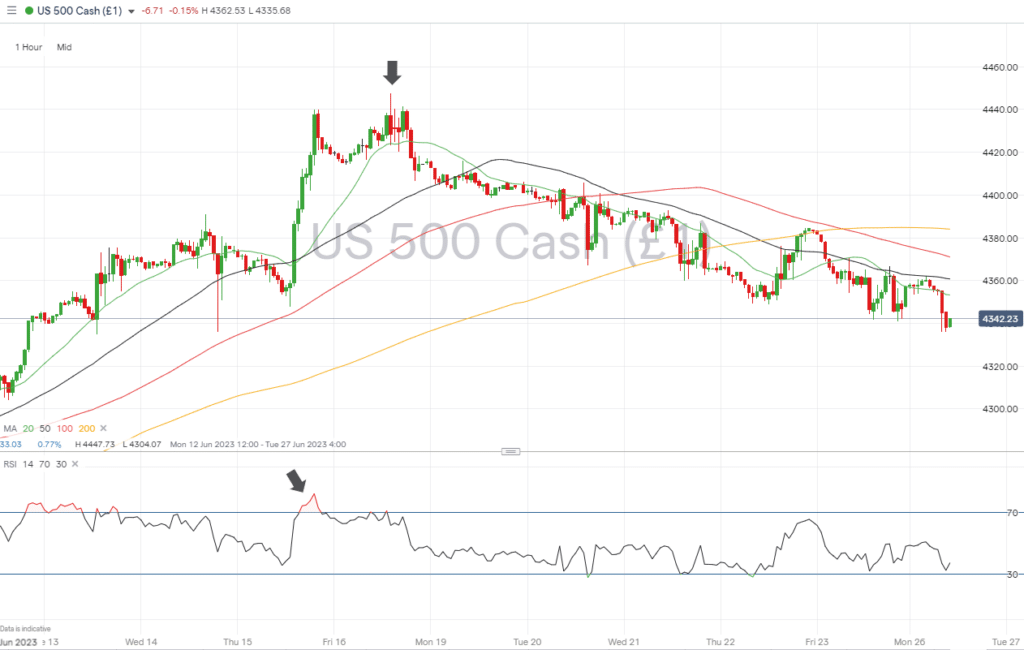

Stocks took a breather last week as analysts tried to establish a clearer idea about the likelihood of future interest rate hikes by the Fed. The statement Jerome Powell will release to the markets on Wednesday should shed more light on to what extent the pause in rate hikes in June signals a pivot in policy.

S&P 500 Chart – Daily Price Chart

Source: IG

S&P 500 – Hourly Price Chart

Source: IG

Economic data report likely to influence the value of US stocks:

- Tuesday 27th June – 3 pm BST – US consumer confidence (June). Analysts predict the index to rise to 104.

- Wednesday 28th June – 2.30 pm BST – Federal Reserve Chair, Jerome Powell, updates markets on interest rate policy.

- Friday 30th June – 1.30 pm BST – US PCE price index (May). Forecasts predict prices to rise 4.1% from 4.4% year-on-year and 0.5% from 0.2% month-on-month.

People Also Read:

- WEEKLY FOREX TRADING TIPS – 2023.06.26

- BoE Interest Rates: Short-term and Long-term Prospects for GBPUSD

- “Hawkish Pause” Dominates EURUSD Strategy Planning

Risk Statement: Trading financial products carries a high risk to your capital, especially trading leverage products such as CFDs. They may not be suitable for everyone. Please make sure that you fully understand the risks. You should consider whether you can afford to risk losing your money.

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk