If Wednesday’s news on US interest rate levels hadn’t been preceded by a 5% reduction in share price values, then it could well have sparked its own sell-off. As it was, the announcement by Jerome Powell that rates would be held and the extensive liquidity program would be scaled back “soon” was followed by an uptick in prices.

The guidance given by the US Federal Reserve Chair wasn’t necessarily good news for the markets. But after a two-week battering, stoic bulls came back into the market late Wednesday and by Thursday morning were showing an appetite for holding their nerve.

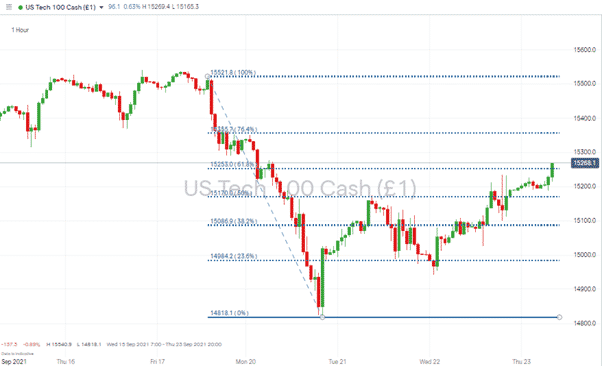

Nasdaq 100 index – 1Hr price chart with bounce and 61.8 % Fib as broken resistance level

Source: IG

Those with long positions in tech stocks will note that Thursday’s show of strength took price through the 61.8% Fib resistance line, which had been holding up progress until then.

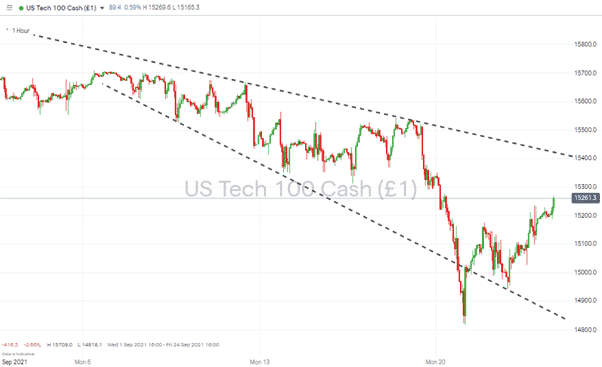

Nasdaq 100 index – 1Hr price chart with bounce downward price channel

Source: IG

Nasdaq 100 index – 1Hr price chart with bounce and 52-week high

Source: IG

With the downward trend channel diverging, there is a lot of room for upside price trends to continue. Upper trendline resistance in the Nasdaq 100 is currently marked at 15,400, some way off Thursday’s price levels (15,260). On a longer timescale, there is an opportunity for the bullish price action to reach the 52-week high of 15,708. For the most optimistic traders, this is a time to ‘fill your boots’. The one necessary check is what guidance the US Fed gave on Wednesday.

US Fed Announcement – What’s New and What Stays the Same

As the US Fed is obliged to offer regular announcements, their guidance on Wednesday can be seen as one stage on a journey to more normal conditions.

Quantitative Easing – The $120bn monthly purchases of Treasury and mortgage-backed instruments continues – for now. Proposed dates for it being scaled back are still TBC, but Powell explained this would be “soon”.

Inflation – While “soon” is now the term most likely to be over analysed by investors, the previous buzzword “transitory” is still in play. This was the phrase used by Powell in prior meetings to explain the Fed’s view. Wednesday’s update confirmed that Fed officials now expect inflation to run at 4.2% in 2021, an upgrade from the 3.4% estimate in June. In the period 2022 – 24, inflation is expected to fall back to 2.2%, a view in line with that given in June.

Jobs – Projections on unemployment have turned more pessimistic. The June estimate of year-end unemployment was 4.5%, and that is now quoted as 4.8%. There has at the same time been a shift in voting patterns on the FOMC, which suggest the Fed is adopting a higher pain threshold regarding unemployment. It would now only take a “reasonably good employment report” for Powell to hit the trigger to taper the bond purchases. He continued, “many on the committee feel the test has already been met”.

The Fed report offered some clarity and highlighted the questions which remain. With the statement being in line with market expectations and the continuing benevolence of the Fed to some extent confirmed, it looks like buying risk-on assets is still the default position for many investors.

If you have been the victim of a scam, suspect fraudulent behaviour, or want to know more about this topic, please contact us at [email protected]

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk