There’s every reason to think that the traditionally busy autumn trading period is once more going to throw up a range of interesting trading opportunities. Q4 is associated with an uptick in price volatility as the IPO market stirs back into action, US companies report earnings and central bank policies towards ‘tapering’ come into focus.

The minor equity sell-off in September and a beginner-grade rollercoaster ride through the first half of October have worked well as a warm-up act. The US dollar is showing signs of strength in forex, and crude oil and Bitcoin prices have picked up the pace. These conditions are an ideal opportunity for short and medium-term trading strategies – the price volatility doing enough to support range-based or momentum-based strategies, depending on the time frame selected.

Source: IG

Which Brokers Are Improving Their Service Levels?

With interest in trading picking up and newbies setting up accounts, it’s worth checking the latest T&Cs offered by some popular, trusted brokers. The brokers need to make a profit to remain healthy, but trading is a difficult enough business without having your broker take more than a fair cut from your trading activity.

Comparing broker to broker can be a labour-intensive operation. The good news is that the Forex Traders team has conducted a detailed autumn review of the behind-the-scenes fees and conditions of six of the most popular brokers. To keep things simple, the summary notes give a high-level appraisal of the broker but keep in mind that individual circumstances might throw up an anomaly when setting up an account.

eToro | Markets.com | AvaTrade | Admirals | IG | |

Live Account Fee | No charge | No charge | No charge | No charge | No charge |

Demo Account Fee | No charge | No charge | No charge | No charge | No charge |

Cash Deposit Fee | No charge | No charge | No charge | No charge | No charge |

Cash Withdrawal Fee | Yes - $5 per transaction | No charge | No charge | No charge | No charge |

Inactivity Fee | Yes - $10 per month after 12 months inactivity | Yes - $10 per month after 3 months inactivity | Yes - $50 per quarter after 3 months inactivity | Yes - $10 per month after 2 years inactivity | Yes - £12 per month after 24 months inactivity |

Base Currencies | Offers accounts in USD, only | Offers accounts in 14 base currencies incl. USD, GBP, EUR | Offers accounts in USD, GBP, EUR, AUD | Offers accounts in EUR, USD, GBP, CHF, BGN, CZK, HRK, HUF, PLN, RON | CHF, USD, NZD, SGD, PLN, DKK, NOK, SEK, HKD, ZAR, JPY, GBP, and EUR |

Minimum Deposit | From $50 | $250 (or equivalent) | $100 (or equivalent) | No minimum | $250 (or equivalent) |

The terms and conditions on everyone’s account are a function of where they live and which account they choose to open. The above data is provided as an aggregated summary of T&Cs. It is designed to offer an overall rating of how each broker performs in each category.

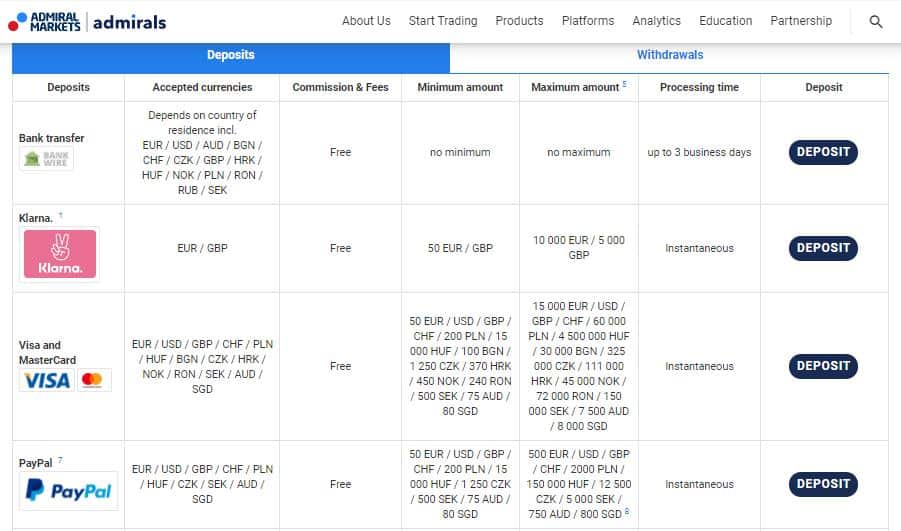

Upgrades to Payment Methods

Firstly, there is the question of payment methods. Brokers try to make things as easy as possible for those sending funds to their account. They have moved on a long way from only offering bank transfers and credit/debit card options. PayPal, Klarna, Skrill and Neteller are frequently offered, as are some more bespoke methods such as Przelewy and iBank. The processing time of each payment method can vary from instantaneous to three business days. Some allow larger amounts to be sent, and some support a more extensive range of currencies.

Source: Admirals

All six brokers offer at least one payment method which doesn’t generate charges on cash deposits. Only one charges for making a withdrawal, and that $5 fee is probably best thought of as irritating rather than game changing.

Base Currencies at Brokers

One significant improvement in service levels is the number of base currency options that some brokers are now offering. One hidden cost associated with trading relates to converting a client’s base currency, for example, GBP, into the base currency of the platform, for example, USD. Most brokers offer at least EUR, GBP and USD, so deposits made in those currencies go through without generating additional charges. IG has gone one step further, offering 13 base currency options Great news if you’re looking to open an account with PLN, SEK, NOK or other currencies which are not always catered for.

Free Demo Accounts

Demo accounts are still free to set up at all brokers. Some brokers set time restraints as short as one month on an account’s lifespan, but others allow traders to run their Demo accounts for as long as they want. It is a neat feature and enables traders to test new strategies and trading ideas using virtual funds. Demo accounts are also an excellent place for traders to put on ‘boredom’ trades. Trades put on without absolute conviction and in the hope, rather than in expectation, of making a profit can tip a profitable account into the red.

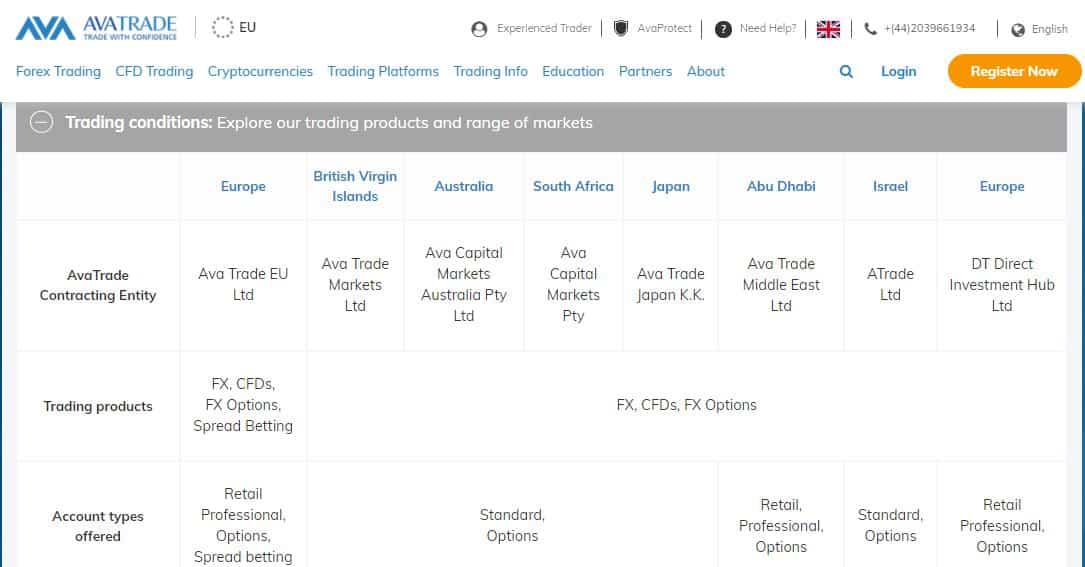

Source: AvaTrade

Inactivity Fees

These are something to watch out for. Markets.com and AvaTrade introduce inactivity fees after three months of no trades being booked. These fees can be easily avoided, and the brokers need to be given a bit of slack on this issue. Maintaining dormant accounts is as costly as maintaining active ones, and good housekeeping allows brokers to concentrate on providing better services to active clients. AvaTrade is one of the brokers which is at the stricter end of the spectrum on this issue. That is not surprising as the broker sets the standard in terms of regulatory approval and operates under licences from seven regulators, including Tier-1 authorities such as the Central Bank of Ireland, ASIC and the Financial Services Agency of Japan.

Minimum Funding Requirement

One of the big investment themes at the moment is inflation. Price rises and interest rate hikes appear to be around the corner, and strategies for trading inflationary pressures are already being shared. It could be that brokers take part in that trend by increasing the minimum balance requirements, but for now, they are holding at the levels they’ve been at for some time.

Good brokers don’t only compete in terms of bid-offer spreads on trade execution. The recent upgrades made by some are to be welcomed, and a bit of common-sense can help traders avoid unnecessary costs as they enter the markets during the busy run-in to year-end.

If you have been the victim of a scam, suspect fraudulent behaviour, or want to know more about this topic, please contact us at [email protected]

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk