| Pros | Cons |

|---|---|

| In-house web trader and mobile app | Not available to US customers |

| Full featured demo account |

Trader’s Viewpoint

Although one of the newer trading platforms on the scene, Alvexo have nevertheless managed to quickly build up a name for themselves in a relatively short amount of time. Founded as a collaboration between experienced forex trading professionals and fintech innovators, Alvexo is one of a new breed of trading platforms aiming to disrupt the industry.

Based primarily out of Cyprus, it is currently regulated by the CySEC financial regulator, which means clients will benefit from various EU customer protection schemes. This includes a requirement to keep client funds segregated from trading funds, as well as a compensation scheme should things go wrong.

Alvexo offers a wide range of online trading to suit all tastes, experiences levels, and investment strategies. This includes cryptocurrency trading, CFD trading on over 140 assets, as well as forex trading across over 40 major and minor currency pairs.

Whilst not the largest selection out there, it should be enough for most beginner to intermediate traders. Alvexo offers a straight-through processing and no dealing desk trading model for retail trading accounts, which gives them access to high levels of liquidity and quick execution speeds.

Trading is delivered through four different account types which include a Classic Account, a Gold Account, an ECN account, and a Prime Account. The basic Classic Account is perfect for new and intermediate traders and offers commission-free trading with decent spreads. Commissions will vary across the three other account types, with the Prime Account offering the most competitive spreads.

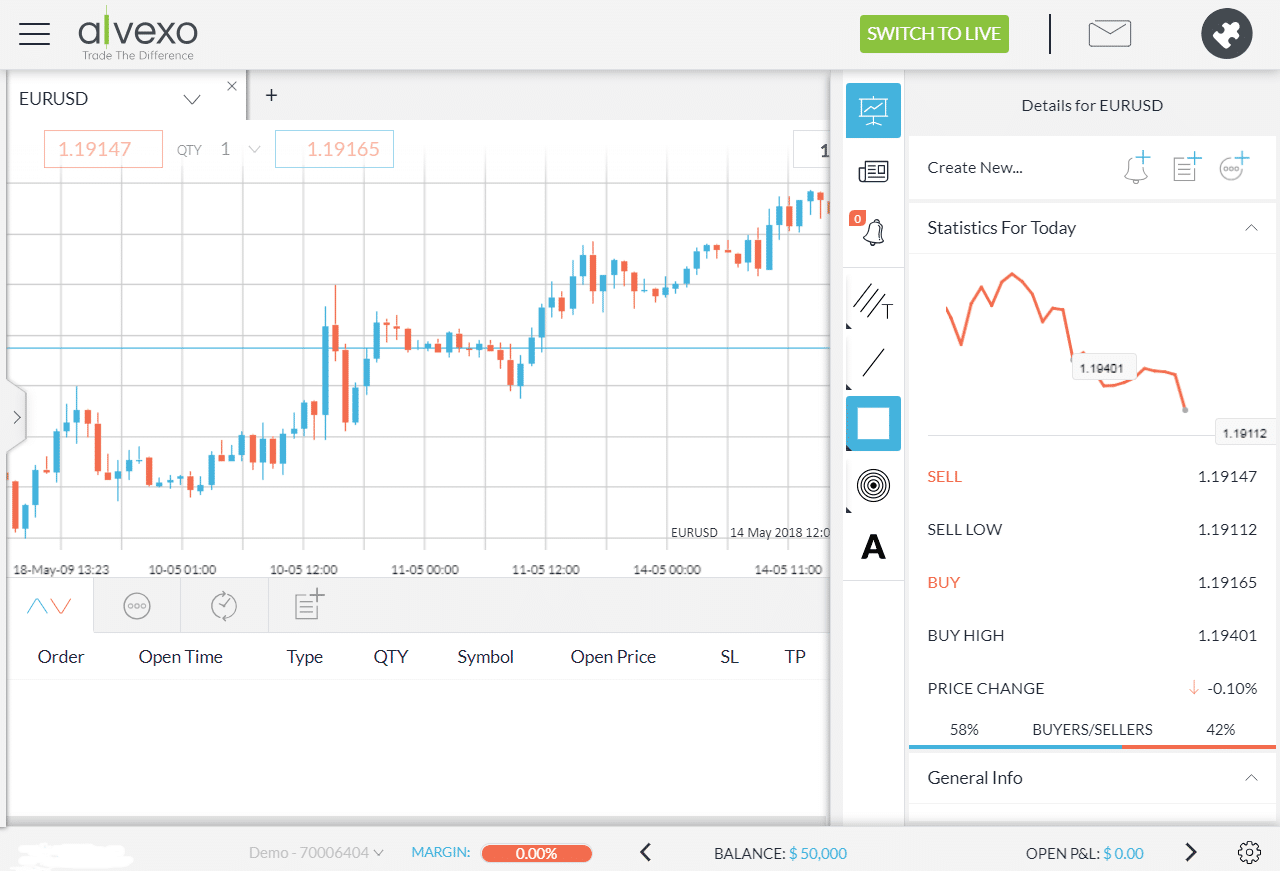

Alvexo offers a number of different trading platform options. This includes a proprietary web-based trading platform, dedicated mobile app, as well as the MetaTrader 4 app. The web-trader platform is streamlined, robust, and relatively easy to use for beginners.

It also benefits from being accessible from any device that has a working web-browser and internet connection. The in-house mobile app offers 100% trading functionality, allowing you to manage positions and execute trades on the go.

If you run into an issue with your account, Alvexo offers a multi-lingual customer support team, with language support provided for customers from the UK, Sweden, Cyprus, South Africa, Spain, France, Romania, and Italy. Email support is available via email, phone, and web-chat.

To help their clients reach their trading potential and to upskill where necessary, Alvexo provides an extensive range of educational and learning materials in the ‘Trading Academy’ section of the website.

Here you can find a number of useful resources, including tutorials, articles, and materials to learn both fundamental and technical analysis. Whilst primarily aimed at the novice and intermediate trader, there is something here for traders of all skill levels.

Overall, Alvexo is a well-rounded broker who delivers favourable trading conditions in a sleek, well-put-together package. The proprietary web-trader and mobile trading platforms are a particular highlight and make a highly functional alternative to the MetaTrader platform.

Although the minimum account balance is quite high on the basic account, the spreads are nevertheless competitive, and the commission-free trading is a big selling point. For this reason, if you are an intermediate trader or below, Alvexo is a great option.

The Alvexo brand was established in 2014 and is operated by VPR Safe Financial Group Limited, which was originally registered as a Cyprus Limited company in 2013. According to its website, Alvexo was founded by a team of high tech professionals and market veterans with the aim of providing comprehensive investment and trading services to give traders the best prospects for success.

Alvexo has its headquarters in Cyprus and is located at 1, Agias Fylaxeos Street, 3025 Limassol, Cyprus. Alvexo’s parent company, VPR Safe Financial Group Limited, operates as a Cyprus Investment Firm under CySEC oversight with registration number HE322134, while Alvexo’s regulation by CySEC falls under license number 236/14.

Alvexo’s CySEC supervision and regulation obligates the company to comply both with relevant local laws and with European regulations that include the MiFID (Markets in Financial Instruments Directive). The firm must also adhere to the European Union’s Law 144(1)/2007, also known as the Investment Services and Activities and Regulated Markets Law of 2007.

The official website for Alvexo is located at http://www.alvexo.com, and a screenshot of its home page appears below:

Start Trading With Alvexo Today

Follow The Simple Sign Up Process And Get Started Instantly

Alvexo currently does not accept U.S. based clients, so traders residing in the United States should look elsewhere for brokerage services.

Features at Alvexo

In addition to allowing cryptocurrency and CFD trading in its Prime and ECN accounts, Alvexo offers their forex trading customers an execution service in over 40 major, minor, exotic and cross rate currency pairs. In total, Alvexo offers trading on more than 140 assets, including currency pairs, indices, stocks and commodities.

For the company’s retail trading accounts, forex trading Alvexo takes place via a highly-desirable Straight Through Processing (STP) No Dealing Desk (NDD) model. This model facilitates Alvexo having some of the best available direct bid/offer prices that come from their liquidity providers who act as counterparty to the customer’s trades. Alvexo does not as a market-maker and gets compensated by charging its customers a commission fee based on the amount of volume traded.

Commissions can be debited when a position is opened or closed, or they can be included as a mark-up in the dealing spread, depending on what type of account the trades in question get executed in. Leverage for positions varies from 1:2 to 1:30 depending on account type.

Alvexo offers a demo account funded with virtual money and four live STP account types as follows:

- The Classic Account requires an initial deposit of $500, has a minimum dealing size of 0.01 lot with dealing spreads beginning at 3.3 pips. No commissions are charged on the Classic Account, with leverage of 1:2 to 1:30 and offers traders free trading signals. Stop out 50%. Margin Call 80%.

- The Gold Account has a minimum deposit of $2,500 with a minimum dealing size of 0.05 lots. Dealing spreads begin at 2.2 pips with leverage of 1:2 to 1:30. In addition to free trading signals, Gold Account holders get one-on-one support, an economic calendar, SMS capabilities and technical analysis. Stop out 50%. Margin Call 80%.

- The ECN Account has a minimum deposit of $5,000 and has a minimum dealing size of 0.05 lots. Dealing spreads begin at 0.0 pips with leverage of 1:2 to 1:30. In addition to free trading signals and technical analysis, ECN account holders get a direct line to Senior Account Managers with one-on-one support, as well as an economic calendar and SMS capabilities. Stop out 50%. Margin Call 80%.

- The Prime Account has a minimum deposit of $10,000 and has a minimum dealing size of 0.25 lots. Dealing spreads begin at 1.8 pips with leverage of 1:2 to 1:30. In addition to free trading signals and technical analysis, and a direct line to Senior Account Managers with one-on-one support, Prime accountholders get an economic calendar, SMS capabilities and Technical Analysis reports. Stop out 50%. Margin Call 80%.

No additional commissions are charged on the Classic Account; however, a commission is charged on all transactions made in the other account types. Commissions vary and are based on trading volume.

Other Services:

Clients can start live trading with a minimum of $500 deposited in their trading account, which is considerably more than many other brokers require.

Alvexo keeps client funds in segregated account in accordance with the CySEC Investors Compensation Fund. If segregation fails, then your trading account balance is covered in an amount up to €20,000 per person, per firm by the EU’s Investors Compensation Fund.

Platforms

Alvexo offers its clients trading services via three types of trading platforms:

- Web-based trading platform – the broker’s WebTrader platform does not require a download and can be accessed from any computer with an Internet connection.

- MetaTrader 4 – the world’s most powerful and popular forex trading platform, which offers a high level of programmability and automation The software also has the capacity for multiple order execution types, automated trading, custom indicators, chart-based trading, position keeping, and trading alerts and signals.

- Mobile App – the company’s Mobile app is available for Apple iOS and Android devices. It offers 100% trading functionality for managing positions, along with total access to your portfolio.

The screenshot displayed below shows the functionality of Alvexo’s WebTrader, which includes technical analysis and position management features.

Deposits and Withdrawals

Alvexo does not charge clients for withdrawals or deposits. The broker allows customers to deposit and withdraw funds using VISA, MasterCard credit cards; VISA Electron, Maestro; or wire transfers.

Only the amount originally deposited through a credit card may be withdrawn to that account, and the balance of funds will then be transferred to the client’s bank account. Presently, Alvexo only allows transactions in U.S. Dollars and Euros.

Deposits generally get credited immediately to customer’s accounts, with the exception of wire transfers, which can take one to four days to appear in the trading account.

Open Your Live Trading Account To Start

For A Limited Time, Receive A Free Trader's Playbook!

Customer Support

Alvexo offers a multi-lingual customer support service via telephone in the United Kingdom, Sweden, Cyprus, South Africa, Spain, France, Romania and Italy. In addition, email support is available for support, compliance, finance and marketing, with fax numbers available at the broker’s Cyprus office.

Alvexo also offers its customers a Trading Academy, where new traders can learn forex trading essentials, watch tutorial videos, and pick up some simple trading strategies. A section for advanced trading strategies features how to develop a trading plan, how to perform market research and analysis, and how to enhance your trading strategy with more sophisticated techniques.

Alvexo – Conclusion

Alvexo appears to be a well-regulated STP and ECN broker offering a forex and CFD trading service. The broker makes both a demo account and four additional trading account types available, depending on the size of a client’s initial deposit.

A significant issue with this broker is that it charges a trading commission per trade for all accounts except for the basic Classic Account, which has a rather wide 3.3 minimum pip spread. These transaction fees could be compensated for by the tighter dealing spreads in the premium accounts and may not be a burden to those who have a substantial initial deposit and/or trade infrequently. Still, they might also add up considerably for frequent traders who deal in smaller sizes, such as those employing day trading strategies.

In terms of its trading platforms, Alvexo offers its WebTrader web-based platform, a versatile and fully-functional mobile app, and the ability to use MetaTrader4, which is the industry standard. This allows traders to automate of trading strategies, develop custom indicators and run third party expert advisors.

The broker’s customer support offers clients multi-lingual telephone and email support, with a comprehensive educational section that caters to both novice and more experienced traders. Overall, this broker appears to be a good choice for traders of all skill levels provided they can put up the $500 minimum initial deposit this broker requires.

Open Your Alvexo Trading Account Today

As Approved By Forextraders.com

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.

Your capital is at risk

Your capital is at risk

Your capital is at risk

Your capital is at risk