Retail forex trading has come a long way in the past 25 years. Traders across the globe, including those in both developed and developing counties, have been drawn to the world’s largest and most liquid market. The Bank for International Settlements (BIS) conducts a triennial survey to assess the market’s turnover, and its last report in 2019 disclosed that daily turnover is more than $6.6 trillion. The report in 2022 will more than likely show a steady increase in most countries, as well as in Nigeria, which at last count had some 300,000 active forex traders.

The forex market does not have a central exchange but is comprised of overlapping global networks. It operates “24×7”, five days a week, beginning early on Monday in New Zealand, considered as part of the Sydney – Asian session. It then follows the sun across the planet, not stopping until the close of business for New York on Friday. Nigeria is conveniently located within the same time zone as London, a good thing when it comes to deciding when the time is most advantageous for trading foreign currency pairs.

The Federal Republic of Nigeria is the leading economy in Africa, rated Number One in nominal GDP of just over $514 billion. Its exports are roughly 10% of that figure and are primarily related to the petroleum industry. It is the eighth largest exporter of oil in the world. The country has a well-developed financial infrastructure. It is often referred to as the Giant of Africa, a source of pride for its 200+ million inhabitants. Nigeria is blessed with an enormous supply of natural resources, and the financial sector includes major international banks, brokerage houses, insurance companies, and private investment banks.

As with other developing economies, Nigeria suffered from the early impacts of the Covid pandemic, perhaps more on an economic basis than on a health one. Three recorded waves of the Covid virus have swept through the country, with the chief impact being on oil exports, representing 80% of the nation’s exports and 50% of the government’s revenue. Coupled with a significant decline in oil prices, Nigeria endured its worst recession since the 1980s. The government was slow to institute protective measures, but as oil prices have dramatically improved recently, so has the economy of Nigeria.

Periods of positive economic prosperity have created a burgeoning middle class within Nigeria, which has led to increased investment activity in both stocks and currency pairs. This increased investment has also spurred the influx of reputable and stable members of the global brokerage community. There is now an abundance of top tier brokers that compete for the patronage of Nigerian investors and traders. Forex trading is legal in the country, and there are tax laws that pertain to related gains and losses. This article will be looking at the best times to trade forex in Nigeria. We will look at the country’s economy, different trading sessions, and times when the markets are quietest and most volatile.

Forex Trading in Nigeria

In Nigeria, trading currency pairs is relatively new, but the activity is legal. Regulatory oversight, however, is regarded as light by global standards. The Central Bank of Nigeria (CBN) is the regulator of note in the region, and it has established government regulations that apply to both brokers and local traders. These guidelines are meant to protect brokers’ clients. Nigeria’s national currency, the Naira (NGN), no longer floats freely in exchange markets.

Some 300,00 Nigerian citizens – by the latest estimate – actively trade in the forex market. The trading of currency pairs follows traditional norms, but Nigerians also like to dabble in cryptocurrencies. The CBN, however, has restricted banks from handling crypto accounts, thereby putting a damper on any local crypto enthusiasm.

Observers attribute the preference for traditional forex trading over cryptos to the lack of regulation in the crypto sector. Women have also been prominent in the surge in forex trading, accounting for a 46% increase in account openings by women in the past year. MetaTrader4 is the most popular trading platform, followed by MetaTrader5, but a more interesting set of statistics is that there has been an influx of young traders below the age of 35. Mobile trading apps have commanded a 35% share of new account openings.

Due to recent poor economic conditions, the CBN took action related to the Naira. The NGN no longer floats freely in the forex market. From time to time, the CBN fixes the rate for the Naira through a process called the Nigerian Autonomous Foreign Exchange Rate Fixing Mechanism (NAFEX). The Nafex rate pertains to import and export transactions, while the Naira remains domestic tender. The moves were taken to reduce potential inflation and stabilise the nation’s foreign exchange reserves, which had declined sharply due to Covid and falling oil prices.

Related Articles

- How to Start Forex Trading in Nigeria

- Is Forex Trading Legal in Nigeria?

- The Best Forex Brokers in Nigeria

The Three Forex Market Trading Sessions

Determining the best time to trade in the forex market is dependent on which currency pair you wish to trade and when it has the best liquidity. As large as the daily forex market is, there are still times when liquidity is thin. Spreads tend to widen during these periods, which is not conducive to making good entry and exit trades. Off-hours trading can witness spreads increasing from 10 to 50 pips for even active pairs.

The market appears to be one continuous stream without the imposition of daily exchange cut-offs, as is the case with trading stocks. The Interbank system is a computer network of large global banks and other financial institutions, which connects to the various regional exchanges seamlessly to facilitate money transfers related to international trade. Corporate treasurers and money managers are also busy hedging forex risk with options, futures and forwards, but speculators comprise the balance of activity and serve to tighten spreads.

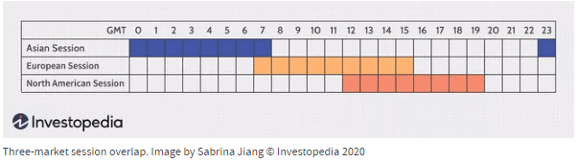

From a broad overview perspective, the market operates in three sessions – Asian, European, and North American. The sessions overlap to a degree. These overlap times offer the greatest liquidity and volatility. Both of these issues could favourably or unfavourably impact your trading style. The following graphic depicts how these three basic trading sessions overlap:

The daily forex operating routine commences in Asia, where exchanges in Auckland, Sydney, and Tokyo predominate. The European session follows, where London is the financial centre of activity. These two sessions have a brief overlap, which is where you will find the highest liquidity for pairs like the “EUR/AUD” or the “EUR/JPY”. Lastly, New York kicks in four hours before the European session concludes. The highest level of activity occurs during these four hours. Pairs involving the USD are the most active, constituting more than 90% of the activity.

It is also important to note that inexperienced traders should avoid trading currency pairs during the opening or closing of a session. Volatility can increase dramatically as professional traders close positions for the day or hedge their after-hours currency risk. Beginners are also counselled to avoid trading during their sleeping periods since a lack of sleep can impair judgment. You should experiment with currency pairs that favour your time zone and offer the best liquidity.

The Best Time to Trade Forex in Nigeria

What is the best time to trade forex in Nigeria? Your trading style and your choice of currency pairings will determine the best times for forex trading in the market. Fortunately, Nigeria and the West Africa Time zone (WAT) correlate nicely with the European session timeframes. The overlap with the North American session is also convenient for Nigerian traders, offering the best of both worlds for USD and EUR pairings.

Trading styles tend to fall equally into two categories, either day-trading or swing-trading. Trading from 10 am through the afternoon at 5 pm would favour both styles. The most popular trading pair is often the “EUR/USD”, especially for newcomers to the forex trading arena; it trades in tight ranges, especially during the London/New York overlap. The “EUR/JPY” is also popular and might be liquid enough for favourable trades during this period.

Conclusion

Trading foreign currency pairs is legal and popular in the Federal Republic of Nigeria. A vibrant middle class, eager to invest and trade, has drawn the attention of the best and most reputable global forex brokers. The best time to trade depends upon your trading style and your chosen currency pairs, but the most convenient period is between 10 am and 5 pm, especially when London and New York markets overlap.

Recent currency controls imposed by the CBN may be restrictive. It is recommended that you consult your local banking staff to ensure you follow the current rules when establishing a forex trading account. Many online global forex brokers can provide an excellent trading experience on MT4 or comparable trading platforms.

The Best Brokers to Trade Forex within Nigeria

| Broker | Features | Regulator | Platforms | Next Step | |

|---|---|---|---|---|---|

Between 74-89% of CFD traders lose

Founded: 2010 Between 74-89% of CFD traders lose

Founded: 2010Between 74-89 % of retail investor accounts lose money when trading CFDs |

|

ASIC, FCA | MetaTrader 4, MetaTrader 5, cTrader | ||

Your capital is at risk

Founded: 2006 Your capital is at risk

Founded: 2006Europe* CFDs ar... |

|

ASIC, FSA, FSB, MiFID | MetaTrader4, Sirix, AvaOptions, AvaTrader, Mirror Trader | ||

Your capital is at risk

Founded: 2014 Your capital is at risk

Founded: 2014 |

|

FSPR | MT4 | ||

Your capital is at risk

Founded: 2009, 2015, 2017 Your capital is at risk

Founded: 2009, 2015, 2017 |

|

ASIC, CySEC, IFSC | MT4 Terminal, MT4 for Mac, Web Trader, iPhone/iPad Trader, Droid Trader, Mobile Trader, MT5 | ||

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.