Trader’s Viewpoint

Admiral Markets offers a range of trading services ideal for both beginners and experienced traders. The choice of three state-of-the-art platforms, including the popular MetaTrader MT4 and MT5, along with the in-house developed platform, provides a robust trading experience. The Supreme Edition of the MT4 dashboard and other MT add-ons give Admiral Markets an edge over competitors.

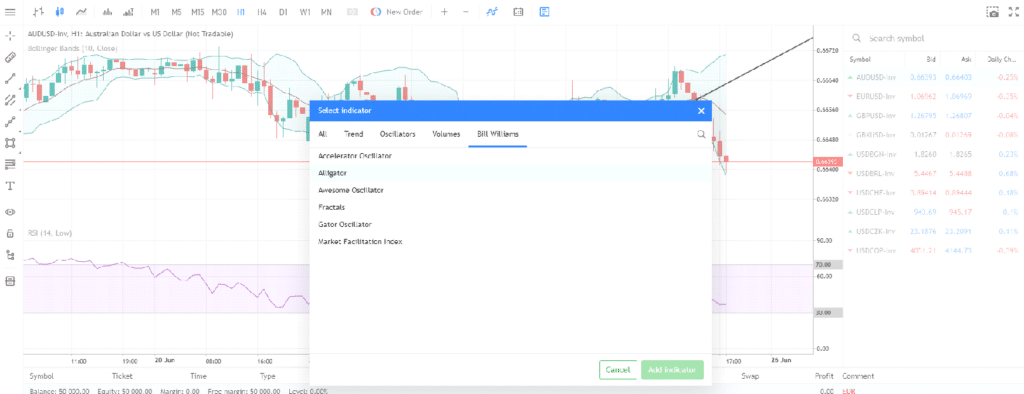

The in-house developed platform launched in 2023 benefits from recent technological advances, offering a crisp aesthetic and user-friendly functionality. It allows traders to access various markets and trade from any location with internet access. The platform’s navigation is intuitive, and technical indicators can be easily overlaid onto price charts.

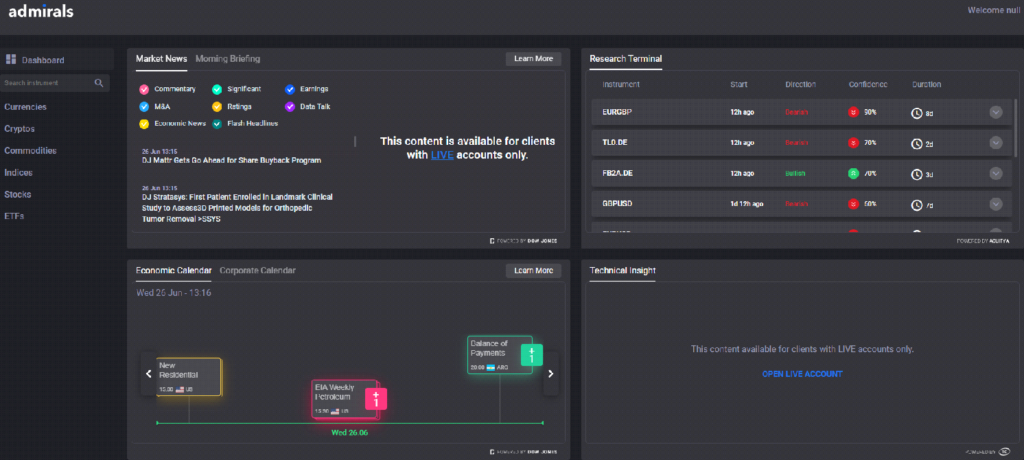

Trade execution is fast and reliable, and the range of research and analysis tools, including the Premium Analytics portal, helps the broker stand out. The portal offers market news, technical analysis, an economic calendar, and global sentiment indicators. Heat Maps and Fundamental Analysis tools provide valuable insights into market trends and individual instruments.

About Admiral Markets Group

It is a leading financial services hub with a global client base of over 65,000 account holders. Founded in Estonia in 2001. The UK headquarters is located at 2, Leman Street, London E1 8FA. The firm has expanded globally, with offices in Cyprus, Australia, South Africa, Jordan, Kenya, and Seychelles.

Admiral Markets promotes corporate responsibility, actively addressing social challenges such as climate change, clean water, deforestation, and orphaned children.

Who does Admiral Markets Appeal to?

Admiral Markets provides a service that accommodates all types of traders. The platform combines high-level trading tools with user-friendly functionality, making it suitable for both beginners and experienced traders. The provision of MetaTrader’s MT dashboards allows established strategies to be transferred to the Admiral Markets platform. The firm’s educational and research tools support traders in developing their skills and understanding of the markets.

Account Types

Admiral Markets offers various account types tailored to the trading platform chosen:

- MT4 Account: Minimum opening requirement of £250, offering STP trading in over 130 CFD instruments with spreads as tight as 0.5 pips.

- MT5 Account: Lower opening balance requirement of £100, offering trading in over 4,000 CFD markets, fractional shares, Level II market depth, and STP execution.

- Demo Account: Free to use for risk-free trading practice.

- Shariah Compliant Swap-Free Accounts: Available for clients requiring compliance with Islamic finance principles.

- Negative Balance Protection: Most accounts benefit from this feature.

Markets and Territories

Admiral Markets is a global broker supporting clients from various countries and offering exposure to all areas of the global financial system. Clients can trade macroeconomic trends using commodities or forex, or pinpoint investments in US stocks. The broker offers over 4,500 CFD instruments with leverage terms up to 1:30 for non-professional traders.

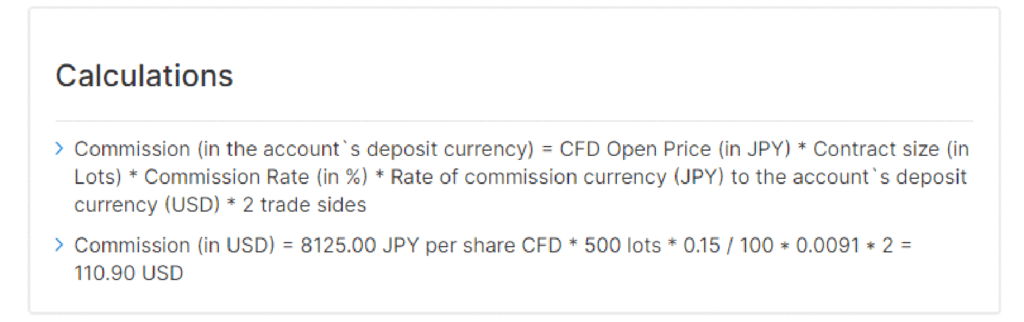

Fees and Commissions

Admiral Markets offers competitive and transparent pricing plans. The T&Cs vary according to the chosen account, with detailed breakdowns of costs. There is an inactivity fee of €10 per month for accounts dormant for longer than 24 months.

Platform Review

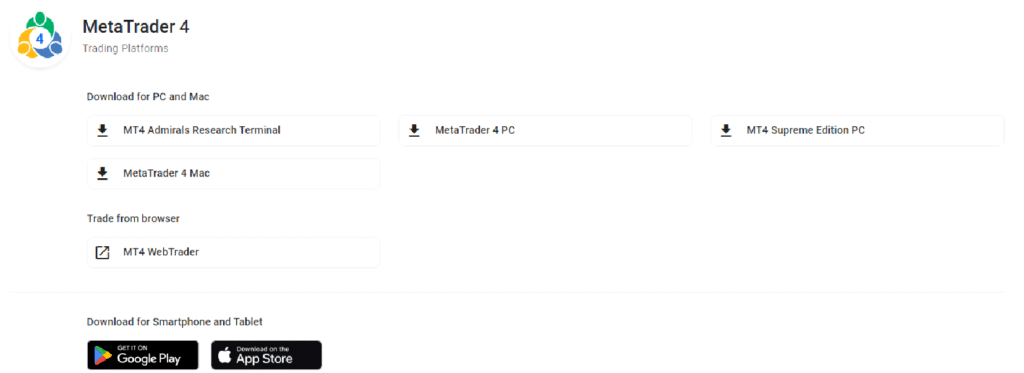

Admiral Markets offers three reliable and effective trading platforms:

- MetaTrader 4 (MT4) and MetaTrader 5 (MT5): Ideal for charting and technical analysis, with MT5 offering more markets.

- In-House Developed Platform: Launched in 2023, offering tools for fundamental analysis and a user-friendly interface.

- Mobile Trading: The Admiral Markets mobile trading app, developed in-house, allows for trade booking, account management, and cash transfers. It is compatible with iOS and Android devices and includes the latest personal security features.

Charting and Tools

The MetaTrader platforms are ideal for charting strategies, offering over 30 indicators. The Admiral Markets platform provides a vibrant look and a wide range of colour options, with indicators grouped by characteristics for easy combination.

Education

Admiral Markets offers extensive educational and research materials, including beginner-level lessons, the Hero to Zero course, and the Premium Analytics portal. These resources support traders in building their skills and understanding of the markets.

Trader Protections by Territory

Admiral Markets UK Ltd is authorised and regulated by the FCA, ensuring client money is kept in fully segregated accounts with Tier-1 banks. UK clients benefit from FSCS protection, which can pay compensation of up to £85,000 if the firm ceases trading or if an eligible bank holding segregated funds goes into liquidation.

Opening an Account

Opening a Demo account with Admiral Markets is quick and easy, requiring only an email address. Setting up a live account involves uploading personal documentation for KYC compliance and completing an online questionnaire about investment objectives.

Making a Deposit

Deposits can be made via bank transfer, debit or credit card, Klarna, PayPal, Skrill, Neteller, Ideal, and Poli. All cash deposits are commission-free, and there are no charges on the first withdrawal made in any calendar month.

Placing a Trade

Trades can be booked using the left-hand side bar to select markets, with positions opened via the trade execution monitor or by right-clicking on price charts.

Contacting Customer Support

Customer support is available via Live Chat or email from 5.30am to 6pm EET. The platform’s functionality and user-friendly FAQ section minimize the need for support, but the absence of round-the-clock support and telephone contact could slow down query resolution.

The Bottom Line

Admiral Markets is a multi-asset broker catering to all types of traders and investors. The product range, choice of platforms, and T&Cs make it a reliable and effective option for market access. The educational and research tools further support clients in their trading journey.

Disclaimer: This financial promotion is intended for informational purposes only and does not constitute investment advice. Trading CFDs involves significant risk and may not be suitable for all investors. Ensure you fully understand the risks involved and seek independent advice if necessary.

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  77% of CFD traders lose

77% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk