Interested in HFTrading? We’ve found that FXTM consistently comes out on top in our exhaustive broker reviews.

Learn More Here

| Pros | Cons |

|---|---|

| Over 750 tradable assets | Not available in the UK and the US |

| Adequately regulated | Relatively new |

| Competitive spreads | |

| Zero commissions |

Expert’s Viewpoint

HFTrading is a relatively new brokerage with operations in New Zealand and Australia. It provides over 750 tradable instruments in spot forex and CFDs. Traders looking for a balanced portfolio can trade forex alongside CFDs on major stocks such as Netflix and Facebook. The broker also provides top indices such as the S&P 500 and DJA and commodities such as WTI crude oil, natural gas, copper, and gold.

Traders interested in crypto can access over 32 coins and over 50 pairs. That is more than most competitors offer. HFTrading is an STP broker and hence charges floating spreads and zero commissions. The spreads differ with the type of account and asset traded. With the spread for the EUR/USD pair starting as low as 0.3 pips for the platinum account, this broker is reasonably priced.

HFTrading provides leverage of up to 1:500 for the Platinum account. This account type is for the expert trader. Beginners should register with the Silver account, which provides leverage of 1:200. This level of leverage provides opportunities with minimal risk. Consequently, it is suitable for a practice account. Please note that the Silver account is for practice and you should be ready to upgrade when comfortable with your trading skills.

Regarding trading platforms, this broker only provides MT4. While it is what most traders need, it would be useful if the broker offered more options. Even so, traders can get nearly everything they need on the HFTrading MT4. Moreover, the broker’s educational centre is well-equipped to cater for a beginner as well as the expert traders.

About HFTrading

HFTrading is an STP broker founded and headquartered in New Zealand. It was launched in 2019 and currently operates in the country of origin and Australia only. HFTrading offers spot forex and CFDs in stocks, indices, energies, and crypto.

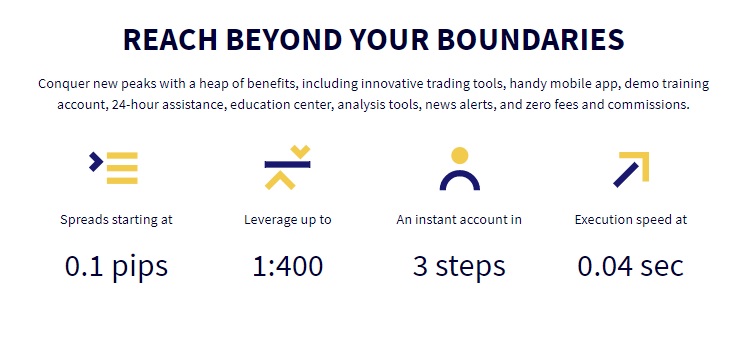

Like most brokers, HFTrading provides the MT4 trading platform. As an STP broker, it offers variable spreads and no commissions. As we will see later in this review, the spreads are highly competitive, starting from as low as 0.1 pips.

Regulated by the Australia Securities and Investment Commission (ASIC), HFTrading is a tier-one regulator with global recognition. It is also monitored by the Financial Markets Authority of New Zealand (FMA). The top-tier regulation, after less than two years of operation, shows the broker’s commitment to quality and transparency.

HFTrading provides a well-equipped educational centre to cater for the beginner as well as the advanced trader. Traders can access the necessary materials before registration, but they must make a deposit to access the advanced ones. As we will see later in this review, it takes three simple steps to create an account with HFTrading.

All HFTrading users are required to go through identity verification by uploading a scan of their government-issued ID cards. The minimum deposit required to trade with this broker is $100. HFTrading appears popular with users given the excellent ratings on most independent consumer feedback platforms.

Who does HFTrading appeal to?

As stated above, HFTrading is suitable for the beginner, intermediate, and experienced trader. The broker provides personalized educational materials and support to suit the three categories of traders. Beginner traders enjoy a leverage of 1:200 while the intermediate and advanced trader get 1:400 and 1:500, respectively.

Leverage magnifies opportunities but also increases risk; hence beginners should limit their leverage use. HFTrading offers a dedicated account manager to walk the beginner through the baby steps of trading. In all fairness, nearly all brokers provide a dedicated account manager.

Moreover, like most brokers, HFTrading provides the MT4 trading platform. It is the industry standard and is friendly for both the beginner and the experienced trader. The platform also offers immense opportunities for social trading.

HFTrading also appeals to those looking to trade a wide variety of instruments. As we will see later in this review, the broker provides over 750 tradable instruments in forex, stock, commodities and crypto. However, this broker is purely an STP and hence may not appeal to institutional traders.

Institutional traders prefer ECN brokers due to the tighter spreads at the cost of a commission charged as a percentage of the traded lots. Most scalpers also prefer an ECN broker.

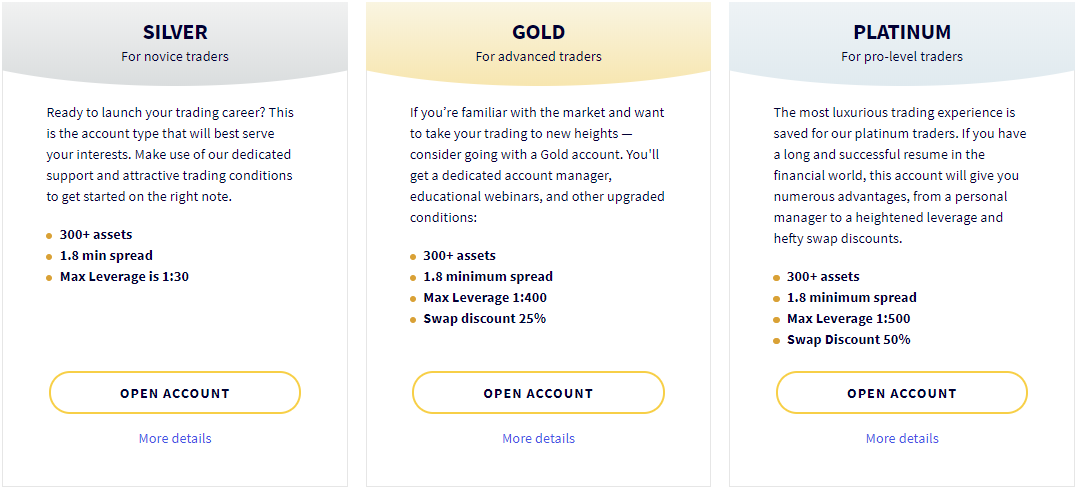

Types of Accounts

HFTrading provides three types of accounts, namely Silver, Gold, and Platinum. Each account type comes with different requirements and trading conditions. The Silver account is the most basic and is recommended for beginner traders. It doesn’t have a deposit limit and provides a leverage of up to 1:200. Moreover, its spreads start from 1.8 pips and don’t charge any commissions.

The typical spread for the EUR/USD pair on this account type is 2.2 pips. That is averagely priced when compared to most competitors. With the Silver account, traders can access over 300 instruments. The Silver account is more of a practice account, and hence you should be ready to upgrade once you are confident with your trading skills.

The Gold account is suitable for the advanced trader and provides a leverage of up to 1:400. It also doesn’t have a deposit limit. Traders who subscribe to this account type enjoy all the 750 tradable instruments in all major global markets.

Furthermore, the Gold account offers variable spreads starting from as low as 0.5 pips. The typical spread for the EUR/USD pair in this account is 1.3 pips. That is highly competitive when compared with other top brokers. Other benefits associated with this account type include an average execution speed of 0.05, a swap discount of 25% and 24/5 customer service.

The Platinum account has the best trading conditions and is highly recommended for Pro-level traders. As mentioned earlier, the Platinum account offers a leverage of up to 1:500 and zero commissions. Its spreads start from as low as 0.03 pips with an average spread of 0.3 pips for the EUR/USD pair. There is also a no deposit limit, and traders get to enjoy added benefits such as a swap discount of 25%, free VPS, News Alert, and hedging.

HFTrading provides a free, highly intuitive demo to help new traders to practice. Moreover, an Islamic account is available for the three types of accounts.

Markets and Territories

HFTrading is a newish broker that is only available for clients in New Zealand and Australia. The broker launched in 2019, and it seems to pay more attention to the quality of service rather than expansion into new markets. Even so, HFTrading has expressed an intention to expand in other markets.

As mentioned above, this broker provides access to all major global markets. HFTrading offers spot forex and CFDs on major global stocks and commodities. With this broker, traders can access popular global stocks such as Netflix, Microsoft, Google, Alibaba, Amazon, and many more. Plus popular global indices such as the S&P 500, DJA, NASDAQ 100 and Dax 30 among others.

Also available are global commodities such as WTI Crude oil, Brent Crude, natural gas, copper, silver, and gold.

Instruments and spreads

HFTrading provides over 750 tradable instruments in spot forex and CFDs in stocks, indices, commodities, and crypto. The broker offers over 45 forex currency pairs, including all the majors, most minors, and a few exotics. As explained earlier, this broker provides variable forex spreads that depend on the pair traded and the type of the trading account used.

The spreads for the Silver account start from as low as 1.3 pips with the typical spread for the EUR/USD pair being 2.2 pips. Trading conditions for the Gold account type are better, with spreads starting from as low as 0.5 pips and the average spread for the EUR/USD pair at 1.3 pips. The Platinum account is the pinnacle, with spreads starting from 0.03 pips and the typical spread for the EUR/USD at 0.3 pips.

HFTrading offers CFDs on forex, stock, indices, commodities, and crypto. The CFDs on forex include popular pairs such as the EUR/USD, GBP/USD, and EUR/GBP. CFDs on stock include global shares such as Netflix, Facebook and Amazon. The leverage on Stock CFDs is 1:10.

As mentioned earlier, HFTrading also offers access to major stock indices such as the S&P 500, DJA, DAX 30, NASDAQ 100 and many more. The leverage for CFDs on indices is 1:125. Also available are 20+ commodity CFDs to include top energies, precious metals, and grains. The leverage for commodity CFDs is also 1:125.

HFTrading also provides crypto CFDs on Bitcoin, Ethereum, Litecoin, Ripple, Dash, Ripple, Monero, and many others. Popular crypto pairs you can trade with the broker include BTC/USD, BTC/EUR, and BTC/GBP. The maximum leverage for crypto CFDs is 1:1, and the spreads are floating.

Fees and commissions

HFTrading is an STP broker and therefore doesn’t charge any commissions. Swap charges apply depending on the type of account and the asset traded. Moreover, they are applied at midnight GMT+3 and are tripled every Wednesday. A swap charge/rollover fee applies when a position is left open overnight.

It is worth noting that HFTrading updates rollover fees weekly on all its trading platforms. These fees apply to any trade that applies leverage, and they vary for short and long positions.

HFTrading doesn’t charge any deposit fees. Withdrawals are also free but may incur a fee if the amount being withdrawn is below 100AUD. Inactive accounts may also incur a withdrawal charge. When compared to other brokers, HFTrading’s fee mechanism can be termed quite transparent.

Trading platforms

HFTrading provides the MT4 trading platform only. Most competitors offer a wide variety of platforms, including a proprietary one. Even so, the MT4 is the industry standard and is the most preferred by beginner and experienced traders.

Apart from being highly customizable, the MT4 comes with a myriad of tools and functionalities to enhance user experience. These include a comprehensive charting package, more than 80 pre-installed indicators, a navigator and market watch window, risk management features such as stop loss, take profit and negative balance protection among many others.

The MT4 also allows social and algorithmic trading. Social trading involves the user copying trades from a list of expert signal providers. Algorithmic trading, on the other hand, requires trading automation. With the MT4, users can build their trading robots and Expert Advisors (EAs) using an integrated programming language known as MQL4.

The HFTrading MT4 is available in web, desktop, and mobile versions. It is compatible with Windows, Mac and Linux devices. Moreover, the web-version can be accessed from any browser.

When compared to competitors, HFTrading offers limited trading platforms. Moreover, it does not provide third-party tools to support social and algorithmic traders. While the MT4 offers decent features for this purpose, some traders may prefer more.

Mobile Trading

The MT4 is available in mobile versions compatible with Android and iOS. Traders can download the mobile app from Apple Store or Google for free. The apps are lightweight and hence do not affect the performance of the device in which they are installed.

After downloading the MT4 app, traders can search for HFTrading through the broker search box and link it to the app by registering an account. The mobile MT4 comes with nearly all the features available in the desktop and web versions.

Moreover, the HFTrading mobile MT4 appears to be the easiest way to access the demo account. All that is needed to access the HFTrading demo account through the mobile app is to download the MT4 and link it to the broker.

Social & copy trading

HFTrading supports social trading through the MT4. However, this robot is not the best for the purpose, given that it doesn’t provide additional social trading tools. Most competitors offer the likes of Zulu Trade to enhance the social trading experience.

HFTrading is a relatively young broker and hence is still building its portfolio of trading tools. It is likely to introduce new features soon.

Crypto Trading

HFTrading offers crypto CFDs in Bitcoin, Ethereum, Ripple, Dash, Monero, Bitcoin Cash, among many other cryptos. In total, the broker provides around 30 cryptos and over 60 CFD pairs.

Popular crypto CFDs pairs you can trade with HFTrading include BTC/USD, BTC/EUR, BTC/GBP, and ETH/USD. As mentioned earlier, the maximum leverage for crypto CFDs is 1 pip. Moreover, the spreads are variable, and there are no trading commissions. HFTrading doesn’t disclose the average spreads for its crypto pairs.

Charting and tools

As mentioned earlier, HFTrading offers the MT4 platform. This platform comes with powerful technical analysis tools comprising 30 built-in indicators, 2000+ free custom indicators, and 700 paid ones.

Also available are 24 analytical objects, including lines, channels, shapes, arrows, and the Gan and Fibonacci tools. These tools allow traders to forecast the price direction, detect trends, and set support/resistance levels.

The MT4 is the holy grail of trading, and hence HFTrading provides what most traders prefer. And as mentioned earlier, the platform is highly intuitive.

Trading education

HFTrading provides a comprehensive trading education centre. The centre caters for the beginner, intermediate and expert trader. Trading education materials are available in blogs, vlogs, live webinars and eBooks. However, we didn’t find a webinar calendar on the website.

HFTrading also provides structured courses and tutorials covering beginner to advanced trading education. Most of the structured courses are free but third parties provide some, and they come with a fee. HFTrading also provides an Economic Calendar and Earnings Seasons Calendar. The economic calendar also presents an analysis and forecast of the impact of the event on the markets.

Moreover, the Earning Report from Yahoo Finance provides information on company announcements on quarterly and annual earnings. The Earning calendar also provides the latest leading stock current price and forecasts. This information is crucial in stock CFDs trading.

HFTrading also provides a well-organized FAQ page to help users get quick answers to basic trading questions. New traders can access basic materials before registration, but they must register and deposit to access the advanced ones. Traders who register through the Gold and Platinum accounts are assigned a dedicated account manager to help them through the first stages of trading.

As mentioned earlier, HFTrading provides an intuitive demo account to help new traders practice before going live.

Trader Protection

HFTrading is regulated by the Australian Securities and Investment Commission (ASIC) under AFSL NO. 414198. It is also regulated by the New Zealand Financial Markets Authority (FMA) under FSPR NO. FSP197465.

ASIC is a top-tier broker that has earned global recognition for adopting stringent broker regulation standards. All ASIC regulated brokers must have at least $1 million in operating capital and must work with tier-one banks for keeping client deposits in a segregated account.

Moreover, ASIC brokers are part of an investor compensation scheme that compensates investors in the event of insolvency.

How to open an account with HFTrading

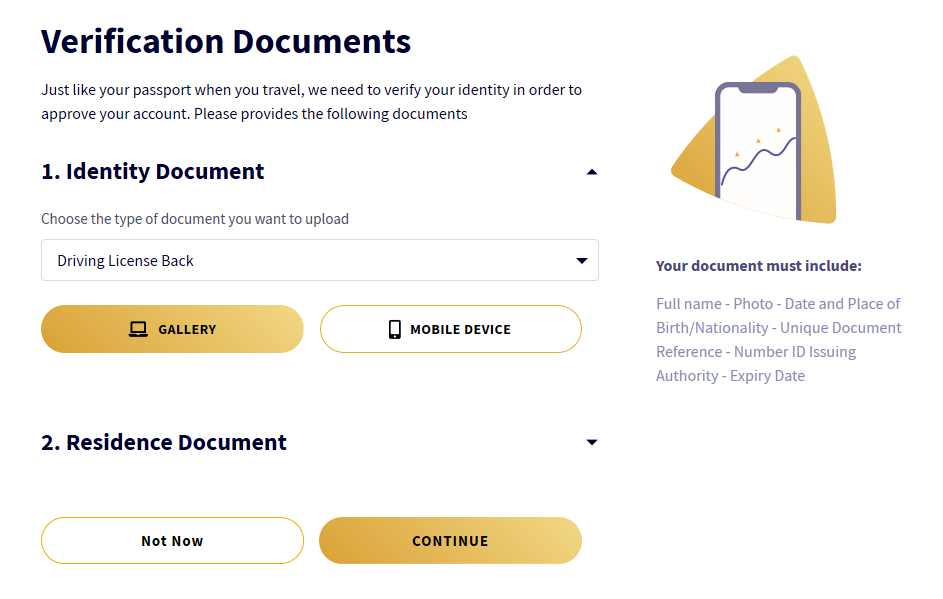

Registering a trading account with HFTrading is straightforward. All users are required to verify identity, proof of current address and payment method.

Identity verification is part of the KYC process, which is a requirement with all well-regulated brokers. It involves uploading a scanned copy of both sides of a government-issued ID card or driving licence. The identity document must have a clear photo.

Traders are required to upload a recent utility bill with the current address displayed at the top for proof of address. Payment method verification, on the other hand, involves uploading a photo of your debit card or credit card with the card number and CVC hidden.

As mentioned earlier, the minimum deposit with HFTrading is $100 for the Gold and Platinum accounts. Account funding can be through Visa, Master Card, VPay, Maestro, Skrill, and Neteller.

Customer support

This broker provides 24/5 customer support through email, phone and live chat. Traders who register through the Gold and Platinum accounts enjoy VIP services.

HFTrading customer care is easily reachable through live chat and phone. It takes a few minutes to get connected to an agent through these methods. Emails, on the other hand, can take up to 24-hours to get a response.

HFTrading customer service agents seem friendly and knowledgeable. They are reachable from 8:00 am to 11:00 pm GMT.

Bottom line

HFTrading is a legitimate and trustworthy broker given that they are regulated by ASIC, a top tier regulator with global recognition. This broker adopts the STP model and hence charges variable spreads with zero commissions.

HFTrading provides three types of accounts, namely Silver, Gold, and Platinum. The Silver account is suitable for complete beginners, while the Gold and Platinum accounts are for experienced traders.

Traders must deposit at least $100 to trade with the Gold and Platinum accounts. There is no minimum capital requirement for trading with the Silver account. HFTrading provides a leverage of up to 1:500.

This broker provides the MT4 trading platform only. Most competitors offer a variety of platforms. However, this should not be a reason to shun this broker since the MT4 is the holy grail of the industry.

HFTrading also provides a comprehensive educational centre covering beginner, intermediate, and experienced level education. Traders who register through the Gold and Platinum account are assigned a dedicated account manager.

Like most brokers, HFTrading provides 24/5 customer support with users registered under the Gold and the Platinum accounts enjoying VIP services.

FAQs

Is HFT trading trustworthy?

HFTrading is a well-regulated broker and hence is highly trustworthy. It is regulated by the Australian ASIC and New Zealand FMA.

What are the deposit options for HFTrading?

HFTrading deposit options include Visa, Master Card, Vpay, Maestro, Skrill, and Neteller. The minimum deposit for the Gold and Platinum accounts is $100.

How do I open a demo account with HFTrading?

Demo trading with HFTrading is easy to use. Download the MT4 from the Apple Store or Google Store and link it to the broker. You can also open a demo account on their website.

How do I withdraw from HFTrading?

You need to fill a request form to withdraw with HFTrading. Withdrawals can take up to 24-hours to be processed.

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk