In the world of technical analysis, there is a special family of indicators known as ‘oscillators’. Traders have used moving averages to indicate the changing directions of a trend, but they needed a tool that could signal potential overbought and oversold conditions. Oscillators fulfil that mission by typically oscillating between two extremes to provide their signals.

The incorporation of these oscillators with other technical tools is commonly referred to as a quantitative trading method. The objective of this combined effort is to provide greater insight into the ongoing price behaviour of your chosen asset. There are several oscillators, some more popular than others, and some better equipped to operate either during a trend or during ranging periods. Formulas may differ, but the end result is to provide a signal of an event before it is apparent in a pricing chart.

The underpinnings of these oscillators are that market prices tend to gyrate as buyers and sellers search for a new equilibrium. As a result, a forceful move in one direction may overshoot the mark with respect to finding a final support or resistance level. Oscillators help a trader to predict that a reversal is imminent and, in some cases, to gauge the health of the trend at hand.

Oscillators may vary in presentation and right-axis values, but these indicators generally appear on the bottom of a pricing chart. Timeframes can be varied to present a variety of looks with the same oscillator. Each one follows these three rules:

- Extremes: The primary value of an oscillator appears either at the extreme upper or the extreme lower portion of their scales.

- Divergence: Signals can also appear when the oscillator direction diverges from the path of prices for the underlying asset or currency pair for the forex trader.

- Mid-Point: Crossings of and activity below and above a mid-point or zero line can also provide insights related to directional signals of future pricing behaviour.

There are several oscillators from which to choose. Traders often choose two to offer better confirmation. In all cases, however, there is a shortcoming that must be understood. While the interpretation of these indicators is fairly straightforward, an oscillator fails when it comes to timing. For this reason, a competent trader will also rely upon pattern recognition, levels of support and resistance, and other types of indicators to guide their decision-making process.

A List of Popular Oscillators

The popular oscillators will almost always appear on broker proprietary trading platforms and be standard issue for MT4 and MT5 platform systems. Each one has a setup screen for settings selection. The default settings are automatic, as specified by the creator, but a trader can always test the results after minor customisation in a practice session.

What is an oscillator that is right for you? The most popular oscillators are listed below:

- Relative Strength Index (RSI)

- Moving Average Convergence Divergence (MACD)

- Stochastics

- Momentum (MoM)

- Commodity Channel Index (CCI)

Examples follow each one using the daily timeframe chart for the ‘EUR/USD’ currency pair, courtesy of eToro. For comparative purposes, observe the sensitivity of each oscillator under the same conditions, how the right-axis scale appears, how potential signals are created, and how the oscillator behaves above and below the mid-point line.

Related Articles

Example: RSI

If popularity were based on how widely an oscillator was discussed in the press, then the Relative Strength Index would win the contest with no other even close. Does popularity imply that the RSI is the best of the oscillator family? Not necessarily. Each member of this family has its own benefits and drawbacks, but when an example is presented for instruction for the group, the RSI is the winning example by far. It is classified as a leading indicator.

Overbought and oversold conditions arise when the single indicator line crosses the ‘80’ or ‘20’ values, respectively, though some platforms may show a ‘70/30’ combination. J. Welles Wilder Jr. revealed his brainchild publicly in his 1978 book New Concepts in Technical Trading Systems. His indicator attempts to detect how quickly prices are changing in the market by comparing the ratio of higher closes to lower closes over a chosen time period, typically ‘14’.

In the strong downtrend of the euro versus the US dollar shown above, the RSI never reflects an overbought condition, though it crosses the ‘30’ extreme on three occasions. More importantly, however, the RSI rarely crosses the 50-mid-line with authority, a signal that the downtrend is relatively strong and showing no signs that a true bottom has been reached.

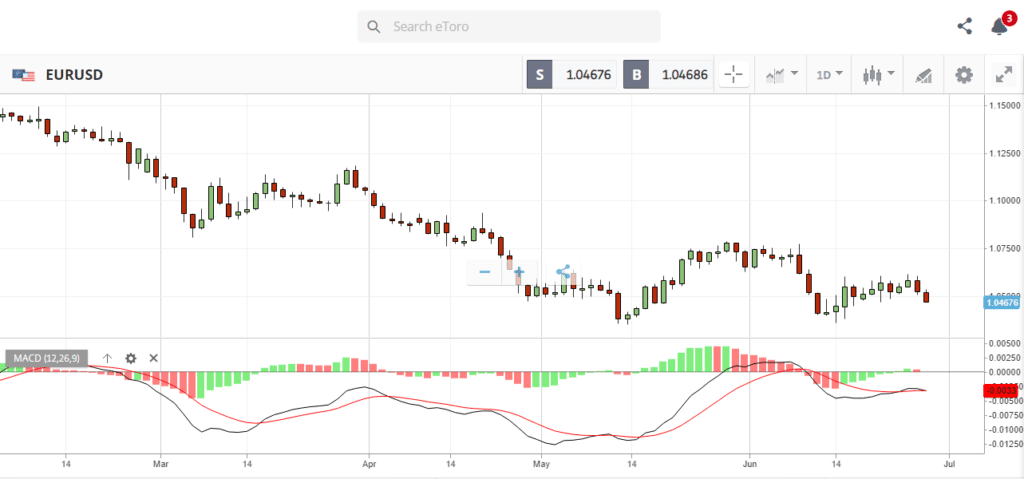

Example: MACD

The Moving Average Convergence Divergence example depicted above includes the net of two smoothed exponential moving averages, the MACD line in Black, and a 9-period EMA Signal line in Red, along with what is called a ‘Histogram’, the red and green bars that hover about a ‘zero’ centerline. Gerald Appel, its inventor, developed his idea in the 1960s with the help of mainframe computing. His insight was to measure the difference or the divergence between the two MAs and a current EMA and how this measure deviated over time. The Histogram bars reflect the ongoing net changes about a zero line.

The scale on the right is variable, not ‘0’ to ‘100’, as with the RSI. Key Buy and Sell signals occur when the Signal line crosses over the MACD line. The Histogram will always equal zero at these points. The Histogram is helpful from a visual perspective as it peaks either up or down when momentum is slowly ebbing, a signal of an imminent change or crossover. As the MACD is based on moving averages, it is often said to be a lagging indicator.

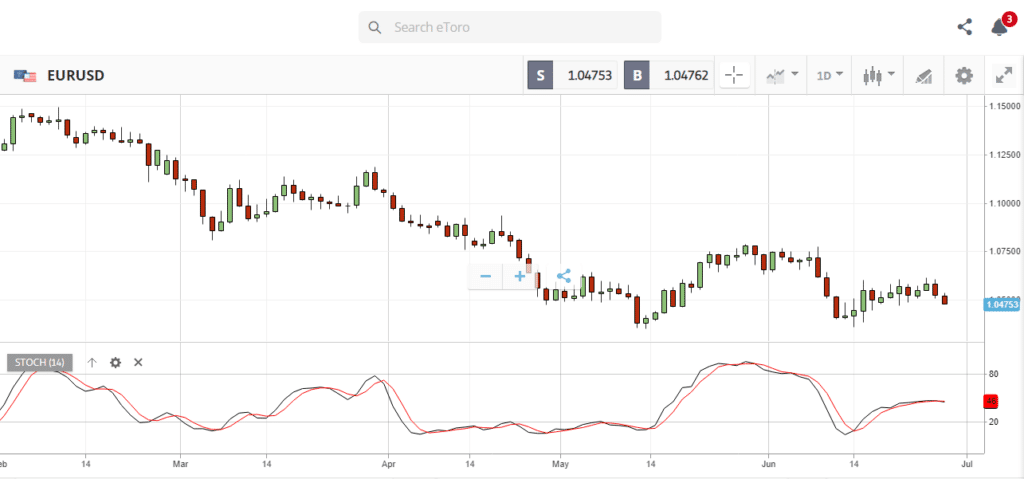

Example: Stochastics

Except for having two lines, the Stochastics indicator looks very similar to the RSI. The scale to the right is from ‘0’ to ‘100’, and extremes are marked at the ‘20’ and ‘80’ levels. Overbought occurs at the high end and vice versa for oversold. It was created by George Lane, and his approach was to compare closing prices to a range of prices over a chosen time period (%K line – Red), and then calculate a specific ratio involving components of the %K (%D line – Black). The default setting for %K for the period is 14. It is considered a leading indicator, as is the RSI.

There is a slow and a fast stochastic, but software today typically combines the best parts of each. Forex traders tend to favour slow stochastics, which can be more sensitive and give better readings in ranging markets. RSI is better for trending ones. Key crossovers are when the %K line crosses the %D line after it peaks, which do not have to occur within extremes.

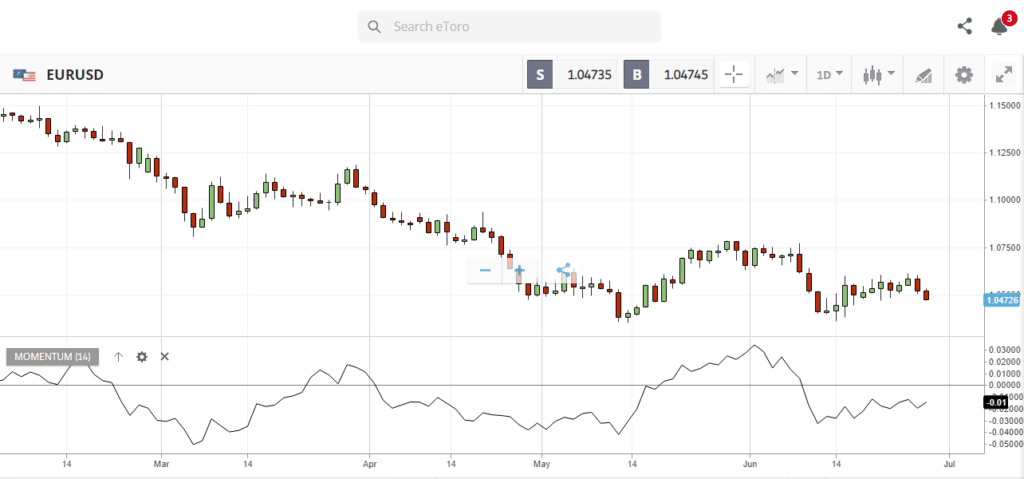

Example: MoM

The origin of the Momentum indicator is not known, but much has been written about it. Once again, it is a single-line version with a variable scale to the right, and traders use it to detect oversold and overbought conditions, as well as measuring the strength of a trend.

There are two versions in the marketplace, one with values as shown above, and the other with percentages. The former measures the rate of price change by differences, while the latter uses percentages. In either case, the key points of reference are movements to the extreme and crossovers occurring at the centerline.

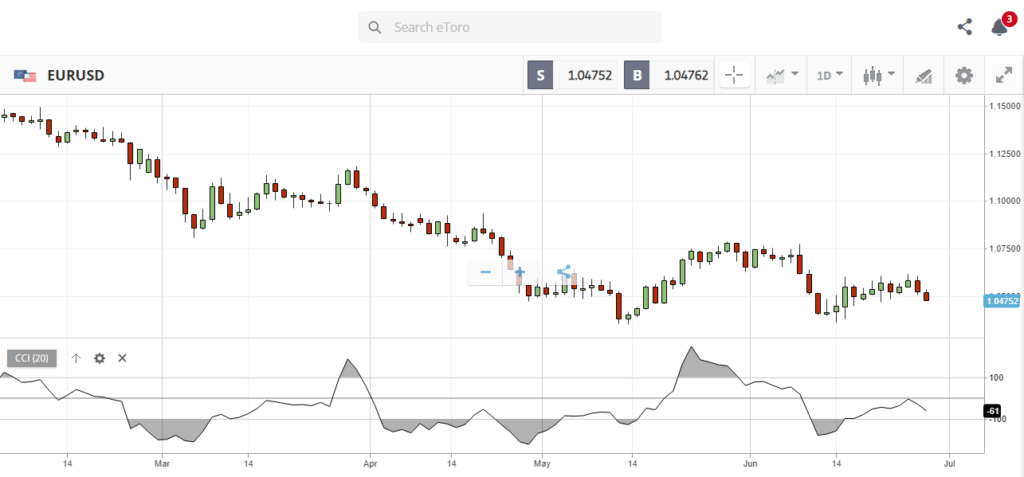

Example: CCI

Lastly, we have the Commodity Channel Index. Donald Lambert, its developer, published the CCI in a magazine in 1980, and although it has ‘Commodity’ in its name, it can be used in all trading markets. It comprises a single line, which oscillates about a centreline with extremes denoted as positions above 100 or below a negative 100.

The calculation method is rather lengthy, involving 20 periods, averages of the High/Low/Close for each period, and the deviation of price from the average. A factor of 0.015 is applied to ensure that 75% of the data falls within the ‘100 to -100’ territory. The extremes are as depicted above and represent trading opportunities.

Conclusion

Oscillators are the favoured technical tools for quantitative traders, both for beginners and for seasoned veterans. There are several different types that a trader can access on their trading platform, and a few have become popular favourites within the trading community for currency pairs, as well as for stocks, commodities and any other tradable assets. The benefits extend to all asset classes and to all trading timeframes.

These tools help guide the trader to potential overbought and oversold conditions, but not necessarily to the exact timing of an imminent reversal. Which oscillators are suited for your trading style? Which oscillator should you choose? Should you use two in tandem for trend confirmation? The best way to answer these questions is to test a few oscillators during a practice session and pick your favourite one or duo. Next, incorporate it or them into your step-by-step trading strategy and look for their specific setup signals.

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.