Wednesday’s European session has seen markets adopt a much calmer mood as the holiday approaches. With most asset groups trading sideways in low volume, one market is still holding on to relatively high price volatility and throwing up buying opportunities.

Forex

The currency markets have formed price patterns which denote that the year’s trading is almost done for many. Even the most volatile and news-driven forex pairs are taking a break.

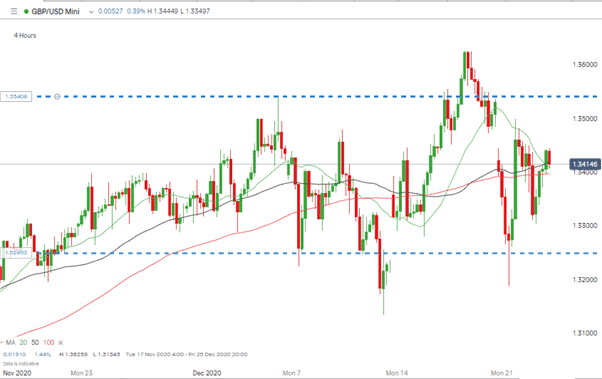

GBPUSD

Monday’s blockade of the Channel ferry ports and stringent lockdown measures in reaction to a mutation of the COVID-19 virus looks likely to be the highlight in terms of price volatility.

Both news events were shocking enough in their own right. Delivered simultaneously they had a significant impact on the price of GBPUSD.

Source: IG

The 4hr chart shows that the news failed to cause a valid break of the 1.3250 support line. The recovery also fizzled out with price holding onto the 20, 50 and 100 SMA averages.

The breakthrough in the upper resistance line gives more hope to the bulls. The strength seen on Friday came as market participants put positions on in the hope of a Brexit-deal being done. In conclusion, price rose on the back of a non-story but fell less convincingly on the back of two genuine ones.

It looks like the path of least resistance for GBPUSD might be upwards. With targets above 1.3600 hard to identify, it might be the case that speculators look to other markets with more evident entry and exit points.

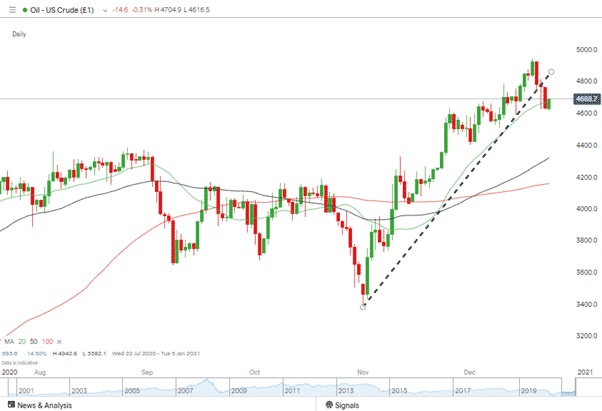

Oil

The long-term prognosis for oil prices has for several weeks been positive. Expectations of a pick up in global trade were boosted by vaccine approval and a democrat president-elect having the keys to the White House.

The new variant of the COVID virus being reported in the UK has caused a break in momentum. The sight of thousands of lorries parked on a motorway and freight ferries stuck in port provides a reminder of how reliant a pick-up in travel is on the vaccines being widely administered.

With the underlying momentum to the upside, some may see the recent weakness in crude as a buying opportunity.

Source: IG

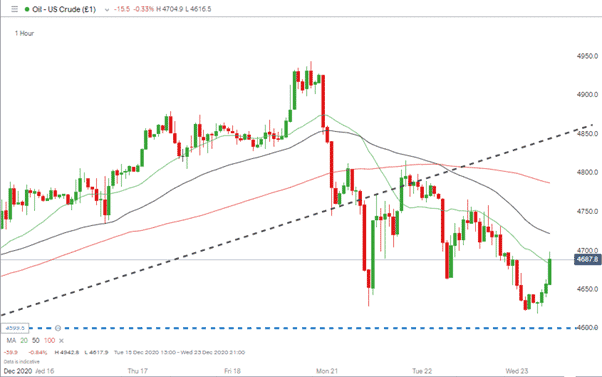

The keen-eyed will note that price has tested and held on the Daily 20 SMA. Further confirmation of this being a chance to buy a dip will come if the price of US WTI crude holds the $46 level.

Source: IG

From a fundamental analysis perspective, it should be noted that the UK finding a version of a COVID-19 variant is not unusual. As the virus has swept across the globe, new variants have appeared.

On Monday, South Africa matched the UK news by announcing it also had a new variant of the virus within its population. In the summer months, new strains were reported in Southern US states and Spain.

As long as medical experts keep proclaiming that the vaccines will effectively treat all virus strains, there is hope that oil prices will continue their upward move.

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  77% of CFD traders lose

77% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk