Monday the 1st of March

The argument for cryptocurrencies having the potential to revolutionise the global financial industry is a compelling one. The blockchain technology used to support cryptos is, in principle at least, an upgrade to current accounting protocols.

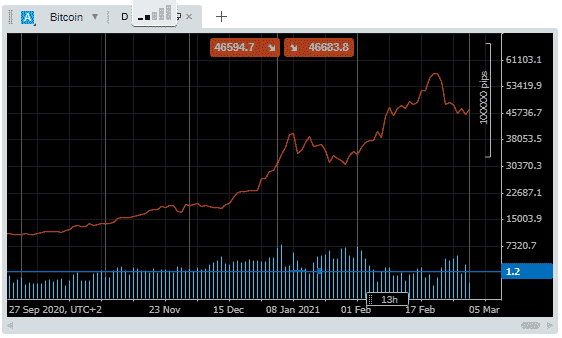

To date, the question has been which of the cryptos is best suited to be a store of wealth and a means of exchange. The recent blockbusting rises in the price of Bitcoin and Ethereum reflects investors believing the technical issues are getting closer to being resolved and wider-spread adoption will then follow.

Another Fundamental Analysis style factor is increasingly coming into play that might apply downward pressure on crypto prices. That is the vast and growing energy consumption needed to service the online networks. Could it be the pin that bursts the Bitcoin bubble?

Bitcoin’s energy consumption is trending

When Bitcoin traded at $58,000 in February, it posted an all-time high price and an all-time high in terms of its carbon footprint.

Source: Pepperstone

In 2018, professors at Princeton University presented a report to the US Senate Committee on Energy and Natural Resources. It claimed that at the time, bitcoin mining accounted for about 1% of the world’s energy consumption.

An estimate by Cambridge University researchers states that Bitcoin consumes around 121.36 terawatt-hours (TWh) a year. That’s equal to:

- The amount of electricity used by the whole of Argentina

- 156 million horses

- 49,440 wind turbines (412 turbines per GW) generating power at peak production per second

- Crypto miners in Iceland use more electricity each year than all the homes in the country

The higher the price, the higher the energy consumption

Recent studies suggest the levels of power-hungry mining are increasing as the price of BTC rises. Bitcoins are released to miners in an orderly fashion, one-quarter of one coin every 10 minutes. The greater the market price, the greater the energy used by the miners, and they still break even. The laws of supply and demand come into play and increase the amount of mining around the globe.

These energy consumption levels can’t be avoided because the decentralised blockchain framework requires members of the network to record every transaction. It’s currently estimated that as many as one quintillion calculations are made every second.

Bitcoin’s dirty secret

Iceland has become a popular host location for Bitcoin miners thanks to its geothermal energy supplies; however, more than two-thirds of the world’s mining is done using high carbon fuel sources. China is another popular host location for miners, and 36% of mining occurs in the Xinjiang region. The reason being that the area has an abundant supply of cheap coal which is costly to transport. Being flexible about where they are located, the miners have simply set up their operations in the region.

What does this mean for Bitcoin Prices?

Do Bitcoin traders mind the ecological costs intrinsic to the market? Time will tell. It is likely to at least increase already high price volatility levels.

It might become socially unacceptable to brag about Bitcoin profits at parties but making money never goes out of fashion. Elon Musk’s firm Tesla’s purchase of Bitcoin in early February is now showing a $900m profit.

If you want to know more about this topic, please contact us at [email protected]

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk