- The long-term prospects of EURUSD remain weak, but market noise could bring about a short-term bounce.

- Monthly RSI is below 30 but sell into any rally that doesn’t break 1.05

- The Ukraine crisis remains the key price driver, but bond market clouds are also forming.

The price of EURUSD has been pummelled throughout 2022 and August was no exception. It was the month when euro-dollar touched 1.0000 and then failed to bounce off the hugely important parity price level.

How long can the preference for the US dollar over the euro continue to dominate the market, and will the long-term trends continue through September? Our analysis of what to expect in the world’s largest forex market in September points to increased noise and more pain for the euro as market traders return to their desks after the summer break.

EURUSD – A Short-Term Bounce?

The fundamental analysis price drivers detailed below are long-term in nature, and given the challenges faced by eurozone economies, there is plenty of further potential downside. There are also a limited number of technical analysis support levels in play, with the euro entering areas of the price chart it hasn’t visited since 2000 and price trading below the SMAs on all timeframes.

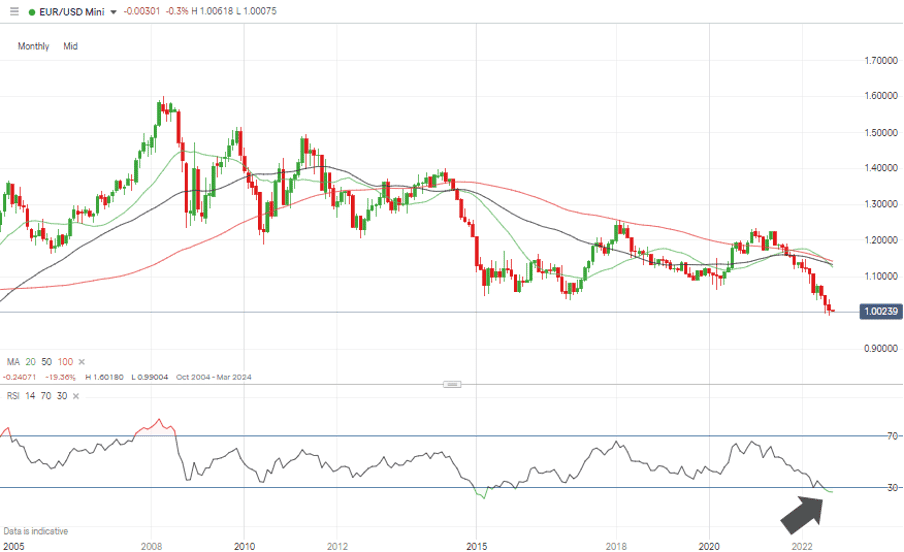

Markets love to offer surprises and the chance of a short-term bounce can’t be dismissed in the first weeks of September. Indicators such as price oscillators are pointing to the currency being oversold and the RSI on Monthly Price Chart for EURUSD is currently at 26.59.

EURUSD – Monthly Price Chart – RSI < 30

Source: IG

The probability of a bounce is increased by the fact that trading volumes can be expected to pick up as investors return to the office and look ahead to the end of the year. That could stir up short-term rallies, which cut thought short position stop losses and therefore build upwards momentum. Some investors will also undoubtedly take the view that enough is enough and buy EURUSD at parity. But they would do well to lock in any profits associated with a price bounce because of the deep-seated issues facing eurozone economies.

EURUSD Forecast for September

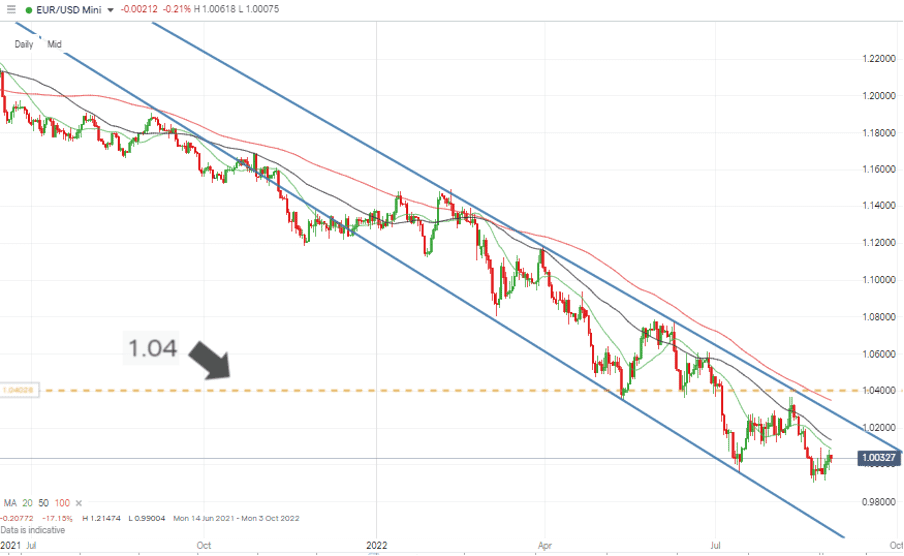

The key price level to look out for is 1.04. This has provided support and resistance in equal measure throughout 2022. Short selling into strength would allow traders to average into positions. Stop-losses set at 1.05 would allow those positions some breathing space.

A break above the 1.05 price level would indicate a paradigm shift. The most likely catalyst for that would be a truce being called between the eurozone economies and Russia. The conflict in Ukraine continues to be the overriding price driver of EURUSD and an energy crisis is one very possible outcome. If German gas supplies do end up being rationed over the winter, then economic production and standards of living could be greatly affected. In that scenario, it’s hard to see the euro trading anywhere except below parity.

EURUSD – Daily Price Chart – 1.04 Support / Resistance

Source: IG

Keep an eye on the bond market too. The Italian government is once again finding that the ECB is the only entity willing to buy its bonds in any size. Previous crises in southern eurozone states have relied on northern eurozone states such as Germany stepping in to prop up their economies. With the Ukraine crisis being what it is, the appetite for any bail-out would be considerably challenged.

If you have been the victim of a scam, suspect fraudulent behaviour, or want to know more about this topic, please contact us at [email protected].

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk