Trouble in China has softened up the global markets in a week when looming updates from the US Federal Reserve could bring about a much talked about correction.

How Did We Get Here?

Investors may have talked themselves into the jittery position in which they now find themselves. With risk-on asset prices rebounding in a multi-month bull run, valuations begin to look extended enough for perma-bear commentators to come out of hibernation. It’s not only the gloom-mongers who have been sharing such views on market valuations:

“As the equity market reaches new highs, the divergence in the advance-decline line suggests we may be approaching a top.”

“In the past, such divergence has indicated the market is vulnerable to a sell-off.”

Guggenheim global chief investment officer Scott Minerd.

“For the last several months, most stocks have declined more frequently than they have advanced–evidence of a weakening market condition.”

CFRA chief investment strategist Sam Stovall.

The negative thoughts appear to be creeping into trading decisions. On a weekly timeframe, the Dow Jones index has notched up three straight losses. Confirming there is little sign of an immediate mood change, the Hang Seng index in Hong Kong lost 4% on Monday. Soon after the European bourses started the week, it was the turn of the German DAX index to be down more than two per cent.

Dow Jones Index – Heiken Ashi Price Chart – Hourly Candles

Source: IG

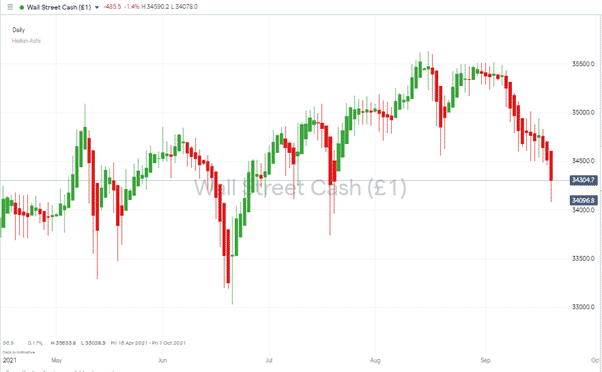

Dow Jones Index – Heiken Ashi Price Chart – Daily Candles

Source: IG

China Property Market Concerns Rattle the Markets

The catalyst of Monday’s price move was a familiar source, the housing market. Memories of the US subprime mortgage fiasco causing markets to crash in 2008 still haunt the markets, but this time concerns are being raised most acutely in China.

Shares in China Evangrande Group were as much as 17% down intraday, and the Hang Seng Property index plummeted 6.9% to a 52-week low. Price action, which can only be described as Bearish, is threatening to pull away one of the legs supporting economic growth in one of the world’s most important economies.

What Next for the Markets?

While this recalibration of risk is going on, the next interest rate announcement by the US Federal Reserve is creeping up on investors and their portfolios. The statement is due at 7 pm London time on Wednesday and being caught in positions is a real risk. There’s some uncertainty about exactly how much continuing support Jerome Powell will offer. Talk of a scaling back of monetary policy has been rife, and that US-sponsored liquidity remains the ultimate driver of market prices.

In previous months, the ‘will he, won’t he?’ conversation has been preceded by sideways price action, and the steep slide in risk-on assets may well subside in the next two days as investors prepare to brace themselves for the Fed’s announcement. That does open the door to dip-buyers to take the view that the Fed will be reluctant to abandon its recovery project prematurely. At the start of this week, the question is whether the current move is a pullback due to buyers taking a momentary break or a fundamental revaluation of risk?

If you have been the victim of a scam, suspect fraudulent behaviour, or want to know more about this topic, please contact us at [email protected]

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk