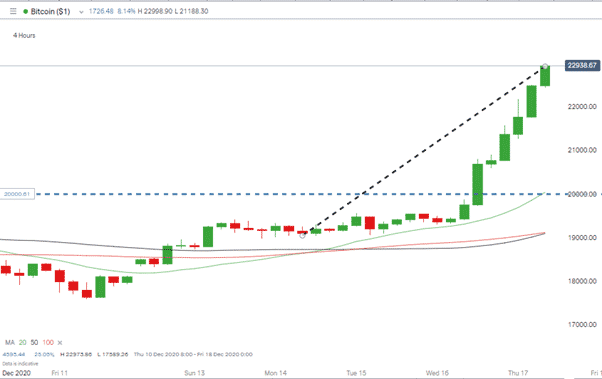

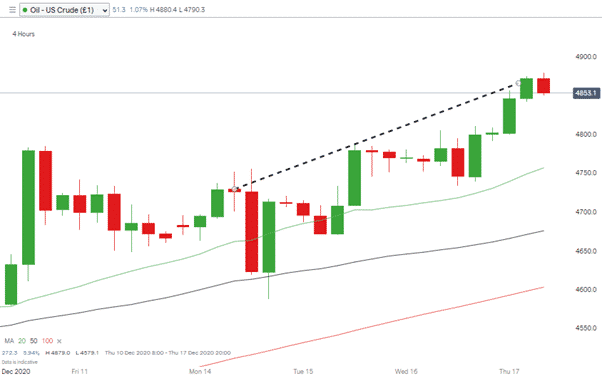

Price moves in equities during the earlier part of the week have set up an opportunity to buy the dips into a hoped-for year-end rally. In the Forex Traders report of Tuesday, our analysts picked out strength in the oil markets possibly spilling over into equities. The drivers of the rally in crude being likely to offer support to equities as well.

Possible triggers for the Santa Rally

- The relative calm in the White House has increased the odds of more fiscal stimulus being injected into the economy

- The roll-out of COVID-19 vaccination programmes offering hope of a return to normal economic activity

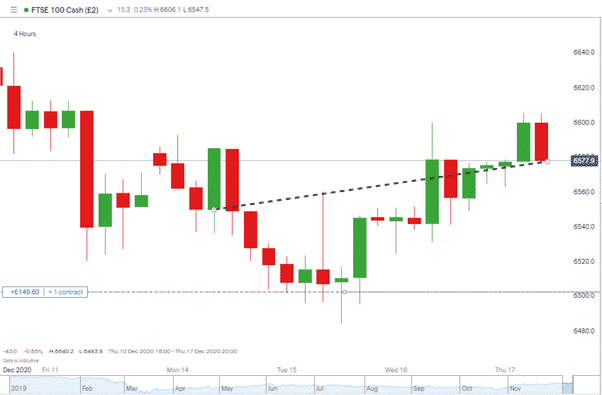

Both of these good news stories should also be positive for the equity markets. The global stock indices are up on the week but whereas crude and Bitcoin have rallied hard, the equity price shift has been modest.

Source: IG

Source: IG

Source: IG

From the open of the markets on Monday morning to midway through Thursday’s European session, the S&P 500 index was up 0.91% while crude was up 3.09% and Bitcoin up 20.24%.

It such euphoria is contagious then it could be that these higher volatility risk-on assets are leading indicators of an equity Santa Rally. That raises the question of how to play it?

What are the next steps if you want to trade the Santa Rally?

The most significant risk with any trading venture is that you get caught up in a scam. For that reason, it’s vital always to use a regulated broker. Choosing one that is authorised and regulated by a Tier-1 authority is crucial.

The list of the authorities includes the Financial Conduct Authority (FCA), the Australian Securities and Investments Commission (ASIC) and the Cyprus Securities and Exchange Commission (CySEC).

As the Santa Rally is mainly an equity related strategy, then choosing a broker that specialises in that area is another step in the right direction. The two mentioned below also offer the option of free Demo accounts in case you want to test the Santa Rally theory using virtual funds by clicking here or here.

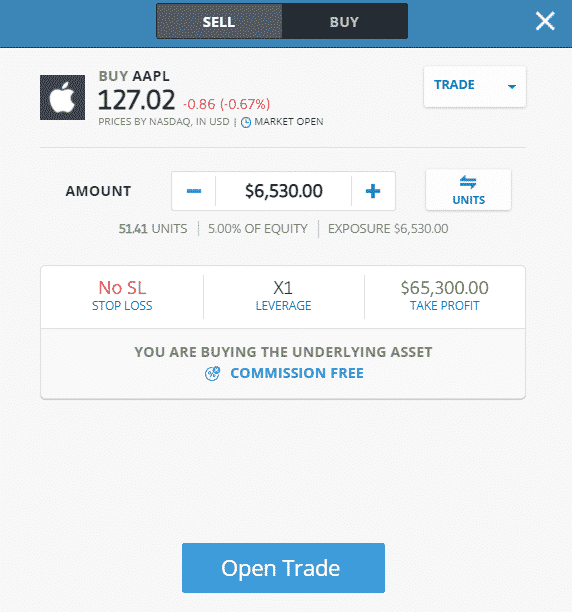

The increasingly popular platform eToro now has more than 13m clients and a strong position in the equity markets. The broker is well known for offering Copy Trading but also supports self-trading. The functionality is super-easy to use and at time of writing, eToro is offering zero commission trading on US equities.

Source: eToro

FCA regulated broker Plus 500 scored well in our last review. Like eToro they offer all the global indices if investors are looking for broad exposure to the equity markets. They also provide markets in over 2,000 single stocks, should you have a particular target in mind.

What next?

Generally speaking, the November-May period tends to deliver better returns for equity markets than the summer months. The ‘January Effect’ is another seasonal phenomenon which statistically speaking is more reliable than the Santa rally.

The Santa Rally itself has historically performed better than a 50-50 coin-toss. December has recorded up-months 60% of the time. There are no guarantees that there will be gains this year but equity markets do look worthy of attention.

The bubbling crypto and commodity markets do indicate that something could be about to give.

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk