- Japanese Yen continues to lose ground to other major currencies.

- The Bank of Japan’s decision not to raise interest rates in line with other central banks has triggered an exodus of capital.

- The policy stands out but matches the challenges facing the domestic economy, but the situation could be about to change.

The US dollar’s price surge has been the major forex talking point of 2022, but an equally distinct trend has also been observed in the Japanese yen. Since the start of the year, the yen has weakened not only against the resurgent dollar but also against relative laggards, the euro, and the British pound. While the yen move hasn’t gone unnoticed, it hasn’t dominated the headlines as much as the dollar’s price move, which raises the question, what is going on and is it a trend still worth trading?

Explaining Yen’s Weakness

The yen’s price fall is due to the Bank of Japan’s willingness to follow a monetary policy that completely contrasts with that of the other major central banks. While the US Federal Reserve has, for example, raised US interest rates by 75 basis points three meetings in a row, the BoJ has been holding rates low and in the region of 0% – 0.25%.

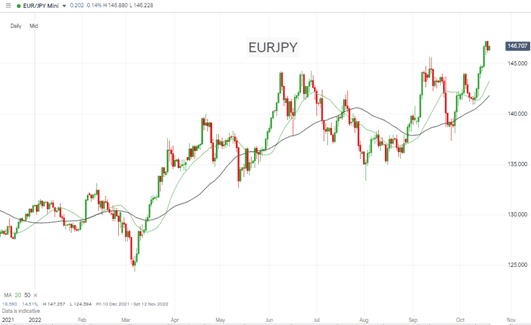

In line with classic economic theory, liquid cash assets held in Japan have, throughout 2022, transferred into other currencies offering a higher return. Even the European Central Bank has caught on to the idea of raising rates to dampen inflation, which means that EURJPY is now up 12.6% on a year-to-date basis.

EURJPY Daily Price Chart – 2022

Source: IG

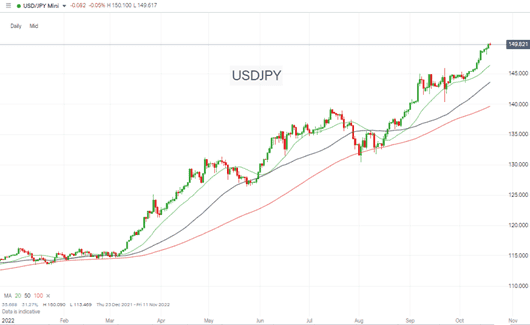

The USDJPY chart tells a similar but more dramatic story. That currency pair has posted a 30.51% price gain thanks to yen weakness and dollar strength working in tandem.

Also Read: EUR/JPY Chart Forecast

USDJPY Daily Price Chart – 2022

Source: IG

Will Yen’s Weakness Continue

The BoJ’s decision to hold interest rates close to zero while those of other countries have spiralled stems from the lower price inflation Japan is experiencing. Consumer price data reports that inflation sits between 2.5% – 3.0%.

Lower inflationary risk means that the BoJ isn’t being forced to hike interest rates in the same way as other central banks, and the domestic economy still needs the support that loose monetary policy provides. After years of stagnation, any tightening could snuff out the recent uptick in economic production.

The risk facing the BoJ and those holding positions in one of the trades of the year is that inflation could be ‘imported’ into Japan. The weaker currency means raw materials and consumer products purchased from international partners will become relatively more expensive. Those price rises are more a case of when rather than if.

While the actions of the Bank of Japan are out of sync with the rest of the market, it is, at face value adopting conventional policy measures. It’s just that the domestic situation it currently faces is different from those in most other major economies. It doesn’t mean it has thrown the rule book out of the window, but it will have to change direction at some point.

People Also Read

- Forex Outlook – Technicals vs News Flow

- Investors See First Sign That Cycle Of Higher Interest Rates Might Be Slowing

- The Best and Worst Performing Currency Pairs in September 2022

If you have been the victim of a scam, suspect fraudulent behaviour, or want to know more about this topic, don’t hesitate to get in touch with us at [email protected]

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk