Asian markets saw widespread selling through Wednesday’s session as analysts nervously lifted the lid on the Archegos Capital Management debacle. The billion-dollar US-based investment company was forced to liquidate certain of its positions on Friday to meet margin calls at the big banks that managed its accounts. The standard practice of freeing up spare cash rocked the share price of some big businesses and has led to a behind-the-scenes squabble between some of Wall Street’s biggest names.

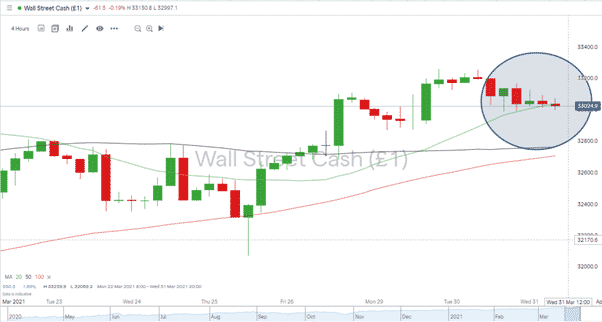

Wall Street index 4-hour price chart has found some support from the 20 SMA but a break of that key level could trigger further downward pressure.

Archagos

The Prime Brokerage departments of big US banks could be on the hook for $6bn in losses. The fund scaled up its borrowing across the board but when forced to engage in a fire-sale, the pain wasn’t equally shared by the banks.

Reports suggest that Nomura, Credit Suisse, Goldman Sachs, Deutsche Bank and Morgan Stanley had communicated with each other regarding the troubled Archagos fund. There are currently no regulatory requirements for banks to share the size of their lending to a third-party. This lack of transparency makes it easy for funds to take on risk levels far greater than any one bank will be aware of.

Things became interesting soon after the banks showed their cards. Goldman, Deutsche and Morgan Stanley appear to have minimised losses by getting positions off their books at breakneck speeds. Nomura and Credit Suisse were left holding the bag and saw their share prices tumble by more than 10% after disclosing that they are facing “significant” losses.

The situation is still unravelling, and Bank of America, Citi, UBS and Barclays also reported positions greater than 2% in some of the stocks in which Archagos was fully loaded.

JP Morgan

One name not on the list of involved parties is JP Morgan. Its reluctance to offer prime brokerage services to Archagos may relate to the fund’s CEO Bill Hwang having previously pleaded guilty to charges of insider trading in 2012. It could also be they’ve experienced their fair share of embarrassing situations, such as the London Whale unwind of 2012, in which they played a pivotal role.

The JP Morgan statement on Archagos is a lesson in dramatic understatement. Analyst Kian Abouhossein said he was “puzzled” by the situation, which was “surprising to us”.

The Archagos unwind has some way to go and following the JP analysts who have in-depth industry knowledge looks like the best route to take to get an insight. It’s thought Nomura losses could reach $2bn, which JP described as a “not unlikely outcome”.

Deliveroo & Data

More risk-aversion followed when the London market opened. Deliveroo made a disappointing debut as one of the largest IPOs of the last decade saw secondary trading price the food delivery firm’s shares 30% lower than the launch price.

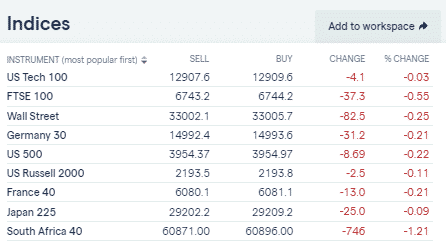

Both events have dampened the mood, with futures in the FTSE 100, DAX 30, S&P 500, Nasdaq 100, Nikkei 225 and DJIA all trading below their previous close.

Global equity indices – Wednesday European Market Open

Source: IG

Positive economic data releases have offered some support but the good news from China and the UK have proved no match for the fear of the unknown being generated by Archagos.

- China – PMI data beat expectations. Manufacturing 51.9 and Services 56.3

- UK – Q4 GDP growth was revised upwards from 1.0% to 1.3%

If you want to know more about this topic, please contact us at [email protected]

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk