Wednesday’s release of the minutes from the US Fed’s last meeting was, to put it mildly, “much anticipated”. The headline interest rate announcements of the Fed relating to base interest rates have been “no change” for more than 12 months. That has left investors and traders who want an indication of the direction of US monetary policy having to dig into the details of the minutes when they are shared.

The most recent disclosure of what was said, by who, about what, has resulted in a slew of markets shooting off in different directions. Gold is up, the US dollar is down, and tech stocks posted a dead-cat bounce. Those ‘risk on’ moves proved slightly surprising, considering the Fed’s minutes confirmed that tapering of monetary policy is going ahead as planned. There were few, if any, surprises in the notes from the meeting, but the market reaction has undoubtedly raised a few eyebrows.

For the nervous investor, some of the divergences in asset prices point to markets not knowing what direction they are taking. The tapering news has been priced in for weeks, if not months. Following September’s sell-off of equities, the most recent price moves have a sense of the ‘jitters’ about them.

The added extra was JP Morgan and other banks kicking off the earnings season. To get a flavour of how topsy-turvy things are at the minute, JP’s stock price fell 2.6% despite it beating analysts’ forecasts.

- JPM Quarterly Revenue $30.44bn compared to $29.8bn forecast by Refinitiv

- JPM Earnings Per Share $3.74 compared to $3.00 forecast by Refinitiv

- JPM Companywide Revenue up 2%

Gold -1hr Price Chart and Fed Minutes Spike

Source: IG

The price spike in gold was more notable due to the super-tight trading range the market formed since the start of October. Gold’s role in the financial markets may be more talismanic than anything else, but the burst out of the long term tight price channel in the world’s asset of last resort points to something going on.

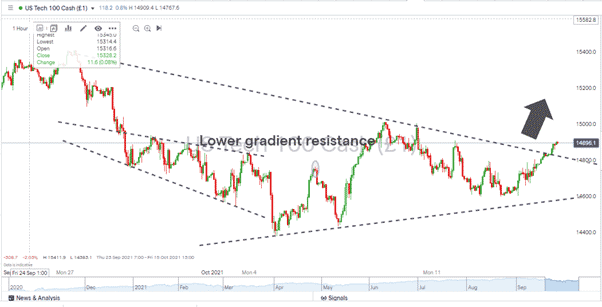

Nasdaq -1hr Price Chart and Fed Minutes Spike

Source: IG

The Nasdaq 100’s price rise followed a more gradual gradient than the spike in gold. This could be more of a relief rally after a sell-off in growth stocks, but resistance trend lines are being broken.

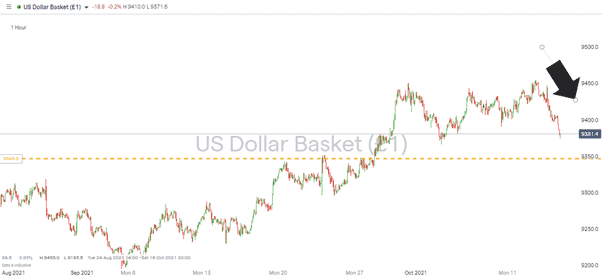

USD Basket -1hr Price Chart and Fed Minutes Price Drop

Source: IG

The US dollar basket’s overnight price slide is potentially the most surprising of the reactions to the Fed’s minutes. The upward move since Mid-Sep is based on triple-bottom indicators dating as far back as 2018. What had looked like a strong and clear buy signal in the basket index had been found to have weak foundations. The announcement from the Fed regarding tapering was pretty much on message. Those who see this as a short-lived last dance for the bears will be looking for chances to buy the dips near the 93.50 level.

If you have been the victim of a scam, suspect fraudulent behaviour, or want to know more about this topic, please contact us at [email protected]

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk