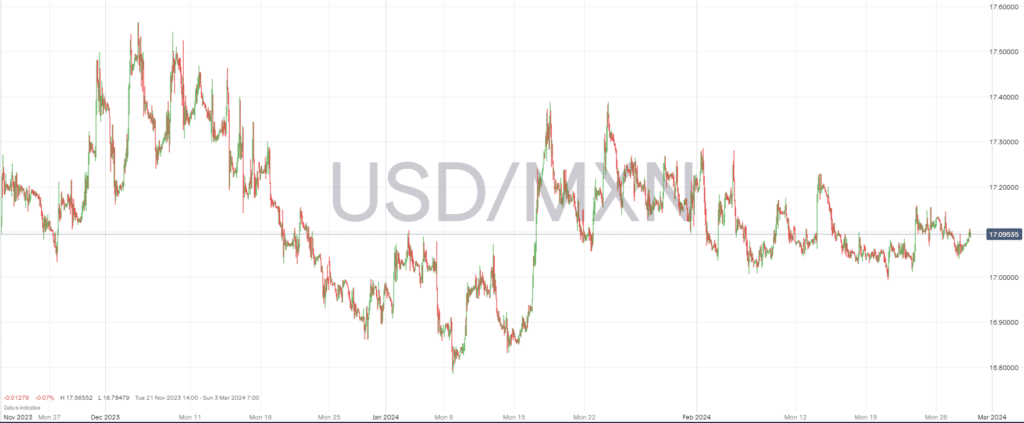

The USDMXN currency pair, represents the exchange rate between the US Dollar and the Mexican Peso. It has seen fluctuating dynamics in recent times, influenced by a myriad of economic factors and market sentiments. As of February 27, 2024, the pair opened at a rate of 17.1129, reaching a high of 17.1446 and a low of 17.0667 throughout the trading session, ultimately settling at a slightly lower figure by the session’s end.

This currency pair’s movement is a reflection of broader economic and geopolitical trends affecting both the United States and Mexico. Various economic indicators, such as trade balances, manufacturing indexes, and central bank policies, play pivotal roles in shaping the exchange rate’s trajectory. For instance, the Dallas Fed Manufacturing Index and the Balance of Trade from both countries are closely watched by traders for signs of economic health and policy implications.

Geopolitical Risks Affecting USDMXN

Donald Trump’s potential re-election as President of the United States poses a serious risk to the Mexican financial markets. In 2016, USDMXN fell dramatically driven by uncertainty over future relations between the USA and Mexico. We could see a similar effect if Trump were to regain power, as Ernesto Di Giacomo – Market Analyst at XS.com – points out:

If Trump returns to power, instability in the Mexican financial market could worsen. His policies could trigger additional inflationary pressures and prolong the wait for the US Federal Reserve to cut interest rates.

The year-to-date change suggests a modest appreciation in the value of USDMXN. This is indicative of the intricate balance of trade relations, inflation rates, and interest rate differentials between the two economies. The 52-week range of 16.6210 to 19.2348 underscores the volatility and the range within which traders operate, driven by varying market sentiments and economic forecasts.

Looking ahead, market analysts will closely monitor these geopolitical tensions and economic policies. These global macroeconomic indicators will help to forecast future movements of the USDMXN pair. These analyses are crucial for investors and traders alike, providing insights into potential risks and opportunities in the forex market.

Don’t Trade Before you see this!

We consulted our team of experts and put together 10 tips to help improve your trading.

These tips could help make you a better trader – and we’re giving them away for free!

Related Articles

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk