The majority of countries in the world have their own currency, but the unique economic conditions of each country can vary dramatically. For example, the US is an economic powerhouse compared to, say, a developing country such as Uruguay. Because of this, some currencies account for the majority of the daily trading volume on the forex market, while others are very thinly traded. In this article, we will explore the exotic forex pairs, the most popular traded pairs, and how to trade them.

What Are Exotic Forex Pairs?

When the national currencies of two countries are paired together and traded on the foreign exchange market, we refer to them as currency pairs.

A currency pair such as the USD/SEK consists of the base currency on the left (in this case, the US dollar) and the quote currency on the right (in this example, the Swedish krona).

All of the currency pairs available today can be classified or grouped into three categories: major forex pairs, minor forex pairs and exotic forex pairs.

Exotic forex pairs are traded less frequently and represent both emerging nations and numerous developed European nations. The International Monetary Fund (IMF) served as the catalyst for the formation of the group of exotic currencies.

The Most Popular Exotic Forex Pairs

Exotic currency pairs typically include one major currency paired with a currency from a developing or emerging country. Some of the most popular exotic pairs are the USD/SEK, USD/NOK, USD/MXN, GBP/SEK and USD/ZAR – according to their daily trading volume.

Special consideration should be given to the amount of volume traded on exotic currency pairs because the demand for exotic currencies is far less than the major and minor pairs. Lesser demand leads to low volume and often highly volatile trading conditions.

Next, we will look at how to trade the exotic forex pairs and the important factors you need to be aware of with this group of currency pairs.

Related Articles

- What Are Major Forex Pairs?

- What Are Minor Forex Pairs?

- What Are Forex Cross Pairs?

- What Are Commodity Forex Pairs?

How to Trade Exotic Forex Pairs

Image for illustration purposes only

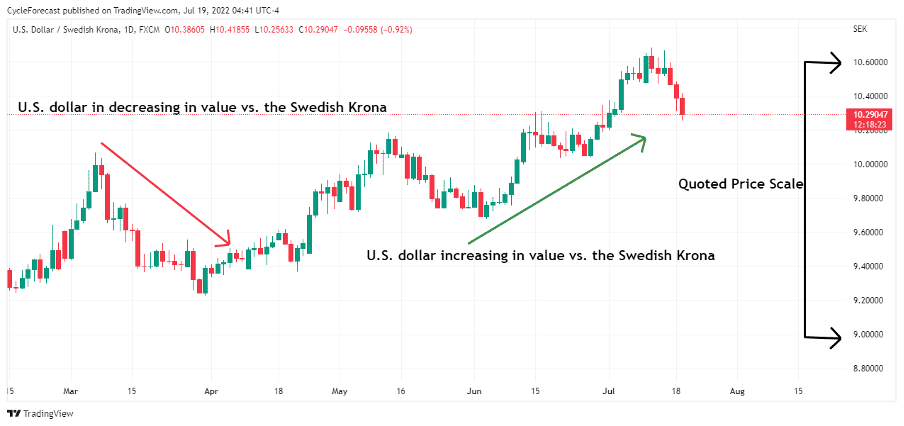

Let’s first have a quick look at what the quoted prices of a currency pair look like on a chart and what happens to each currency pair when prices fluctuate up or down.

The image above shows the price chart of the USD/SEK (US dollar and Swedish krona pair). When prices rise, the US dollar will increase in value relative to the Swedish krona (green arrow). The opposite is true when prices decline – e.g., the US dollar will decrease in value relative to the Swedish krona (red arrow).

The quoted prices for the currency pair appear on the right-side axis of the chart (black arrows).

When the USD/SEK trades at 10.30, for example, all this means is that it would cost 10.30kr (Swedish krona) to buy $1 (US dollar).

Image for illustration purposes only

Our second image shows the bid and ask prices for the USD/SEK (on the right side of the image), which indicated the best potential prices that the USD/SEK could be sold or bought for at that point in time. The difference between the quoted buy and sell price at any given time is referred to as the spread.

The first step required to trade the exotic currency pairs is to place an order. This can be done by opening an order box (similar to the one above) via your broker’s platform. The second step would be to decide at which price you want to buy or sell the currency pair.

Thirdly, you will have to know the right order type to use as well as your chosen position size before you submit the order during the final step.

The chart image below shows an example of what a trade position would look like after an order has been submitted.

Image for illustration purposes only

Our final chart image shows an open short position on the USD/SEK, with the red horizontal line representing the price level at which the USD/SEK was sold.

The number 1 000 refers to the position size of the trade and the green and orange horizontal lines represent the take profit and stop loss levels.

For this trade position to turn profitable, the USD/SEK would need to move below the sell level, but if price moves higher instead, then the position would turn negative, and a trader would start to lose money. Please be aware that trading is risky and can result in significant losses.

Please note that the example above might differ in appearance from your broker’s platform. With most trading platforms, it is also possible to see these order levels within your position and order panel (not shown in the example).

Here is a quick list of the important factors you need to be aware of that generally affect the exotic forex pairs:

- Wide Spreads: The difference between the sell and buy price, or the spread, is often very wide when trading the exotic forex pairs. Wider spreads indicate less liquidity. Major currency pairs, for example, have much smaller spreads.

- Less Liquidity: Liquidity is directly related to volume, and it is an important factor that traders take into account. The higher the liquidity is in a market, the easier it is to execute large position sizes without affecting the price of a currency pair too much. Exotic currency pairs have less liquidity, which could lead to wild price fluctuations without notice.

- Higher Slippage: Slippage refers to instances where a market or stop loss order is executed at a worse rate than the order was set for. This generally happens when there is a sudden and fast change in price during highly volatile periods. The risk of slippage is considerably higher in currency pairs with less liquidity – such as exotic currency pairs.

Conclusion

The group of exotic currency pairs accounts for the least amount of volume on the forex market. With less volume comes more potential risk, especially if you are a beginner trader. That being said, traders who thoroughly understand the important economic factors that influence any particular exotic currency often benefit from these pairs. It’s important to note that the market is volatile, and trades can also result in loss.

Hopefully, this article helped to shed some light on what exotic forex pairs are and whether you should consider trading them, especially after considering all of the important factors mentioned before.

Trade Minor Forex Pairs With Top Brokers

| Broker | Features | Regulator | Platforms | Next Step | |

|---|---|---|---|---|---|

Your capital is at risk

Founded: 2014 Your capital is at risk

Founded: 2014 |

|

FSPR | MT4 | ||

Your capital is at risk

Founded: 2006 Your capital is at risk

Founded: 2006Europe* CFDs ar... |

|

ASIC, FSA, FSB, MiFID | MetaTrader4, Sirix, AvaOptions, AvaTrader, Mirror Trader | ||

Between 74-89% of CFD traders lose

Founded: 2010 Between 74-89% of CFD traders lose

Founded: 2010Between 74-89 % of retail investor accounts lose money when trading CFDs |

|

ASIC, FCA | MetaTrader 4, MetaTrader 5, cTrader | ||

Your capital is at risk

Founded: 2009, 2015, 2017 Your capital is at risk

Founded: 2009, 2015, 2017 |

|

ASIC, CySEC, IFSC | MT4 Terminal, MT4 for Mac, Web Trader, iPhone/iPad Trader, Droid Trader, Mobile Trader, MT5 | ||

Your capital is at risk

Founded: 2006 Your capital is at risk

Founded: 2006 |

|

CySEC, DFSA, FCA, FSB, SIA | MetaTrader4, MetaTrader5, cTrader, FxPro Edge (Beta) | ||

Your capital is at risk

Founded: 2011 Your capital is at risk

Founded: 2011 |

|

CySEC, FSC, FSCA, MISA | MT4, MT5, OctaTrader | ||

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.