The foreign exchange market (forex) is the largest financial market in the world where all of the world’s currencies can be traded. With trillions of dollars’ worth of currencies being traded on a daily basis and across multiple continents, the forex market continues to provide traders with a multitude of lucrative opportunities. In this article, we will take a look at what the minor forex pairs are, the most popular traded pairs, and how to trade them.

What Are Minor Forex Pairs?

When the national currencies of two countries are paired together and traded on the foreign exchange market, we refer to them as currency pairs.

A currency pair – for example, the EUR/GBP – consists of the base currency on the left (in this case, the euro) and the quote currency on the right (in this example, the British pound).

All of the currency pairs available today can be classified into three categories: major forex pairs, minor forex pairs and exotic forex pairs.

The minor forex pairs simply refer to the currency pairs that are not associated with the US dollar and are also commonly known as cross-currency pairs.

The Most Popular Minor Forex Pairs

The most popular traded minor forex pairs are the EUR/JPY, GBP/JPY, EUR/GBP, AUD/JPY, EUR/AUD and EUR/CHF.

Minor forex pairs fall into this category because their daily trading volume is less than the major forex pairs. That being said, they still have sufficient liquidity to make them attractive trading pairs.

The EUR/JPY accounts for roughly 3.93% of the overall daily volume traded on the foreign exchange market, followed by the GBP/JPY with 3.57% and the EUR/GBP with 2.78%.

Although these percentages might sound small, the minor currency pairs still account for billions of dollars’ worth of trading volume on a daily basis.

Related Articles

- What Are Major Forex Pairs?

- What Are Exotic Forex Pairs?

- What Are Forex Cross Pairs?

- What Are Commodity Forex Pairs?

How to Trade Minor Forex Pairs

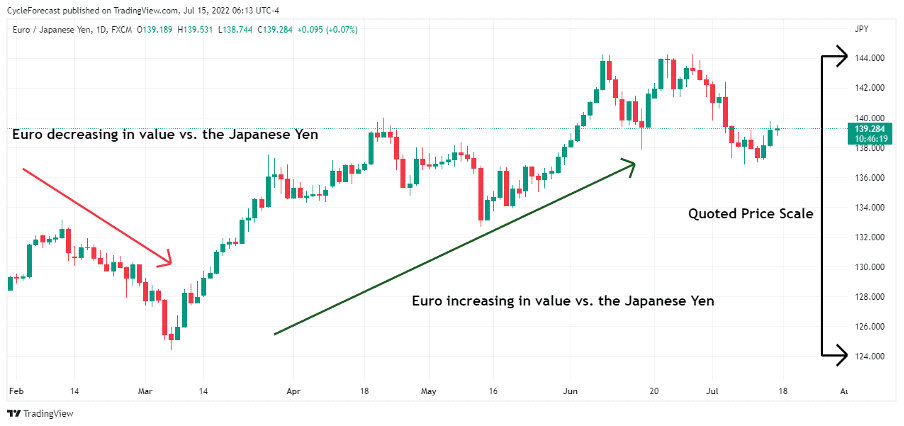

Image for illustration purposes only

Before we discuss the basics of how to trade minor forex pairs, let’s first take a look at what the quoted prices of a currency pair look like on a chart, and what it means for each currency when prices move up or down.

Following the EUR/JPY chart example above, when prices decline, the euro will decrease in value relative to the Japanese yen (red arrow). The opposite is true when prices increase – e.g., the euro will increase in value relative to the Japanese yen (green arrow).

The quoted prices for the currency pair appear on the right-side axis of the chart (black arrows).

Let’s say that the EUR/JPY is trading at 139.00, for example – all this means is that it would cost ¥139.00 (Japanese yen) to buy €1 (euro).

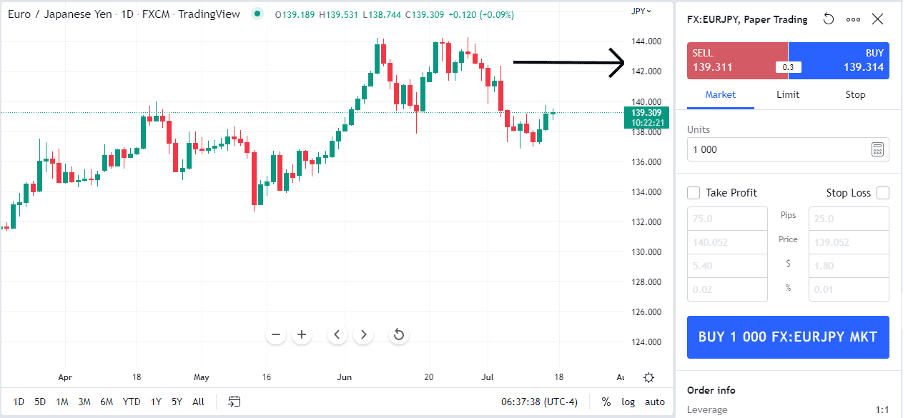

Image for illustration purposes only

The second chart example shows the bid and ask prices for the EUR/JPY (on the right side of the image), which indicated the best potential prices that the EUR/JPY could be sold or bought for at that point in time.

When the time has arrived to place a trade, a trader will firstly open an order box (similar to the one above) via a broker’s platform. The second step would be to decide at which price you want to sell or buy the currency.

Thirdly, a trader will have to know the right order type to use, and lastly the position size. Once all of these factors have been considered, an order can be submitted via your broker’s platform and the order will become active, if accepted by market.

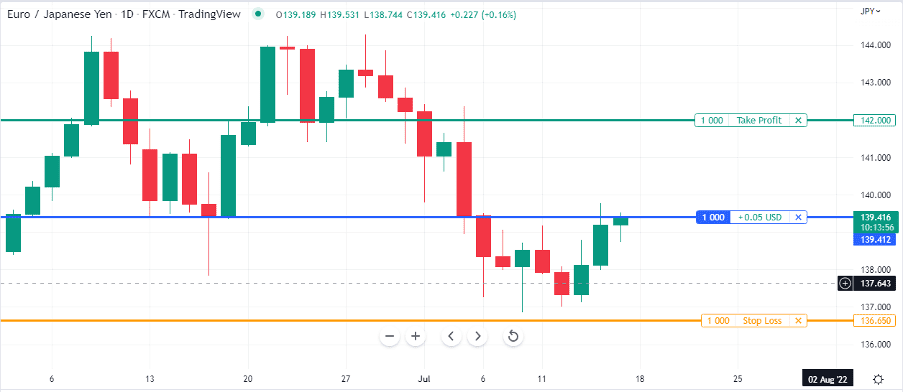

The chart image below shows an example of what a trade position would look like.

Image for illustration purposes only

Our final chart image shows an open long position on the EUR/JPY with the blue horizontal line representing the price level at which the EUR/JPY was bought.

The number 1 000 refers to the position size of the trade and the green and orange horizontal lines represent the take profit and stop loss levels.

For this trade position to turn profitable, the EUR/JPY would need to move above the buy level. However, if price moves lower instead, then the position would turn negative, and a trader would start to lose money.

Please note that the example above might differ in appearance from your broker’s platform. With most trading platforms, it is also possible to see these order levels within your position and order panel (not shown in the example).

Conclusion

Although the minor forex pairs account for less of the overall daily trading volume than the forex majors, they are still heavily traded and very popular among forex traders.

With so many forex pairs available today, there are almost unlimited trading opportunities. Hopefully, this article helped to shed some light on what minor forex pairs are and the most popular ones you might want to check out when you place your next trade.

Trade Minor Forex Pairs With Top Brokers

| Broker | Features | Regulator | Platforms | Next Step | |

|---|---|---|---|---|---|

Your capital is at risk

Founded: 2014 Your capital is at risk

Founded: 2014 |

|

FSPR | MT4 | ||

Your capital is at risk

Founded: 2006 Your capital is at risk

Founded: 2006Europe* CFDs ar... |

|

ASIC, FSA, FSB, MiFID | MetaTrader4, Sirix, AvaOptions, AvaTrader, Mirror Trader | ||

Between 74-89% of CFD traders lose

Founded: 2010 Between 74-89% of CFD traders lose

Founded: 2010Between 74-89 % of retail investor accounts lose money when trading CFDs |

|

ASIC, FCA | MetaTrader 4, MetaTrader 5, cTrader | ||

Your capital is at risk

Founded: 2009, 2015, 2017 Your capital is at risk

Founded: 2009, 2015, 2017 |

|

ASIC, CySEC, IFSC | MT4 Terminal, MT4 for Mac, Web Trader, iPhone/iPad Trader, Droid Trader, Mobile Trader, MT5 | ||

Your capital is at risk

Founded: 2006 Your capital is at risk

Founded: 2006 |

|

CySEC, DFSA, FCA, FSB, SIA | MetaTrader4, MetaTrader5, cTrader, FxPro Edge (Beta) | ||

Your capital is at risk

Founded: 2011 Your capital is at risk

Founded: 2011 |

|

CySEC, FSC, FSCA, MISA | MT4, MT5, OctaTrader | ||

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.