After October saw strong gains in the US dollar, the easing of macroeconomic and geopolitical concerns saw risk assets make solid gains during the month. The US dollar was, of course, a loser against many of those risk assets and makes a regular appearance in this month’s list of best and worst-performing currencies.

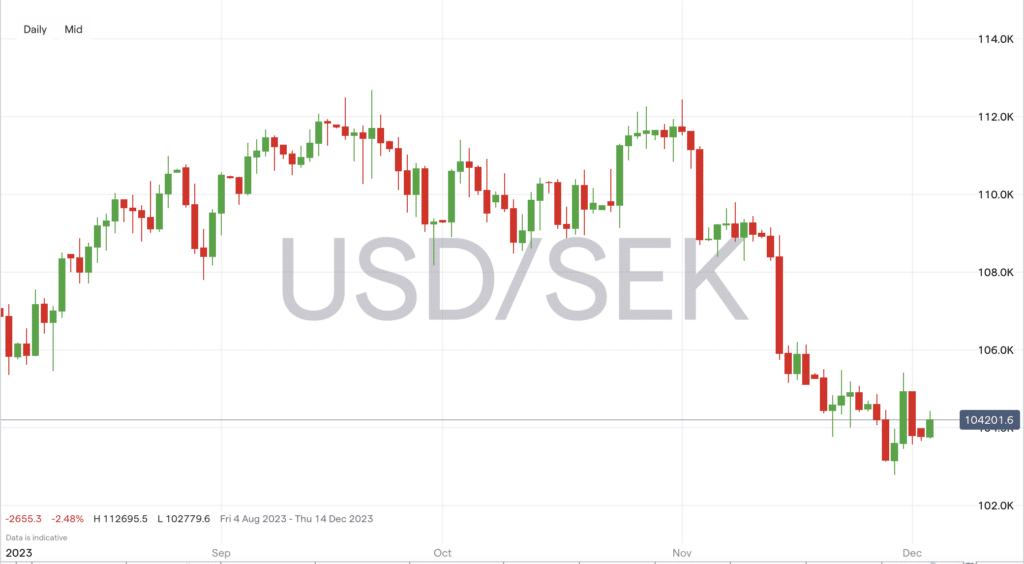

USDSEK -7.12%

- The Swedish krona/US dollar pair hit a low of 10.2758 in November, back at levels last seen in July.

- In fact, the krona posted its best month against the US dollar since September 2010, and according to Bloomberg, was the best performer among the world’s 16 major currencies.

- With slowing growth and inflation concerns easing in Sweden and the country’s central bank signalling another rate hike could arrive, the krona rallied during November.

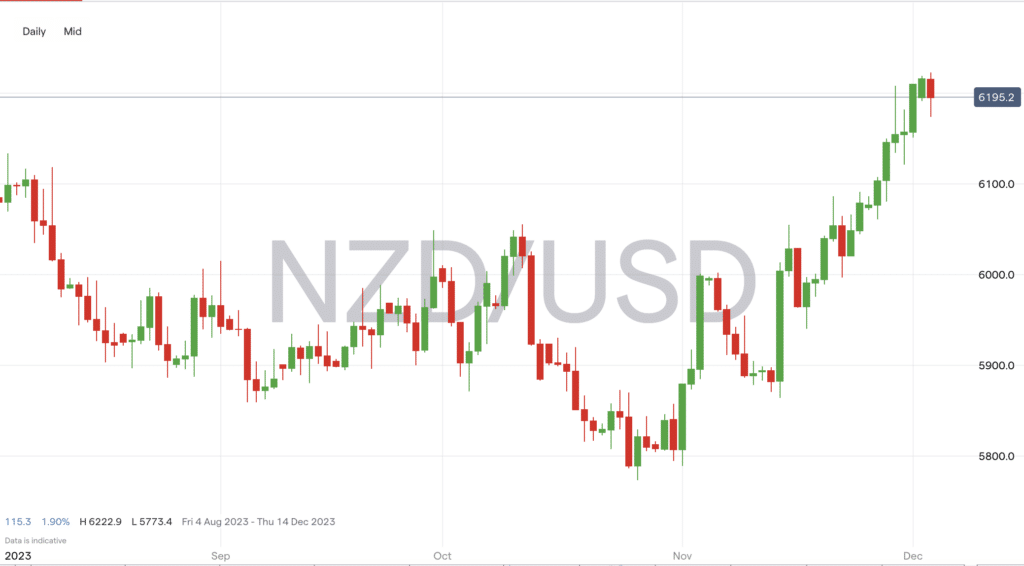

NZDUSD +6.82%

- The New Zealand dollar rose above 0.62 during November before closing at around 0.6150.

- The improving economic outlook in New Zealand, alongside a hawkish central bank, boosted the country’s currency against the greenback.

- At the time of writing in December, the pair is now back around the 0.62 mark.

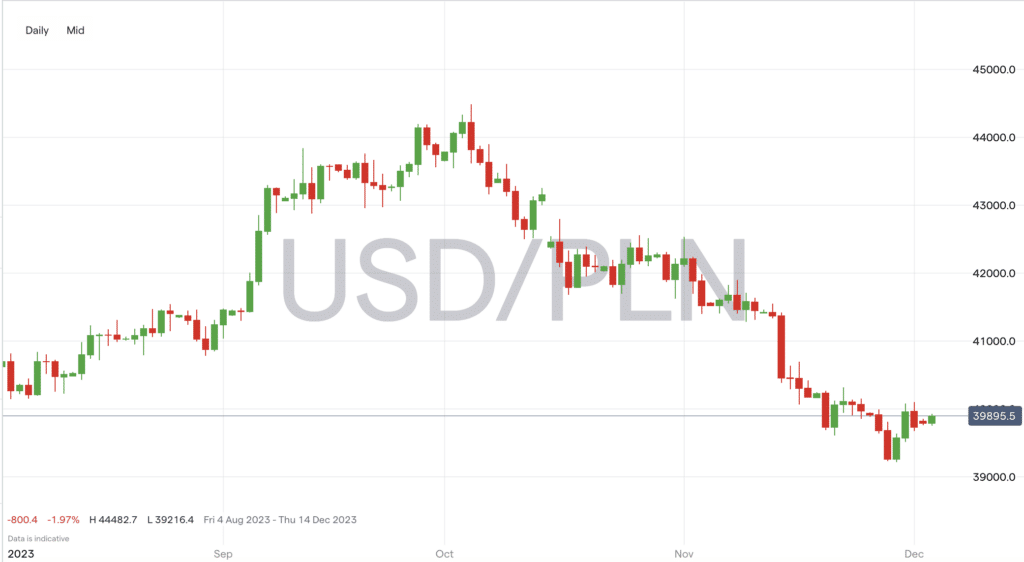

USDPLN -5.65%

- The Polish zloty was another significant gainer during November, closing at around 3.99740 after a retracement in the last two trading sessions of the month.

- A political shift in the country saw investors flock back to the zloty at the end of October, which continued into November.

- Alongside general market sentiment, the zloty was boosted in November by Poland’s pro-European coalition reaching a deal.

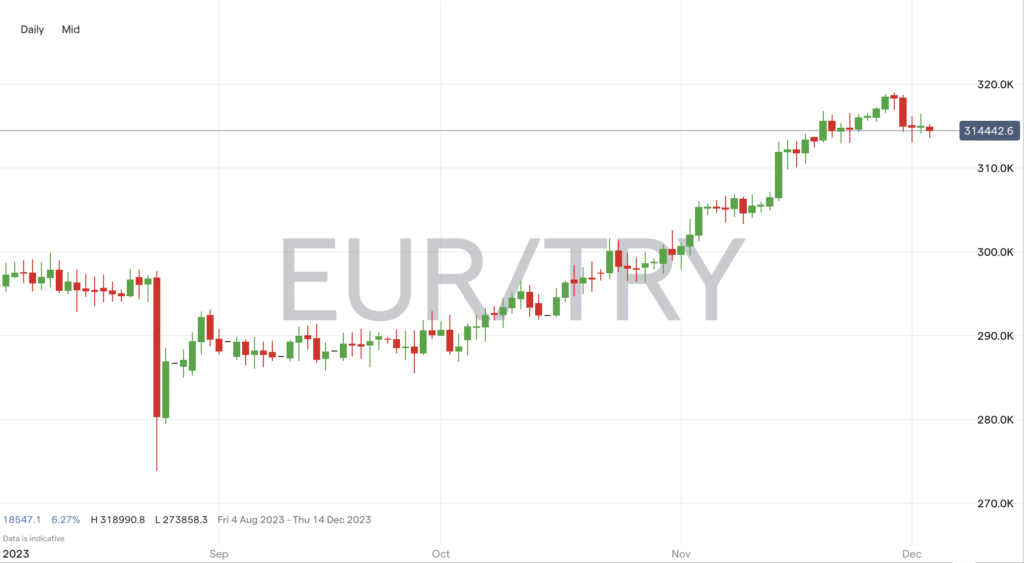

EURTRY +4.98%

- The EURTRY pair makes it onto the list for the second month in a row, climbing above the 31.85 mark during November.

- Inflation in Turkey continues to soar, with the country now hiking its interest rate to 40% in a bid to curb rapidly rising prices.

- General euro strength during the month, alongside the fact it is seen as a safer currency, helped it make strong gains against the Turkish lira.

People also Read:

- Forex Market Forecast for December 2023

- Forex vs Commodities – Which One Should You Trade?

- Choosing A Forex Broker

Trade Forex with our top brokers

| Broker | Features | Regulator | Platforms | Next Step | |

|---|---|---|---|---|---|

Your capital is at risk

Founded: 2014 Your capital is at risk

Founded: 2014 |

|

FSPR | MT4 | ||

Your capital is at risk

Founded: 2006 Your capital is at risk

Founded: 2006Europe* CFDs ar... |

|

ASIC, FSA, FSB, MiFID | MetaTrader4, Sirix, AvaOptions, AvaTrader, Mirror Trader | ||

Between 74-89% of CFD traders lose

Founded: 2010 Between 74-89% of CFD traders lose

Founded: 2010Between 74-89 % of retail investor accounts lose money when trading CFDs |

|

ASIC, FCA | MetaTrader 4, MetaTrader 5, cTrader | ||

Your capital is at risk

Founded: 2009, 2015, 2017 Your capital is at risk

Founded: 2009, 2015, 2017 |

|

ASIC, CySEC, IFSC | MT4 Terminal, MT4 for Mac, Web Trader, iPhone/iPad Trader, Droid Trader, Mobile Trader, MT5 | ||

Your capital is at risk

Founded: 2006 Your capital is at risk

Founded: 2006 |

|

CySEC, DFSA, FCA, FSB, SIA | MetaTrader4, MetaTrader5, cTrader, FxPro Edge (Beta) | ||

Your capital is at risk

Founded: 2011 Your capital is at risk

Founded: 2011 |

|

CySEC, FSC, FSCA, MISA | MT4, MT5, OctaTrader | ||