FOCUS ON: Busy Week for Traders. Interest Rate, Inflation and GDP Numbers to be Released

- The Fed, ECB, and Bank of Japan will update markets on interest rate decisions this week.

- The US CPI inflation report due Tuesday could influence central bank policy.

- Price volatility is expected to increase in a busy news week for the markets.

Three major central banks will this week update on interest rate policy. After months of consecutive rate hikes by the ECB and US Federal Reserve, some are forecasting the latter may pause for breath. Some uncertainty is creeping into analyst forecasts, and the US CPI inflation report due on Tuesday could undo a move toward a more dovish approach.

Forex

GBPUSD

The latest UK unemployment figures are due out on Tuesday. Any sign that the jobs market is showing resilience would open the door to the Bank of England continuing to focus on inflation and to raise interest rates at the next meeting of the MPC. On the other hand, should fears of stagflation mount, a more accommodating approach from the BoE could be expected.

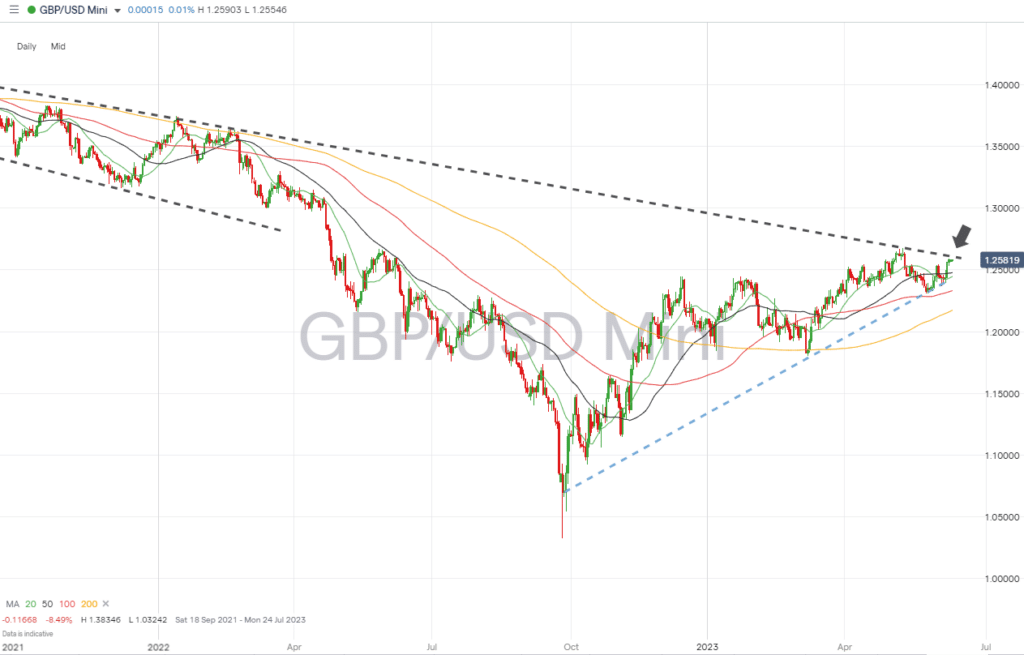

Daily Price Chart – GBPUSD Chart – Daily Price Chart – Trendline Break Confirmed?

Source: IG

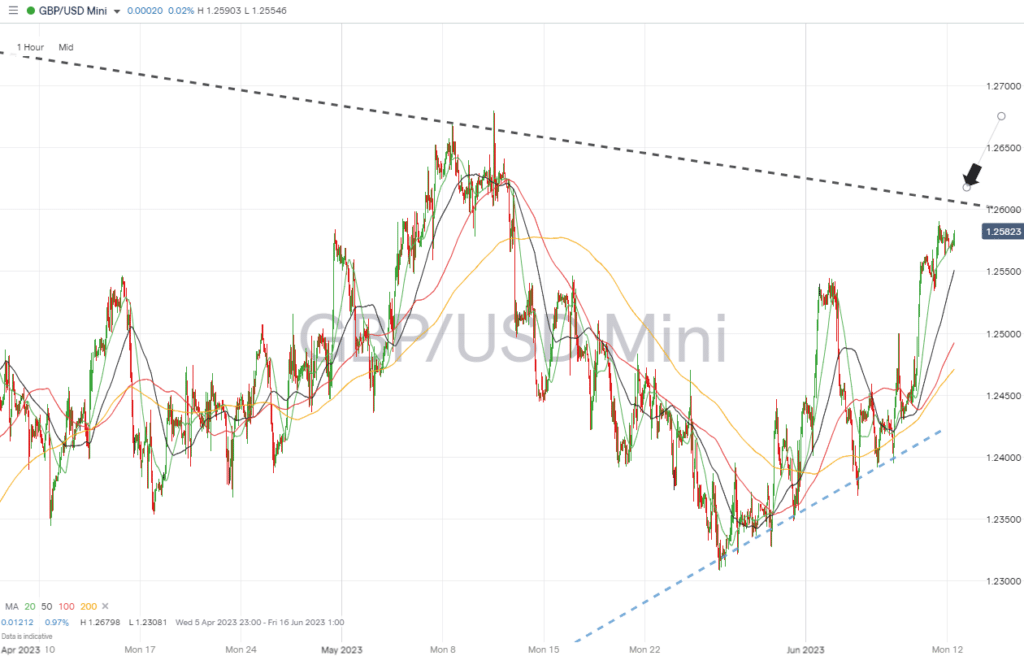

GBPUSD Chart – Hourly Price Chart

Source: IG

Economic data report likely to influence the value of GBP currency pairs:

- Tuesday 13th June – 7 am BST – UK unemployment data. May claimant count expected to fall to 22,000, and the unemployment rate to hold at 3.9% in April. Average earnings to rise to 4.7% for April.

- Wednesday 14th June – 7 am BST– UK GDP (April). Month-on-month growth is forecast to be 0.2% in April.

- Wednesday 14th June – 7 pm BST – US Federal Reserve interest rate decision. The current consensus is that rates will be held at 5.25%. The press conference which follows at 7.30 pm may provide further clues on future policy.

- Thursday 15th June – 1.15 pm BST – ECB interest rate decision. (Press conference at 1.45 pm). Analysts expect rates to rise to 3.5%; further commentary in the press conference may drive volatility.

- Friday 16th June – 4 am BST – Bank of Japan interest rate decision. Analysts forecast rates to remain at -0.1%.

EURUSD

The big event of the week for Eurodollar traders is the announcement by the ECB on Thursday regarding interest rate levels. Analysts are currently pricing in a 25-basis point rise, and any move different to that can be expected to result in increased price volatility in EUR-based currency pairs.

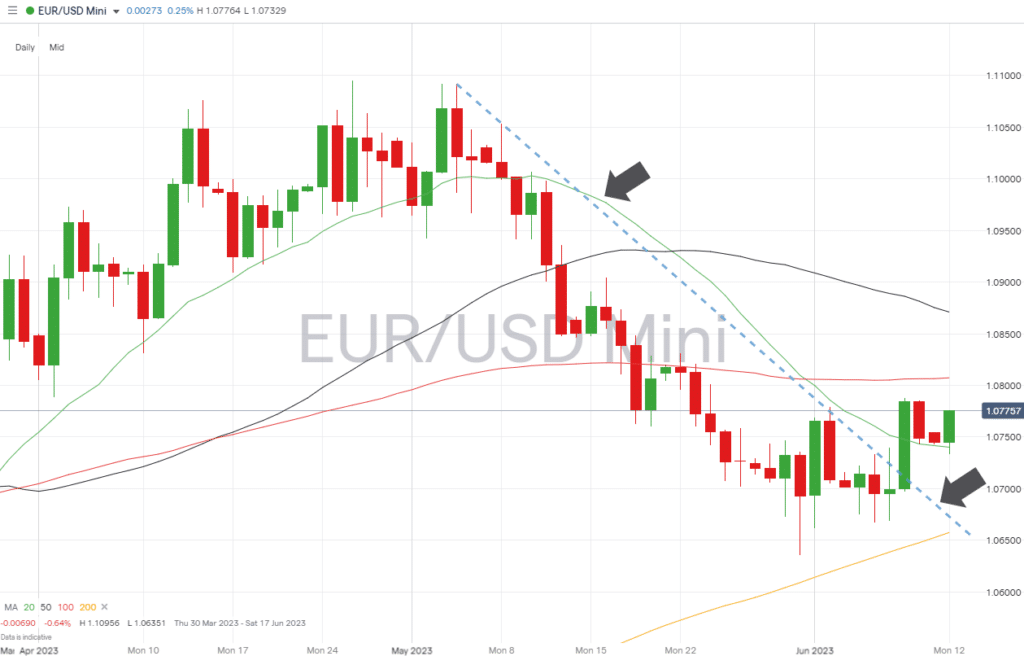

EURUSD Chart – Daily Price Chart – Downwards Price Action

Source: IG

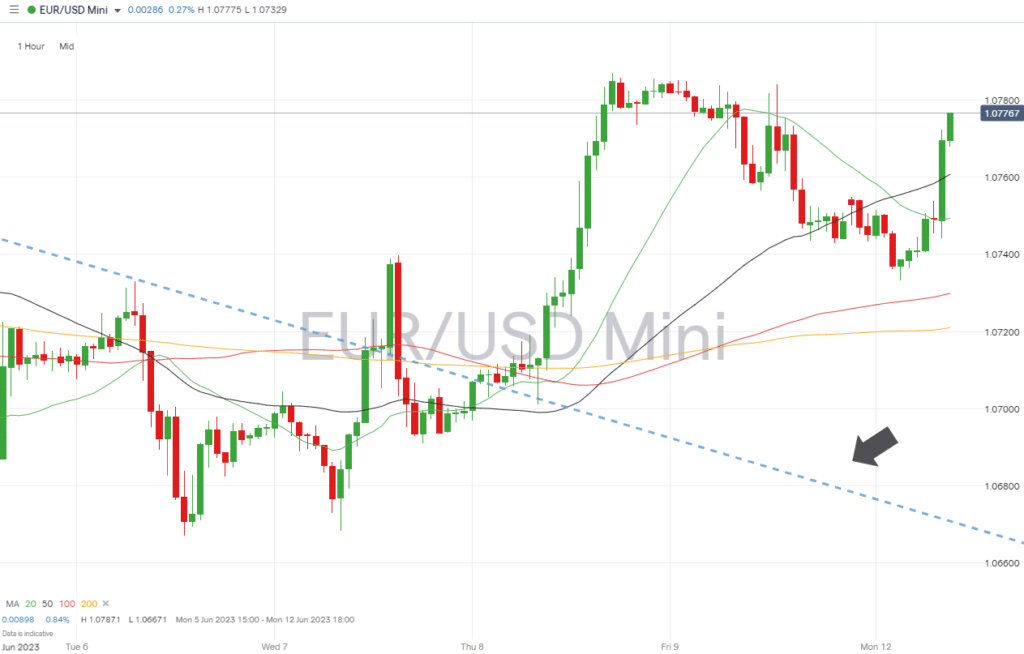

EURUSD Chart – Hourly Price Chart

Source: IG

Economic data report likely to influence the value of EUR currency pairs:

- Tuesday 13th June – 10 am BST – German ZEW index (June). Analysts expect the index to fall to -14.

- Wednesday 14th June – 7 pm BST – US Federal Reserve interest rate decision. The current consensus is that rates will be held at 5.25%. The press conference which follows at 7.30 pm may provide further clues on future policy.

- Thursday 15th June – 1.15 pm BST – ECB interest rate decision. (Press conference at 1.45 pm). Analysts expect rates to rise to 3.5%; further commentary in the press conference may drive volatility.

- Friday 16th June – 4 am BST – Bank of Japan interest rate decision. Analysts forecast rates to remain at -0.1%.

Indices

S&P 500

Traders of US stocks can expect significant price moves this week. Two big news events will influence investor sentiment, with the US inflation report due out on Tuesday and the interest rate announcement by the Federal Reserve out the next day.

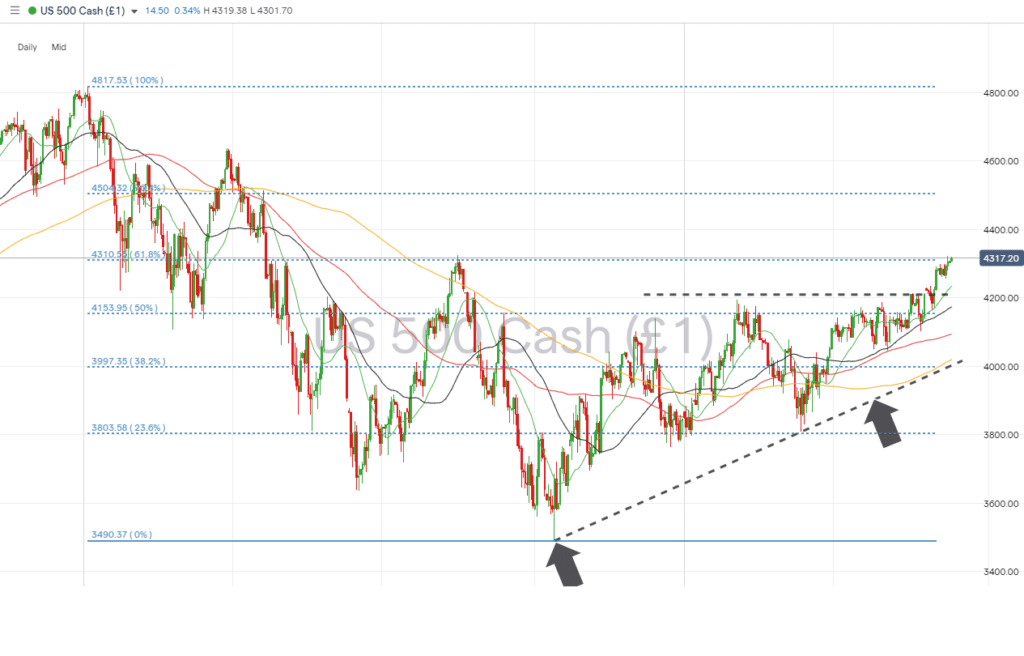

S&P 500 Chart – Daily Price Chart

Source: IG

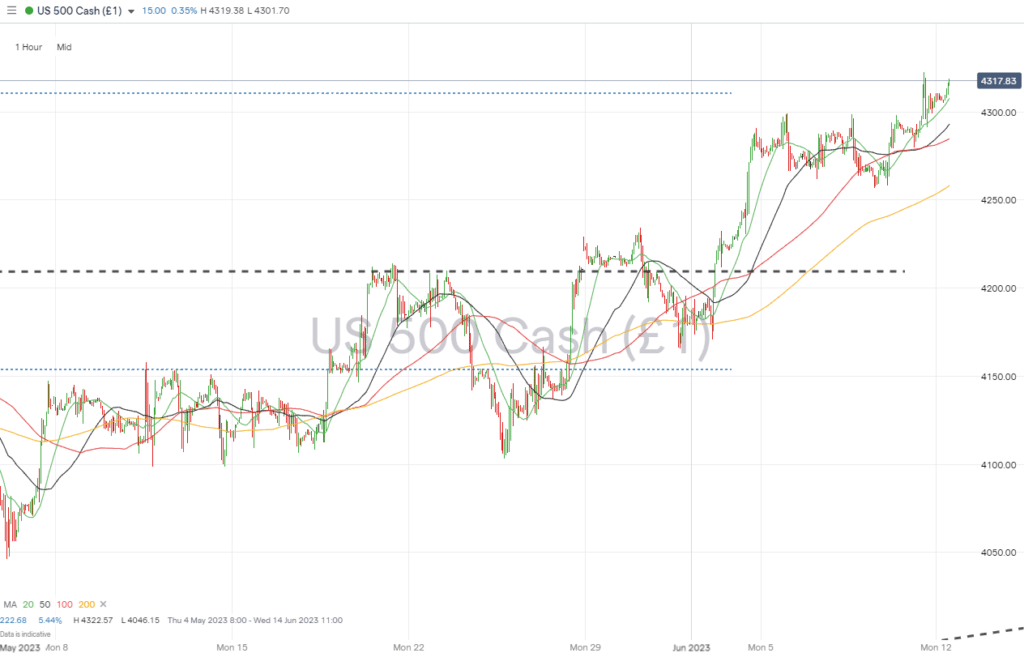

S&P 500 – Hourly Price Chart

Source: IG

Economic data report likely to influence the value of US stocks:

- Tuesday 13th June – 1.30 pm BST – US CPI Inflation Report (May). Analysts expect inflation to fall to 4.7% year-on-year, down from 4.9%, and 0.3% from 0.4% month-on-month.

- Wednesday 14th June – 7 pm BST – US Federal Reserve interest rate decision. The current consensus is that rates will be held at 5.25%. The press conference which follows at 7.30 pm may provide further clues on future policy.

- Thursday 15th June – 1.15 pm BST – ECB interest rate decision. (Press conference at 1.45 pm). Analysts expect rates to rise to 3.5%; further commentary in the press conference may drive volatility.

- Friday 16th June – 4 am BST – Bank of Japan interest rate decision. Analysts forecast rates to remain at -0.1%.

People Also Read:

- The Case for Buying EURUSD Ahead of Next Week’s Interest Rate Decisions

- WEEKLY FOREX TRADING TIPS – 2023.06.12

- The Best and Worst Performing Currency Pairs in May 2023

- Forex Market Forecast for June 2023

Risk Statement: Trading financial products carries a high risk to your capital, especially trading leverage products such as CFDs. They may not be suitable for everyone. Please make sure that you fully understand the risks. You should consider whether you can afford to risk losing your money.

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk