FOCUS ON: Markets Brace for Busy News Week.

- US GDP numbers will offer an insight into the health of the world’s largest economy.

- Earnings season hits top gear with big names due to update investors.

- Bank of Japan on Friday to update markets on interest rate policy.

Last week’s consolidation-based market price moves look like a case of the quiet before the storm. A wide range of reports are due to be released in the coming days, each with the potential to trigger a move in asset prices.

Forex

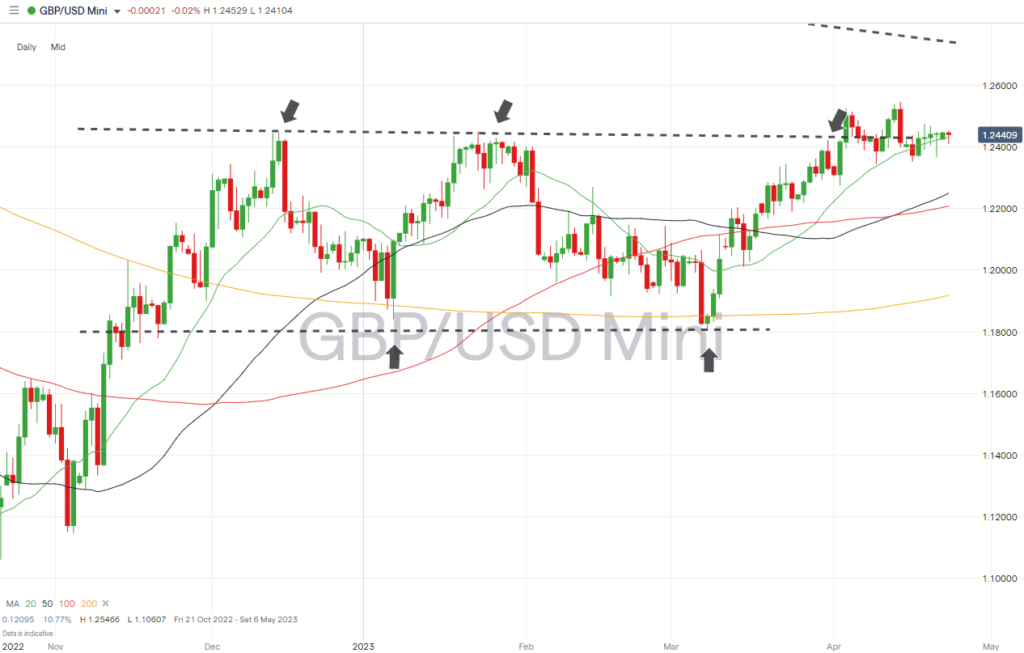

GBPUSD

The absence of UK-specific economic data releases doesn’t necessarily mean sterling-based currency pairs won’t see an uptick in price volatility this week. Hugely influential reports coming out of the US can influence GBPUSD and potentially trigger the next price trend, and FTSE 100 firms will also be releasing full-year earnings numbers to the market.

Daily Price Chart – GBPUSD Chart – Daily Price Chart

Source: IG

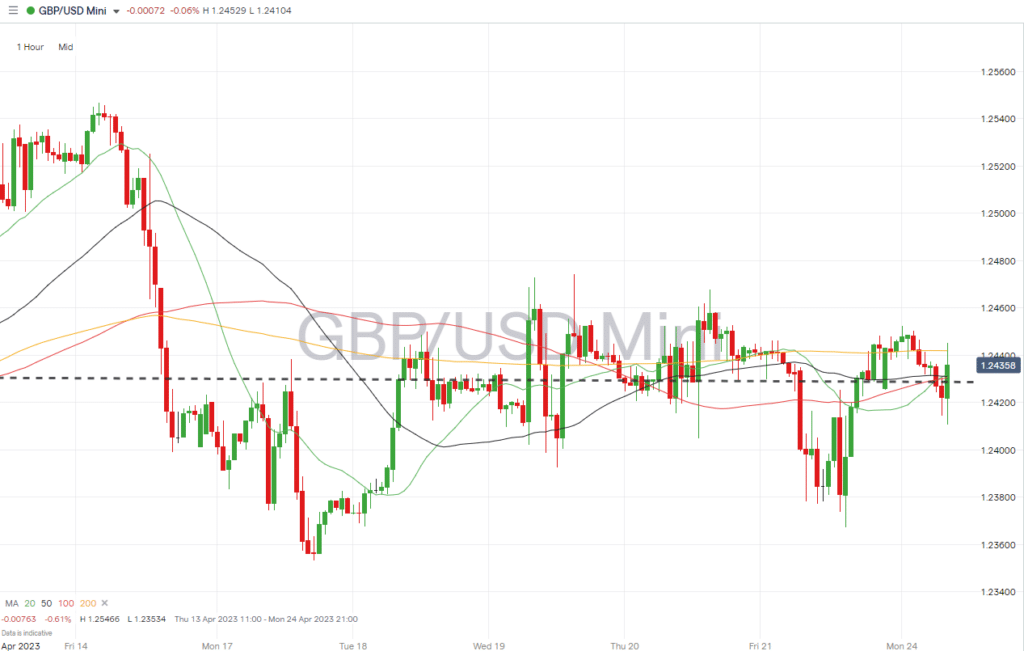

GBPUSD Chart – Hourly Price Chart

Source: IG

UK company reports:

- Tuesday 25th April – Whitbread, Avacta, full-year earnings.

- Wednesday 26th April – Metro Bank, Reckitt Benckiser, trading updates. GSK and Standard Chartered quarterly earnings.

- Thursday 27th April – J Sainsbury full-year earnings. AstraZeneca and Barclays release quarterly earnings.

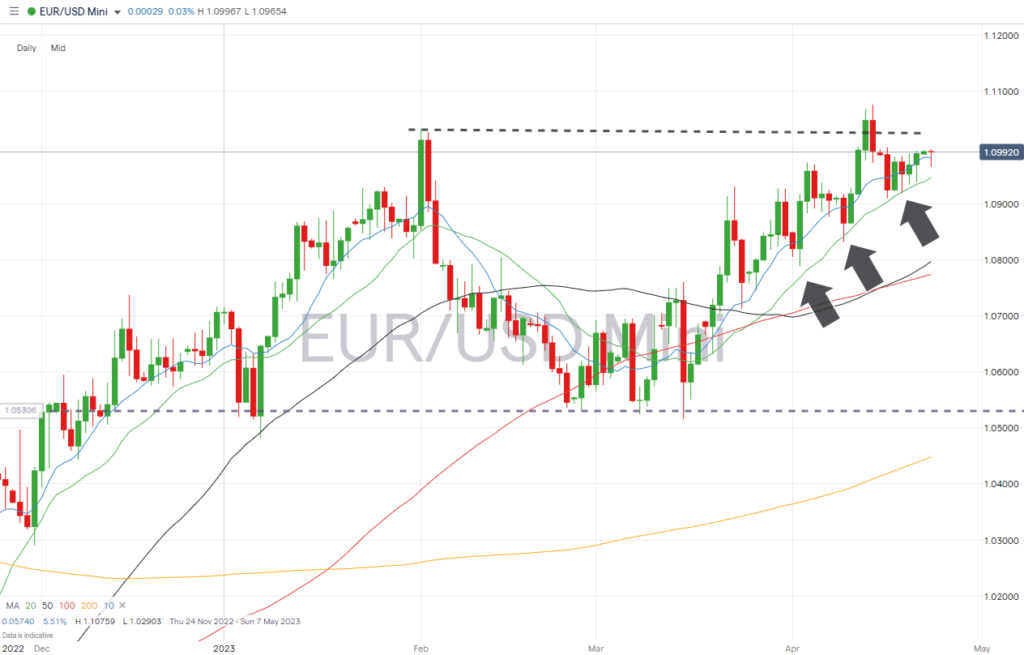

EURUSD

Euro-dollar traders will this week see significant economic and corporate reports released on a near-daily basis. Eurozone consumer confidence and German GDP reports are the highlights, with US earnings reports adding more data into the mix.

EURUSD Chart – Daily Price Chart

Source: IG

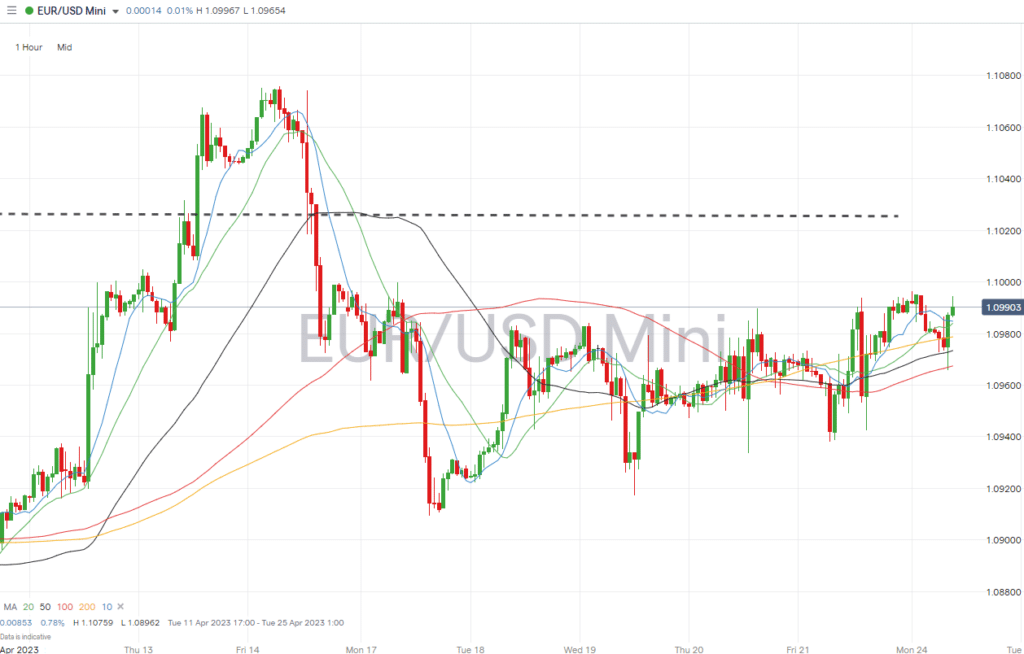

EURUSD Chart – Hourly Price Chart

Source: IG

Eurozone asset-influencing economic data:

- Monday 24th April (9 am GMT) – German IFO index (April): Analysts predict the business climate index to rise to 94.4.

- Wednesday 26th April (7 am GMT) – German GfK consumer confidence (May): Analysts expect the index to rise to -28.

- Friday 28th April (9 am GMT) – German GDP (Q1, flash): Analysts forecast quarter-on-quarter growth to be -0.1%, from -0.4%, and -1.2% year-on-year from 0.9%.

Indices

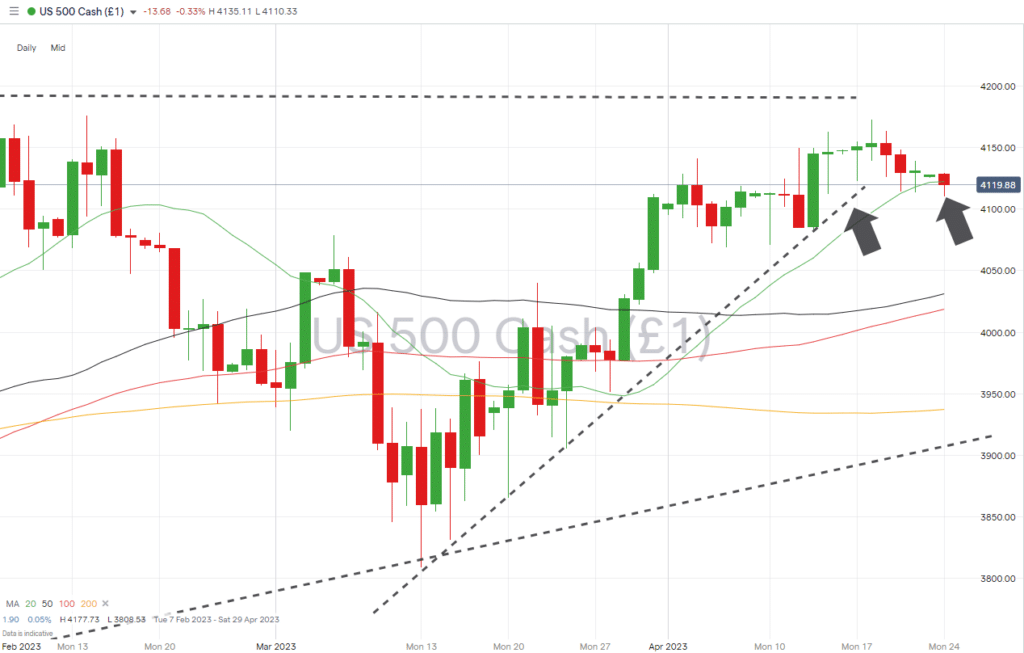

S&P 500

The US Q1 GDP report is due on Thursday and is surrounded by a wide range of Q1 updates from big corporations as earnings season gets into full swing.

S&P 500 Chart – Daily Price Chart – SMA Support

Source: IG

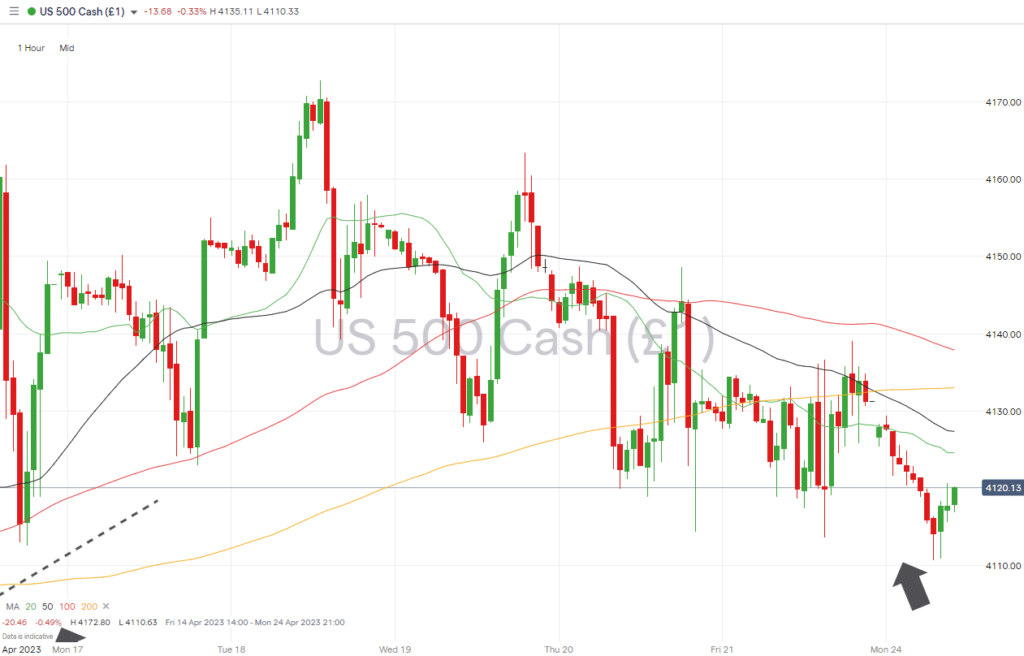

S&P 500 – Hourly Price Chart

Source: IG

US economic data:

- Tuesday 25th April (3 pm GMT) – US consumer confidence (April) Analysts predict confidence index to weaken to 104.2.

- Wednesday 26th April (1.30 pm GMT) – US durable goods orders (March): orders are forecast to rise 0.9% overall and fall 0.3%, excluding transportation orders.

- Thursday 27th April (1.30 pm GMT) – US GDP Q1 (preliminary) Growth is expected to be 2% quarter-on-quarter, down from 2.6% in Q4.

- Friday 28th April (2.45 pm) – US Chicago PMI (April): Analysts expect index to fall to 42.8.

US company reports:

- Monday 24th April – Coca-Cola quarterly earnings.

- Tuesday 25th April – Quarterly earnings released by Microsoft, Alphabet, General Motors, Visa, General Electric, and McDonald’s.

- Wednesday 26th April – Boeing, Meta Platforms, and eBay release quarterly earnings.

- Thursday 27th April – Amazon, Caterpillar, Intel and Snap release quarterly earnings.

- Friday 28th April – Chevron and Exxon Mobil quarterly earnings.

People Also Read:

- WEEKLY FOREX TRADING TIPS – 2023.04.24

- Prospects for GBPUSD after UK Inflation Remains in Double-Figures

- US Reports Hint at GBPUSD Breaking Through Triple-Top Resistance

Risk Statement: Trading financial products carries a high risk to your capital, especially trading leverage products such as CFDs. They may not be suitable for everyone. Please make sure that you fully understand the risks. You should consider whether you can afford to take the risk of losing your money.

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk