FOCUS ON: Banking Sector Concerns

- With a few major announcements due this week, news flow from the finance sector can be expected to drive price changes.

- Price volatility is expected to remain high following collapse of SVB and Credit Suisse.

- Forex markets poised for a move in either direction, with currency pairs forming short-term consolidatory price patterns.

The focus on the banking sector has turned to German giant Deutsche Bank. Following the demise of SVB and Credit Suisse, concerns about a bank the size of Deutsche have left markets treading water while investors wait for an update on the health of the financial system.

Forex

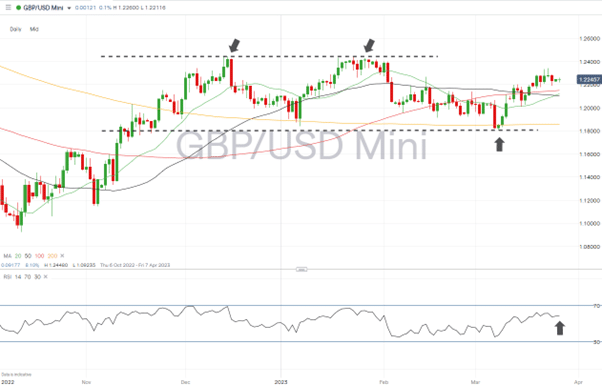

GBPUSD

The decision by the Bank of England last week to raise interest rates by 25 basis points was in line with the majority of analyst expectations, but also triggered a debate on how the hawkish policy is impacting the economy. This line of discussion has room to run, with many pointing this could be the time the BoE pivots towards a more ‘dovish’ policy.

Daily Price Chart – GBPUSD Chart – Daily Price Chart

Source: IG

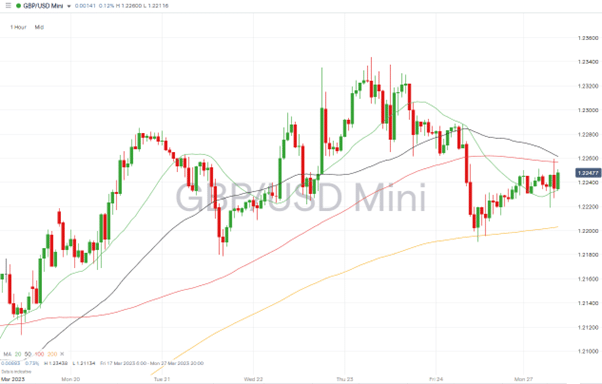

GBPUSD Chart – Hourly Price Chart

Source: IG

UK company reports:

- Tuesday 28th March – AG Barr full-year earnings, Ocado trading update.

- Wednesday 29th March – Next Plc full year earnings.

- Thursday 30th March – Moonpig trading update.

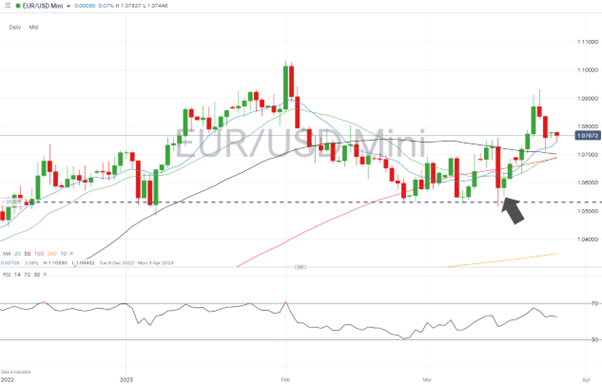

EURUSD

Further concern about the health of Eurozone banks could trigger a move into other currencies, which are often seen as a safe haven. EURJPY and EURUSD currency pairs can be expected to experience higher than average levels of price volatility this week.

EURUSD Chart – Daily Price Chart

Source: IG

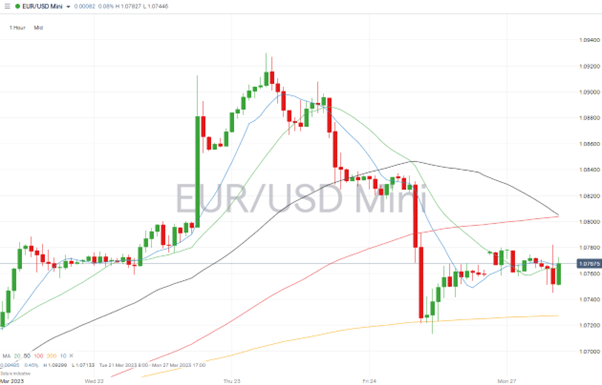

EURUSD Chart – Hourly Price Chart

Source: IG

Eurozone economic data:

- Monday 27th March – 9am (GMT) – German IFO index (March), analysts expect business climate index to fall to 90.9.

- Thursday 30th March – 1pm (GMT) – German CPI (March, preliminary) analysts expect prices to rise 8.4% year-on-year and 1.5% month-on-month, from 8.7% and 0.8% respectively.

- Friday 31st March – 9am (GMT) – 10am – eurozone CPI (March), analysts expect CPI growth to fall to 7.8% from 8.5% year-on-year.

- Friday 31st March – 9am (GMT) – 10am – eurozone unemployment rate (March), analysts expect unemployment levels to be unchanged at 6.7%

Indices

S&P 500

US stock prices can be expected to react to the release of consumer confidence data on Tuesday. The PCE (Personal Consumption Expenditure) index data released on Friday will also offer an insight into how the US economy is holding up in the face of continued interest rate rises.

S&P 500 Chart – Daily Price Chart – Trendline Support

Source: IG

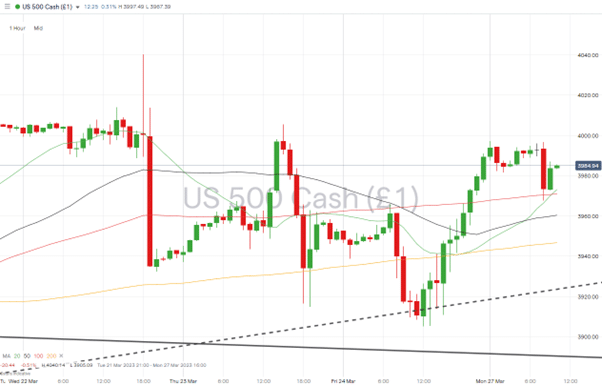

S&P 500 – Hourly Price Chart – Trendline Support

Source: IG

US economic data:

- Tuesday 28th March – 3pm (GMT) – US consumer confidence (March), analysts expect index to fall to 101.

- Friday 31st March – 1.30pm (GMT) – US core PCE price index (February) analysts expect index to fall to 0.4% from 0.6%.

People Also Read:

- Short, Medium and Long-Term Forecasts for EURUSD Following ‘Dovish’ Fed Announcement

- BoE Raises Interest Rates, Says Inflation to Fall Sharply For The Rest of 2023

- WEEKLY FOREX TRADING TIPS – 2023.03.27

Risk Statement: Trading financial products carries a high risk to your capital, especially when trading leveraging products such as CFDs. These products may not be suitable for everyone. Please make sure that you fully understand the risks before trading; you should consider whether you can afford to take the risk of losing the money that you may invest.

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk