FOCUS ON: Central Bank Interest Rate Decisions

- RBA and RBC are to update markets on interest rate decisions this week.

- Further insight is to be offered by decisions of these economies that are favourites of ‘risk-on’ investors.

- The stronger than expected US Non-Farm Payroll jobs number on Friday triggered an upward move in stocks.

The threat of the US debt ceiling leading to a government default was avoided, triggering an upward move in risk-on assets. Stocks rallied strongly on Friday, with the S&P 500 gaining 1.36% in value during the trading session.

The news out of the Capitol also triggered a surge in demand for the US dollar which means that the currency maintains the upward trajectory which dates back to the beginning of May. All currency pairs can be expected to be influenced by updates from the central banks of Australia and Canada, which both set interest rate targets this week. The RBA makes its decision public at 5.30 am BST on Tuesday 7th June, and the RBC updates markets at 3 pm BST on Wednesday 8th June.

Forex

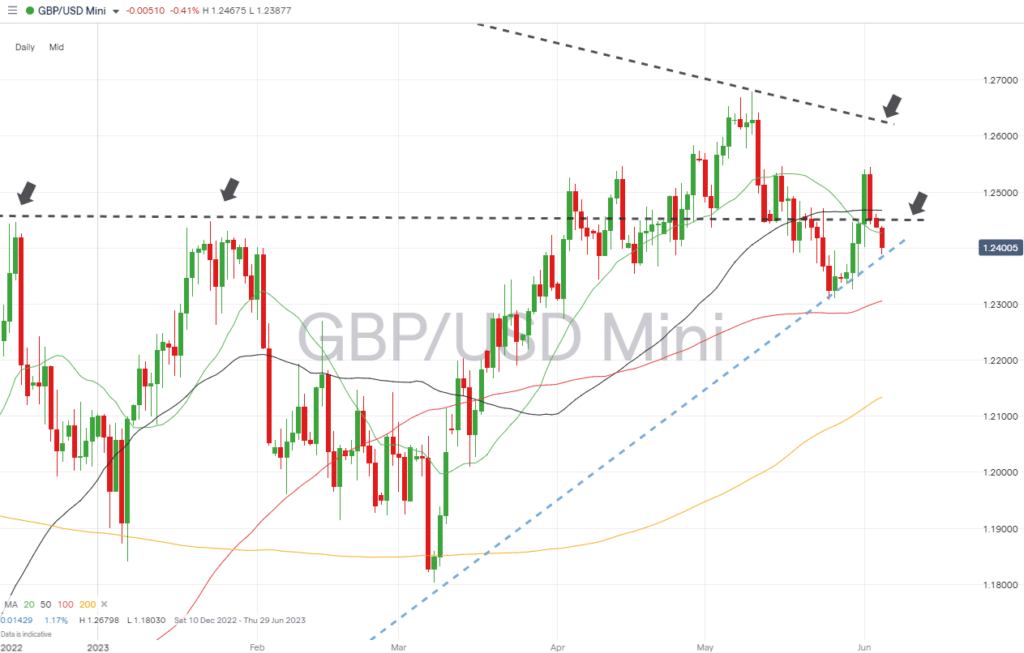

GBPUSD

For the first time in almost a month, the trading week for London exchanges won’t be foreshortened by a national holiday. It could be a long week for traders of GBP-based currency pairs with few significant news releases due. That leaves room for price consolidation patterns to form and price to trade within a relatively tight range.

Daily Price Chart – GBPUSD Chart – Daily Price Chart

Source: IG

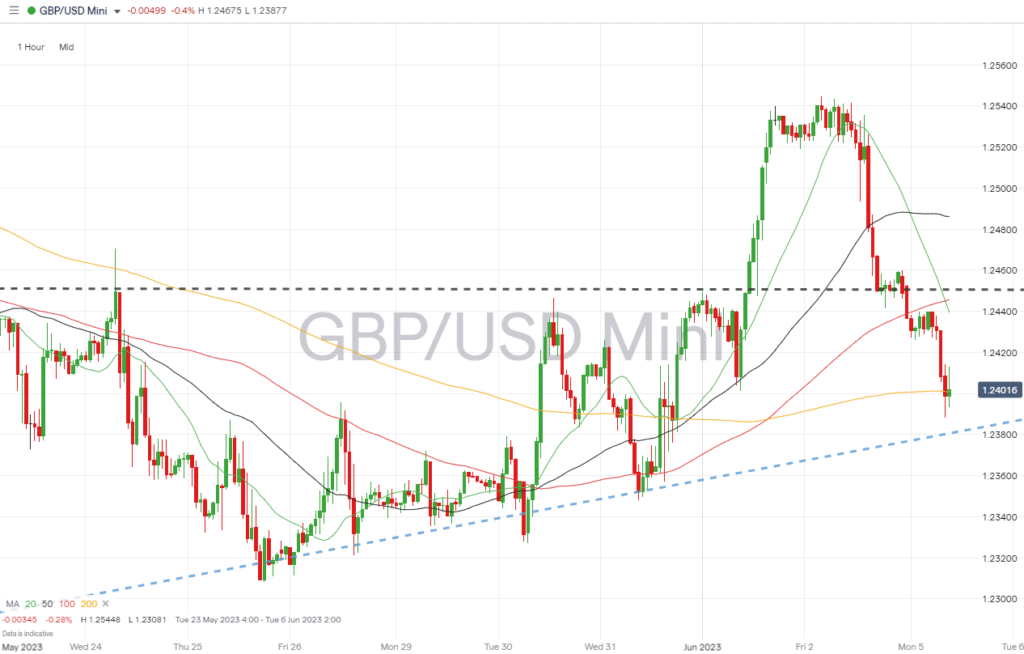

GBPUSD Chart – Hourly Price Chart

Source: IG

UK earnings reports:

- Monday 5th June – Ferguson, British American Tobacco.

- Thursday 8th June – Wizz Air, First Group, Mitie, Crest Nicholson, Foxtons.

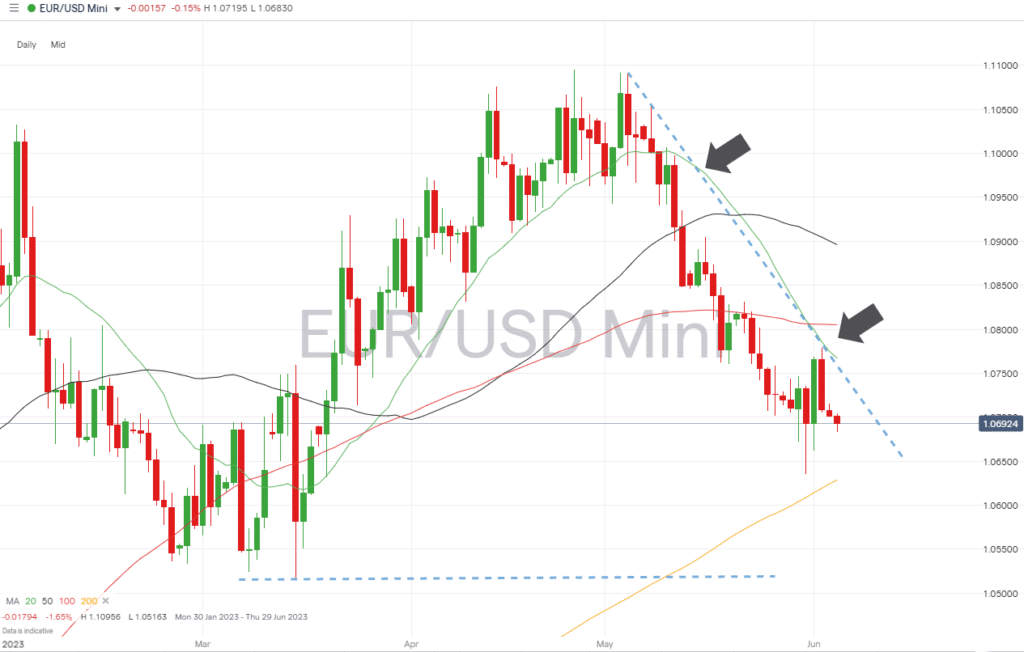

EURUSD

Last week’s softer than expected Eurozone inflation numbers triggered a sell-off in the euro on the back of suggestions that ECB interest rates might not have to be raised as high as previously forecast. Traders of the Eurodollar have little in terms of news announcements to contend with this week, but both the ECB and US Federal Reserve update markets during the week beginning 12th June. That can trigger price moves as investors build positions to trade those news events.

EURUSD Chart – Daily Price Chart – Downwards Price Action

Source: IG

EURUSD Chart – Hourly Price Chart

Source: IG

Indices

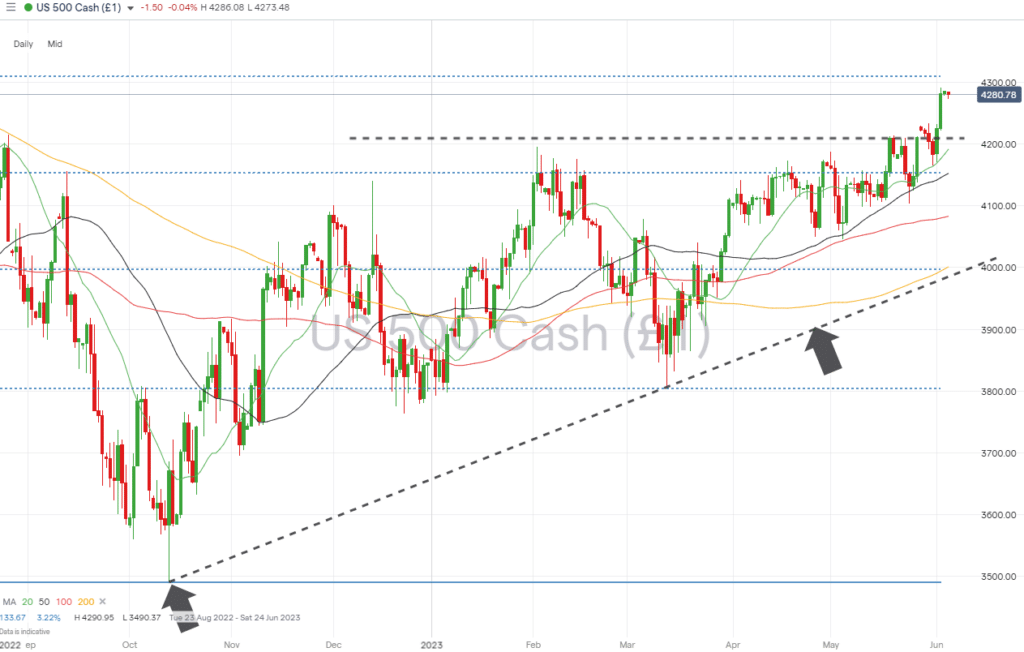

S&P 500

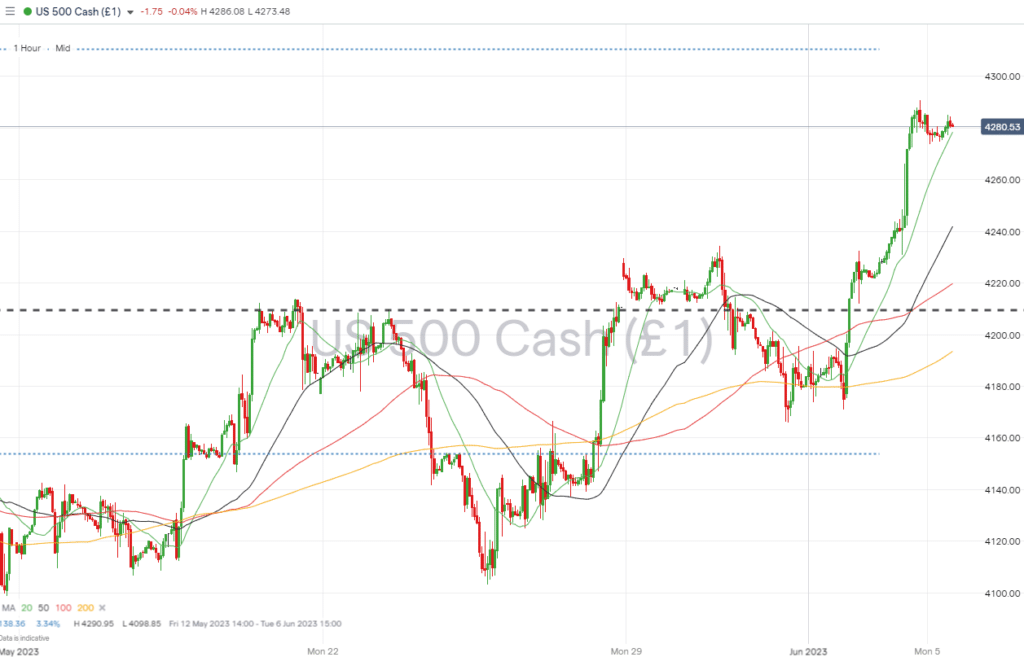

The S&P 500 index finished the week in bullish mode after the debt-ceiling crisis was resolved, and better than expected US Non-Farm Payroll employment data pointed to the US economy showing resilience. The coming week will be quieter for traders of US-based currency pairs, but with the US Federal Reserve due to meet on 13th – 14th June, investors will be beginning to take positions to trade that news event.

S&P 500 Chart – Daily Price Chart

Source: IG

S&P 500 – Hourly Price Chart

Source: IG

US economic data:

- Monday 5th June – 3.00 pm BST – US ISM services PMI (May): Analysts forecast the index to rise to 52.1 from 51.9.

People Also Read:

- The Best and Worst Performing Currency Pairs in May 2023

- Forex Market Forecast for June 2023

- Surprise German GDP Data Triggers Euro Sell Off

Risk Statement: Trading financial products carries a high risk to your capital, especially trading leverage products such as CFDs. They may not be suitable for everyone. Please make sure that you fully understand the risks. You should consider whether you can afford to risk losing your money.

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk