After a week of raucous behaviour, financial markets are approaching the coming week with a fair degree of calm. The sideshows of meme stocks and crypto volatility are still managing to generate some fireworks, but there is a sense that they may be background noise rather than centre stage. Global stock futures have started the week flat and indicators on major currency pairs and precious metals are mixed with hourly and daily metrics failing to align. It could be that we see sideways trading continue into the rest of the week.

Instrument | Hourly | Daily | |

GBP/USD | 1.4125 | Strong Buy | Strong Buy |

EUR/USD | 1.2149 | Strong Sell | Strong Sell |

FTSE 100 | 7,062 | Strong Sell | Neutral |

S&P 500 | 4,218 | Strong Buy | Strong Buy |

Gold | 1,881 | Strong Sell | Strong Buy |

Silver | 2,748 | Strong Sell | Neutral |

Crude Oil WTI | 68.99 | Sell | Strong Buy |

Bitcoin | 35,960 | Strong Sell | Strong Sell |

Source: ForexTraders Technical Analysis

Many are pencilling in Thursday’s US inflation data as the event to watch. The Consumer Price Index (CPI) report for April could show signs of the US economy overheating, which would in turn put more pressure on the US Federal Reserve to increase interest rates. The problem for the Fed is that the price rises are not across the board. Some sectors are rebounding from the pandemic, but others are not. The two-tier state of the US economy is probably best demonstrated by last Friday’s employment numbers, which included some big disappointments. Nonfarm payrolls in May increased by 559,000 but missed the analyst forecast of 671,000.

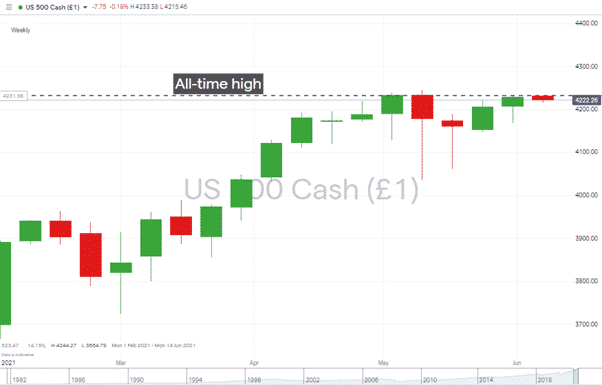

That ‘bad number’ caused a spike in equity prices as traders determined that US monetary policy will remain dovish. The question is whether it’s enough to take the S&P 500 and its peers above their all-time highs. Friday’s closing price of the S&P 500 was 4228, just below the record weekly close of 4233 on 7th May.

Source: IG

The index was trading back at 4222 after the open of European markets on Monday and could tread water in the run-up to Thursday’s announcement. Those suffering from nerves at these levels will take little comfort from the words of US Treasury Secretary Janet Yellen, who over the weekend appeared to be preparing the markets for rate hikes. Speaking with Bloomberg about the planned $400bn per year fiscal stimulus package, Yellen, herself an ex-chair of the Fed, drifted onto the subject of monetary policy. Her statement that higher interest rates could be good news not for the first time stepped on the toes of the current Fed management.

“If we ended up with a slightly higher interest rate environment it would actually be a plus for society’s point of view and the Fed’s point of view,” she said.

Source: Bloomberg/CNBC

Will There Be a Correction in Equities?

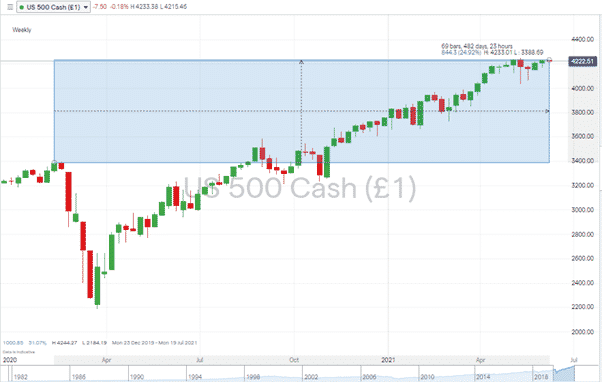

The S&P 500’s current price values it at almost 25% higher than pre-pandemic levels. A lot of this surge is down to supportive medicine administered by central banks and governments. The air could be getting thin for equities, especially if Thursday’s CPI data confirms that the US Fed has no more rabbits left to pull out of the hat.

Source: IG

If you want to know more about this topic, please contact us at [email protected].

Are you ready to trade?

Sign up with Your capital is at risk

Your capital is at risk

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk