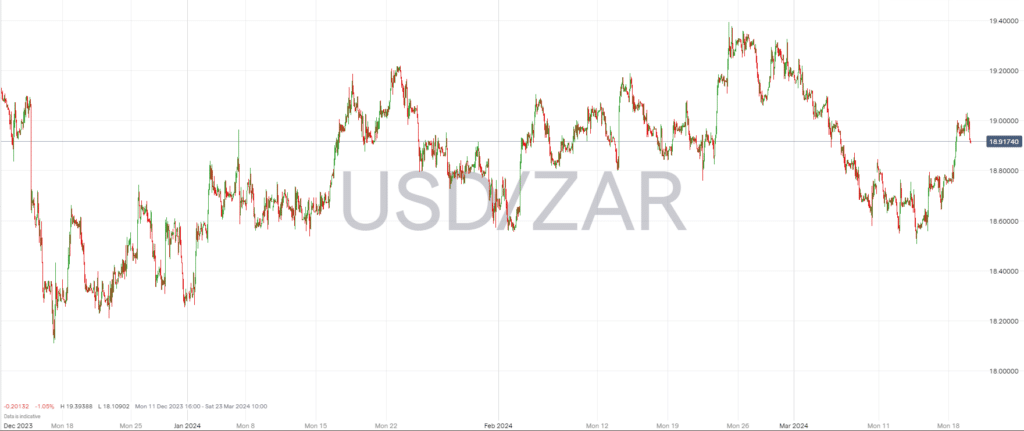

In early trading on Tuesday, USDZAR felt the pressure of an intensifying global financial environment as the U.S. dollar gained strength, resulting in a dip for the South African Rand. Market participants are treading cautiously ahead of the Federal Reserve’s imminent monetary policy decision, an event that invariably sends ripples across worldwide currency valuations.

By 0625 GMT, the rand was observed to trade at 19.0200 against the dollar, marking a 0.4% retreat from its preceding close. This move underscores the sensitivity of the South African currency to international monetary currents, particularly the shifts emanating from the Fed’s policy direction.

In the background, U.S. economic indicators have painted a picture of persistent high inflation. Investors, interpreting these signals, have consequently recalibrated their expectations around the Federal Reserve’s interest rate roadmap. Anticipations of rate cuts have undergone adjustments, contributing to the prevailing sense of uncertainty which typically does not bode well for currencies like the rand.

This sentiment is also reflected in domestic economic forecasts. Analysts anticipate that South Africa will report a rise in its annual inflation rate, expecting a climb to 5.5% in February from January’s figure of 5.3%. Inflation trends are critical for the Reserve Bank of South Africa as it continues its balancing act of monetary policy to sustain growth while mitigating price rises.

Moreover, South Africa’s fiscal health, as gauged by outcomes in the sovereign debt market, showed signs of strain. The benchmark 2030 government bond lost ground, with yields—the return investors demand to hold such debt—ticking up 4 basis points to 10.535% in the early deals of the day. Bond yields serve as a vital sign of investor confidence and the cost of borrowing for the government.

It’s essential to acknowledge that, akin to its emerging market counterparts, USDZAR’s trajectory is deeply intertwined with global financial dynamics, notably U.S. monetary decisions. With U.S. bond yields on the ascent, currency markets worldwide are grappling with the consequences—a stronger dollar invariably means emerging market currencies face depreciation pressures.

Analysts at ETM Analytics have remarked on this phenomenon, noting the inverse relationship between rising U.S. bond yields and the relative strength of currencies like the rand against the greenback. As the world awaits the Federal Reserve’s next move, economies on the southern tip of Africa brace for the impact, highlighting the interconnected nature of modern financial systems.

Don’t Trade Before you see this!

We consulted our team of experts and put together 10 tips to help improve your trading.

These tips could help make you a better trader – and we’re giving them away for free!

Related Articles

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk