| Investous pros | Investous cons |

|---|---|

| More than 270 assets to trade on | Some resources limited depending on account type |

| Detailed education section | No negative balance protection on professional accounts |

| Broad range of tools for clear oversight on investments |

Trader’s Viewpoint

- Investous is a relatively new player in the online retail broker industry. It is regulated by the International Financial Services Commission of Belize. Like many of its competitors Investous offers the MetaTrader MT4 platform allowing for seamless mobile trading and WebTrader platform. It is an ideal platform for many traders of all backgrounds and beginners are likely to find the guidance and education sections particularly useful.

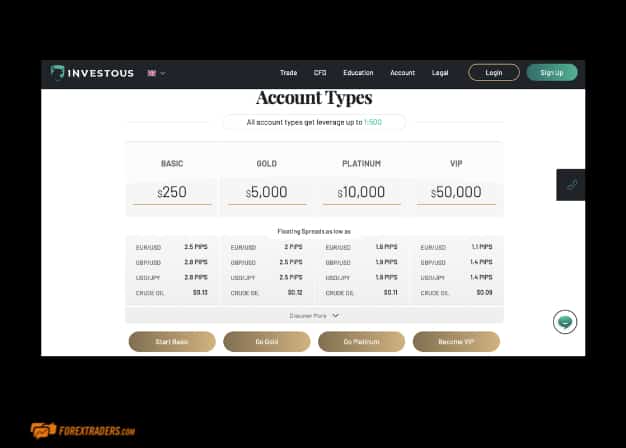

- There are four account types available with Investous, with the available account options being dependent on the size of your deposit and, to some extent, the overall experience as a trader. As discussed, basic accounts require a USD $250 deposit. Gold accounts require a USD $5,000 deposit, whilst Platinum accounts require a USD $10,000 deposit and VIP Accounts a USD $50,000 deposit.

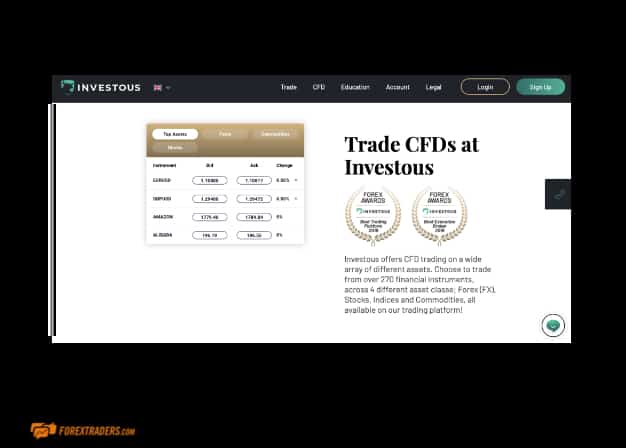

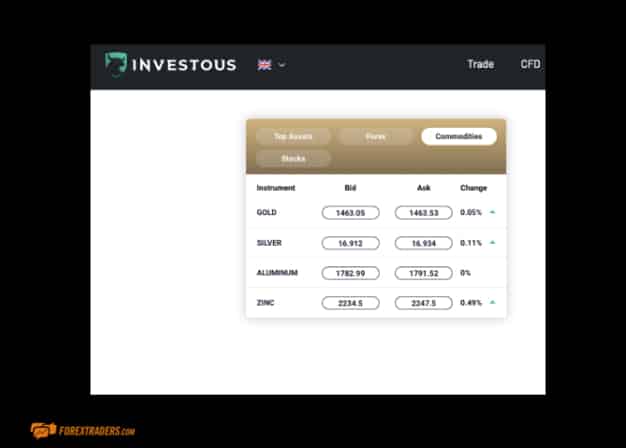

- Investous offers the trader the opportunity to invest in over 270 tradeable assets. It offers 46 forex pairs with a good selection of exotic currencies including the Indian Rupee, South African Rand, Singapore Dollar, Turkish Lira, Swedish Krona, Russian Ruble, Polish Zlty, Norwegian Krone, Mexican Peso, Hungarian Forint, Hong Kong Dollar and Danish Krone. Other assets include CFDs on gold, silver, palladium and platinum, oil, natural gas, commodities like aluminium, zinc, copper, cotton, cocoa, corn, wheat, coffee, sugar, orange juice, and soybean a good selection of stocks, indices in addition to crypto coins, among which there is Bitcoin, Litecoin, Ethereum, Ethereum Classic, Dash, Ripple, Monero, Stellar and Bitcoin Gold.

Investous asks for a minimum deposit of USD250 when opening a Basic account. When looking at the Forex and Commodity spreads and fees, the best rates are with a VIP account, offering floating spreads as low as 0.9 pips for EUR/USD, 1.1 pips for GBP/USD, USD $0.05 for crude oil and just USD $0.22 for gold. For Platinum accounts, the spreads are closer to 1.4 pips, 1.6 pips, USD $0.06 and $0.39 respectively. Gold enjoy spreads of 1.8 pips, 2.2 pips, USD $0.06 cents and USD $0.49 respectively. Basic accounts are out at 2.3 pips for EUR/USD, and marginally higher across the range of tradeable assets. Withdrawal fees are high relative to peers.

Investous has a strong offering of educational resources for clients of all skill levels. It is important to note that more resources become available depending on the account type the trader has set up. The Investous platform has an easy-to-access educational site on leverage and margins and how best to take advantage whilst taking into account the risks. The technical indicators and analysis section is useful for all types of traders. Elsewhere on the website, Investous has an Economic calendar on its portal to offer additional support to its clients and is an undoubted positive feature. There is also an extensive educational video library.

Investous allows for a very competitive access to markets with an offering in over 270 tradeable assets. There are multiple types of accounts to choose from depending upon the size of the deposit and experience of the trader. The Demo account gives the client the same prices and functionality as live pricing in order for the trader to familiarise themselves with the portal. Educational support is very strong, but adjusts according to the level of account chosen. Investous has certainly made some considerable progress in a very short period, it is fully regulated and has developed a strong asset trading coverage.

About

Regulated and licensed by the International Financial Services Commission of Belize, Investous has been operating out of Cyprus and regulated in Europe via the Cyprus Securities and Exchange Commission (CySEC). This subtle change of regulation has unsettled some clients of Investous, but the key metrics of the platform remain unchanged.

While Investous is still a relatively new broker in its very competitive field, this has not stopped it receiving positive commentary. In its brief time to date, Investous has already been awarded the Best Trading Platform in 2018 and Best Execution broker in the same year at the annual Forex Awards. In addition to this, the company behind platform, IOS investments limited, located at 5, cork street, Belize City, Belize, has a longer history and is well regarded in the Financial Industry.

Who does Investous appeal to?

Investous stands up well within a competitive group of Online Trading Portals that appeal to both beginner and experienced traders. It is a relatively new Forex and CFD broker that provides users with CFD trading options across an array of different assets and classes, including Forex, Indices, Stocks and Commodities, and as such, is ideal for traders looking for a variety of options to trade in. Like many of its competitors Investous offers the MT4 platform allowing for seamless mobile trading and WebTrader platform. It is an ideal platform for many traders of all backgrounds and beginners are likely to find the guidance and education sections particularly useful.

Account Types

There are four account types available with Investous, with the available account options being dependent on the size of your deposit and, to some extent, your experience as a trader. As discussed, basic accounts require a USD $250 deposit. Gold accounts require a USD $5,000 deposit, whilst Platinum accounts require a USD $10,000 deposit and VIP Accounts a USD $50,000 deposit.

The maximum leverage permitted on Forex transactions with Investous is 1:30. This applies across all the account levels highlighted above and is in line with the latest European Securities & Market Authority (ESNA) regulations. For very experienced clients it may be interesting to note that Investous offers a Professional account. These remove the ESMA restrictions, so that these accounts can enjoy higher leverage up to 1:200. They would though lose the negative balance protection. Additional criteria would be required for traders to ensure they have the requisite experience and capital at their disposal before opening such a professional account.

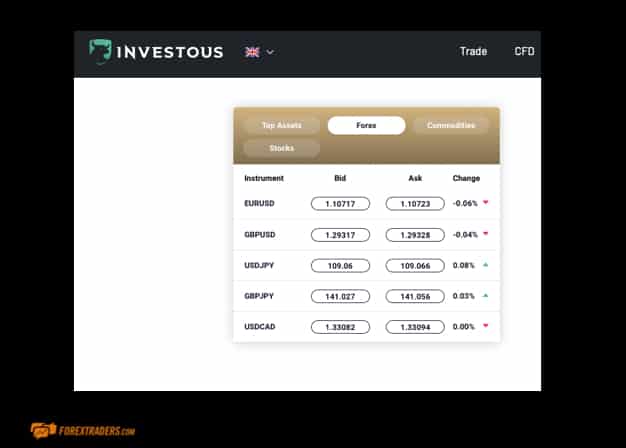

Markets and territories

Investous offers services within Switzerland and the European Economic Area, bar Belgium, and provides competitive access to markets, allowing the user to invest in over 270 tradeable assets. It offers 46 forex pairs with a good selection of exotic currencies including the Indian Rupee, South African Rand, Singapore Dollar, Turkish Lira, Swedish Krona, Russian Ruble, Polish Zlty, Norwegian Krone, Mexican Peso, Hungarian Forint, Hong Kong Dollar and Danish Krone.

Other assets include CFDs on gold, silver, palladium and platinum, oil, natural gas, commodities like aluminum, zinc, copper, cotton, cocoa, corn, wheat, coffee, sugar, orange juice, soybean and weed, lots of stocks, indices and even crypto coins, among which Bitcoin, Litecoin, Ethereum, Ethereum Classic, Dash, Ripple, Monero, Stellar and Bitcoin Gold. In total, with more than 270 assets for clients to trade, we would see this as an attractive and competitive offering to be had on one platform.

Instruments and spreads

Other assets include CFDs on gold, silver, palladium and platinum, oil, natural gas, commodities like aluminum, zinc, copper, cotton, cocoa, corn, wheat, coffee, sugar, orange juice, soybean and weed, lots of stocks, indices and even crypto coins, among which Bitcoin, Litecoin, Ethereum, Ethereum Classic, Dash, Ripple, Monero, Stellar and Bitcoin Gold. In total, with more than 270 assets for clients to trade, we would see this as an attractive and competitive offering to be had on one platform.

There are different spreads depending on the account the end user has set up. The best rates are with a VIP account, offering floating spreads as low as 0.9 pips for EUR/USD, 1.1 pips for GBP/USD, USD $0.05 for crude oil and just USD $0.22 for gold. For Platinum accounts, the spreads can be as low as 1.4 pips, 1.6 pips. USD $0.06 and $0.39 respectively.

Gold enjoy spreads of 1.8 pips, 2.2 pips, USD $0.06 cents and USD $0.49 respectively. Finally, it is worth noting that, Basic accounts will still get competitive market levels with floating spreads as low as 2.3 pips for EUR/USD, 2.5 pips for EUR/USD, USD $0.08 for crude oil and USD $0.59 for gold.

Fees and Commission

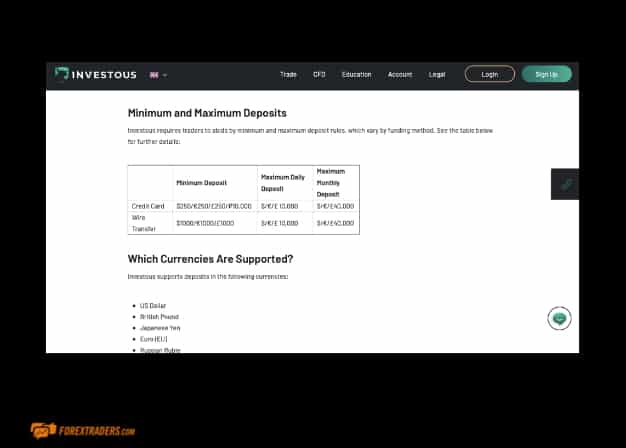

You can start trading at Investous with a minimum deposit of USD250 when opening a Basic account. This is broadly in line with many of its online peers. You can fund your account with the major credit and debit cards, by bank transfer or by using Skrill (electronic payment).

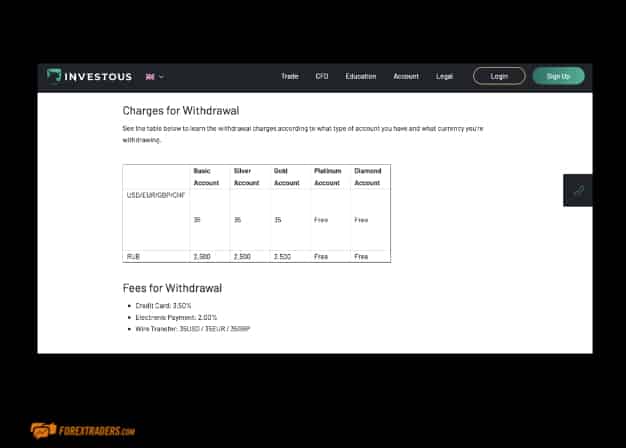

All account types have 100% margin calls, a leverage of up to 1:200 and are not subject to additional commission fees. However, there are differences in terms of the number of free withdrawals each account type receives. VIP accounts pay no fees on withdrawals, whereas Platinum accounts get three free withdrawals per month, Gold accounts one per month and Basic accounts get just the one free withdrawal.

Keep in mind that the client must withdraw their funds via the method that they have deposited them. All withdrawal and deposit transactions can be monitored through the Pending Requests tab on the Investous website. The tab can be found on the users Banking page. There are no deposit fees charged by Investous, but they do charge a withdrawal fee for credit and debit cards of up to 3.5%, which is comparatively high.

The active spread when trading is also very clear, offering traders the opportunity to trade on attractive terms. Investous, for example, offer 2.3 pips spreads when trading the benchmark EUR/USD on basic accounts. They also offer some Forex spreads of just 0.01 pips. In other asset classes, Investous apply some of the smallest spreads available in the market on crypto trading. These spread rates will differ depending on which account the client has set up.

Platform Review

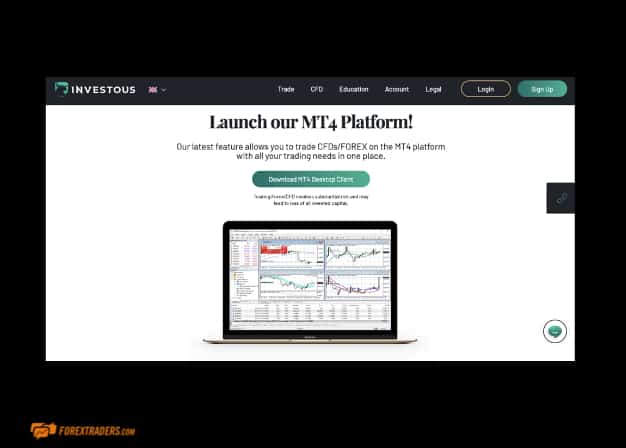

Investous offers a choice of trading platforms. The web-based Web Trader platform is user-friendly and well recognised amongst traders. While the MT4 platform enables seamless mobile trading via iOS, Android and Windows, both enable users to quickly and transparently execute trades in real-time.

MT4 is a well-regarded and popular trading platform. Within the MT4 on the Investous portal there is the ability to customise to suit the user’s needs. There is also the option of three different types of charts and more than 50 technical indicators. All this is available via a link on the Investous website to download the MT4 Desktop client. This is available on most mobile devices.

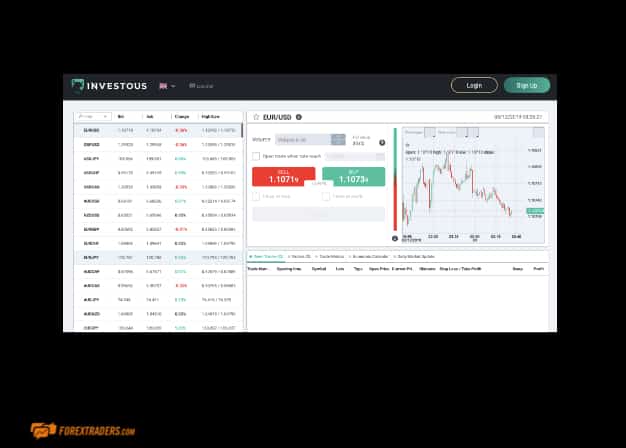

The Investous Web Trader can be opened without logging in or creating an account by selecting trade in the main navigation bar.

If you take a look at the left side of the screen you will find a list of assets. Everything is colour coded, including the bid and offer price, the percentage change and the high/low on the day. In the top left of the screen is the ability to filter the type of assets that a user will wish to focus on. The default position being all assets that are tradeable on the Investous Portal. The right-hand side of the Web Trader screen is taken up by a graph of the asset the user is focused on. The asset can be adjusted by selecting a more appropriate one from the left-most section of the Web Trader screen. When executing you can place a trade by adjusting the volume in lots. There is the additional ability to open the trade when it reaches a certain point, or to close at a stop loss or profit.

Charting and tools

Each platform offers important metrics, educational tips, technical indicators and advice to help all types of traders to come to a more informed decision before investing. There are risk management options on the Web Trader platform to take advantage of placing ‘Stop Loss’ and ‘Take profit’ levels.

The default graph on the Investous Web Trader is a candlestick chart that is colour-coded to highlight rising and falling asset prices. It is very user-friendly in its default mode. A trader can hover any part of the graph to see specific data, like the value of the asset at a particular time, and again it is colour-coded. On the left-hand side of the screen, when in graph-mode, there is a useful tool that highlights, with a red or green bar, whether Investous clients are currently buying or selling the asset. This is a good indicator for both contrarian and momentum investors. Moving away from the default setting, the user can switch between graph types and adjust intervals in order to take a closer look at the shorter- or longer-term pattern of trading the relevant asset in graphic form. There are also a range of drawing tools in order to analyse the trend of the asset in focus, for example using parallel lines, extended lines, rays and horizontal lines. The user will also find more advanced tools, including Fibonacci retracements, fans, time zones or arcs. This is backed up by the Indicators Wizard that gives the user many indicators to choose from to help with their analysis.

Education

Investous has a strong offering of educational resources for clients of all skill levels. It is important to note that more resources become available depending on the account type the trader has set up. However, for all account types there is a glossary that includes a number of important definitions for CFDs and Forex trading. Additionally, the site also has an educational page on leverage and margins and how best to take advantage of them whilst taking into the account the risks. As we would expect there is a section that is dedicated to explaining technical analysis. There is an overview and short briefing on how to use technical indicators to support the user’s investment portfolio. The section also explains more advanced technical tools, like Fibonacci retracement, the relative strength index and moving averages. All of which can be utilised when observing the graph analysis on the Investous portal.

Clients can also click on the CFD tab in the main navigation menu of the Investous portal which leads to a drop-down menu. There is a user-friendly explanatory page as an introduction to CFD trading, on how to calculate gains and losses and setting out the risks to utilising a more complex instrument. Each main asset class is explained under a CFD approach. Forex, Commodities and Stocks all have a specific nuance when engaged in trading via CFDs, however the underlying risks and opportunities are broadly similar for all the asset classes and very well explained on the Investous portal.

Within the same section, there is thoughtful and transparent advice on how to develop a CFD trading strategy. This includes establishing a game plan, setting relevant alerts around stop loss, using risk management tools and staying regularly informed around the trading position that a CFD investor may have or wish to establish. Above all with the CFD explanatory notes, there is a clear recognition of the overriding importance of using leverage responsibly. This is especially important when you consider that market-wide, around 75% of retail investor accounts typically lose money when trading CFDs.

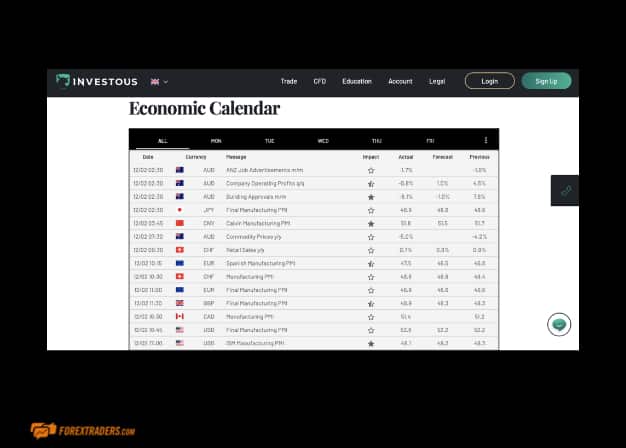

Elsewhere on the website, Investous has an Economic calendar on its portal to offer additional support to its clients and is an undoubted positive feature.

For each event on the Economic calendar the web browser enables the user to see forecasts, actual data, historical data and market impact. There is also a section focused upon fundamental analysis within the portal and how to get the best out of this when trading.

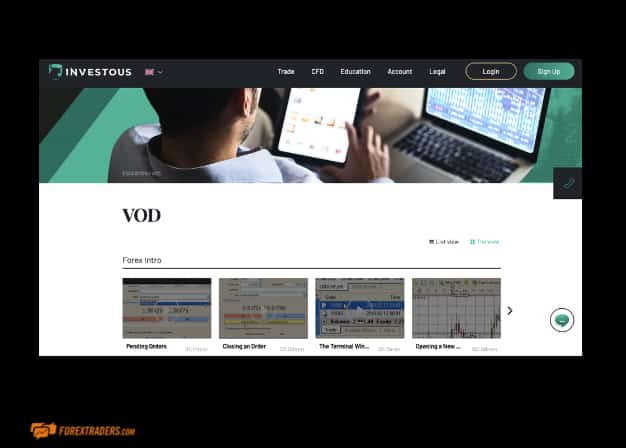

Neatly, Investous has an extensive video library for educational support. It is labelled videos on Demand (VOD) and is split into the categories of Forex Intro, Forex Beginners and Forex Intermediate.

In total, there are over 20 Forex Intro videos and four Forex Beginner’s videos. Topics are wide and helpful, in such areas as the Glossary of concepts, types of orders, the Forex market, long and short, trends, currency pairs and basic Forex terms. The Forex Intermediate video library covers areas like advanced technical analysis, trading psychology, capital management and the world of global trading.

Trader protections by territory

Investous has a number of market leading features that enable this relatively new online trading portal to compete well with existing peers. It is a fact that the change of regulation to the International Financial Services Commission of Belize has raised a few eyebrows amongst European investors in particular. However, protecting funds and client information is supported by very high standards for firewalls, security and data encryption, so a prospective client can be reassured that Investous follows internationally recognised practices for the protection and security of funds. For further security, the platform has protection via Secure Socket Layer protocols, including both ClickSSL and Thawte, with additional defences against any potential cyber-attack. All this should be of considerable comfort to the trader using and depositing funds with the Investous portal.

How to open an account

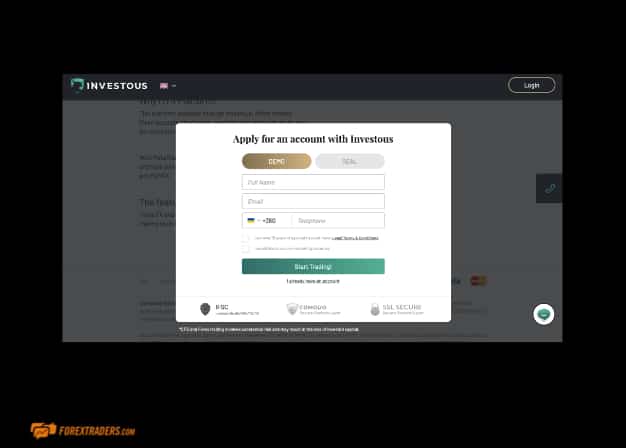

It is important to recognise that as a perspective client of Investous you would have to verify your account. This is part of the broker’s compliance with Anti -Money Laundering (AML) and Know Your Customer (KYC) regulations.

A client can deposit funds and start trading without the verification process but will not be able to withdraw funds until the process is completed. In order to complete the verification process, a confirmation is required that you own the bank account that is connected to your Investous account. In addition to this, a proof of identity and address must be submitted. This is a standard procedure normally requiring a valid government-issued ID and a bank statement or utility bill dated within the past six months as a proof of address.

Customer Support

As with many of its peers, Investous has a live chat feature allowing for the opportunity to discuss prospective trading ideas with their professionals. Investous customer support can be reached by telephone on +357 2526 2513, or via email at [email protected].

The bottom line

Investous offers a very competitive access to markets allowing the user to invest in over 270 tradeable assets. The platform is backed by its own in-house Web Trader that does not require a download once you are on the portal. It also gives the user access to the very well-integrated and respected MT4 trading platform.

Investous offers multiple types of accounts depending on the deposit amount placed with the broker. There is also a professional option for some very experienced traders. There is even a free Demo account, that is highly recommended to fully appreciate what the portal has to offer, that allows users to trade with USD $100,000 of virtual currency. Demo accounts have the access to the same prices and functionality as live accounts.

Access to educational support is high but that will depend on which account you have chosen, whilst spreads are fairly competitive at the basic account levels but again improve markedly with the higher ranked accounts. It is worth taking into consideration that withdrawal fees are high, compared to peers, and that leverage is low for retail traders.

Investous has certainly made some considerable progress in a very short period, it is fully regulated and has a strong asset trading coverage. It also has some market leading technology on its portal and a very user-friendly series of educational and technical analysis tabs to aid when making those key trading decisions. All of which can be done with a single click via a choice of two platforms, one of which is fully operational on mobile devices that are enabled by iOS, Android and Windows.

Please be advised that certain products and/or multiplier levels may not be available for traders from EEA countries due to legal restrictions.

FAQs

How can I open a demo account with Investous?

In order to open an account, you must visit the site and fill out your details in the provided account registration form. The whole procedure takes no more than 3 minutes.

Is Investous a regulated broker?

The company Investus, regulated and licensed by the PCM Financial Services Commission of Belize IFSC / 60/511 / TS / 19, operates in Cyprus and operates in Europe through the Cyprus Securities and Exchange Commission (CySEC).

What fees does Investous charge?

Investous does not charge deposit commissions, but withdrawal fees of up to 3.5% are charged on credit and debit cards, which is a relatively high amount.

An active spread in trading is also very understandable, offering traders the opportunity to trade on attractive terms. For example, investors offer 2.3 pips spreads

How do I withdraw money from Investous?

In order to transfer funds from your Investous account back to a bank account, you must log in and select the “Withdraw funds” option located in the same place from where you previously deposited funds. The minimum withdrawal amount is $ 10.00.

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.

Your capital is at risk

Your capital is at risk

Your capital is at risk

Your capital is at risk  73% of retail CFD accounts lose money

73% of retail CFD accounts lose money  Your capital is at risk

Your capital is at risk  Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  77% of CFD traders lose

77% of CFD traders lose