Founded in 2012, LegacyFX is one broker that was around at the peak of the “Wild West” stage of the industry, where a ton of weird stunts were pulled in the Forex market and the regulation policy was not as strict as it is today.

We’re not saying that the LegacyFX was warped in shady deals back in those days. They did an excellent job delivering a decent service for traders at that time.

The user feedback for this broker is pretty decent. Hence, tons of traders are pleased with the services of the LegacyFX. One remarkable feature of the LegacyFX is the fact that the broker is a regulated and licensed Forex broker.

A.N. (All New Investments Limited) is the corporate body behind the LegacyFX brand, which is registered under the CIF body. In essence, the All New Investments Limited is a member of the Investor Compensation Scheme, and it’s regulated and licensed by CySEC, with license number: 344/17.

Having the CySEC license means that LegacyFX is in full acquiescence with the MiFID directives, which means that it has to obey strict guidelines when dealing with investors’ money.

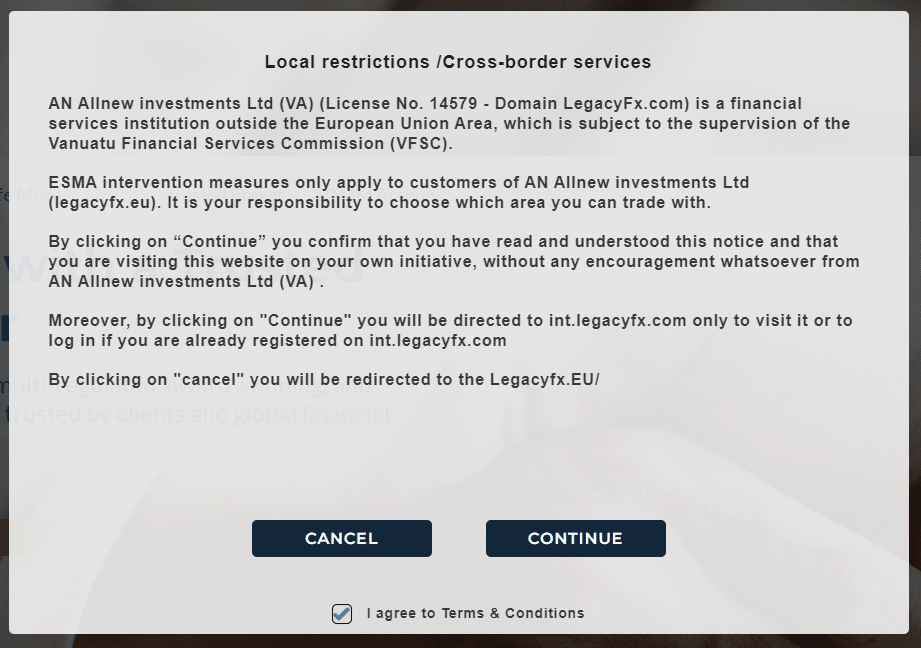

Apart from its CySEC regulation, the brokerage also has an impressive number of other financial regulatory bodies pulling its strings. The regulatory umbrella of the broker covers most EU countries except Belgium. In the UK, they have been given the registration number of 7973433 by the FCA as well as the No. 348194 by BaFin in Germany. They are also licensed under the VFSC with the number 14579. To beef up their security and reputation in Europe, LegacyFX have also been regulated by the Belarus NBRB with a license no: 193180778.

However, it’s essential to know that the broker doesn’t accept traders from the US and Canada.

So why is it a great idea to open a trading account with LegacyFX?

The official LegacyFX website boasts of having several perks for various Forex traders. The broker has unequalled liquidity, which is a great feature to look out for to get the best trading conditions.

The spreads of the LegacyFX are quite competitive when compared to other brokers in the industry. They range from 0.6pips to about 1.6pips, but it all depends on the particular primary currency you select and the exact market condition.

Traders with the Silver account have a minimum of 1.6pips, Gold customers are open to a minimum of 1.0 pips, and the 0.6pips is for platinum members.

Traders switch brokers because they need improvement from their prevailing brokers. That’s where LegacyFX comes in.

The broker seems to be very transparent in its dealings, and it circulates regular market discipline and its annual reports for traders to see.

Also, the support and customer service team of the broker is amazing – they are always around to answer customers for every trading session.

Account Types with LegacyFX

There are three types of trading account available at LegacyFX and the broker makes it really easy for traders to choose the most suitable account for their needs.

The one with the least minimum deposit is the most accessible account. Newbie traders and professional traders who want to test the broker usually start with this account type. It’s known as the Silver account. To open the Silver account, you must be able to produce $250, which is quite reasonable, because the account comes with a ton of perks, apart from analysis insights, dealing Room Direct Line, and 1-on-1 support.

The maximum leverage is 1:200, which is fair enough, considering the credibility of the broker.

The Gold account raises the stakes with a bit. The minimum amount required for a deposit for this one is $5,000. Forex traders can gain access to all the features and perks as well as the ones covered by the Silver account for the $5,000.

For those that opt for the Platinum account, the minimum deposit is $25,000. This allows traders to trade profitably without spending so much on pips. With this money, traders can get enough access to all the broker’s trading platforms, educational bonus, technical support, and 1-on-1 support.

The LegacyFX provides Sharia-biddable accounts for traders of the Islamic faith. These accounts have specific rules concerning Riba, and they are swap-free.

LegacyFX Trading Platforms

MT5 is the flagship of the LegacyFX trading platform line-up. When it comes to satisfying all the needs and wants of most professional traders, the MT5 platform comes in handy. It shines at every operational facet. Plus, it has a superb charting system, and it supports different scores of time frames and drawing tools. The technical tools in the trading are unmatchable. Traders can also customise their tools and generate indicators for their educational purpose. To make things better, it features a vast selection of preinstalled indicators that traders can tweak.

One of the top features of MT5 are the EAs. With these, traders can carry out automated trading to a level where their involvement is only essential when the trading tactics fed into the EAs fail for some reason. The EAs can be tailored and bought from other originators or formed from scratch.

Another strength of the MT5 platform is its chart-based trading along with its position keeping. Traders can instantly react to trading signals and alerts thanks to its remarkable platform.

Traders can download MT5 for free on the LegacyFX website. The platform supports both demo accounts and real money.

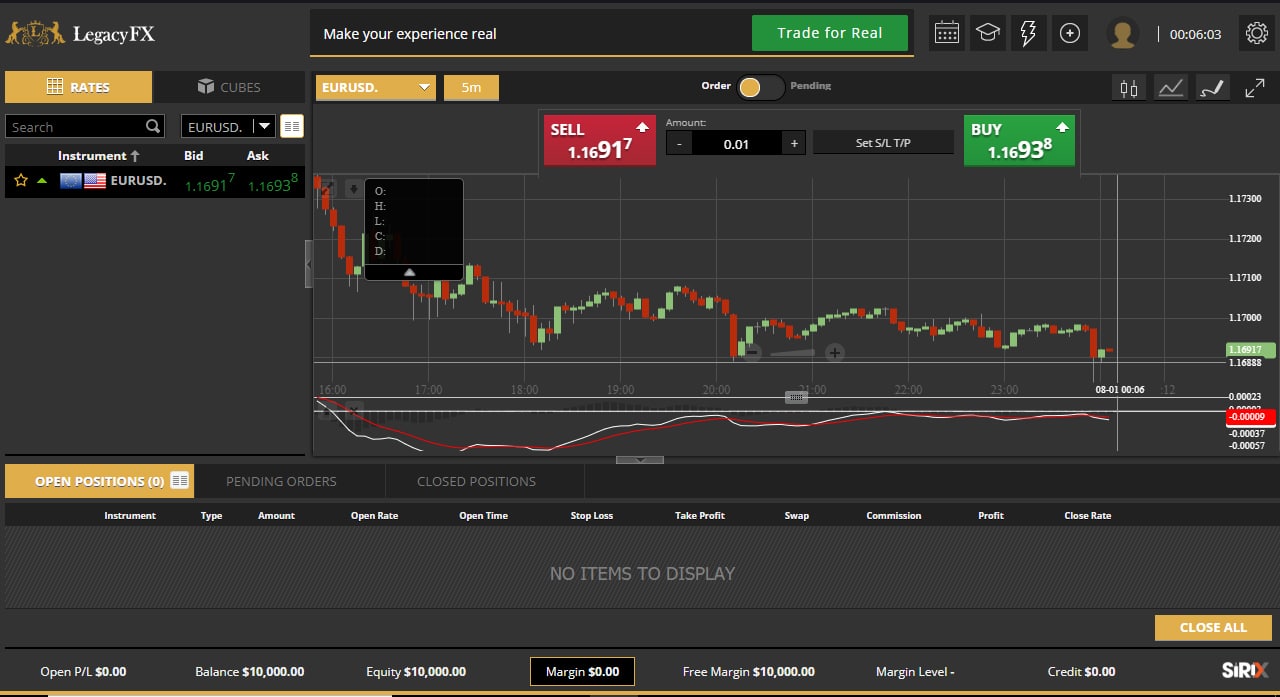

The broker platform also supports the Web Trader, which is a decent trading tool. It comes with one-click trading off the charts, real-time quotes, excellent execution-speed, and scores of order types. Traders can also find the demo account option with the Web Trader too.

Traders also have the option of using the LegacyFX Mobile, which is another solution for traders on the go. Apart from giving enough compatibility to a trader, there is full access to portfolios and trading pairs to pick from. At the touch of a single button, traders can study their account history.

Opening an account

The account opening process at LegacyFX follows a similar format to other regulated brokers. The first step is determining which of the two entities of the firm you want to sign up with and clicking the appropriate button when prompted. That will result in opening an account with the EU-based entity regulated by CySEC or the global arm of the broking group overseen by the Vanuatu Financial Services Commission (VFSC).

Whichever path you take, you must complete a client profile questionnaire. You’ll be asked questions about your trading experience, understanding of the financial markets, the source of the capital you’ll use for trading, and you will be requested to supply proof of identity. These are standard requirements that form part of the brokers’ KYC (Know Your Client) protocols.

The area of the site where you can complete the application is found by clicking on the ‘Trade Now’ button on the broker’s homepage. There is an option to set up a live trading or a demo account.

During the LegacyFX review, testing opening a new live account took less than six minutes, and the demo account was set up in seconds.

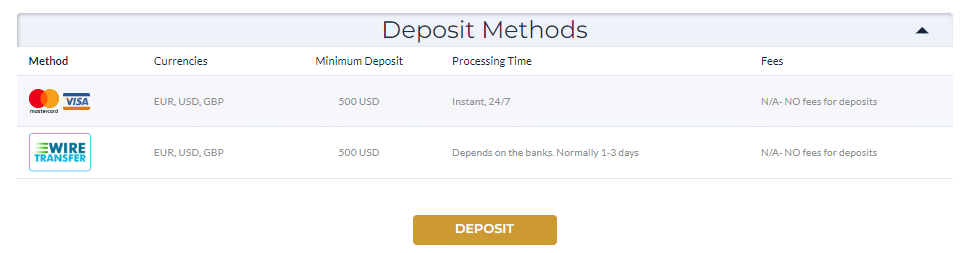

Making a deposit

There is a ‘no-nonsense’ feel about deposits made to this broker. Accounts can be set up in one of three base currencies, USD, EUR, or GBP, and funding transfers can be made using wire transfers and credit and debit cards. If you’re using the wire transfer process, you should allow up to three days for funds to clear, but card payments are processed immediately.

Following tests, the quoted processing times were accurate, and the commitment made by the broker to not levy any charges on deposits proved correct. There is a risk that your bank or another third party might apply charges on cash transfers. You should check the small print and find the most effective way of funding your account to help you avoid additional charges.

Once your account is fully verified, you can make further deposits by visiting the administration section of your account profile. When withdrawing funds, using cards and wire transfers can involve a delay of up to three days. Wire transfers also incur a $50 fee per transaction. Those looking to double-check what fees might be applied can take advantage of the easy-to-read T&Cs section of the broker’s site.

Placing a trade

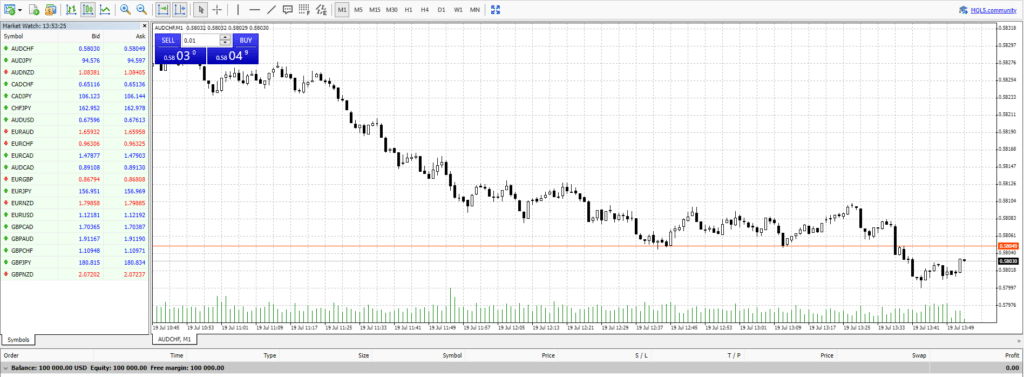

LegacyFX offers clients only one trading platform. Fortunately, the broker has made the highly regarded and super-effective MetaTrader MT5 trading dashboard available. It’s razor-sharp graphics comes with an extensive range of powerful software tools and indicators.

Our LegacyFX review involved booking test trades using the WebTrader and downloadable desktop versions of the MT5 platform. Both platforms have similar functionality; choosing between them depends on your trading style. For many, the web-based version is an ideal choice as it allows you to trade from different devices anywhere there is an internet connection.

Our trades in AUDCHF and AUDJPY were executed without a problem and reported accurately in the Portfolio section of the dashboard, where we could track ongoing moves in P&L. Closing out positions was also straightforward, making booking trades a trouble-free process.

Adjusting the different background colours and timeframe settings allowed us to personalise the screen appearance and to set charts to match our trading strategies. All in all, the trading execution experience using MT5 can be described as faultless and as good as any other platform in the market.

Contacting customer support

The LegacyFX site lays out all the pertinent information about the broker’s services clearly and concisely. The FAQs are well thought out and informative, and there are libraries of documentation relating to client protection protocols and regulatory cover.

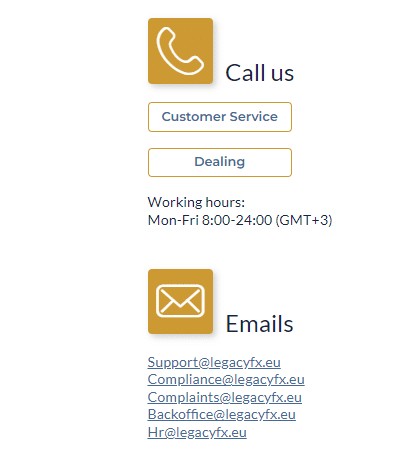

Trading and support queries can be directed to the customer services team, who can help with issues ranging from technical aspects of the site to booking trades over the telephone. During our testing, we found the support team to be highly client-focused and knowledgeable, with all our test issues being resolved at the first time of contact. It is worth noting the telephone service is available from 8.00 a.m. to midnight (GMT +3hrs), which could be an issue for some in different time zones.

Queries which are more detailed in nature, or need resolution when the telephone desk is not available can be sent to the support team in writing. There is an online messaging service and a range of email addresses to choose from to ensure your question is sent to the correct department.

LegacyFX also operates social media accounts on Facebook, Instagram, LinkedIn, Twitter, and YouTube, where you can find additional information on the broker’s services.

LegacyFX Review Conclusion

The LegacyFX is the ideal Forex broker for traders that are looking for an ECN platform with a minimum deposit of $250 and those who are looking for a platform that delivers fast execution trades.

Most importantly, the broker is regulated by five top regulatory bodies that cover most European countries, Middle East Asia, and Sub-Saharan Africa. That fact alone is an excellent reason to trade forex with this broker.

However, traders living in the US and Canada will not be able to use the services because they don’t accept them. Also, newbie Forex traders that are looking for high leverage of 1:1000 as well as ridiculously low minimum deposit can’t trade with LegacyFX.

Please be advised that some particular products and multiplier levels may not be open for traders from EEA countries due to some strict legal restrictions.

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.

Your capital is at risk

Your capital is at risk

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  77% of CFD traders lose

77% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk